Bitcoin

55K Bitcoin worth $5.34B pulled from exchanges in 72 hours – Why?

Credit : ambcrypto.com

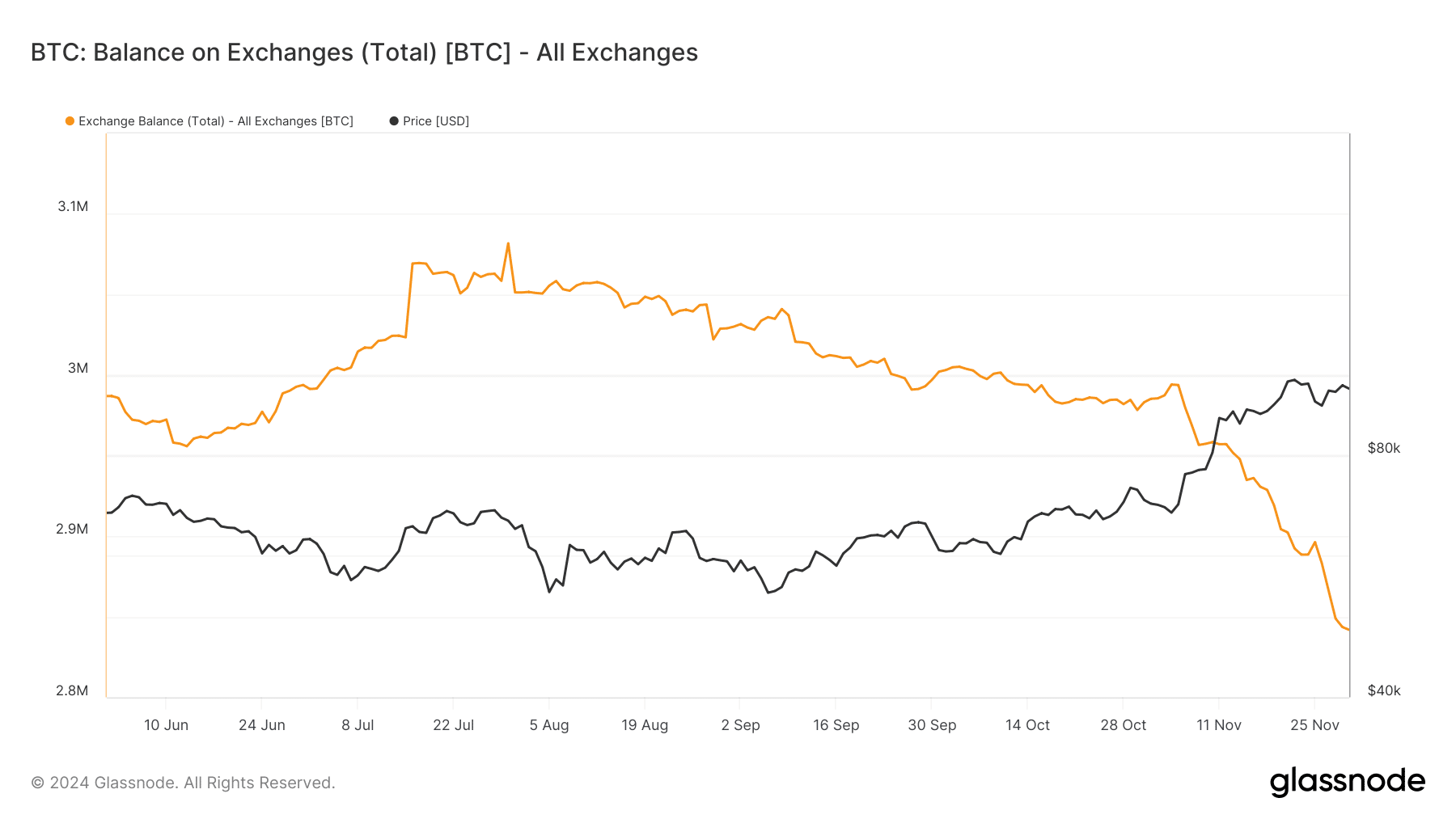

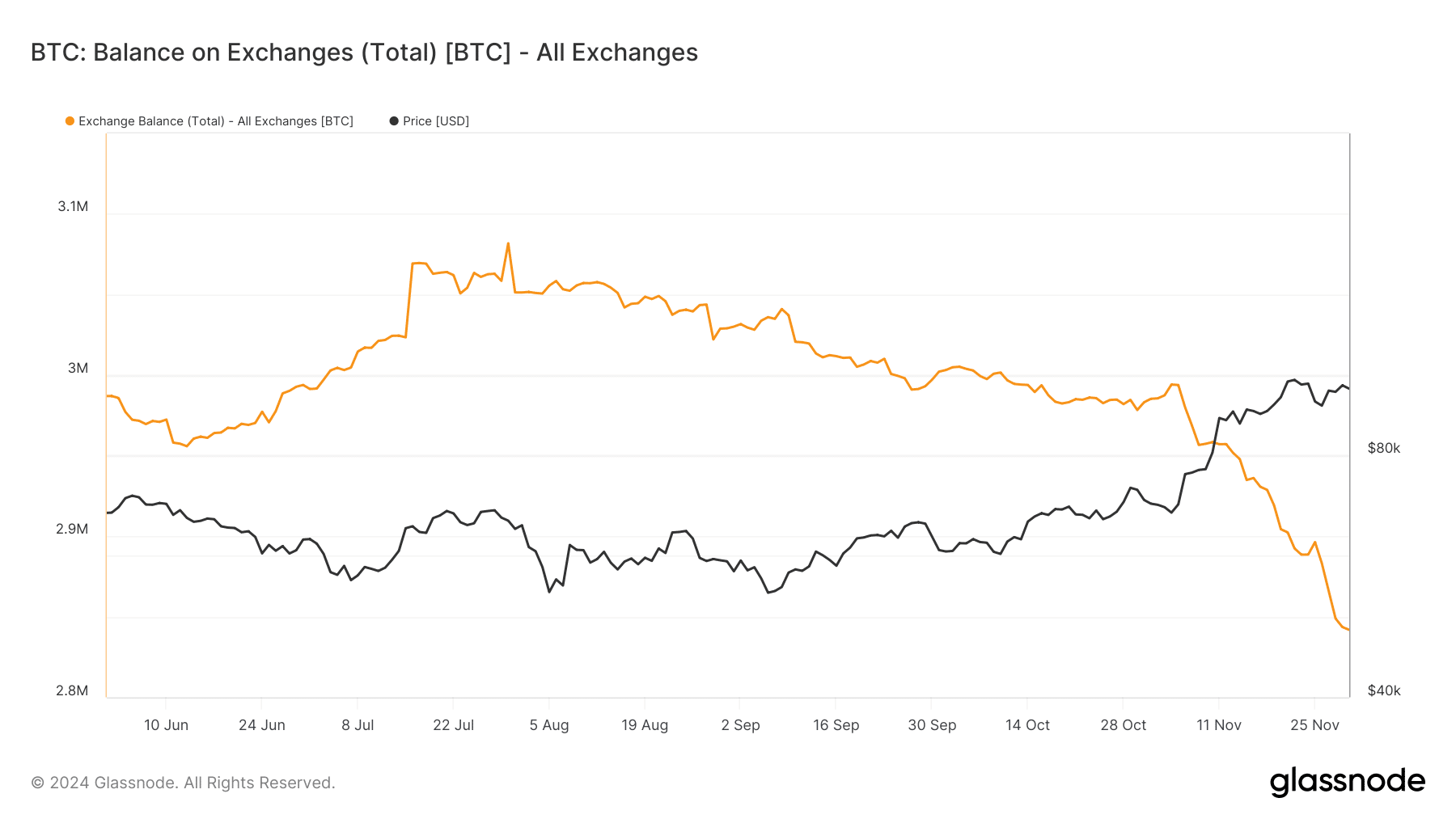

- Inside 72 hours, greater than 55,000 BTC had been withdrawn from the exchanges, highlighting sturdy accumulation and demand.

- Bitcoin’s ‘excessive greed’ indicators warning as historical past exhibits a excessive danger of market corrections

Bitcoin [BTC] has as soon as once more captured the market’s consideration with a colossal withdrawal of over 55,000 BTC from the exchanges in simply 72 hours – a transfer price $5.34 billion.

