Bitcoin

Bitcoin to rally if THIS condition is met, per analyst

Credit : ambcrypto.com

- Bitcoin is down 5.41% prior to now week.

- Market fundamentals recommend a possible upside if Bitcoin closes above the 21-week EMA.

After defying expectations in September, Bitcoin [BTC] has had a tough begin to October, a month that’s often accompanied by an upturn. As such, BTC has skilled a pointy decline over the previous week.

In reality, on the time of writing, Bitcoin was buying and selling at $61980. This marked a decline of 5.41% on the weekly charts, with an extension of the bearish pattern by 0.34% on the every day charts.

Earlier than this decline, BTC was in an uptrend, rising 9.87% on the month-to-month charts.

Present market situations increase questions on whether or not BTC will proceed its uptrend, particularly after the current downtrend.

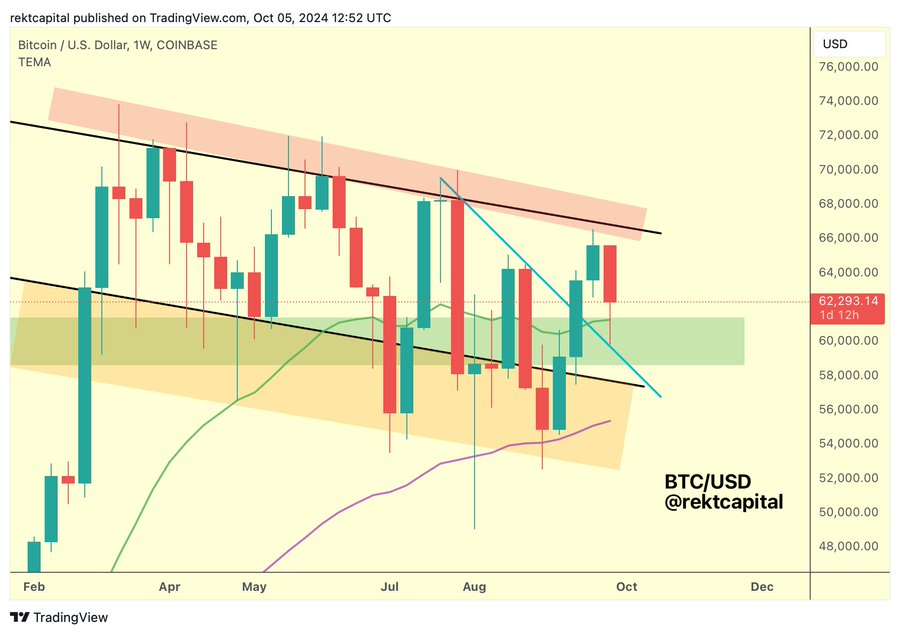

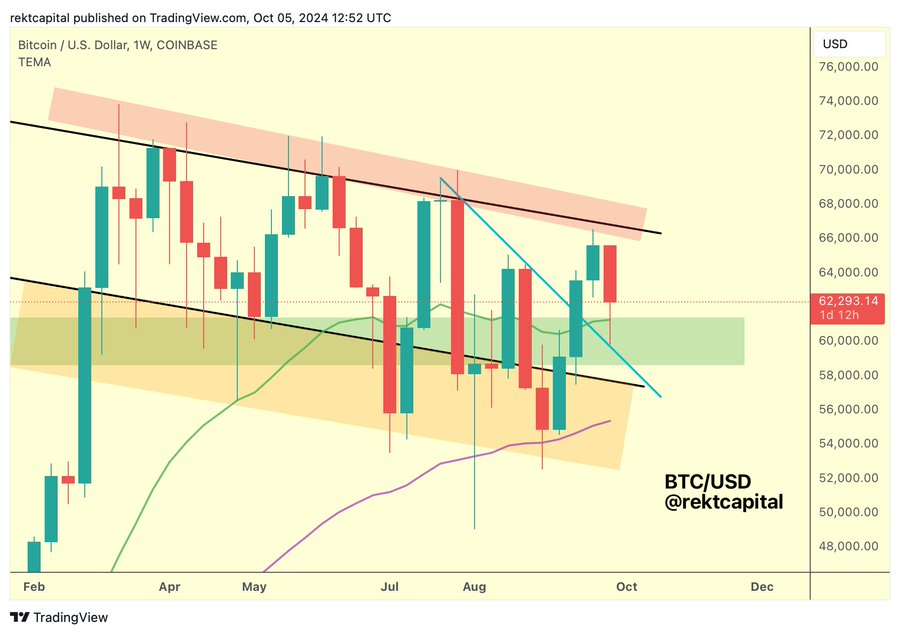

To that extent a preferred crypto analyst Rekt Capital has recommended a possible rally, citing a 21-week bull market EMA.

Which is what the market sentiment suggests

In its evaluation, RektCapital acknowledged that the 21-week EMA has been efficiently retested as help.

Supply:

As BTC stays above this stage, it confirms that market sentiment stays bullish. This means that consumers are coming into the market and worth motion is driving upside.

In keeping with this evaluation, BTC has damaged above a downtrend line that has acted as resistance for months. Such a transfer is a bullish sign, because it suggests the top of the downtrend and a doable shift in momentum.

Due to this fact, a robust shut above the 21-week EMA and a confirmed breakout from the multi-month downtrend would sign additional upside momentum, particularly after a bullish weekly shut above $62,000-$63,000.

What Bitcoin’s Charts Recommend

RektCapital’s evaluation undoubtedly provided promising prospects for BTC. Due to this fact, it’s important to find out what different market indicators are saying.

