Ethereum

330,000 Ethereum Withdrawn From Exchanges In 72 Hours – Supply Squeeze Incoming?

Credit : www.newsbtc.com

Motive to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by consultants from the business and punctiliously assessed

The very best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Ethereum has needed to take care of mass gross sales stress and volatility prior to now month, whereas the whole crypto market developments push down, inflicting Eth to push to essential ranges of demand. With uncertainty that dominates the market, merchants stay cautious whereas Ethereum is struggling to reclaim misplaced terrain.

Associated lecture

Analysts anticipate much more volatility after the chief command of the US President Trump on Thursday, who based a strategic Bitcoin reserve. Though the announcement was anticipated to stimulate market sentiment, it launched extra uncertainty, in order that buyers usually are not certain of its long-term results on the crypto room.

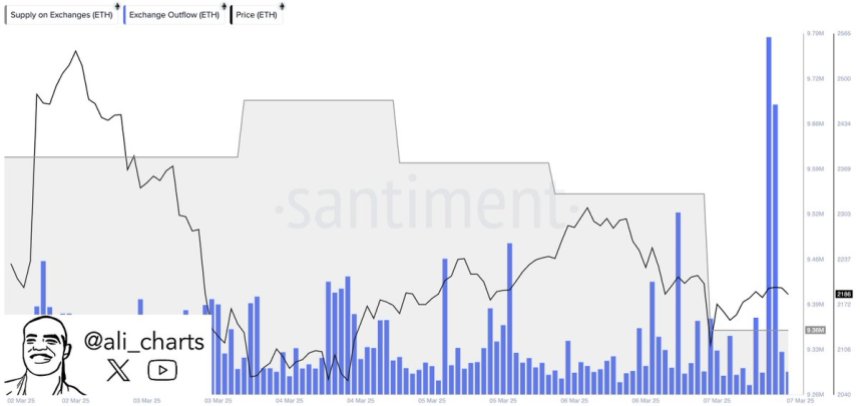

Regardless of the continual decline, information on Santiment chains A Bullish Sign-330,000 Ethereum have been withdrawn from festivals within the final 72 hours. Such main outflows usually point out buyers who transfer ETH to personal portfolios, indicating a decreased gross sales stress and attainable lengthy -term accumulation.

As a result of Ethereum is floating at necessary assist ranges, within the coming days will probably be essential to find out whether or not ETH is stabilizing or is being confronted additional. If the market sentiment improves and the trade outflows proceed, Ethereum might see a robust restoration. Nonetheless, if the gross sales stress persists, one other leg stays a chance, in order that merchants are stored on a excessive alert.

Ethereum stands for a crucial take a look at

Ethereum has misplaced greater than 50% of its worth because the finish of December, inflicting huge worry and panic available on the market. As quickly as a number one drive in crypto conferences, ETH is now fighting the restoration of Momentum, which signifies that buyers wonder if the long-awaited altern season will probably be launched this yr. Many analysts don’t speculate that it’s not, as a result of Ethereum and most altcoins don’t proceed to battle, are unable to reclaim bullish establishments or to arrange a transparent restoration pattern.

Regardless of the bearish sentiment, there’s nonetheless hope for a rebound, as a result of information on the chain suggests attainable bullish catalysts. Ali Martinez shared santiment Knowledge, revealing that 330,000 Ethereum has been withdrawn from festivals within the final 72 hours. This necessary outflow can point out that buyers transfer ETH to personal portfolios, decreasing the fast gross sales stress and probably the stage for an supplied squeeze is ready.

A proposal Squeeze happens when the accessible supply of an energetic on exchanges decreases, making it tougher for sellers to decrease costs. If Ethereum is retained a very powerful demand zones and the shopping for stress will increase, the decreased trade supply might trigger a robust restoration within the course of upper value ranges.

Associated lecture

In the intervening time, merchants or ETH can stabilize and regain crucial resistance ranges. If Bulls returns, Ethereum might begin a restoration pattern within the coming weeks. Nonetheless, if the gross sales stress persists, one other wave of downward motion stays a chance, in order that the market retains on sharp. Within the coming days, it is going to be essential in figuring out the quick -term course of Ethereum and whether or not the latest withdrawal of the trade signaling a turning level for ETH.

ETH value exams essential query

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now