Ethereum

$1.33B Ethereum Whale Just Moved Another $120M USDT to Binance – Details

Credit : www.newsbtc.com

Ethereum is displaying indicators of weak spot because it struggles to reclaim larger worth ranges amid continued promoting strain and broader market uncertainty. After a number of failed makes an attempt to interrupt above the important thing resistance close to $3,600, the asset stays inside its vary, reflecting the cautious sentiment within the crypto market. Regardless of this, a number of analysts imagine that the present part may mark the ultimate shakeout earlier than Ethereum embarks on its subsequent large rally.

Associated studying

Based on latest on-chain knowledge, giant holders – together with institutional gamers and crypto whales – proceed to build up ETH at the same time as volatility persists. This regular inflow of enormous patrons indicators rising confidence in Ethereum’s long-term potential, particularly as community fundamentals stay robust and liquidity circumstances start to stabilize.

The distinction between worth weak spot and whale accumulation factors to a recurring sample seen in earlier cycles, the place accumulation intensifies close to an area low earlier than a big restoration happens. Whereas short-term merchants stay defensive, long-term traders look like positioning themselves forward of a possible breakout as soon as macro circumstances enhance.

Whale Exercise Alerts Renewed Ethereum Accumulation Forward of a Potential Rally

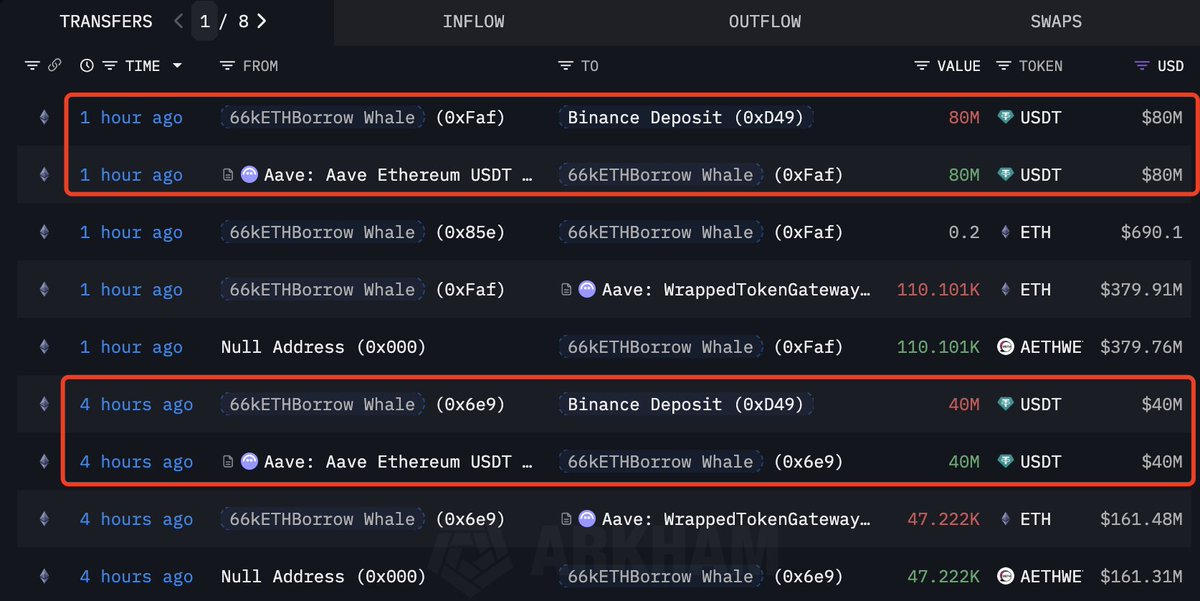

Based on on-chain factsthe well-known Ethereum whale “66kETHBorrow” – already probably the most energetic main patrons in latest weeks – has taken one other large step. After buying 385,718 ETH price roughly $1.33 billion in early November, this whale has now borrowed one other $120 million USDT from Aave and transferred it to Binance, a transfer broadly interpreted as preparation for additional accumulation.

Such conduct from a extremely capitalized market participant usually indicators renewed confidence in Ethereum’s medium-term prospects. Through the use of borrowed cash, the whale will increase publicity, indicating the expectation of a big worth restoration. Any such leveraged accumulation can create upward strain available on the market, particularly when liquidity is tight and sellers are exhausted.

Nonetheless, this technique additionally entails dangers. If Ethereum fails to carry its present assist round $3,400 to $3,500, the whale may face growing liquidation strain, which might improve volatility within the broader market. Nonetheless, the dimensions and persistence of those purchases point out that sensible cash continues to purchase the dip and place itself forward of what may very well be a significant restoration.

Associated studying

Ethereum is consolidating because the bulls attempt to regain management

The each day Ethereum chart reveals a transparent consolidation sample forming above the $3,450-$3,500 zone, indicating an ongoing battle between bulls and bears. After weeks of promoting strain, ETH is making an attempt to stabilize and finds assist on the 200-day shifting common (pink line), which continues to behave as a vital long-term protection degree.

Regardless of failing to reclaim the 50-day shifting common (blue line), presently close to $3,700, the construction means that draw back momentum is weakening. Latest candles have proven tightening vary and declining quantity, usually an indication of equilibrium earlier than a possible breakout. Earlier than Ethereum can affirm a pattern shift, bulls want a decisive shut above $3,650, which might open the door to $3,900-$4,000, the place the following main resistance cluster is positioned.

Associated studying

On the draw back, if ETH loses the $3,400 assist zone, the following main space of curiosity is round $3,100, in keeping with earlier response lows and the psychological barrier that patrons have traditionally stepped into.

Featured picture of ChatGPT, chart from TradingView.com

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now