Ethereum

$259.2M ETH hits exchanges – Another sign of Ethereum facing price pressure?

Credit : ambcrypto.com

- Huge influx of ETH into exchanges as ICO continues to dump

- The Dencun improve has brought on ETH to lose some income by shifting to L2s

Ethereum (ETH), the second largest cryptocurrency available on the market after Bitcoin (BTC), has been on the receiving finish of accelerating promoting stress these days. Particularly as merchants transfer ETH to exchanges.

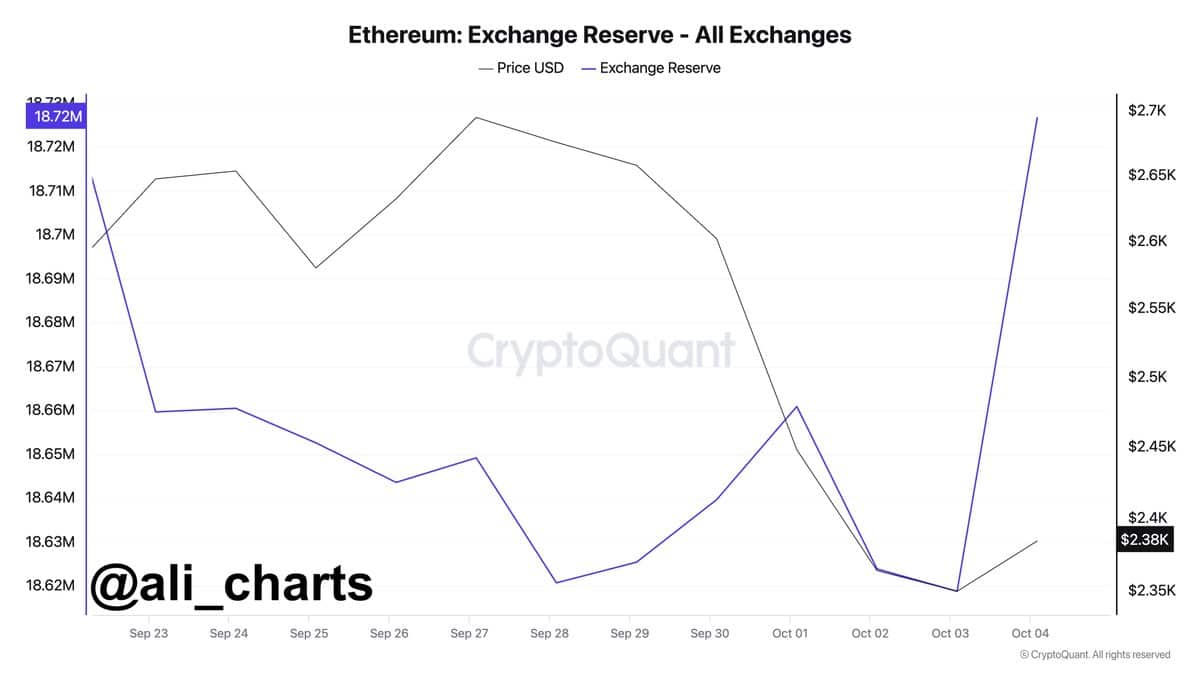

On the time of writing, over 108,000 ETH, value roughly $259.2 million, had been despatched to exchanges inside a interval of simply 24 hours.

Such inflows usually point out a attainable decline within the value of ETH. It is because elevated provide, mixed with stagnant demand, tends to decrease costs.

