Bitcoin

3 Reasons for AAVE’s Stunning Performance and One of Them May Not Be Fully Priced In

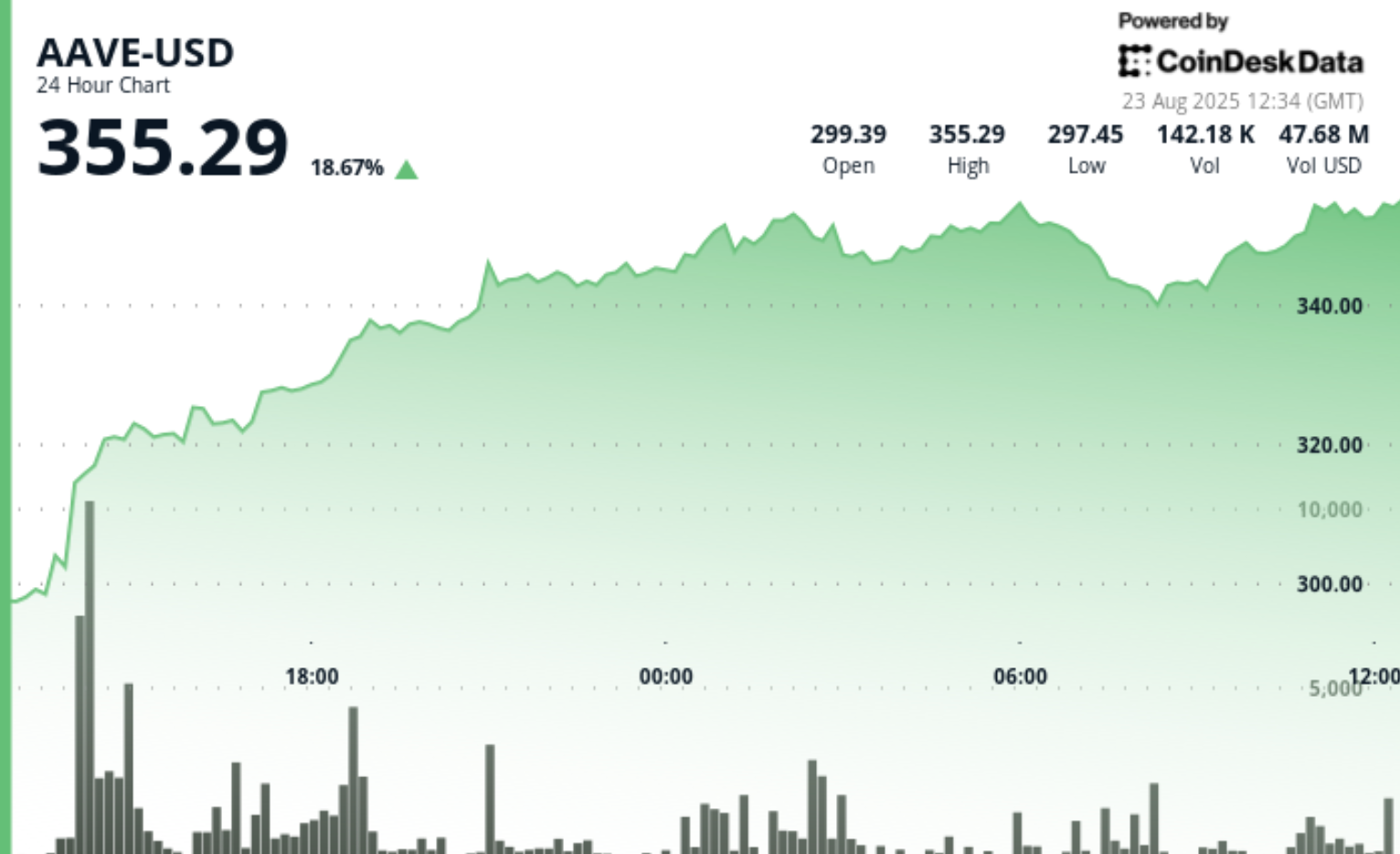

Credit : www.coindesk.com

Aave rose virtually 19% to $ 355 within the final 24 hours, in line with Coindesk knowledge, which led the Prime 40 cryptocurrencies by way of share of day by day revenue when traders responded to his current APTOS extension and the chairman of the Federal Reserve chairman Jerome’s heavy feedback from Jerome Powella.

