Ethereum

1.10M Ethereum scooped up by whales—What do they know that we don’t?

Credit : ambcrypto.com

- Ethereumwalvissen have collected 1.10 million ETH in 48 hours, with speech market hypothesis

- Regardless of shopping for whales, Ethereum stays in a downward pattern

Ethereum’s [ETH] Massive gamers make quick actions! Whales have portfolios within the final 48 hours Ligging 1.10 million ETH, revenue hypothesis available on the market.

Place these excessive neat-worthy buyers for a big catalytic converter, or is that this simply one other recreation calculated in an more and more risky panorama?

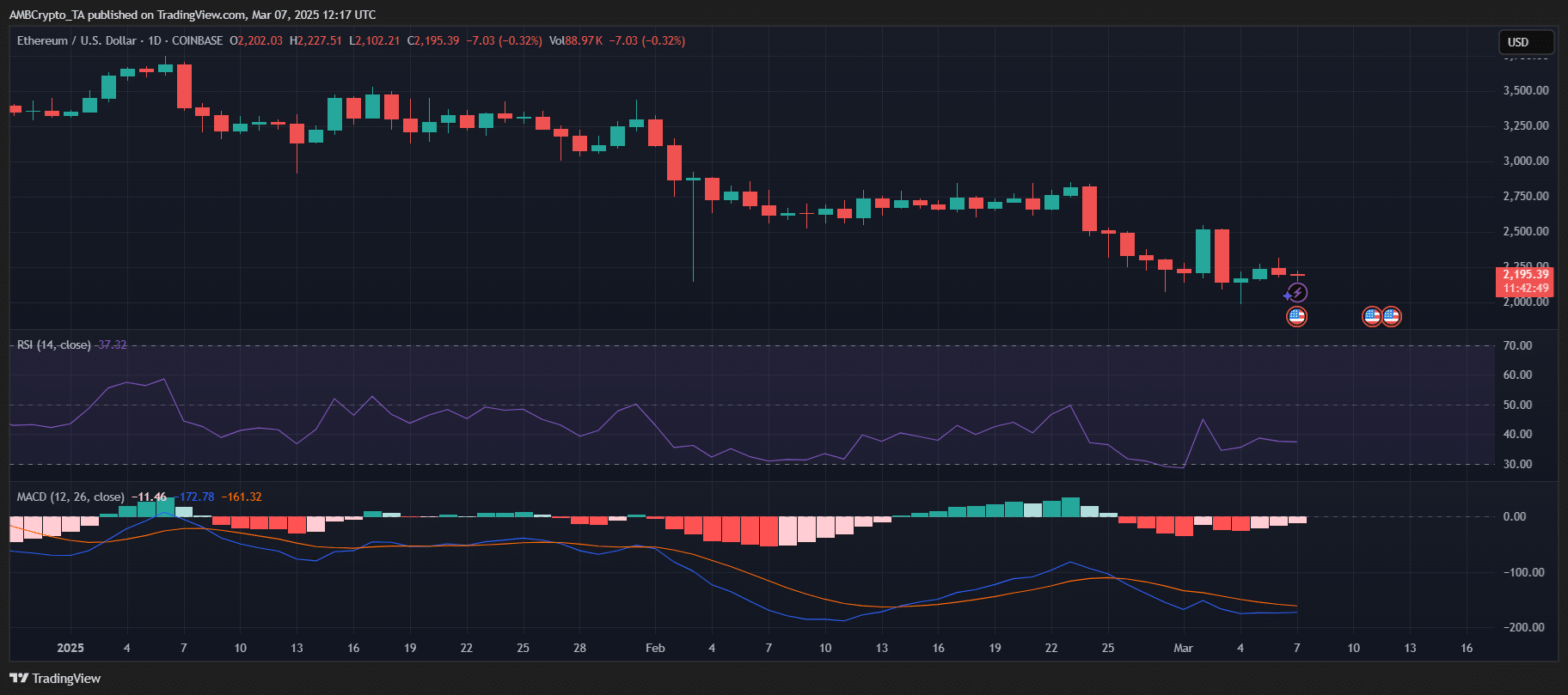

The value motion of Ethereum stays in a tug of conflict, whereas the dominance of Bitcoin strongly influences the whole market sentiment.

The vital accumulation by whales raises the query: can they’ve insights or info that aren’t out there for the broader market?

Ethereumwalfissen: calm accumulation or massive motion?

The current acquisition of 1.10 million ETH by whale buyers underlines a substantial shift in Ethereum’s market dynamics.

From March 2025, the circulating vary of Ethereum is round 120 million ETH. This buy represents virtually 0.92% of the whole supply, making it a big accumulation.

This sample of whale accumulation just isn’t an remoted occasion. In January 2025, massive holders acquired greater than 330,000 ETH – greater than $ 1 billion – in only one week.

The current accumulation coincides with the gradual value efficiency of Ethereum, as a result of ETH is struggling in the beginning of 2025 to get Momentum.

Regardless of the absence of a transparent outbreak, whales positioning aggressively, probably anticipating a market shift earlier than it turns into clear to others.

What causes this peak in whale chanties?

In current months, Ethereum has skilled exceptional whale accumulation, the place massive buyers collectively purchase appreciable quantities of ETH. This pattern is very vital in view of the present circulating vary of Ethereum of roughly 120 million ETH.

Such massive -scale acquisitions by Walvisportfeuilles mirror a robust bullish sentiment amongst massive buyers, which reveals belief within the lengthy -term potential of Ethereum.

This accumulation continues, regardless of the underperformance of Ethereum in comparison with Bitcoin in current months.

The rise in whale exercise coincides with vital developments within the crypto house. On March 2, President Donald Trump introduced an American strategic crypto reserve, during which he expressed his ‘love’ for Ethereum, which elevated investor’s pursuits.

The upcoming Crypto high of the White Home on March 7 elevated market exercise, as a result of stakeholders anticipate attainable authorized assist.

The dominance of Ethereum on the Stablecoin market, with 56% of the whole Stablecoin worth, reinforces its significance as a cornerstoneactive.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024