Ethereum

5 key metrics hint at Ethereum’s next big bull run

Credit : ambcrypto.com

- Ethereum whales are piling up as diminished promoting stress indicators a potential provide scarcity.

- The rising every day trades and curiosity from short-term holders point out that ETH’s subsequent bullish part is close to.

Ethereum [ETH] is positioned as the following crypto to draw substantial capital inflows, in line with evaluation from blockchain intelligence platform IntoTheBlock.

Whereas Bitcoin [BTC] just lately hit an all-time excessive of $99,261.30, the worth of Ethereum is at $3,365.66with a 24-hour buying and selling quantity of greater than $55 billion.

Regardless of underperforming Bitcoin’s latest beneficial properties, Ethereum could possibly be poised for a bullish breakout, with key metrics providing perception into its subsequent trajectory.

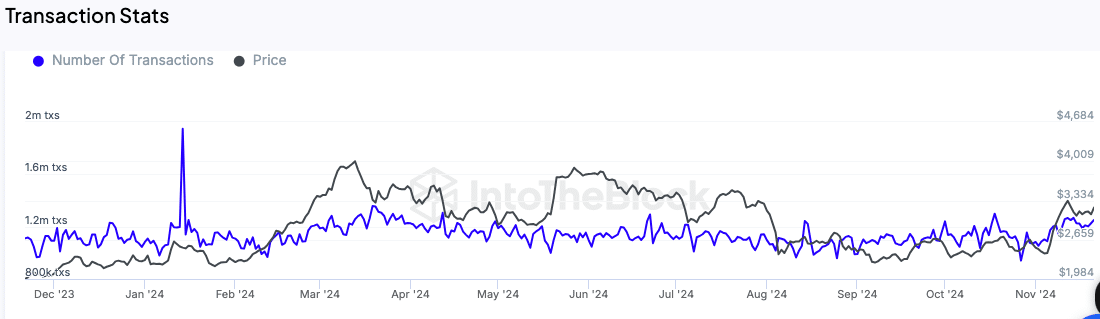

Each day transactions present regular development

The variety of transactions on the Ethereum community has elevated considerably in latest months. The info from IntoTheBlock reveals that every day transactions have grown from 1.1 million to 1.22 million over the previous three months.

This regular rise signifies rising utilization of the Ethereum community, which could possibly be a harbinger of larger worth exercise.

Supply: IntoTheBlock

A rise in every day transaction quantity is usually seen as an early sign of elevated curiosity amongst customers and traders, which may gas additional momentum in Ethereum’s worth.

Massive holders radiate confidence

Whale exercise is one other essential indicator that’s monitored. Based on IntoTheBlock, holders of at the very least 0.1% of Ethereum’s circulating provide are exhibiting optimistic web flows, indicating their confidence within the asset.

This sample signifies accumulation by bigger traders, which has traditionally aligned with upward worth actions.

The diminished promoting stress from these massive holders signifies that they might anticipate additional beneficial properties. Such habits usually indicators optimism amongst institutional and high-net-worth traders, who usually drive substantial market tendencies.

