Ethereum

Is Ethereum local bottom in? Options market signals…

Credit : ambcrypto.com

- Knowledge from the choices market indicated that the ETH worth might have stabilized.

- Nevertheless, market sentiment was nonetheless detrimental amid tensions within the Center East.

Ethereums [ETH] the worth appeared to stabilize after latest volatility following geopolitical escalations within the Center East that spooked the crypto markets.

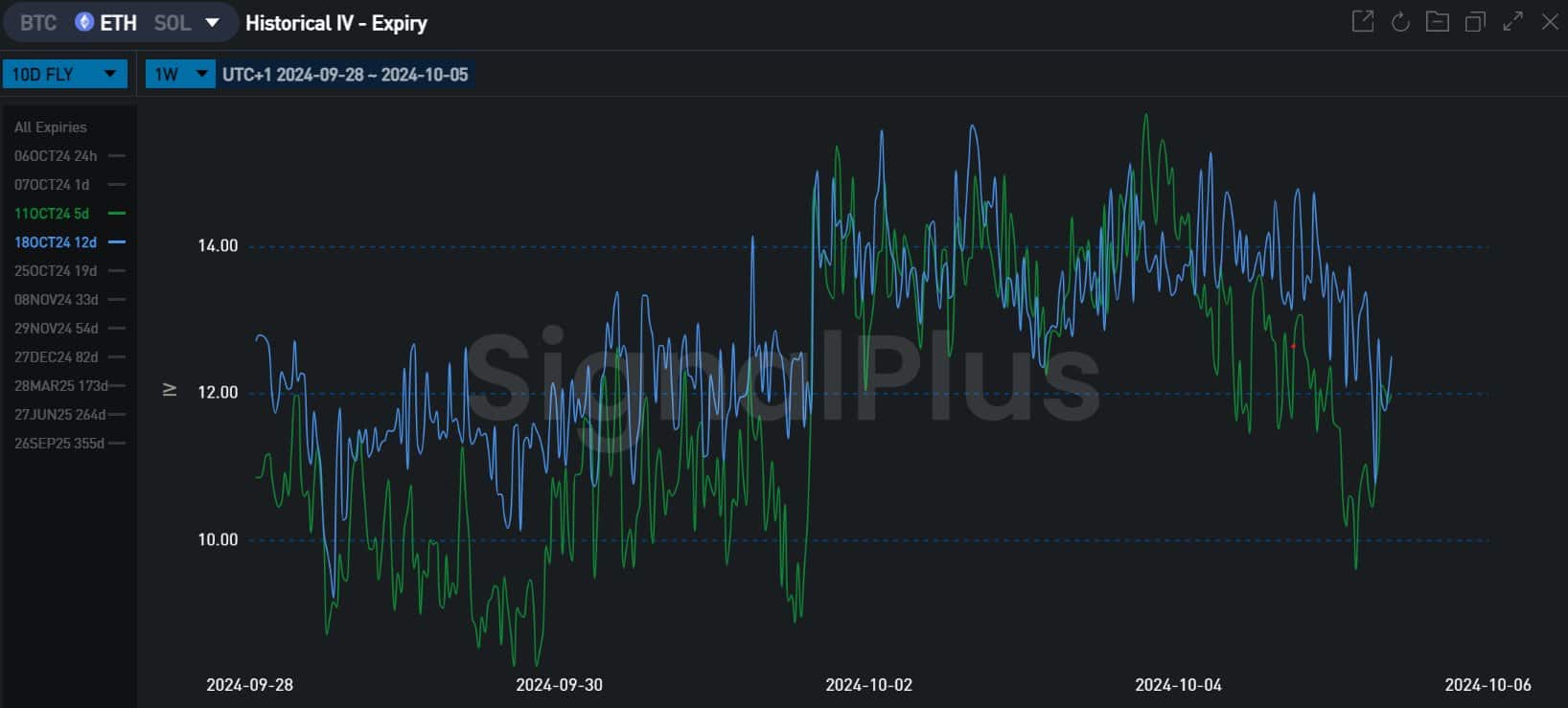

In keeping with Jake Ostrovskis, a crypto dealer at Wintermute, the choices market information prompt {that a} native backside might emerge for the biggest altcoin. He noted,

