Gaming

9 out of 10 projects are abandoned

Credit : cryptonews.net

Based on the 2024 report from ChainPlay, an organization specialised within the evaluation and analysis of blockchain tasks, the GameFi sector can be in nice issue.

Based mostly on the findings, 93% of tasks on this area of interest have failed, with a median decline of 95% from their all-time highs. A complete of three,200 case research had been analyzed.

Even investments within the sector haven’t been notably worthwhile, making buyers alert to the sector’s future within the GameFi panorama.

All particulars under.

ChainPlay research 3,279 tasks within the GameFi sector

ChainPlay, a well known firm within the crypto world, just lately publicly launched its report on the present state of the GameFi business in 2024.

This sector, which is the results of a hybrid between the world of gaming and that of decentralized finance, appears to be present process a metamorphosis part of a serious disaster.

After main the rise of cryptocurrencies through the 2022 bear market and attracting billions of {dollars} in investments, the GameFi panorama now seems to have deteriorated considerably.

Earlier than we get into the core of the subject, we current the methodology that ChainPlay makes use of in its analysis work.

A complete of three,279 completely different blockchain sport tasks had been analyzedpartly because of the cooperation of the accomplice firm Storible.

The details about the value of the respective undertaking tokens comes from Dune Analytics, whereas the person knowledge is obtained from DappRadar.

A undertaking is outlined as “useless” if the value of the token in query has fallen by greater than 90% from its all-time excessive and/or has fewer than 100 energetic customers per day.

The creation date of a undertaking’s token and the date it started assembly the above standards decide its length.

The return on funding for enterprise capital and annual fundraising knowledge comes from an inner database with a number of sources of data.

All knowledge was collected in November 2024.

Supply: https://chainplay.gg/weblog/state-gamefi-2024/

Robust life for brand spanking new GameFi tasks: 93% fail in a short while

As talked about within the introduction, ChainPlay’s report highlights the failing nature of most GameFi tasks.

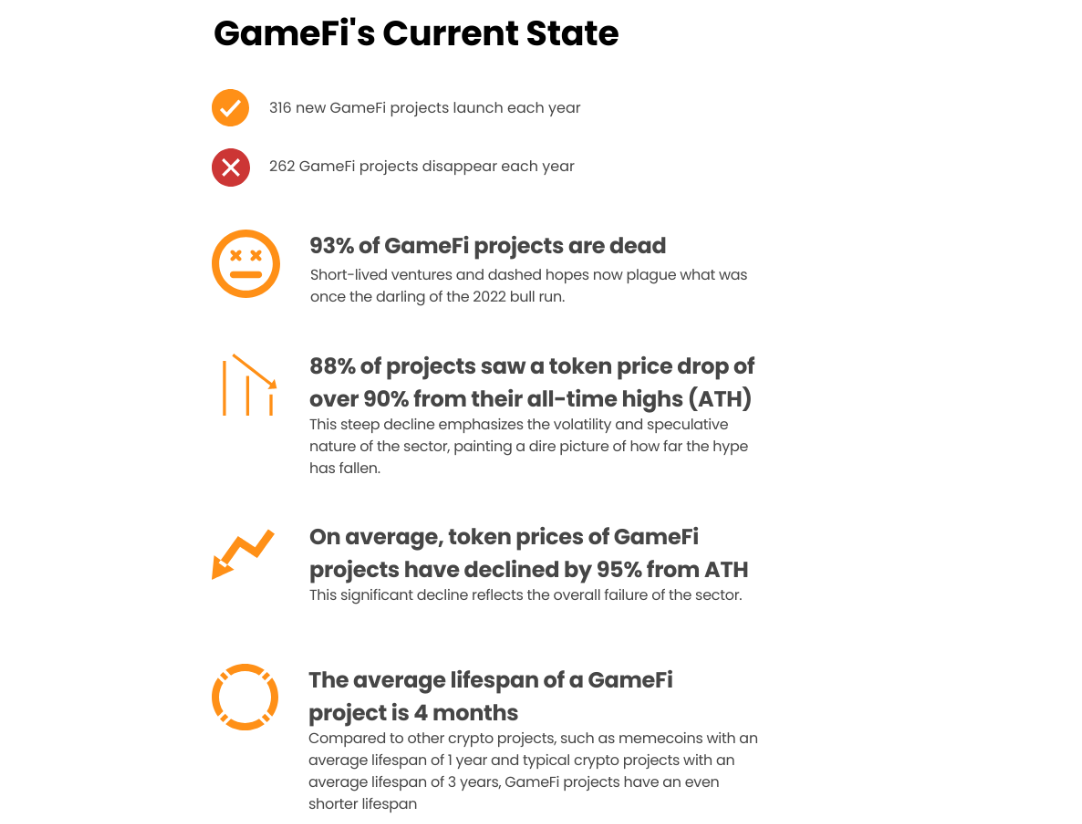

A mean of 316 new tasks are launched yearly, however 262 of them disappear inside a number of months and are thought-about “useless”.

Whereas in 2022 the union of gaming with decentralized finance looks as if a development destined to develop, simply two years later a really completely different image emerges.

88% of all the GameFi token business has seen a worth drop of over 90% from their respective all-time highs. This example highlights the poor utility of the digital property in query, and merely displays a speculative worth associated to the non permanent hype.

On common, the costs of those tokens have fallen by 95% from their ATH, highlighting the nice disappointment of buyers who believed on this story.

Take into consideration that the common length of a GameFi undertaking is barely 4 monthsconsiderably decrease in comparison with different sectors within the crypto and blockchain world.

This extremely brief existence highlights the large difficulties in constructing sustainable gaming ecosystems over time, able to attracting natural visitors.

Additionally contributing to this total failure is the speedy evolution of sport logic and the ever-changing challenges of the gaming business, which frequently differ over time.

All of those statistics paint the GameFi world as a brief place unable to ship long-term experiences to gamers and buyers.

Retail and enterprise capital investments on this market area of interest: questionable efficiency

The GameFi business’s macabre prospects are confirmed by ChainPlay knowledge on retail and enterprise capital investments, that are affected by unattractive efficiency.

Nevertheless, whereas GameFi’s excessive failure price is plain, its profitability parameters reveal two completely different realities for retail buyers and enterprise capitalists.

Concerning the previous, the report highlights one common revenue of 15% for all these small operators who invested in decentralized preliminary provides (I DO).

We’re speaking about figures that aren’t very important and that, regardless of the constructive valuation, ought to be associated to the stratospheric development of all the crypto business since 2022.

Moreover, when retail buyers strategy GameFi token IDOs, they typically must adjust to harmful vesting restrictions, blocking funds for a number of months.

Given the aforementioned common decline of 95%, you perceive that a median acquire of 15% doesn’t justify the presence of such monetary limits.

For a lot of retail buyers, the aspiration to attain monetary success with GameFi has became a terrifying actuality of illiquid property and falling costs.

For enterprise capitalists (VC), returns seem extra polarizedthe place one half produces earnings whereas the opposite displays important losses.

The typical revenue is the same as 66%, with 42% of VCs document efficiency between 0.05% and 1950%, whereas the remaining 58% expertise losses starting from -2.5% to -98.8%.

The highest enterprise capital buyers are Alameda Analysis with an ROI of 713.15%, Leap Capital with an ROI of 519.11% and Delphi Digital with an ROI of 490.50%.

Honorable point out additionally to Binance Labs, which data common efficiency of 338.52% and 3Commas with a return of 267.20%.

Then again, probably the most unproductive funds had been Golden Shovel Capital, which misplaced 97.4% in GameFi, and Infinity Capital with a 97.1% ROI.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024