Ethereum

74% Ethereum supply is underwater – ETH’s next steps look uncertain

Credit : ambcrypto.com

- 74% of Ethereum is held with loss, which signifies a weak market construction and the rising sale of the gross sales aspect.

- The conviction on the buy-side stays low, in order that Ethereum stays accessible, until sturdy quantity and sentiment shift increased.

Ethereum [ETH] is confronted with rising stress, since knowledge on chains reveal a powerful deterioration of the profitability of the holder, in order that the load is added to the idea that the worth is caught underneath an enormous resistance wall.

Supply: X

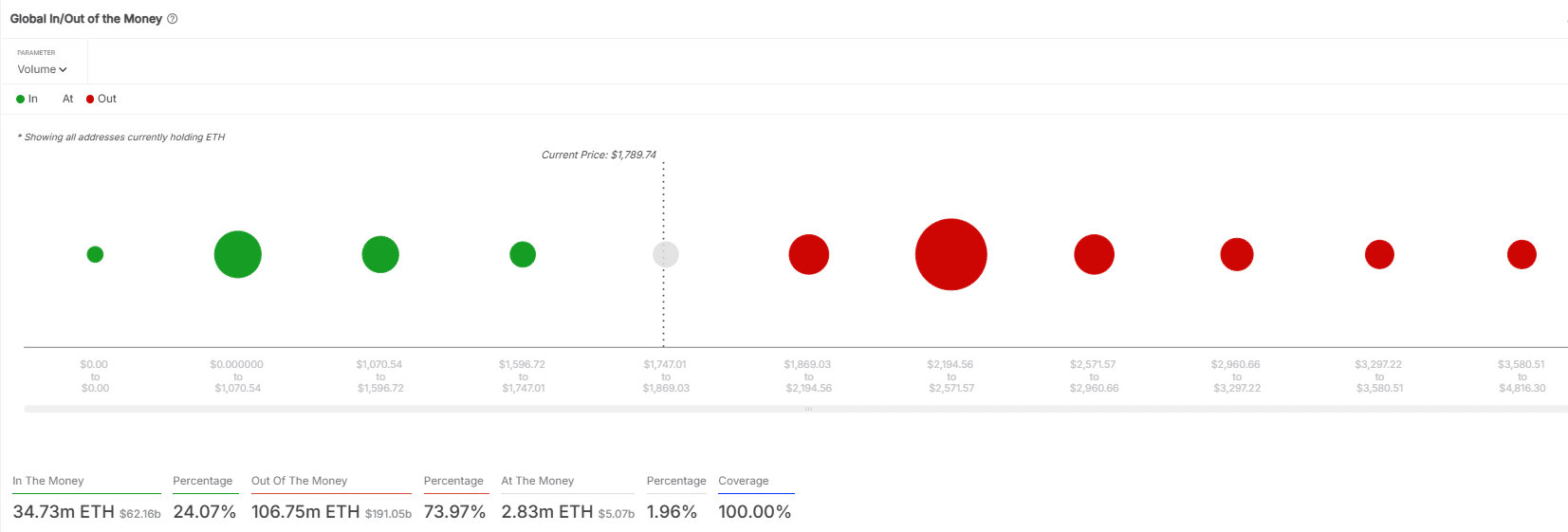

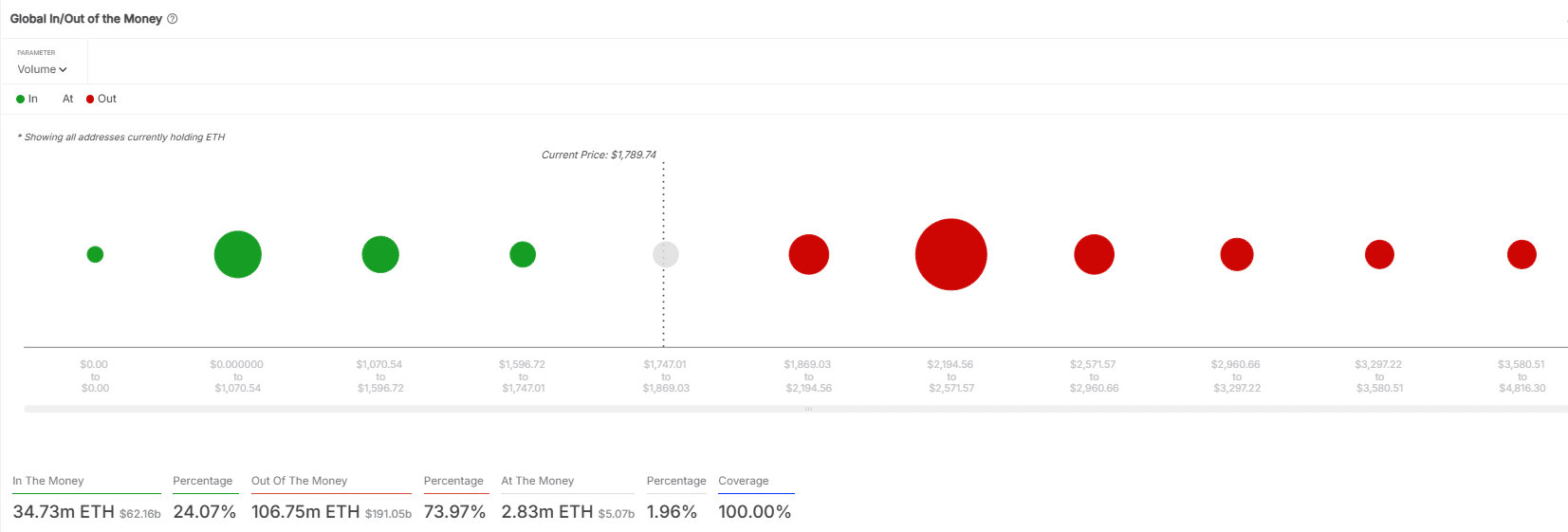

Knowledge from Intotheblock present 73.97% of the ETH supply – Roughly 106.75 million cash – is now being held a loss. However, solely 24.07% of the ETH revenue stays.

This imbalance paints a bearish picture of the present market construction, wherein few holders are in worthwhile positions and plenty of are nonetheless anchored over the present buying and selling vary.

A market hostage

Nearly 45% of the vary of Ethereum-66.29 million ETH-Werd purchased between $ 2,194 and $ 2,571, in line with knowledge on the chain.

Supply: Intotheblock

This attain, held by 12.28 million portfolios, has a median price foundation of $ 2,381.85, which varieties a powerful resistance zone.

However, the help appears to be like fragile.

Solely 2.83 million ETH, or 1.96% of the supply, is at the moment ‘with the cash’. These corporations, purchased between $ 1,786.34 and $ 1,791.11, are unfold over 95,470 addresses – considerably weak help on the present stage on the present ranges.

With out a sturdy conviction of patrons round $ 1,789, the worth may float off – in each instructions. Till the stronger query arises, the worth can float – however gravity is in favor of the bears.

The persistent $ 2,200 – $ 2,580 Wall has once more appeared in successive knowledge runs. Each day confirms its dimension and energy once more.

But there are nonetheless questions – is that this resistance zone actually unbreakable, or is it extra a psychological barrier?