Supply: Ali/X

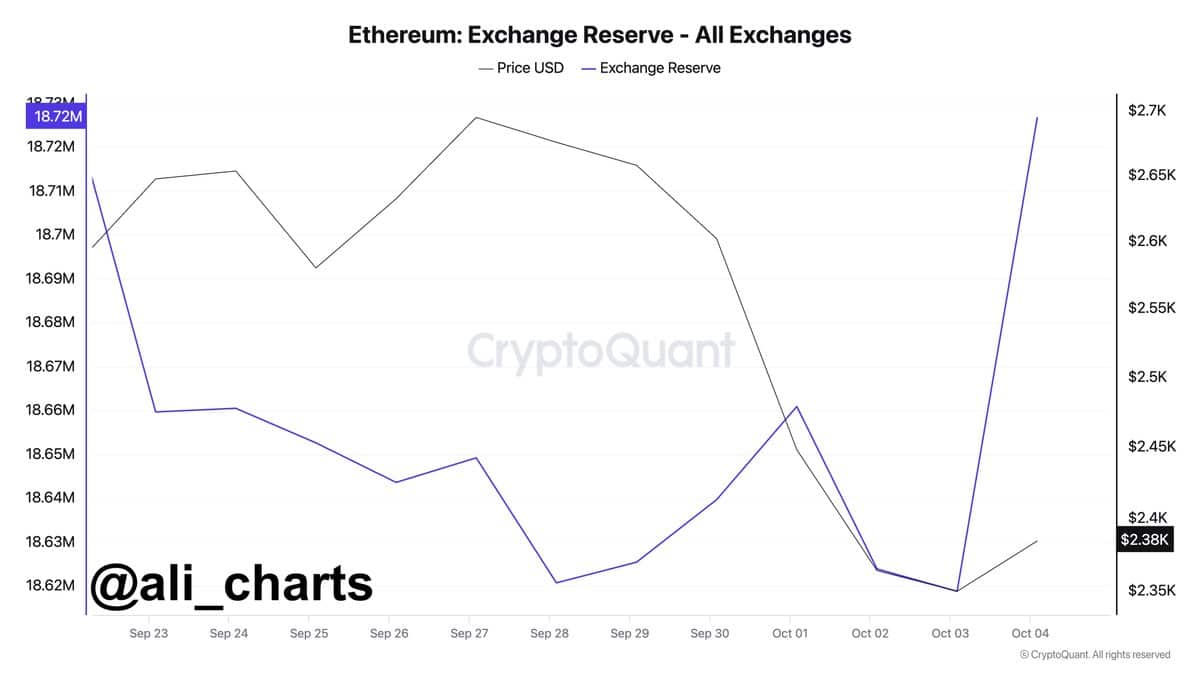

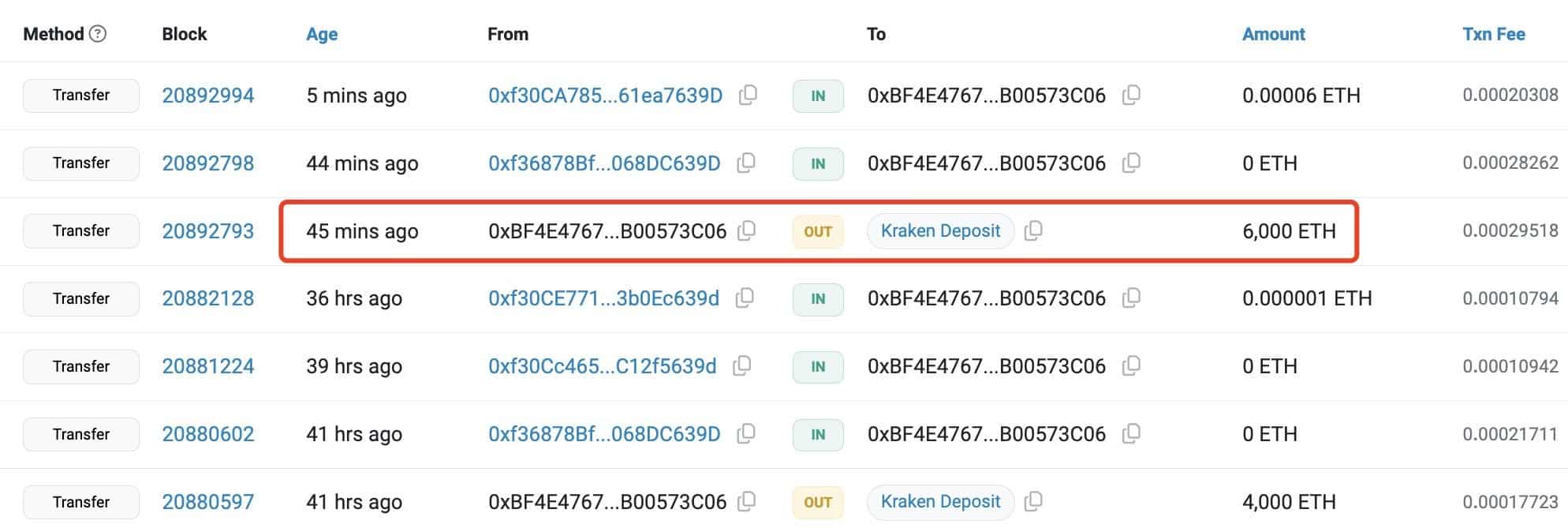

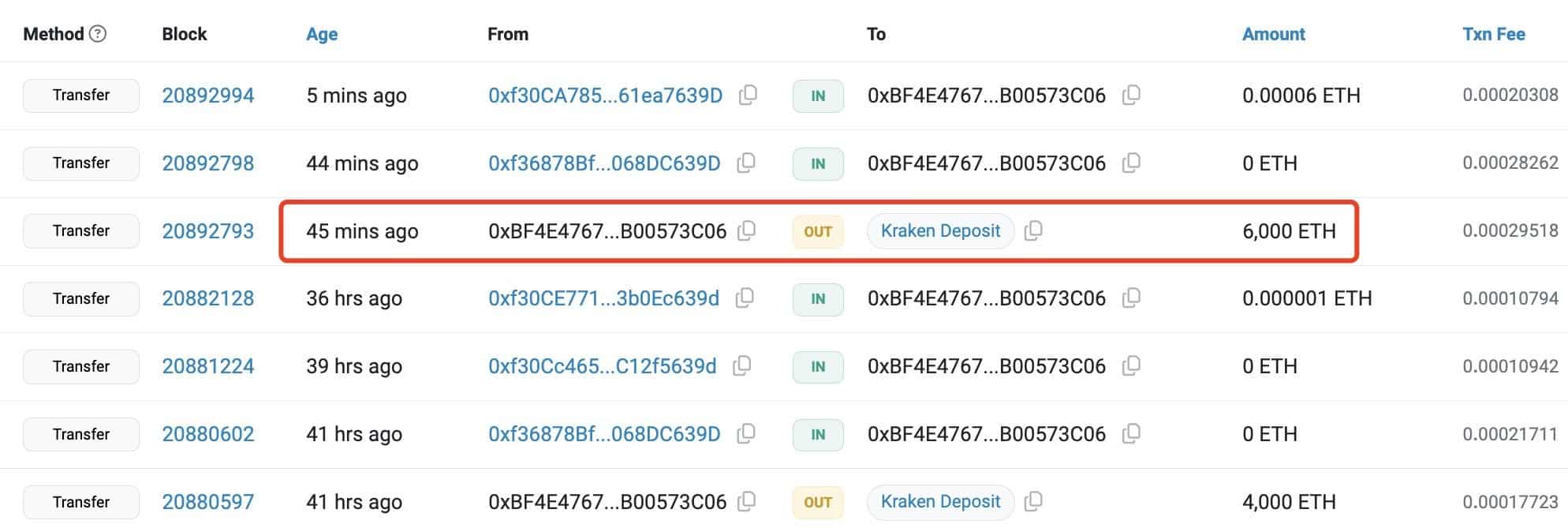

Moreover, an Ethereum Preliminary Coin Providing (ICO) participant has been steadily promoting ETH these days.