Supply: Santiment

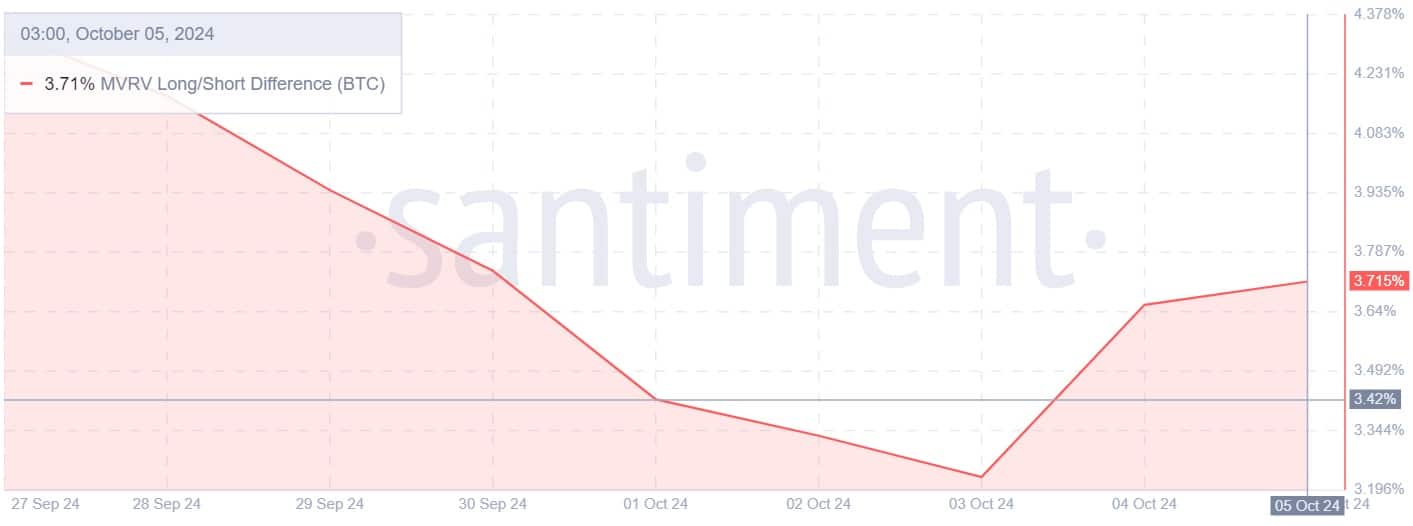

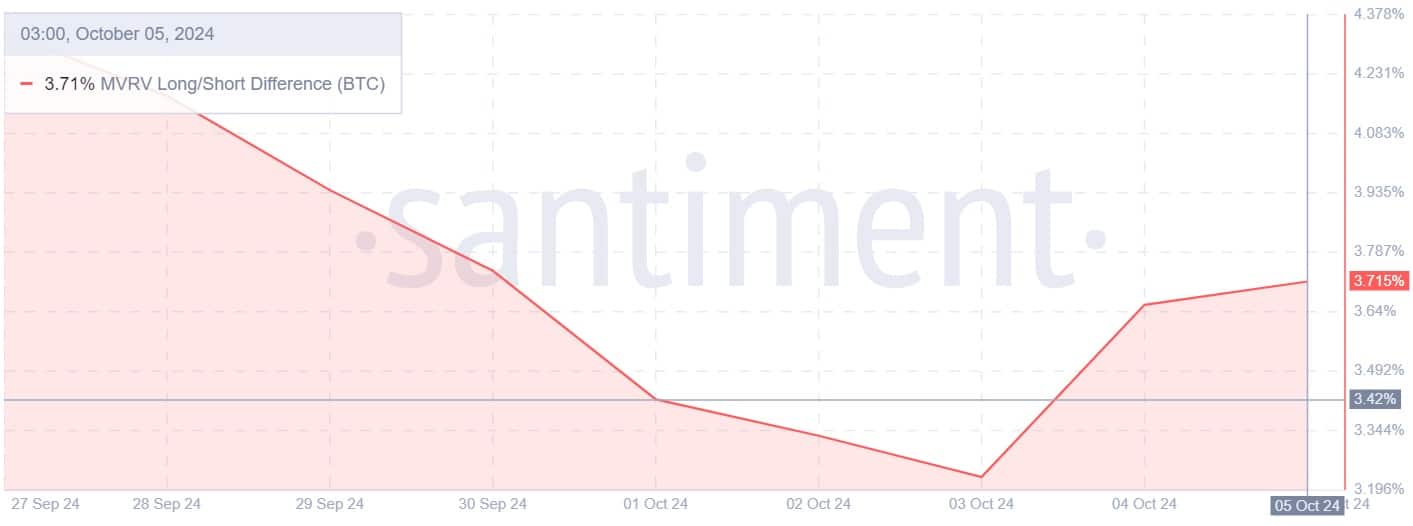

The primary indicator to keep in mind is Bitcoin’s lengthy/brief MVRV distinction, which has shifted from a downtrend to an uptrend.

The MVRV lengthy/brief distinction has risen since September 4, after falling in earlier days.

This means that long-term buyers are extra assured of their positions and are much less more likely to promote shares on which they’re already making a revenue. Because the gaps widen, it means that long-term buyers consider within the upside.

