Bitcoin

$1.14 Billion Wiped Out as Market Faces Double Attack?

Credit : coinpedia.org

The cryptomarkt in the present day witnessed a steep fall. The primary motive for that is the battle tensions between Israel and Iran. The dispute once more escalated when Israel launched an air raid on the nuclear amenities of Iran on 13 June. As well as, the final inflation report of the American Federal Reserve refused the hope for any rate of interest letings in June.

This double version of geopolitics and financial coverage has despatched shock waves by way of the market, resulting in greater than $ 1.14 billion in liquidations. Whereas crypto merchants names, many resorted to safer property equivalent to gold, with Pax Gold and Tether was underneath the uncommon inexperienced tokens in a sea of crimson.

$ 1.14 billion price Liquidation Hits Merchants

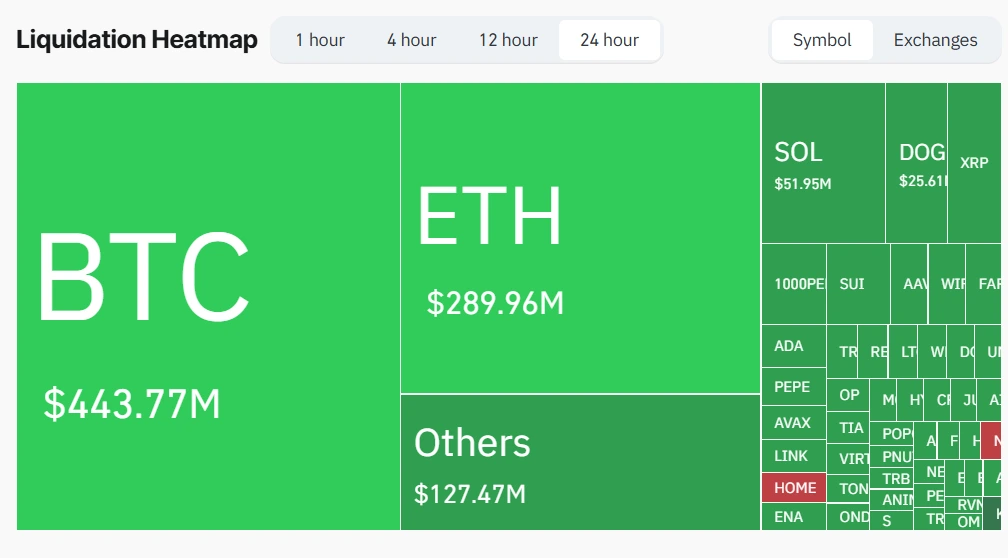

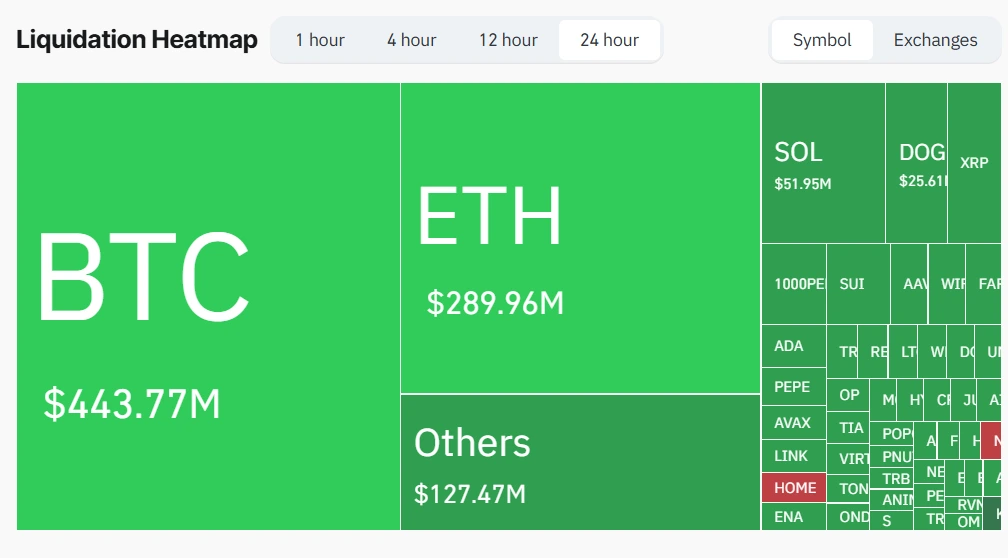

Within the final 24 hours, 246,590 merchants have been liquidated, which emphasizes a critical indirect line on the derivatives market. The entire liquidations from the second of the press have risen to $ 1.14 billion, and emphasizes the extraordinary volatility brought on by the exterior components.

The largest liquidation was registered on the BTC/USDT purple of Binance, with a shocking $ 201.31 million in a single go a shocking $ 201.31 million. Binance was good for the biggest share generally and registered $ 455.60 million, Bybit adopted with $ 370.83 million and OKX with $ 125.58 million.

Bitcoin and Ethereum took an important sufferer of cryptocurrencies, with $ 443.77 million and $ 289.96 million in liquidation quantity respectively. Different altcoins, equivalent to Sol, noticed $ 51.95 million, and do -up $ 25.61 million in liquidations.

The place is the Crypto market to?

On the time of the press, the overall market capitalization of the trade is $ 3.37 trillion, a lower of two.51%, whereas 24-hour commerce quantity drops by 4.77% at $ 129.97 billion. The Concern & Greed Index stays on a greed-driven rating of 61, which is predicted to be decrease because the day passes.

Bitcoin at present trades 3.12% decrease at $ 104,437.94, whereas Ethereum has taken a bigger hit, a lower of 8.85% to $ 2,517.03. Main Altcoins was additionally confronted with strain, with XRP with a lack of 5.47% to $ 2.12 and Sol with 9.74% to $ 144.33.

With BTC -Dominance at 63.2% and ETH at 9.8%, the market stays strongly depending on Bitcoin’s resilience. Nevertheless, until geopolitical dangers settle and macro -economic stability returns, may be additional drawback in retailer.

Additionally learn our Bitcoin (BTC) Value forecast 2025, 2026-2030!

By no means miss a beat within the crypto world!

Proceed to interrupt up information, professional evaluation and actual -time updates on the most recent traits in Bitcoin, Altcoins, Defi, NFTs and extra.

FAQs

Rising battle tensions between Israel and Iran, along with inflation information from the FED, induced panic gross sales and lengthy liquidations between commerce gala’s.

Binance and Bybit noticed the biggest inventory market-based liquidations, whereas Bitcoin and Ethereum Liquidations led to $ 443.77 million and $ 289.96 million respectively.

Sure, with gold -supported tokens equivalent to Pax Gold and Tether Gold received a grip when traders sought security within the midst of world uncertainties.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September