Altcoin

1B USDT Minted: What Does This Mean for Bitcoin?

Credit : ambcrypto.com

- USDT provide rose 0.37%, in step with Bitcoin’s 2% decline from yesterday.

- If confidence in a restoration fades, a mass capitulation could comply with.

In the course of the latest market consolidation, stablecoins have soared. Since September 9, the market capitalization of USDT and USDC has elevated by $1.153 billion: USDT by $410 million and USDC by $743 million.

This coincided with Bitcoin [BTC] rising to $60.5K, a acquire of 12.04% in every week.

Subsequently, this capital influx was essential to Bitcoin’s surge. With the market retreating right into a bearish pullback, are traders assured of a value restoration now?

Improve in USDT provide

Whereas Bitcoin noticed a 2% drop on September 16 from the day earlier than, USDT provide circulated jumped from $54.14 billion to $54.34 billion.

This elevated liquidity might assist potential Bitcoin value features within the coming days, assuming there’s much less reliance on USDT as a protected haven.

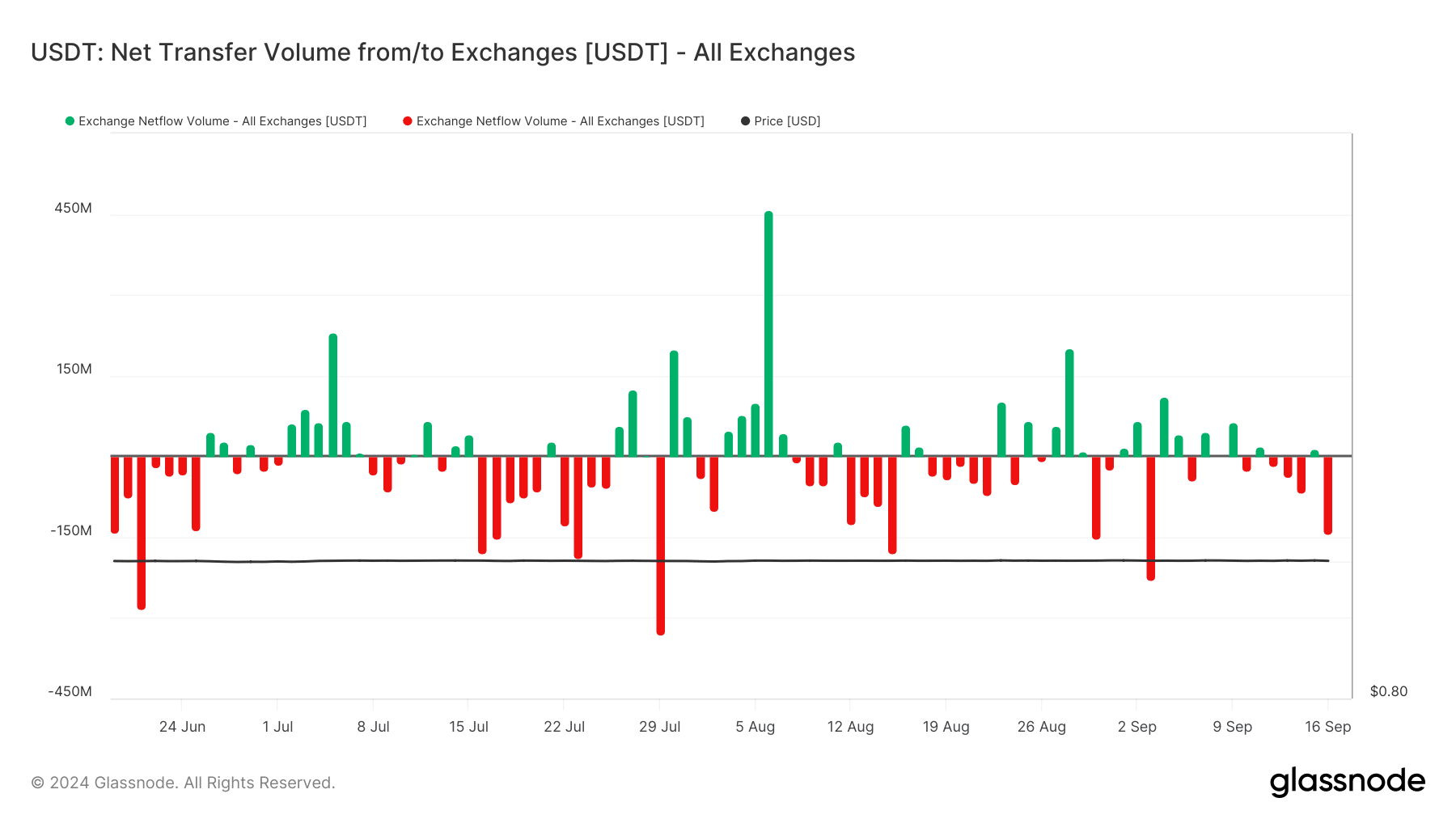

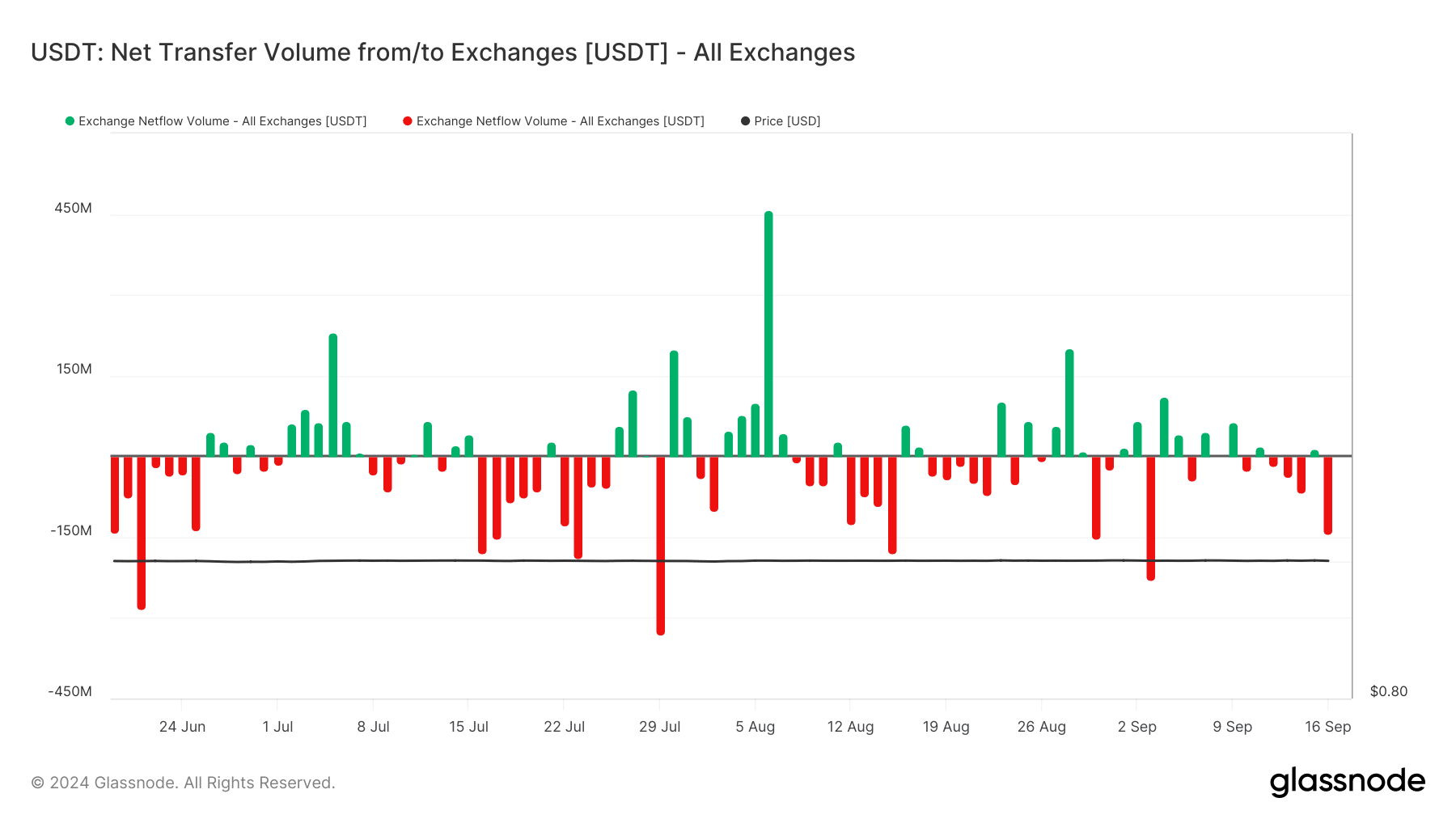

Surprisingly, the graph beneath is in stark distinction to this expectation.

Supply: Glassnode

The tremors have triggered panic amongst stakeholders, as evidenced by the successive detrimental flows. Buyers could have shifted capital into USDT for security as Bitcoin’s value fell, reflecting a liquidity shift fairly than a direct correlation.

Merely put, the soar in USDT provide didn’t correlate with the elevated demand for Bitcoin; different elements could play a job.

On September 16, Tether’s treasury beaten 1 billion USDT tokens, which triggered the sharp enhance in provide by 0.37%.

Whereas this might point out confidence within the value restoration, it might additionally replicate demand for liquidity or market hedging, fairly than quick optimism.

Subsequently, different dynamics should be taken into consideration to measure true belief.