What an aave is and why it issues

Aave is a decentralized monetary protocol with which customers can borrow and borrow cryptocurrencies with out intermediaries. Loans are managed by sensible contracts, the place debtors are wanted to put collateral above their loans.

The Aave -token helps this technique. It may be used to assist safety and earn rewards, used as collateral for borrowing and offering holders of holders. In change, token holders receive voting and reimbursement advantages, which suggests Aave is central to protocol actions.

APTOS -Growth

On August 21, Aave Labs announced That Aave V3 went dwell on APTOS, the primary implementation on a non-EVM blockchain. Builders have rewritten the codebase within the transfer, rebuilt the consumer interface and adjusted the protocol for the digital APTOS machine.

The launch was supported by Audits, a Maving Seize-the-Flag competitors and a Bugbounty of $ 500,000. The primary market helps property, together with APT, SUSDE, USDT and USDC, with supply and mortgage caps which can be regularly elevated. Chaos Labs and Lama Danger have carried out danger assessments and Chainlink provided worth feeds.

Aave Labs -founder and CEO Stani Kulechov called The launch ‘An Unbelievable Milestone’, which emphasizes the shift that goes past EVM chains after 5 years of exclusivity.

Jerome Powell’s Jackson Gap speech

Fed chair Jerome Powell’s speech On Friday morning within the Jackson Gap Financial Coverage Symposium, Momentum added. Powell mentioned that the chance steadiness between inflation and employment had shifted, indicating that rate of interest letings might begin in September.

Markets thought of his feedback similar to Dovish, with CME Fedwatch knowledge that confirmed expectations for a quarter-point discount in September rose to 83% of 75% earlier within the week. American fairness and crypto have gathered broadly since Powell’s speech, with one of many biggest movers.

WLFI publicity will pop up once more

One other issue analysts say that it may not be totally priced within the curiosity of Aave in World Liberty Monetary (WLFI). In October 2024, WLFI suggested Launching his personal Aave V3 copy on Ethereum MAINNET. As a part of the scheme, Aavedao was allotted 20% of WLFI protocol prices and seven% of its boardstocks.

Simon, an analyst at Delphi Digital, noted On Saturday that with WLFIs token begins on 1 September, an implicit valuation of $ 27.3 billion, Aave’s allocation might be price round $ 1.9 billion – greater than a 3rd of the present totally diluted ranking of $ 5 billion. He argued that this publicity might contribute to the Aave assembly, even when traders are solely now revised its that means.

Technical evaluation highlights

- In response to the technical evaluation mannequin of Coindesk Analysis, Aave achieved appreciable revenue through the 24-hour buying and selling time period from August 22 at 12:00 UTC to 11:00 AM UTC, climb from $ 297.75 to $ 353.22-a enhance of 18.65% that displays the rising belief within the growth technique of the platform.

- The digital asset was traded inside a variety of $ 62.11, fluctuated between $ 294.50 and $ 356.60, with probably the most pronounced worth motion that passed off on August 22 at 22:00 UTC, when the commerce quantity reached 340,907 items that reached the day by day common of 102,554 items.

- Persistent buying strain was noticed over the past hour of the evaluation interval from 10:49 AM UTC to 11:48 UTC on August 23, with Aave from $ 349.61 to $ 353.79.

- Business volumes constantly exceeded 3,000 items throughout key worth ranges at $ 352.55, $ 353.98 and $ 355.52, in comparison with the session common of 1,647 items, indicating what market individuals describe as methodical institutional positioning.

Safeguard: Components of this text have been generated with the assistance of AI instruments and assessed by our editorial crew to ensure the accuracy and compliance with Our requirements. For extra data, see The complete AI coverage of Coindesk.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024