700K ETH disappeared in two months

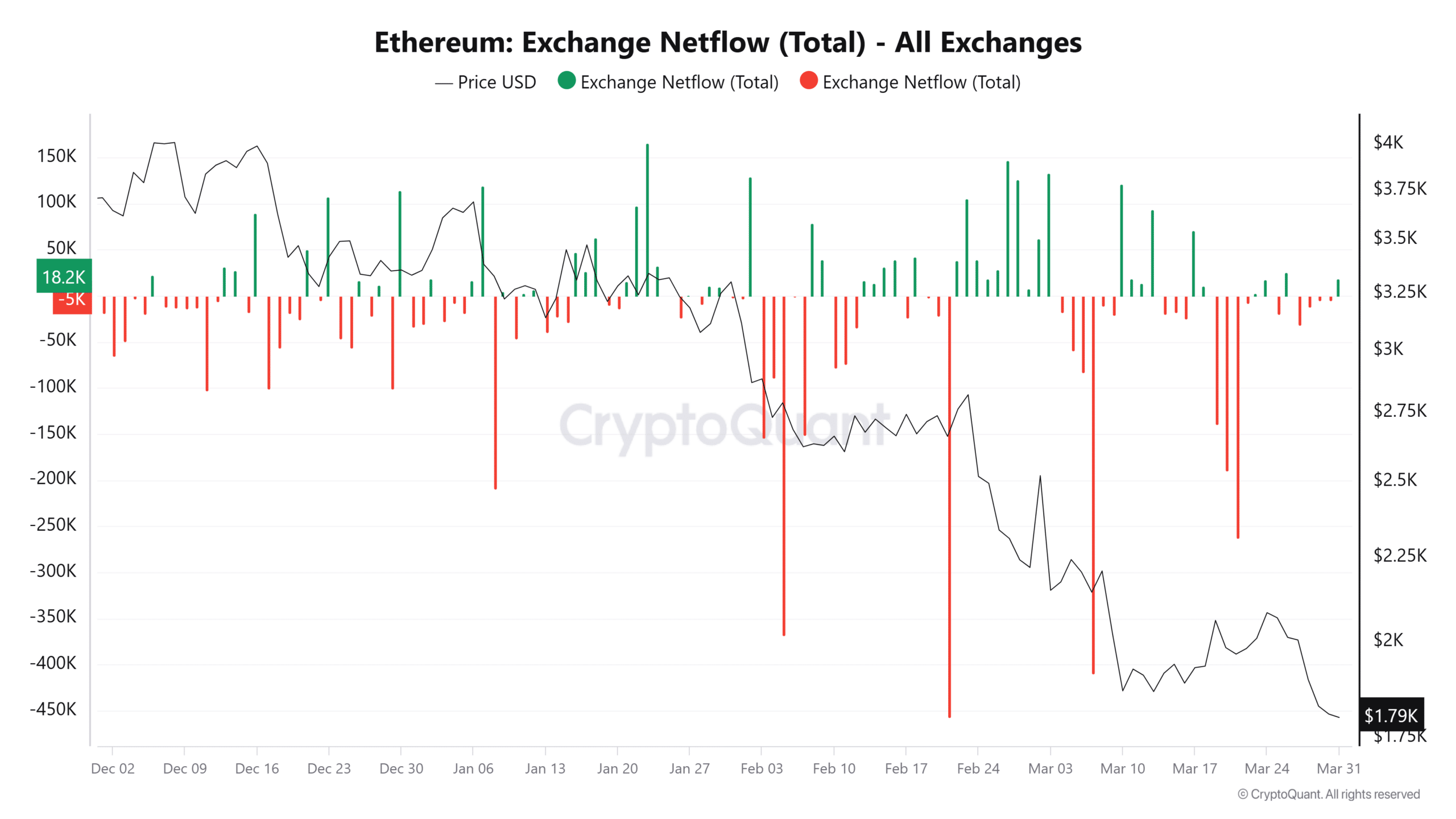

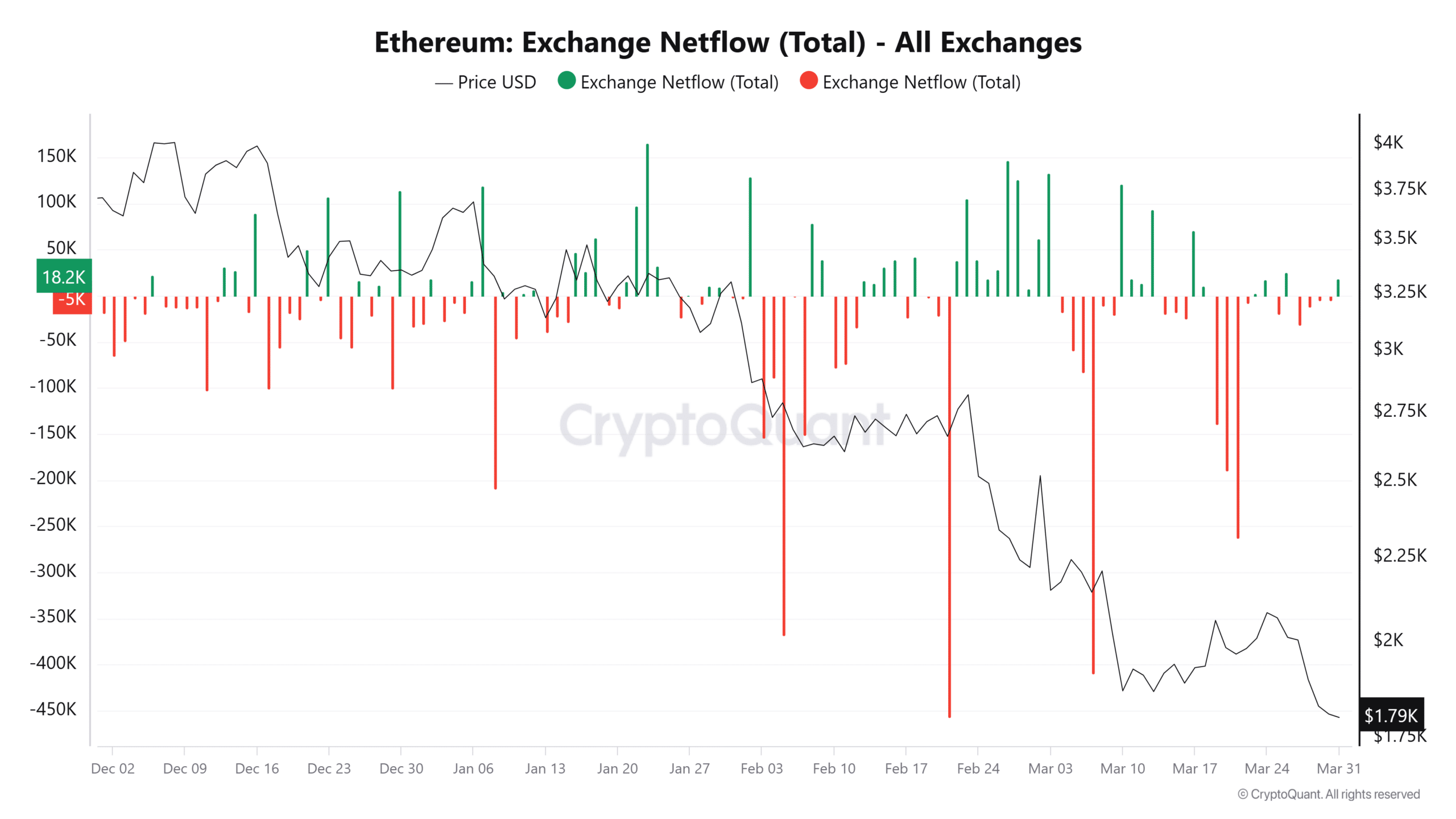

Help for the Bearish show are the change fee community stream knowledge from Ethereum, drawn from cryptoquant, which exhibits a transparent development of large-scale recordings.

Allegedly, in February and March 2025, greater than 300,000 ETH.

Supply: Cryptuquant

This contains peaks of 400k ETH on 17 February and 409k ETH on March 7. These recordings are tailor-made to steep worth decreases, which means that buyers have eliminated belongings to stop them from being offered in weak spot.