Just lately, they bought 6,000 ETH value $14.11 million, bringing the whole to 40,000 ETH bought since September 22, 2024. These gross sales occurred at a mean value of $2,525.

Regardless of these transactions, the ICO participant nonetheless owns 99,500 ETH, value roughly $238 million, indicating potential promoting stress sooner or later.

Supply: Lookonchain

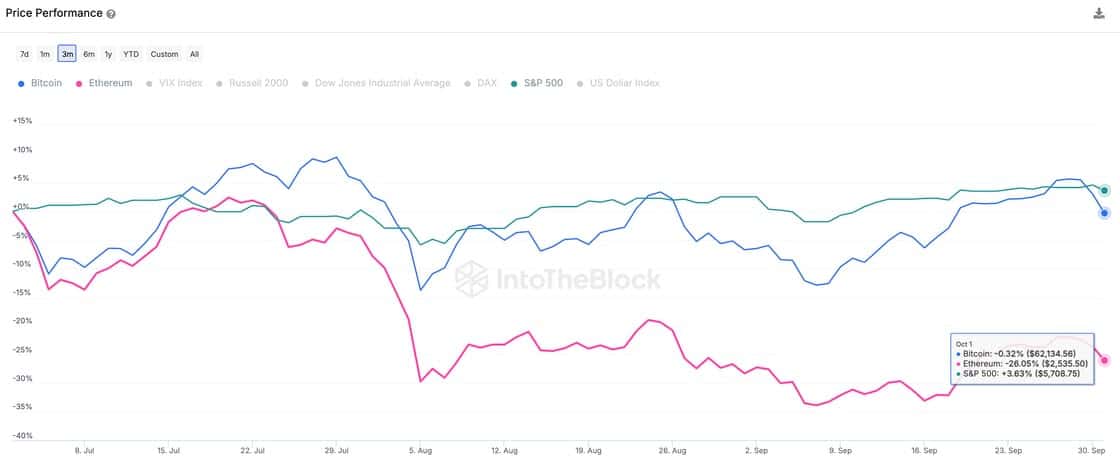

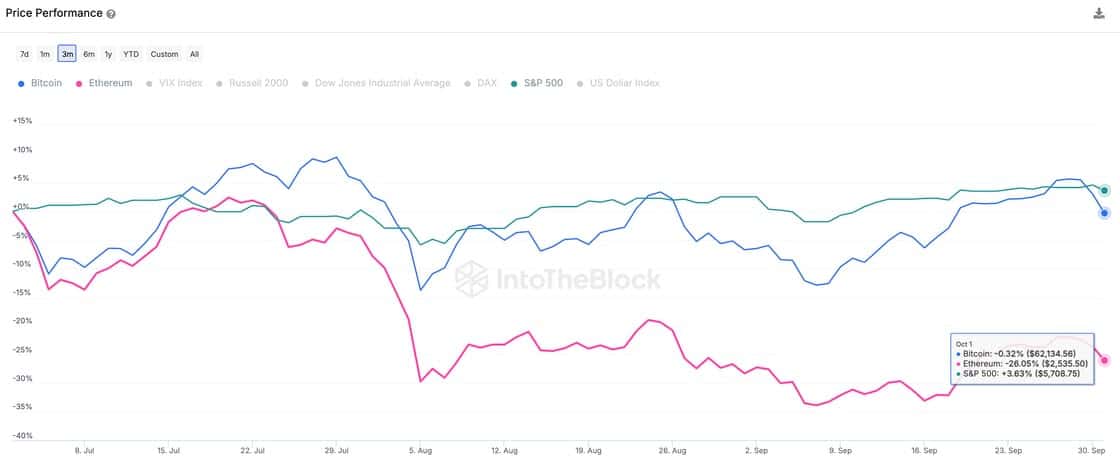

The worth efficiency of ETH in comparison with different property

ETH additionally underperforms in comparison with different dangerous property corresponding to Bitcoin and the S&P 500.

