Altcoin

$ 900 m liquidated in the middle of the steep fall of Bitcoin

Credit : www.newsbtc.com

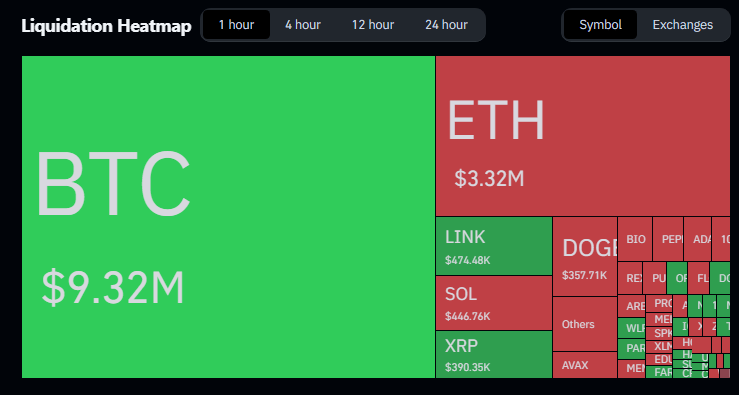

An vital dive within the cryptomarkt has despatched shock waves within the trade for the previous 24 hours, leaving a path of liquidations behind. About 200,000 merchants have been pressured from their positions as Bitcoin Immersed right into a low -seven -week low and greater than $ 900 million in liquidations for someday.

Associated lecture

In keeping with CoinglassMost of these losses got here from lengthy bets that the slide couldn’t endure.

Liquidations contact retail merchants

Experiences have introduced {that a} single giant sale has contributed to the depositing of the cascade. The gross sales stress was intensified as a big holder, loaded 24,000 BTC and led to a wave of liquidations, stated Rachael Lucas, a crypto analyst at BTC Markets.

At Coinbase, Bitcoin fell brief beneath $ 109,000 – the weakest stage since July 9. Market individuals felt the shock shortly; Merchants who have been lengthy have been essentially the most uncovered.

Macros indicators and market response

A latest trace of the Federal Reserve chairman Jerome Powell in Jackson Gap about potential interest rates Modified how some buyers achieved the danger.

Since August 14, when Bitcoin reached a document excessive of simply over $ 124,000, it has been actively corrected by greater than 10%. Primarily based on knowledge, the lower is as a result of Powell’s speech is round 7%.

The one-day motion was measured by virtually 3% lower for Bitcoin, and the full crypto-market worth slipped again under $ 4 trillion to round $ 3.83 trillion as virtually $ 200 billion flowed out of house.

Ether holds

Ether acted close to $ 4,340 and now seems extra secure than Bitcoin. It did, but it surely didn’t violate final week’s low level. Institutional curiosity in Ether stays a chat level. In keeping with Lucas, establishments proceed to focus on EthereumEven when merchants re -assess the danger of smaller cash.

Associated lecture

Altcoins took greater hits

A variety of Smaller tokens fell harder Then the Majors. Solana, Dogecoin, Cardano, Chainlink and Sui belonged to the worst hit.

That pushed losses past the headline Bitcoin numbers and had merchants in altcoin-heavy positions that nurse bigger drawings.

Skinny weekend liquidity served to enhance the worth shields, making the motion extra excessive than on a extra energetic buying and selling day.

The TrackRecord and the Outlook of September

There may be additionally a historic a part of the story. September has a historical past of sturdy pullbacks in bull markets, with sturdy corrections in 2017 and 2021.

Featured picture of meta, graph of TradingView

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024