Bitcoin

$100K, $103K, $106K… – How is Bitcoin breaching one ATH after the other?

Credit : ambcrypto.com

- BTC not too long ago hit one other ATH.

- There was extra competitors to pay money for BTC, which has elevated demand.

Bitcoin has soared to a brand new all-time excessive of $106,000, pushed by an unprecedented surge in institutional demand and tighter provide via OTC businesses.

On-chain knowledge exhibits a major decline in OTC desk balances as obvious demand continued to outpace provide over the previous month. This mixture has led to a provide squeeze that has fueled Bitcoin’s sharp value momentum.

Bitcoin’s institutional accumulation is rising

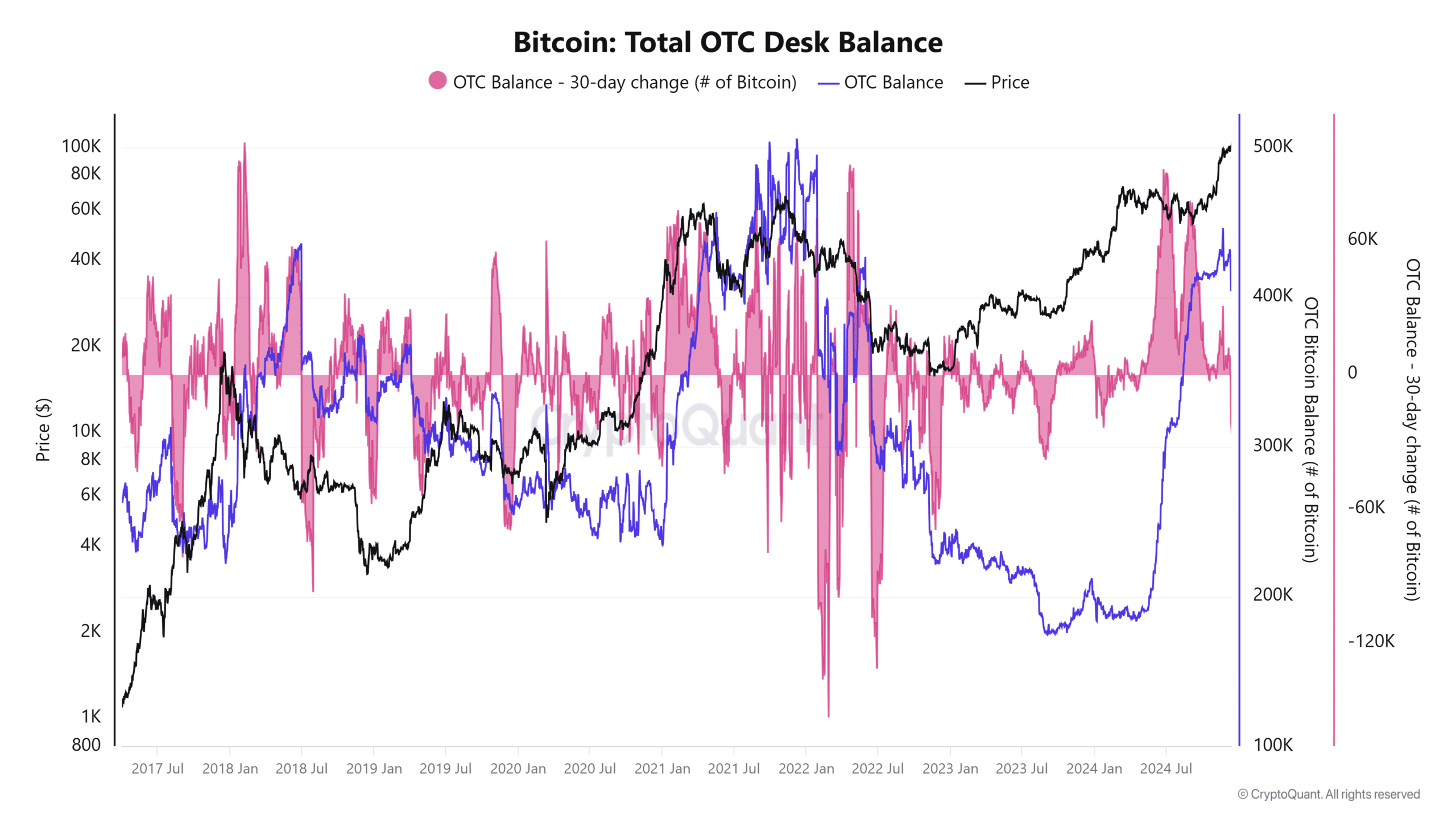

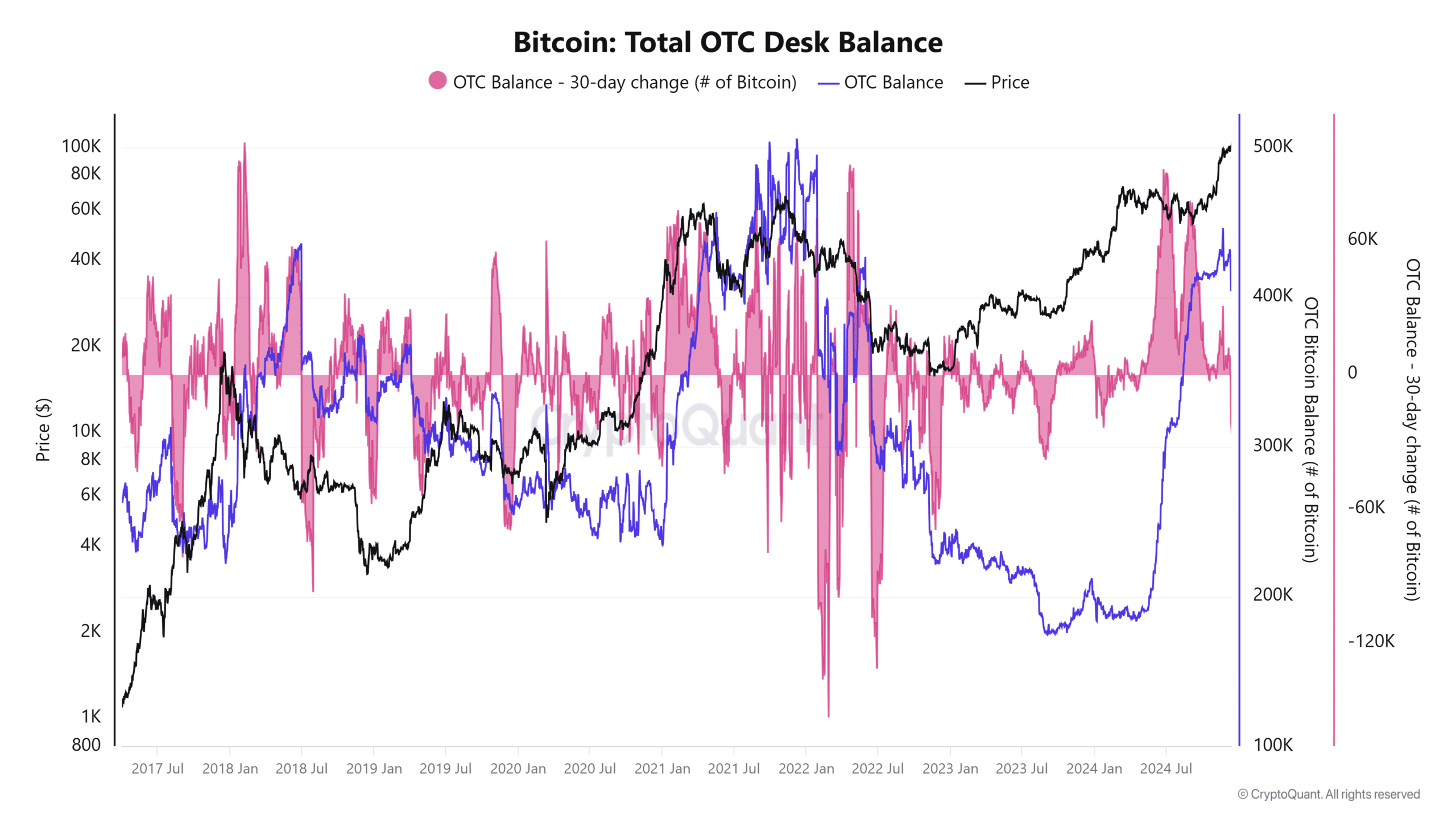

Evaluation of the Bitcoin OTC Desk Steadiness Chart, per CryptoQuantreveals a pointy decline in OTC balances, marking the steepest decline this 12 months. Within the final 30 days alone, OTC desk balances have dropped by 25,000 BTC, whereas a complete of 40,000 BTC have left these desks since November 20.

Supply: CryptoQuant

Institutional buyers and excessive web price people sometimes use OTC desks to buy giant quantities of Bitcoin with out impacting spot market costs. This depletion signifies that establishments are accumulating aggressively, lowering the availability obtainable to broader market members.

The dwindling OTC reserves coincide with Bitcoin’s rally to new highs, illustrating how institutional demand has fueled upward momentum whereas making a provide scarcity out there.