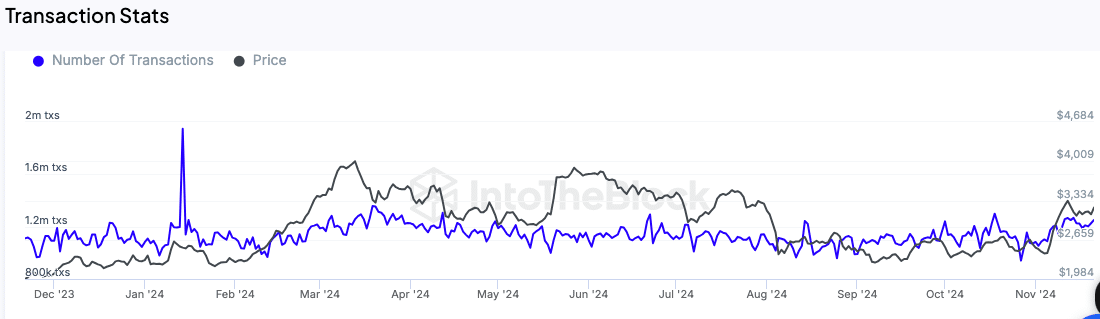

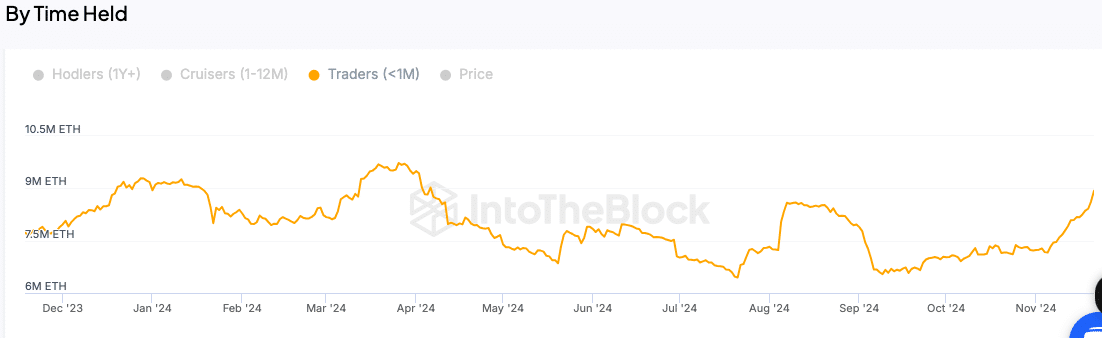

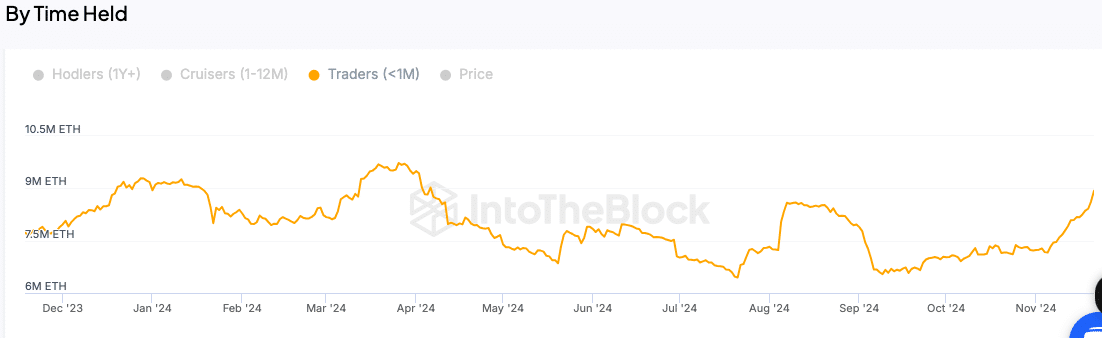

Rising curiosity amongst short-term holders

Quick-term Ethereum holders – those that have held the asset for lower than a month – are additionally being carefully watched. A rise within the variety of these holders signifies renewed curiosity from non-public traders.

This metric is very vital as a result of short-term holders usually reply to market tendencies and play an important function in driving buying and selling volumes.

Supply: IntoTheBlock

A rise of their exercise may contribute to a bullish part for Ethereum, particularly if accompanied by continued confidence from bigger holders.