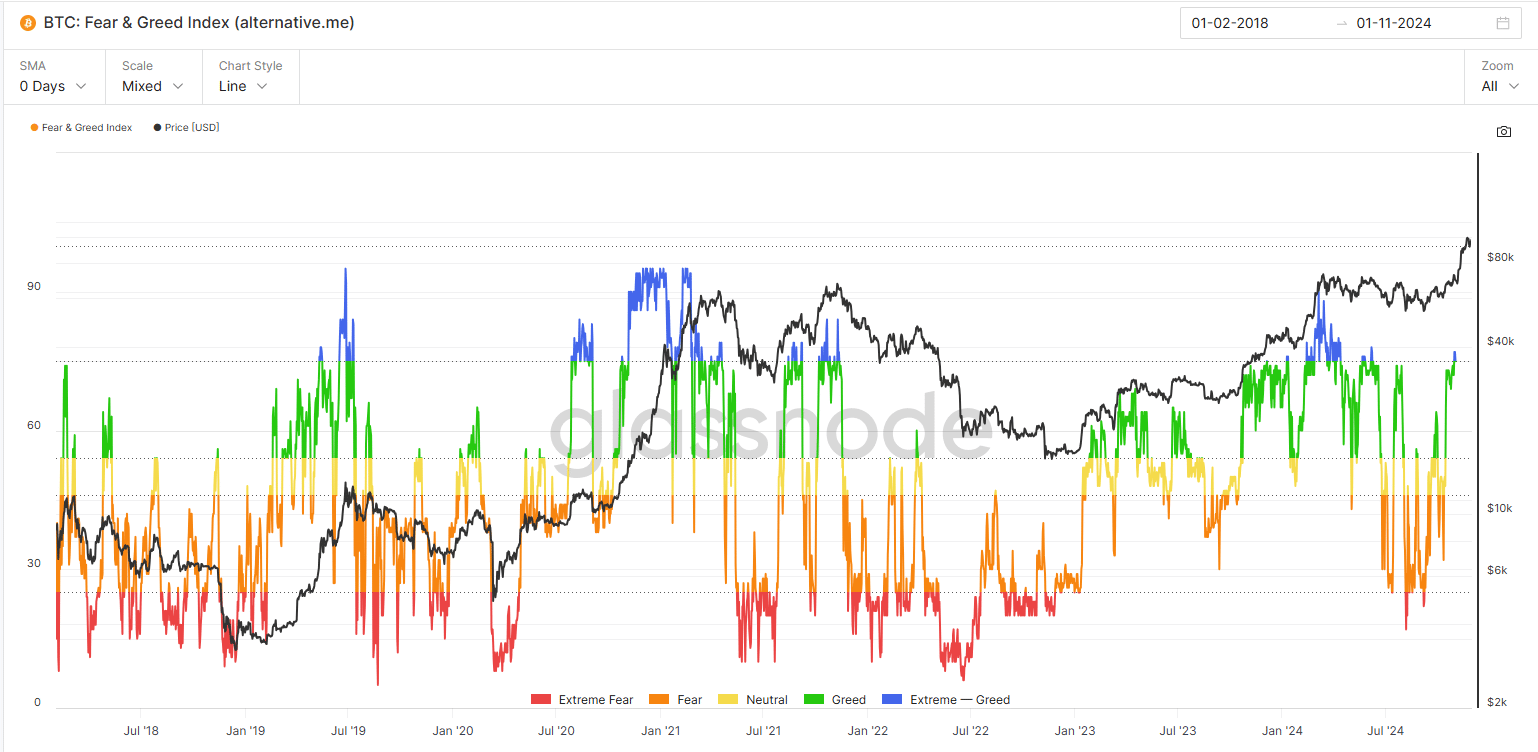

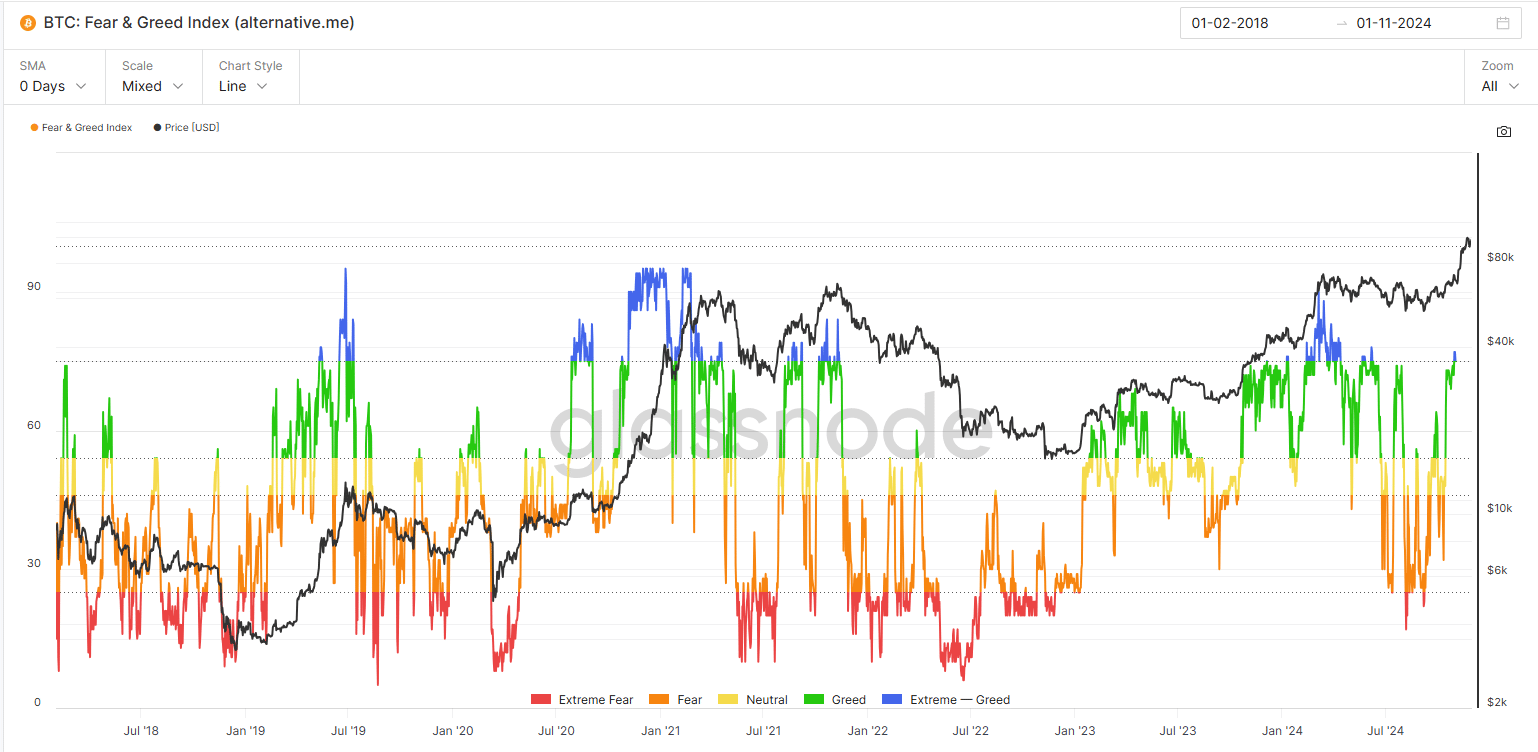

This exodus, mixed with the Concern & Greed Index now recording “excessive greed,” has fueled hypothesis concerning the subsequent huge factor.

The sentiment displays circumstances throughout Bitcoin’s historic bull run, when euphoric optimism pushed the value from $15,000 to $57,000 between 2020 and 2021.

Because the market grapples with this unprecedented exercise, buyers proceed to marvel: are we on the verge of one other explosive rally, or is a pointy correction looming?

The Bitcoin Exodus

The sharp decline in Bitcoin’s change price, which is now beneath 2.8 million BTC for the primary time since 2018, displays strategic strikes by buyers.

This exodus of 55,000 BTC corresponds to elevated exercise on the chain, indicating important accumulation. The transfer coincides with elevated demand for self-control as belief in centralized platforms declines.

Supply: Glassnode

Furthermore, the rising value development factors to a possible provide squeeze. Traditionally, such pullbacks have preceded bull runs, lowering rapid promoting stress on the inventory markets whereas signaling a long-term technique.

Using the wave of ‘excessive greed’

The Bitcoin Fear & Greed Index has entered ‘excessive greed’ territory, reflecting elevated optimism amongst buyers.

This sentiment is above 80 on the time of writing, a stage not seen for the reason that 2021 bull run. This sentiment indicators a possible rally, but in addition indicators warning.

Traditionally, excessive greed has brought on parabolic value actions, such because the climb from $15,000 to $57,000 in 2020-2021.

