Bitcoin

$99 mln gone – James Wynn crypto liquidation adds pressure to shaky market

Credit : ambcrypto.com

- James Wynn Crypto Liquidation sweeps $ 99.3 million away whereas Bitcoin slipped beneath $ 105k, in order that one of many largest losses of the cycle was marked.

- Holders within the brief time period depart the market, which signifies speculative significance and a attainable shift in value dams.

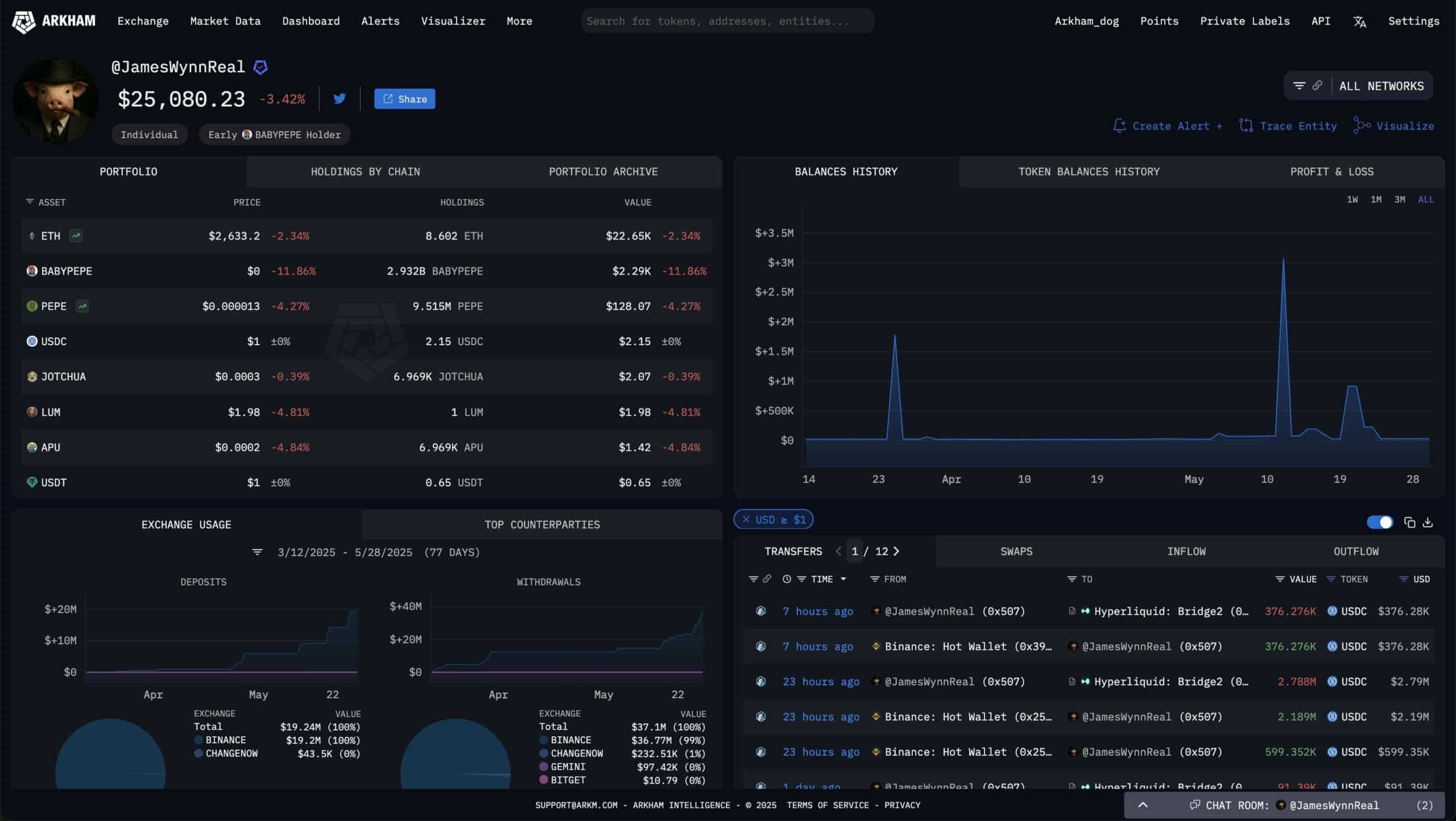

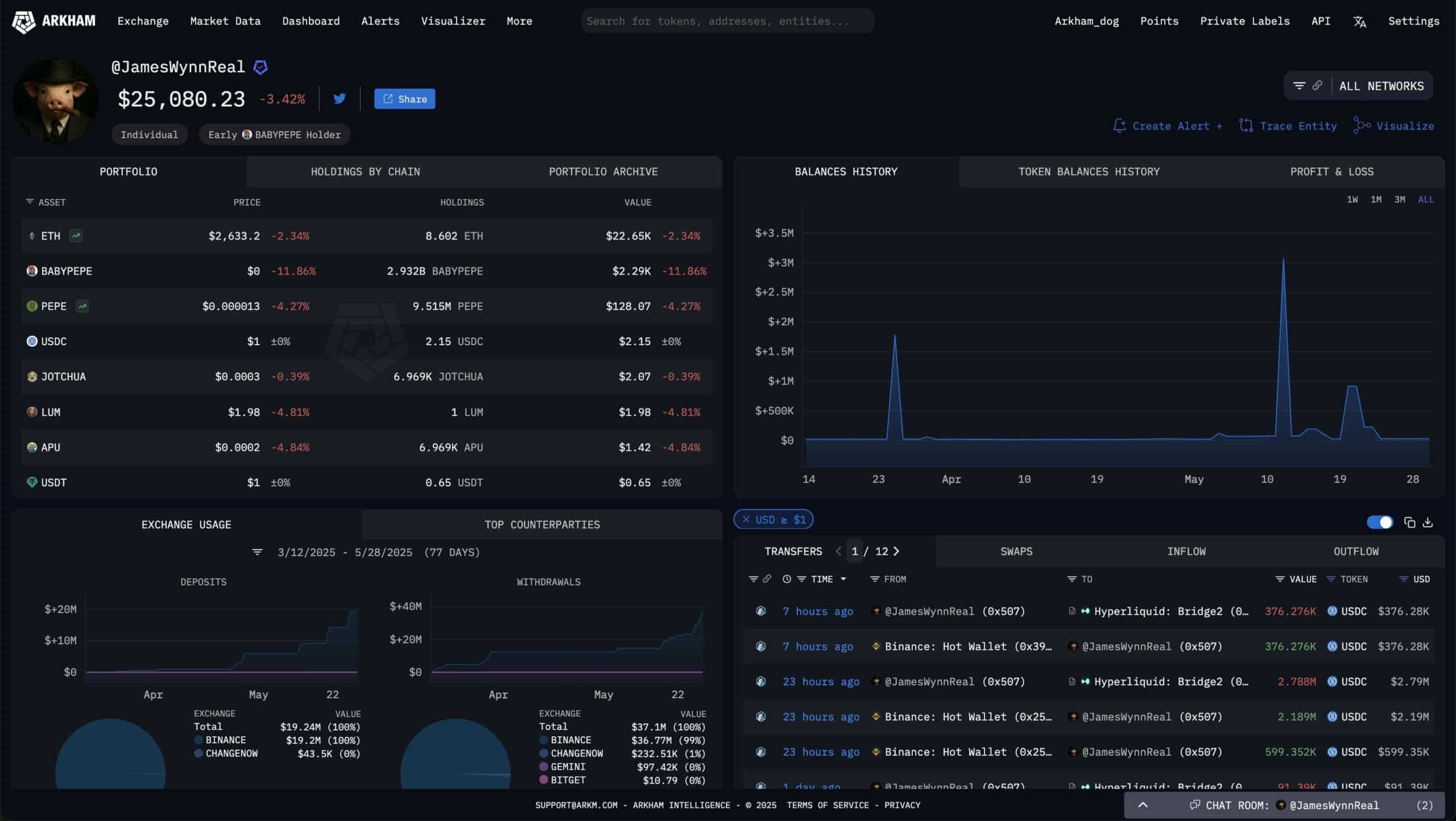

The crypto portfolio of whale investor James Wynn has taken An enormous loss lately.

Whereas Bitcoin [BTC] Fell quickly beneath $ 105,000, Wynn was liquidated For 949 BTC – price round $ 99.3 million.

The liquidation is because of the heels of a broader sale over your complete market, which has activated Tracade liquidations.

The steep fall has been added to the prevailing distress of Wynn. Final week the whale misplaced greater than $ 99 million to non -realized worth as a result of BTC had no vital help ranges.

Supply: Arkham Intelligence

Bitcoin’s fall brought on mass -readings

The dip beneath $ 105k not solely shook one whale. It led to a wider wave of liquidations on crypto gala’s.

Wynn’s large exit headed a fleeting session.

Derivate information confirmed open curiosity that briefly after which collapsed – basic indicators of leverage deviations that happen in actual time.

Supply: Coinglass

Quick -term holders take a step again

The impression is now not unique for whales.

Knowledge on chains present an enormous discount in holders within the brief time period after the correction. This refers to addresses that maintain Bitcoin lower than 155 days.

The lower in cohort indicators lowered the speculative urge for food, in order that the rising hesitation indicators additional arouse with merchants who’ve contributed to the present rally.

With the unloading of brief -term holders, the dominance of the lengthy -term holders might quickly rewrite the value patterns of BTC.

Supply: Cryptuquant

What this implies for Bitcoin sooner or later

The liquidation of James Wynn is a narrative about warning. The occasions reveal how risky and ruthless the present market circumstances may be for seasoned traders.

Though value promotion has not maneuvered a transparent path, the shrinking pool of brief -term holders can recommend {that a} interval of consolidation is imminent.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024