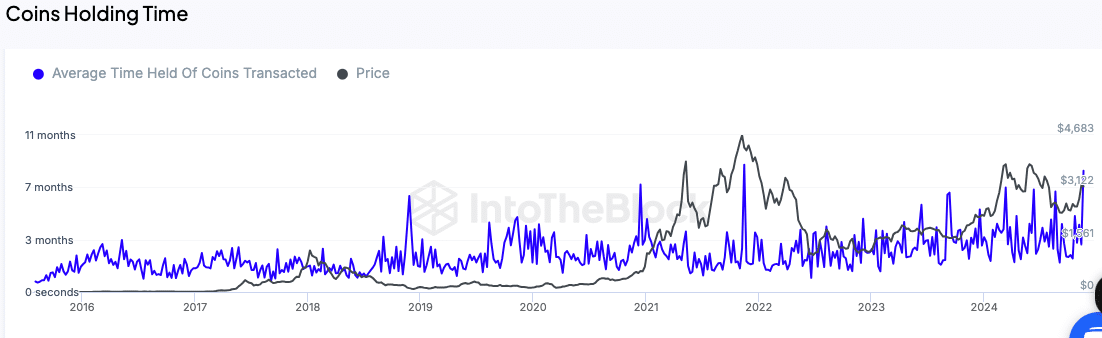

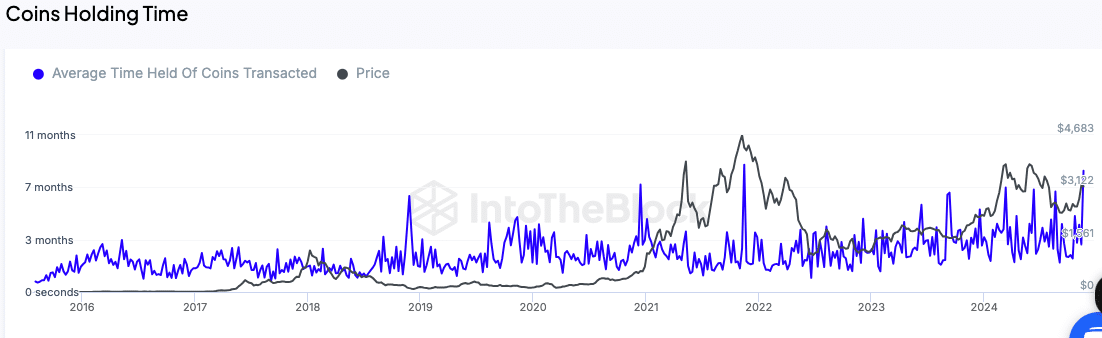

Longer holding occasions point out diminished promoting stress

One other vital metric is the common holding time of traded cash. Based on the analysisthe holding interval has elevated to 11 months, on account of diminished gross sales exercise amongst Ethereum customers.

This development factors to a good provide as there are fewer tokens circulating in the marketplace.

Supply: IntoTheBlock

A diminished willingness to promote usually helps worth stability and might create situations for an upward worth trajectory. Mixed with rising networking exercise, it is a issue that traders are protecting an in depth eye on.

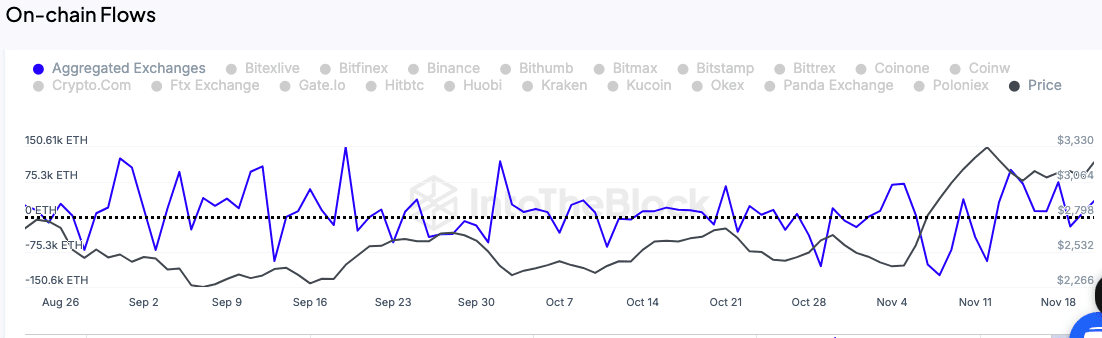

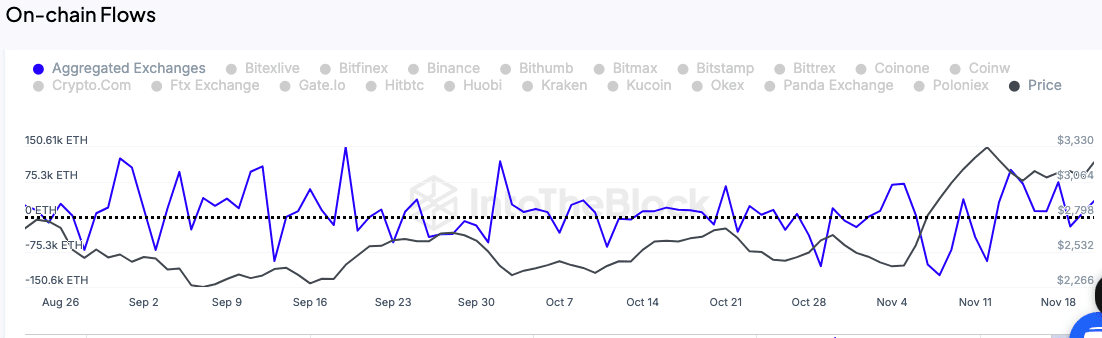

Alternating currents replicate accumulation tendencies

The motion of Ethereum tokens to and from exchanges can also be tracked as a possible sign of upcoming worth motion.

A decline in forex inflows normally indicators accumulation, as traders transfer their holdings into non-public portfolios slightly than holding them on exchanges for potential sale.

Supply: IntoTheBlock

Learn Ethereum’s [ETH] Value forecast 2024–2025

Inflows to the Ethereum exchanges stay low, indicating that holders are selecting to carry slightly than promote.

In the meantime, this accumulation habits is in keeping with expectations of a short-term worth enhance as demand may exceed provide.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024