The outflow of stablecoins might result in capitulation

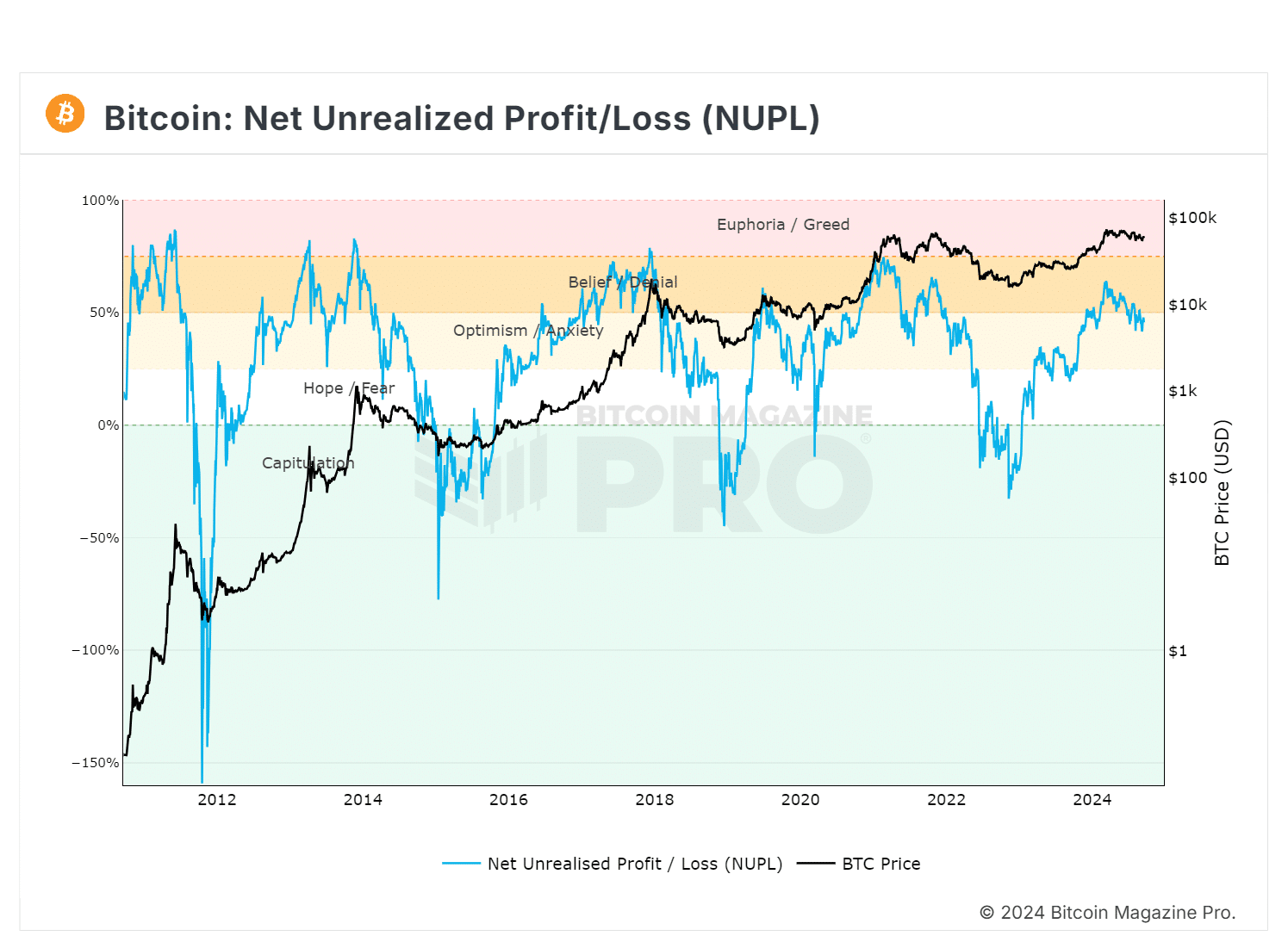

The chart reveals many Bitcoin holders making income, which is bullish however might sign a market high as a excessive NUPL might result in revenue taking and attainable corrections.

Supply: Bitcoin Journal Professional

Conversely, rising USDT outflows might flip the NUPL detrimental, indicating unrealized losses and a attainable promoting to interrupt even.

The precise place will grow to be clearer after the FOMC assembly. If bulls act decisively, revenue holders can maintain their features.

Nonetheless, approaching the $55,000 mark might result in better USDT outflows, signaling a attainable capitulation.

Learn Bitcoin (BTC) value prediction 2024-25

For context, on September 3, an enormous $230 million USDT flowed out of the exchanges on the identical day that Bitcoin fell nearly 3%, after rising 4% the day earlier than.

This indicated that traders had been possible escaping capital, inflicting BTC to fall beneath $54,000 in simply three days. If this development continues, BTC might return to the identical assist degree once more this time.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024