Demand exceeds provide, driving value momentum

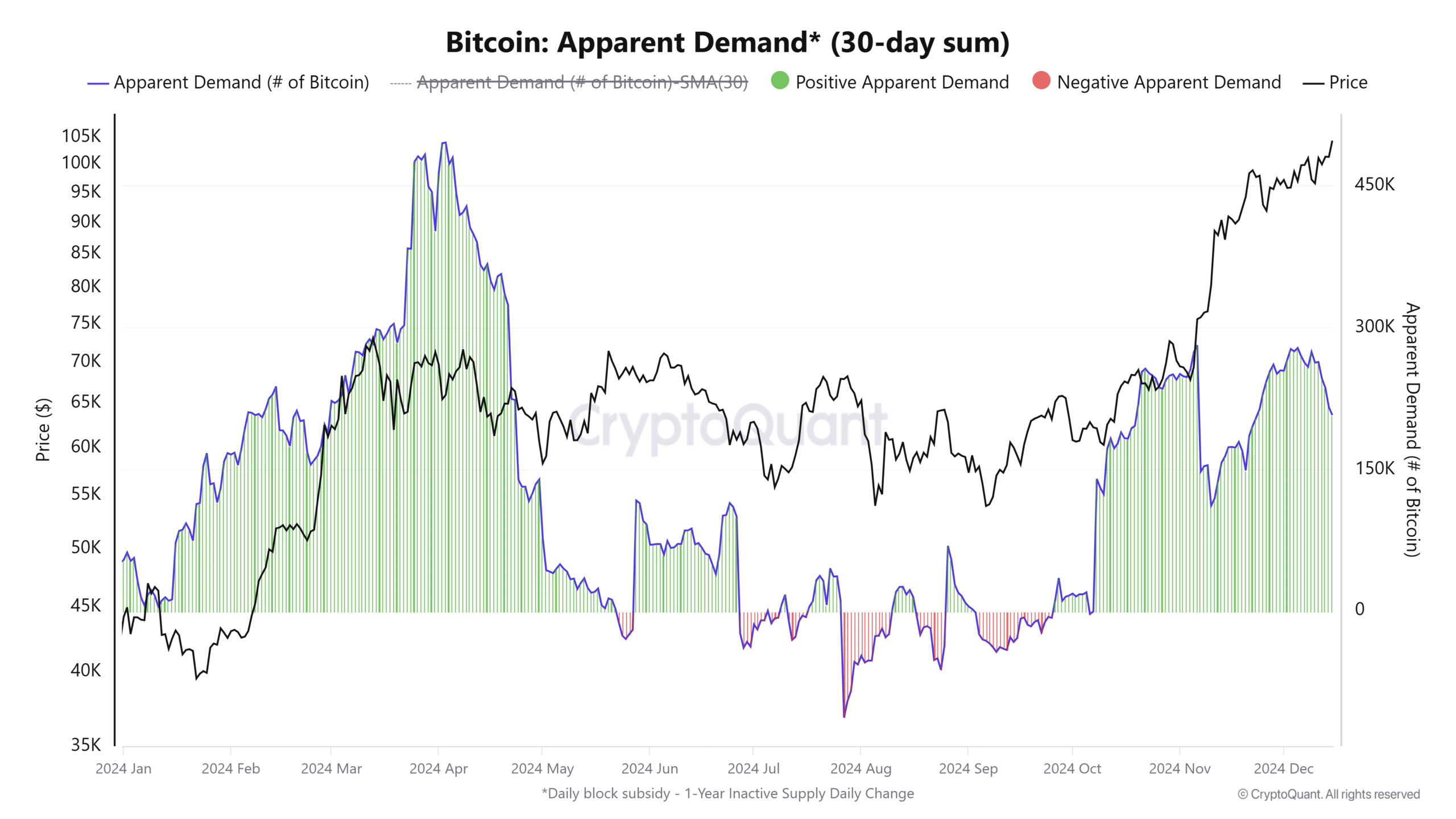

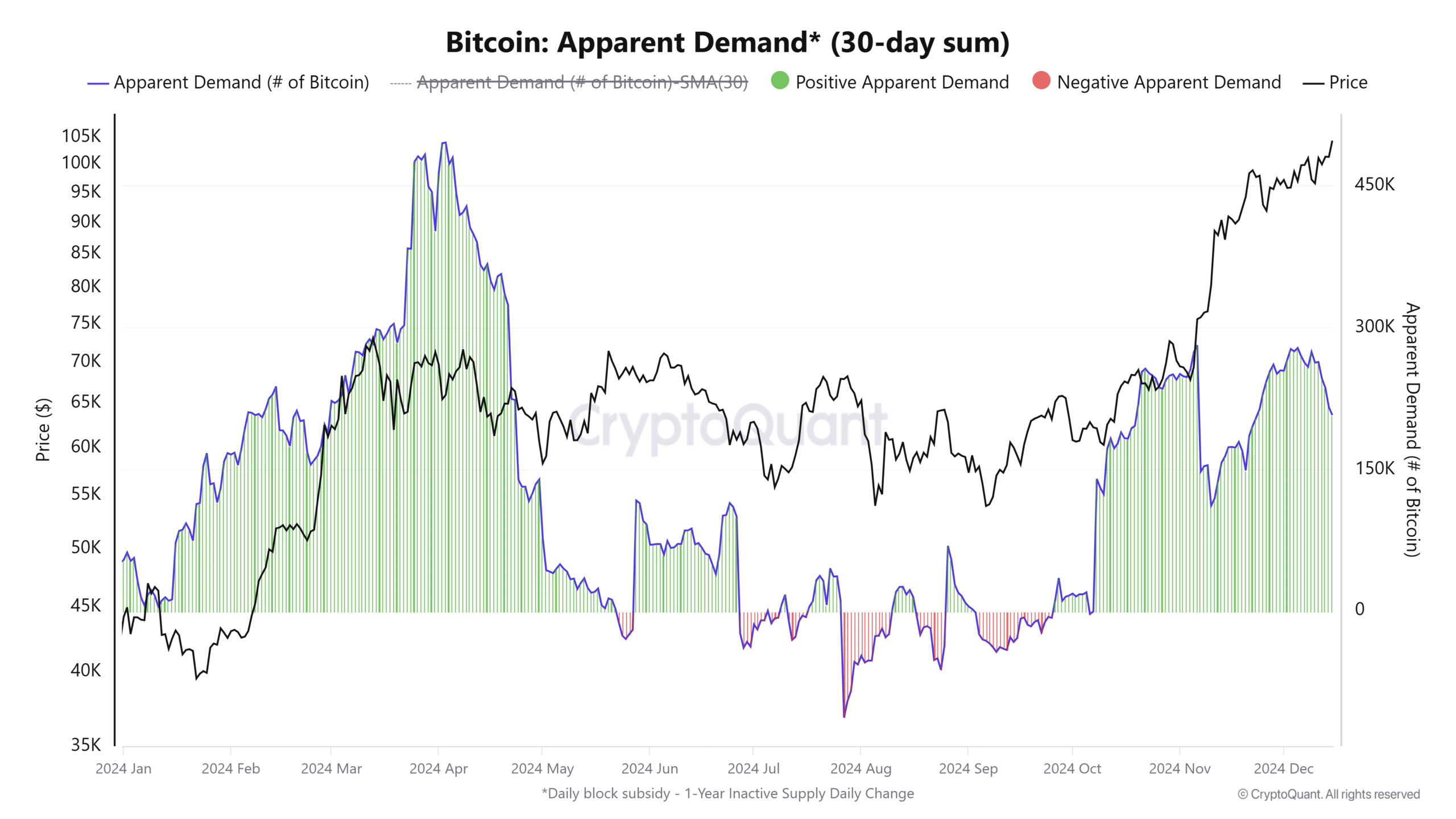

Evaluation of the Bitcoin Obvious Demand chart reinforces the story of accelerating demand. Obvious demand, which tracks web Bitcoin absorption, has soared since November, displaying constant progress because the market rally gained momentum.

Constructive obvious demand has dominated, reflecting a market surroundings the place BTC inflows considerably exceed outflows.

Supply: CryptoQuant

As demand rose, Bitcoin broke via important resistance ranges and reached the present excessive of $106,000.

The decline in OTC balances, mixed with this improve in demand, brought about a provide squeeze, creating the right surroundings for BTC’s file efficiency.

Bitcoin value motion confirms sturdy bullish sentiment

The worth chart confirms Bitcoin’s bullish momentum. The worth has shaped a transparent uptrend, characterised by larger highs and better lows, indicating market energy. Bitcoin stays comfortably above its 50- and 200-day transferring averages, indicating continued assist for the rally.

Supply: TradingView

Moreover, buying and selling volumes have elevated throughout key upward strikes, indicating that value positive factors are supported by sturdy participation from each institutional and retail buyers.

The Relative Energy Index (RSI) is at present round 70, reflecting sturdy momentum. Nevertheless, it additionally suggests the opportunity of near-term consolidation because the market absorbs current positive factors.

Institutional demand and provide squeeze are driving BTC larger

Bitcoin’s rise to $106,000 is a direct results of growing institutional demand and tightening provide. The depletion of OTC desk balances signifies aggressive accumulation by giant buyers as obvious demand continues to exceed obtainable provide.

These components have created the situations for a major provide squeeze, pushing Bitcoin to new all-time highs.

– Learn Bitcoin (BTC) value prediction 2024-25

Whereas consolidation could happen within the quick time period, the long-term outlook stays firmly optimistic as institutional confidence and demand for Bitcoin present no indicators of slowing down.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now