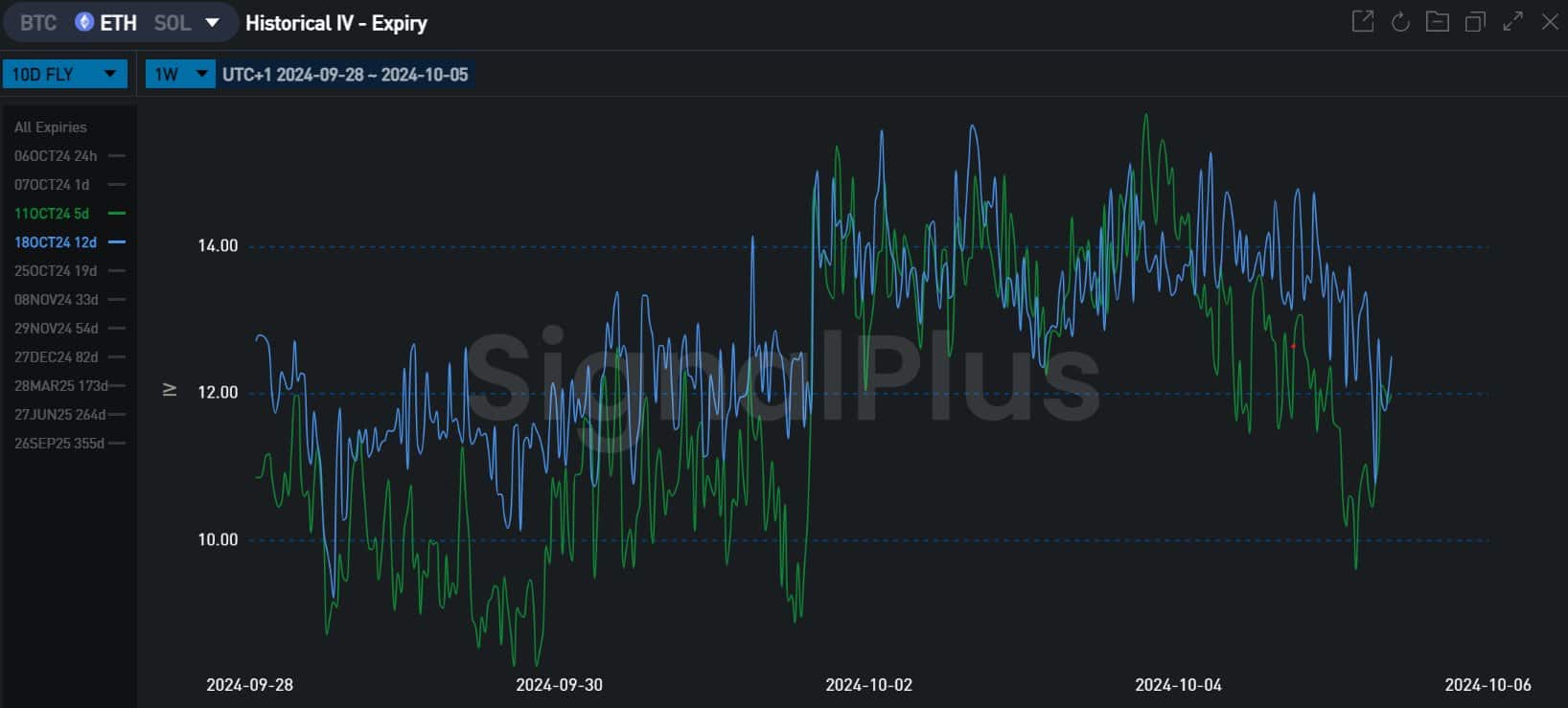

“As of Tuesday, October 1, the biggest hedging flows noticed in #ETH have been in shorter-term contracts, and these flows at the moment are declining because the market appears to be like firmer.”

Supply: SignalPlus

Has ETH’s native backside been reached?

For context, the surge in hedging flows in short-term ETH contracts in latest days meant merchants have been taking hedging positions to guard towards worth swings, particularly amid the escalations between Israel and Iran.

To realize this, they used short-term choices.

Nevertheless, there was a notable decline in hedging flows and declining implied volatility for these short-term choices over the weekend.