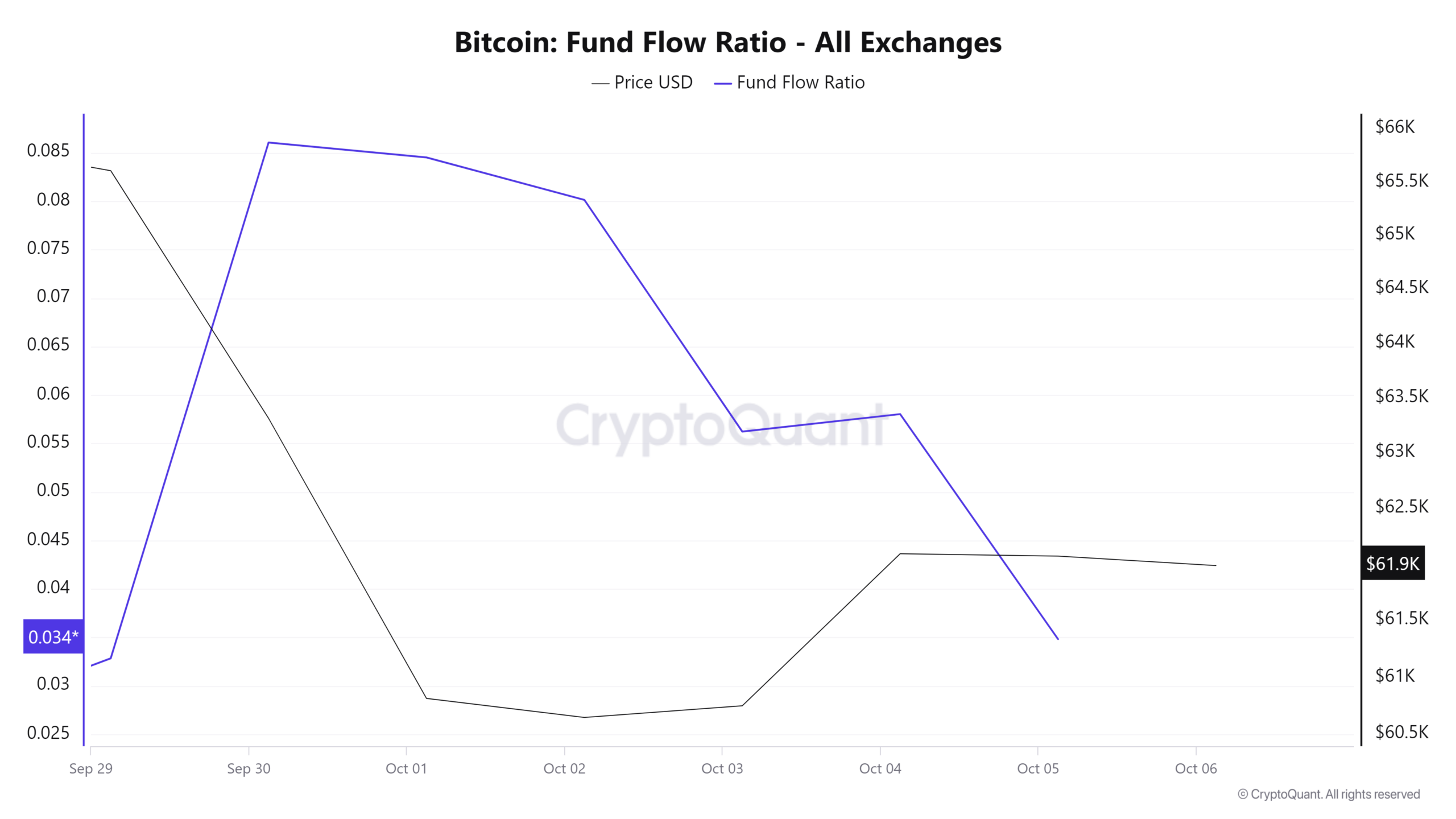

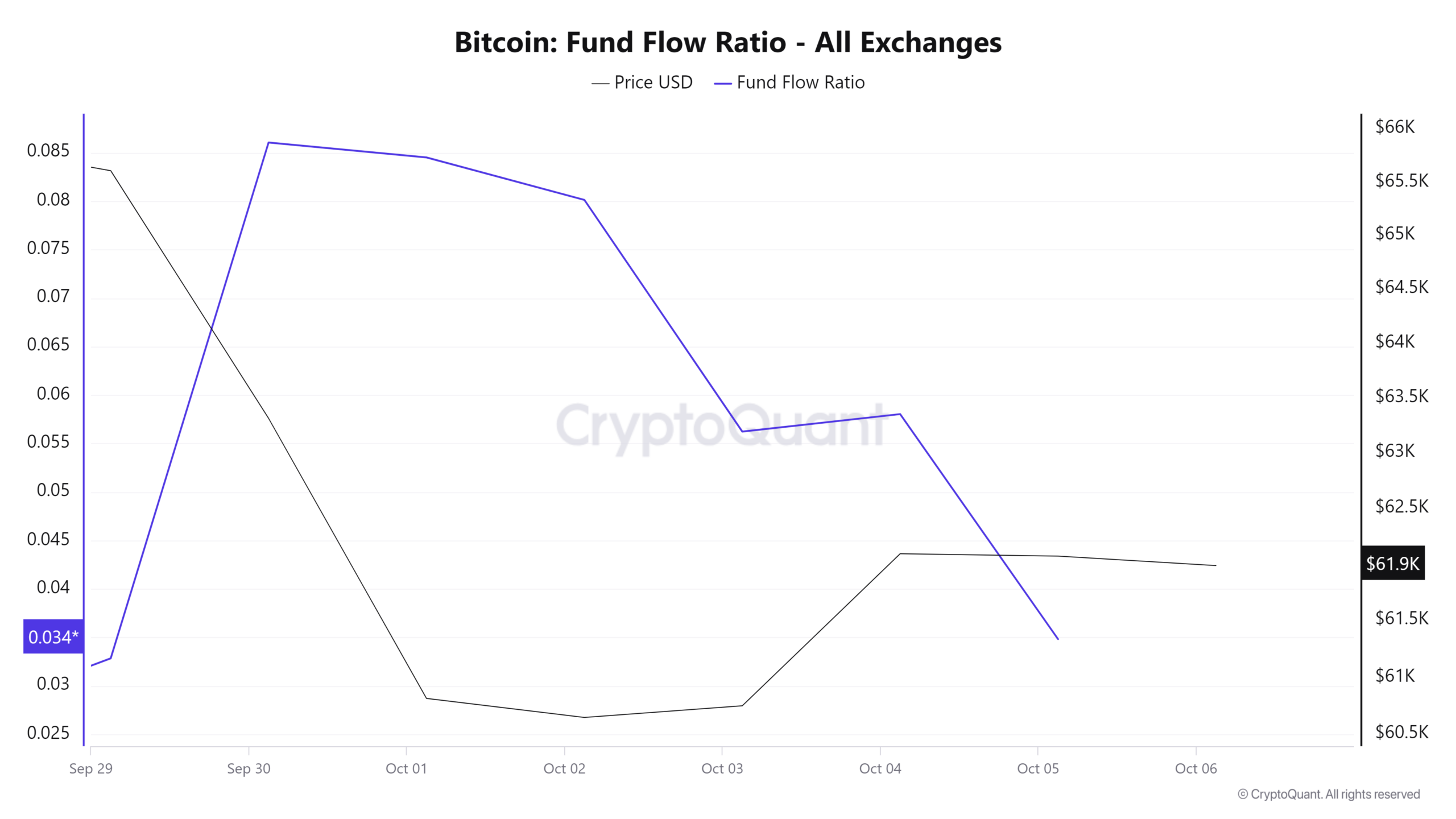

Supply: CryptoQuant

Furthermore, the fund circulate ratio has fallen over the previous six days regardless of market declines. This means that buyers are depositing much less BTC on exchanges to promote, as an alternative storing it in non-public wallets.

Such market conduct signifies accumulation, as buyers count on additional beneficial properties.

Supply: Santiment

Lastly, Bitcoin’s Alternate aggregated funding price has remained largely constructive all week. This means that buyers are taking lengthy positions in anticipation of future worth beneficial properties.

Learn Bitcoin’s [BTC] Worth forecast 2024–2025

Merely put, there was sideways buying and selling in current days, with buyers including to accumulation whereas others took lengthy positions. Such a shift signifies that the market is effectively positioned for additional beneficial properties.

If market sentiment holds, BTC will try resistance at $62,785 within the close to time period.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September