Ethereum

$1.2B In Ethereum Withdrawn From CEXs – Strong Accumulation Signal

Credit : www.newsbtc.com

Purpose to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by consultants from the business and punctiliously assessed

The very best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Ethereum once more wins at Momentum after tagging the $ 2,739 degree and setting a brand new native excessive excessive, reaching costs that haven’t been seen because the finish of February. The rally marks a powerful comeback for ETH, which is underneath appreciable strain earlier this 12 months. Now Bulls appear to be robust in management when the broader crypto market wakes up and capital flows return to Altcoins.

Associated lecture

Analysts ask for a probably altern season, fueled by the relative energy of Ethereum towards Bitcoin and the rising belief of traders. As a result of Bitcoin consolidates virtually all time, Ethereum has taken the chance to carry out higher and with conviction by pushing necessary resistance ranges.

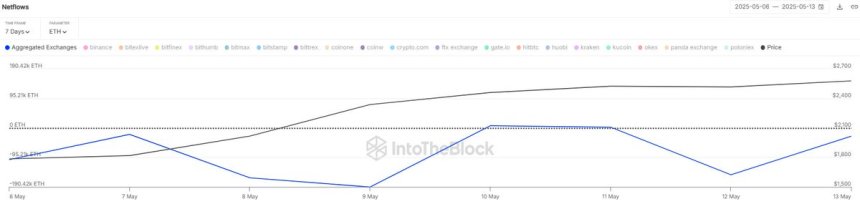

In help of this story, information from Sentora (previously Intotheblock) reveals that $ 1.2 billion in ETH has been withdrawn from centralized inventory exchanges within the final seven days. This persistent pattern of web outcomes suggests steady accumulation and decreased sales-side strain, each robust alerts for long-term bullish momentum.

With the warming of value motion and shifting traders, Ethereum may put together for a big outbreak. If Bulls maintains management, the area of $ 3,000 – $ 3,100 may be examined as the following main resistance zone within the coming days. All eyes at the moment are targeted on ETH as a result of the Altcoin market exhibits indicators of life.

Ethereum builds Momentum as an trade outflow sign accumulation

Ethereum acts above important ranges whereas the hypothesis of a persistent rally continues to develop. After weeks of sluggish motion, ETH has been blunted once more and has gained greater than 50% in worth since final week. This sharp step to the benefit has hosted hope for an altiation season, through which many analysts regard Ethereum’s outbreak because the potential set off for wider Altcoin market energy.

Ethereum now retains agency above $ 2,600 marking, a degree that had been appearing as robust resistance for months. This outbreak, together with rising momentum towards Bitcoin, means that bulls regain management. Merchants look carefully close to the following massive resistance zone between $ 2,900 and $ 3,100, which may function an necessary take a look at for the upward pattern from Ethereum.

Add to the bullish case, Data from Sentora It seems that the $ 1.2 billion in ETH has been withdrawn from centralized gala’s within the final 7 days. This pattern has been intensified because the starting of Could, indicating the elevated accumulation of traders and decreased gross sales aspect. Massive trade outflows are sometimes seen as an indication that holders are planning to retailer ETH off-exchange, decreasing instant supply and supporting upward value motion.

As a result of market sentiment turns into Bullish and Ethereum that leads the management, all eyes at the moment are about whether or not ETH can maintain its momentum and the Altcoin market can float in a brand new development part. If accumulation tendencies persist and bulls comprise necessary ranges, the trail from Ethereum to $ 3,100 can open the door for a wider markettrally.

Associated lecture

Worth promotion Particulars: ETH Testing Key ranges

The weekly graph of Ethereum exhibits a strong outbreak after weeks of Beerarish, with ETH now being traded round $ 2,599.14. The current enhance pushed the worth above each the EMA of 200 weeks ($ 2,259.65) and the 200 weeks SMA ($ 2,451.55), two important lengthy -term pattern indicators. Retaining these ranges of alerts renewed bullish momentum and a powerful shift in sentiment.

The Breakout -candles itself is without doubt one of the largest weekly inexperienced candles in additional than a 12 months, which displays a pointy consumption of the curiosity of patrons and probably marks an necessary reversal level after months. Specifically, this step brings ETH to ranges that haven’t been seen since February, with the native excessive reaching $ 2,739.05 for the week.

The amount has elevated significantly throughout this motion, which confirms the energy behind the rally. Nonetheless, Ethereum is now confronted with overhead resistance close to $ 2,800 – $ 2,900, a zone that beforehand acted as help at first of 2024 earlier than the breakdown. If Bulls Momentum retains and this week closes above $ 2,600, this will open the door for a take a look at of the $ 3,100 resistance zone.

Associated lecture

However, a very powerful help for viewing is round $ 2,450, tailor-made to the 200 weeks SMA. An absence to take care of that degree can invite a retest of $ 2,250. For now the pattern is bullish, however subsequent week shall be essential subsequent week.

Featured picture of Dall-E, graph of TradingView

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024