Whereas BTC has seen a slight decline of 0.32% and the S&P 500 has seen a constructive change of three.63%, ETH has fallen a major 26% over the previous three months.

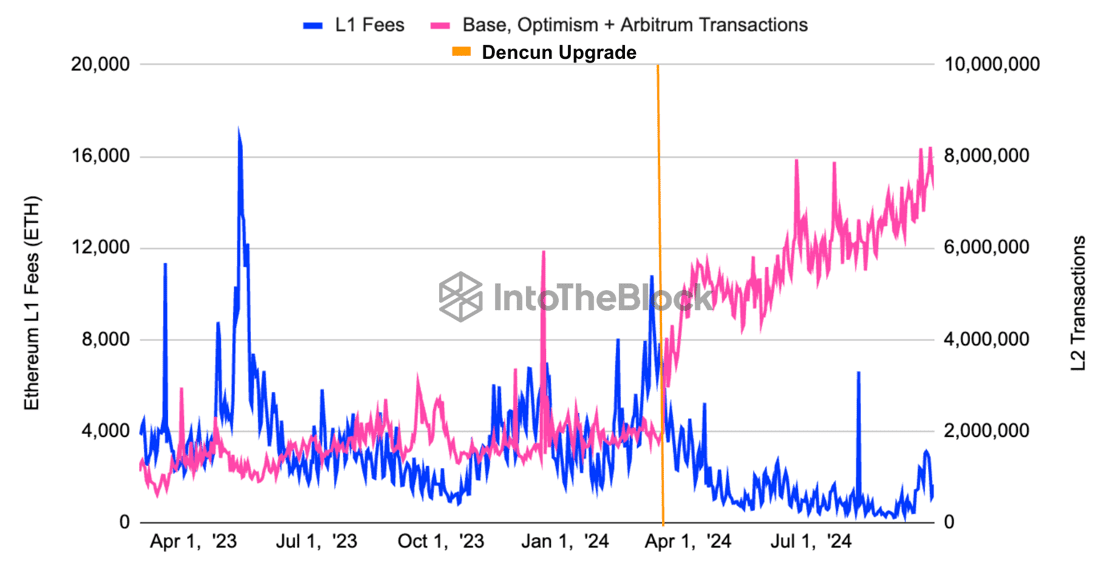

Whole charges on the Ethereum community additionally fell by 43.9% to $247.6 million. The drop in charges is including to Ethereum’s issues. Over the previous quarter, on-chain exercise on Ethereum’s Mainnet additionally declined.

Supply: IntoTheBlock

The impression of the Dencun improve

The Dencun improve has additionally performed a task in Ethereum’s underperformance. This replace, which included EIP 4844, decreased Layer 2 (L2) transaction charges by greater than 10x, leading to a large enhance in L2 exercise.

Because of this, ETH’s Mainnet charges have plummeted and have reached all-time lows. This has affected the quantity of ETH being burned, making the cryptocurrency inflationary once more after beforehand following a deflationary path.

Supply: IntoTheBlock

The summer season lull and sideways buying and selling on conventional markets brought on prices for the chain to fall to the bottom stage in a number of years. Decrease charges and fewer ETH burned are akin to an organization experiencing declining revenues and halting share buybacks. With these adjustments, it isn’t stunning that the worth of ETH has struggled.

Moreover, the long-term advantages that ETH can achieve from the miner extractable worth (MEV) of L2s are nonetheless unsure.

The affect of L2s on ETH’s rise and optimism

Lastly, Optimism (OP), one of many main Layer 2 networks on Ethereum, has seen its governance token outperform others.

Within the third quarter, the OP/ETH pair rose 28%, due to larger on-chain exercise on L2s, that means it’s outperforming Ethereum.

The rise of optimism, due partly to Coinbase’s Base L2 working on the Optimism Superchain, underlines the rising dominance of L2s. This continues to impression the worth of Ethereum.

Supply: IntoTheBlock

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024