Nevertheless, these durations typically precede volatility, as exuberant sentiment will increase the chance of over-leveraged positions and abrupt corrections.

Supply: Glassnode

With Bitcoin passing $99,000 in November, the market is getting into uncharted territory. Overseas change reserves have fallen to their lowest level in recent times, indicating a good provide as long-term holders dominate.

Nevertheless, the mix of maximum sentiment and overheated circumstances warns of potential retracements – corresponding to the latest value correction this previous week.

Bitcoin’s milestone displays sturdy bullish momentum, however underlines the delicate stability between euphoria and warning as buyers weigh their features in opposition to additional upside potential.

Catalysts, sustainability and dangers

Bitcoin’s current rally is the results of a trio of things: tighter provide as international change reserves fall beneath 2.8 million BTC, elevated institutional participation, and macroeconomic uncertainty driving demand for digital property.

The continued provide contraction, mixed with the sturdy enhance in long-term holding exercise, offers a powerful basis for continued upward momentum.

Nevertheless, the dangers are nice. The “excessive greed” sentiment will increase the probability of leveraged liquidations, which may result in sharp corrections.

Learn Bitcoin’s [BTC] Value forecast 2024–2025

Moreover, Bitcoin’s unprecedented progress is amplifying speculative exercise, making it inclined to profit-taking.

Persevering with the rally is dependent upon continued institutional inflows, secure macro circumstances and the flexibility to climate unstable sentiment shifts with out destabilizing the market.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now