Though such recordings could point out the long run, additionally they replicate a low urge for food for spot publicity in a falling market. The consumption, alternatively, was uncommon and weak.

A 166,065 ETH influx throughout the finish of January didn’t succeed within the worth momentum, which signifies a restricted buy rate of interest.

Stack losses when hope fades

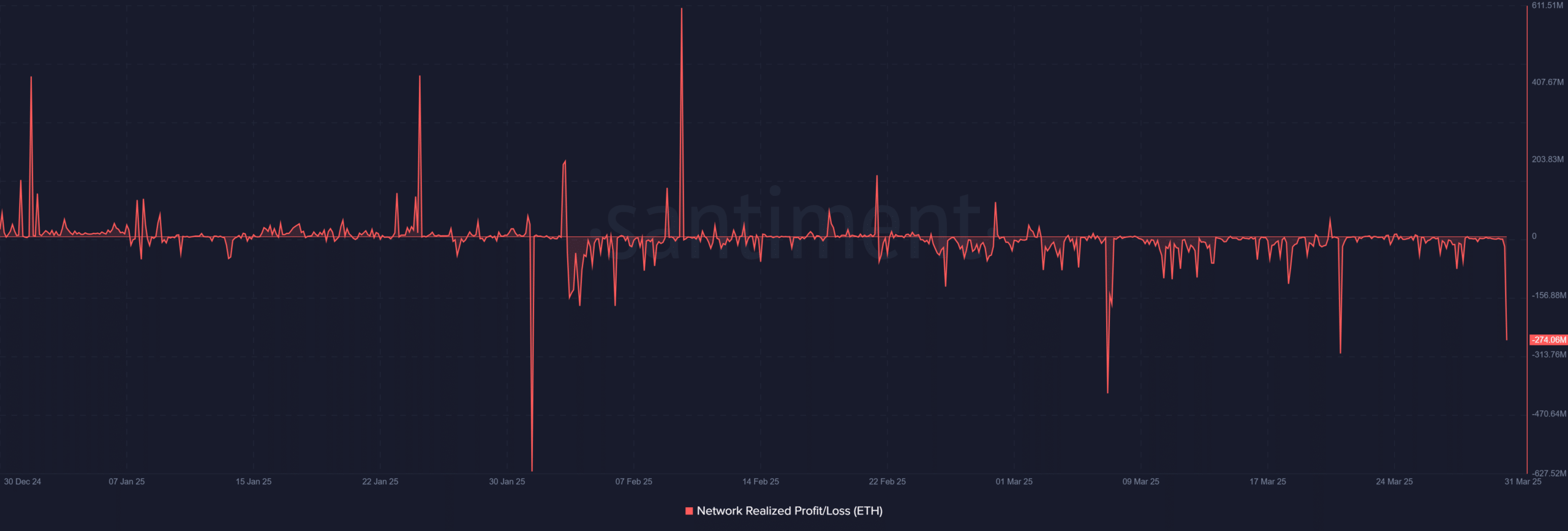

Santiment statistics present related alerts.

Supply: Santiment

The community realized revenue/loss graph exhibits successive losses realized. For instance $ 922.48 million on 3 February and $ 788.36 million on March 7.

The revenue normally appeared at first of January, with a peak at $ 580.15 million on the brand new yr. The NRPL has remained detrimental since then.

This dominance of losses corresponds to the Giom lecture that the majority holders are underneath water. Analysts name it capitulation habits and replicate a decreased belief within the brief time period.

Ethereum stays underneath stress with nearly 74% of its vary with losses, normally between $ 2,200 and $ 2,580.

This zone is a crucial resistance barrier, bolstered by weak help at present costs, steady change retailers and chronic losses realized.

Though the info confirms a powerful overhead resistance, it doesn’t assure that it’ll apply. An vital outbreak continues to be potential if it meets enough quantity and demand.

Till that point, Ethereum will most likely maintain underneath $ 2,200, with the stress of the vendor and the restricted purchaser’s pursuits closed the other way up.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024