Ethereum

Bitcoin And Ethereum Addresses Shrink In 2024

Credit : www.newsbtc.com

This text is on the market in Spanish.

The cryptocurrency market is presently experiencing a major decline, as are each Bitcoin and Ethereum have skilled a considerable decline within the variety of energetic addresses. This development, which has continued into 2024, has raised issues about the way forward for these outstanding cryptocurrencies. The implications for market dynamics may very well be profound as investor enthusiasm wanes.

Associated studying

Reducing energetic addresses

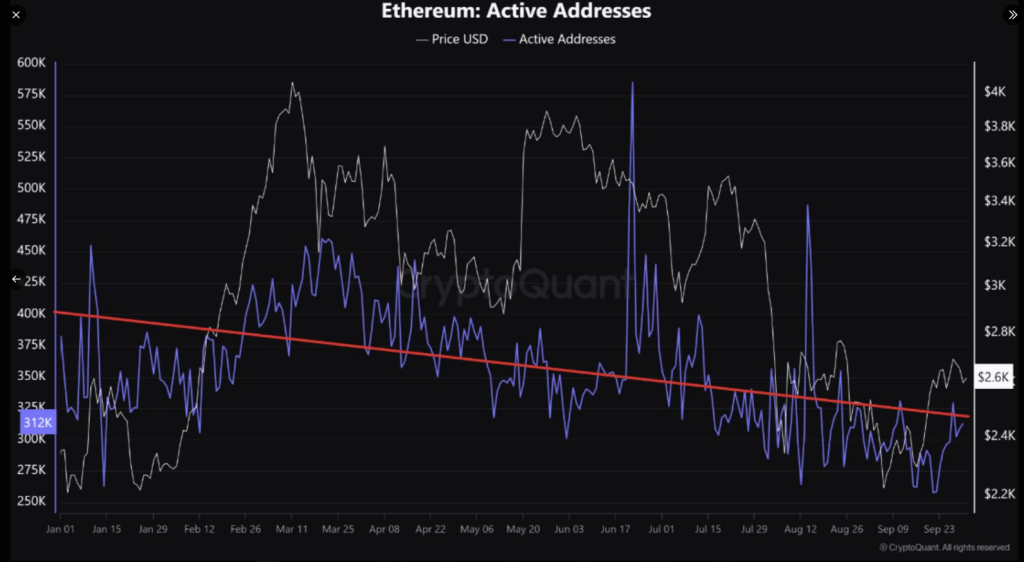

In line with the newest statistics from CryptoQuant, Bitcoin’s energetic addresses have shrunk by roughly 1.17 million to 855,000, whereas Ethereum has decreased by roughly 382,000 to 312,000. This equates to a 27% decline for Bitcoin and an 18% decline for Ethereum this yr.

The lack of new investors entry into the market seems to be the principle reason for this decline. That is important for sustaining favorable momentum as present members dominate buying and selling exercise within the absence of recent capital inflows.

Since early 2024, energetic Bitcoin and Ethereum addresses have declined

“If the bulls wish to dominate the market, the influx of recent traders is an important situation.

1. Bitcoin 1.17 million -> 855K

2. Ethereum 382K -> 312K” – By @burak_kesmeciFull publish 👇https://t.co/gZftQidnxa pic.twitter.com/q5cdpv7x6t

— CryptoQuant.com (@cryptoquant_com) October 1, 2024

The anticipated pleasure surrounding the adoption of spot ETFs has not translated into elevated exercise on the blockchain. But the present person base has many traders who anticipated such developments. The Federal Reserve’s ongoing quantitative tightening continues to empty liquidity from the market, including additional strain to the state of affairs.

Market sentiment and future prospects

Nonetheless, there are indications {that a} potential restoration is imminent within the face of those challenges. For instance, Ethereum funding charges have remained constructive over the previous week, that means there may be rising curiosity amongst traders in lengthy positions. This suggests that whereas Ethereum’s worth declines are ongoing, a big majority of the market stays optimistic about its future efficiency.

BTC and ETH addresses are declining: BTC drops to 855K, ETH to 312K in 2024

Since early 2024, the variety of energetic Bitcoin and Ethereum addresses has continued to say no. Bitcoin addresses fell from 1.17 million to 855,000, whereas Ethereum addresses fell from 382,000 to…

— CoinNess World (@CoinnessGL) October 1, 2024

It is fairly attention-grabbing that main Ethereum holders have been accumulating their property, fairly than promoting them. These massive holders have lowered their outflows from 311,950 to 139,390, indicating they’re assured within the long-term prospects of the altcoin. Traders who take all these actions sometimes count on costs to get well rapidly.

Moreover, Bitcoin’s Trade Move A number of has seen a major decline. This measure contrasts with short-term and longer-term inflows and outflows, indicating that present buying and selling exercise is considerably decrease than historic averages. A low Trade Move A number of typically signifies that traders are holding their property in anticipation of future worth will increase, fairly than actively buying and selling them.

Associated studying

Bitcoin and Ethereum: broader perspective

The broader bitcoin market is negotiating a sophisticated terrain formed by geopolitical issues and authorized modifications. Current occasions have prompted traders to be typically extra cautious. For instance, regardless of market volatility inflicting Ethereum to drop to round $2,390, Bitcoin has managed to remain persistently above $61,100.

Featured picture from Vecteezy, chart from TradingView

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024