This prompt that merchants have been gaining confidence within the stability of the ETH market and that hedging was not needed.

Put one other approach, ETH’s native backside might quickly be in, particularly since Israel has not retaliated towards the latest assault on Iran.

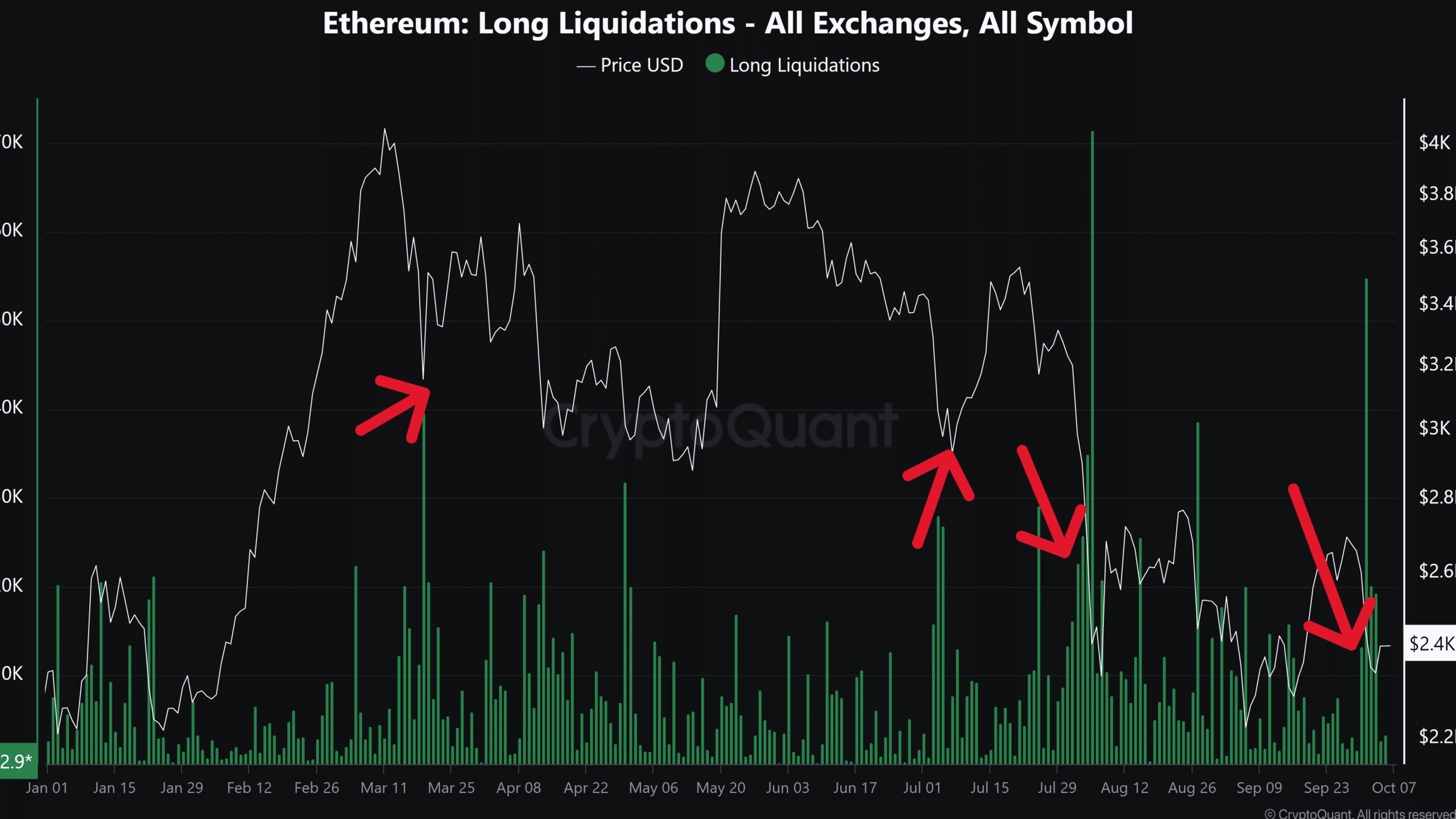

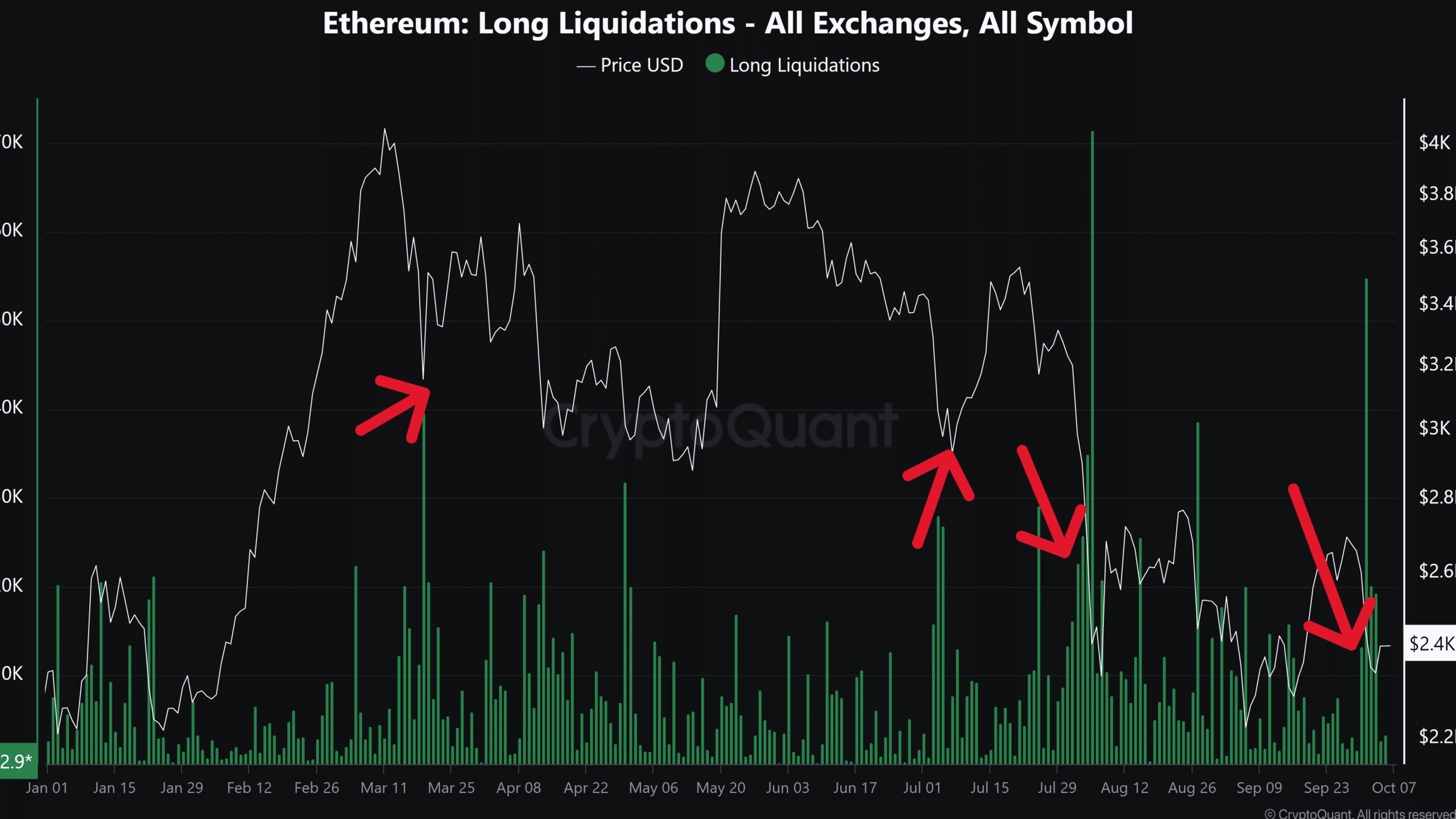

Supply: CryptoQuant

One other information set that prompt ETH might have bottomed was the rise in long-term liquidations. The latest plunge has liquidated over $50 million price of ETH lengthy positions.

In most previous tendencies, a spike in lengthy ETH liquidations coincided with native bottoms. This sample was noticed in March, July and August.

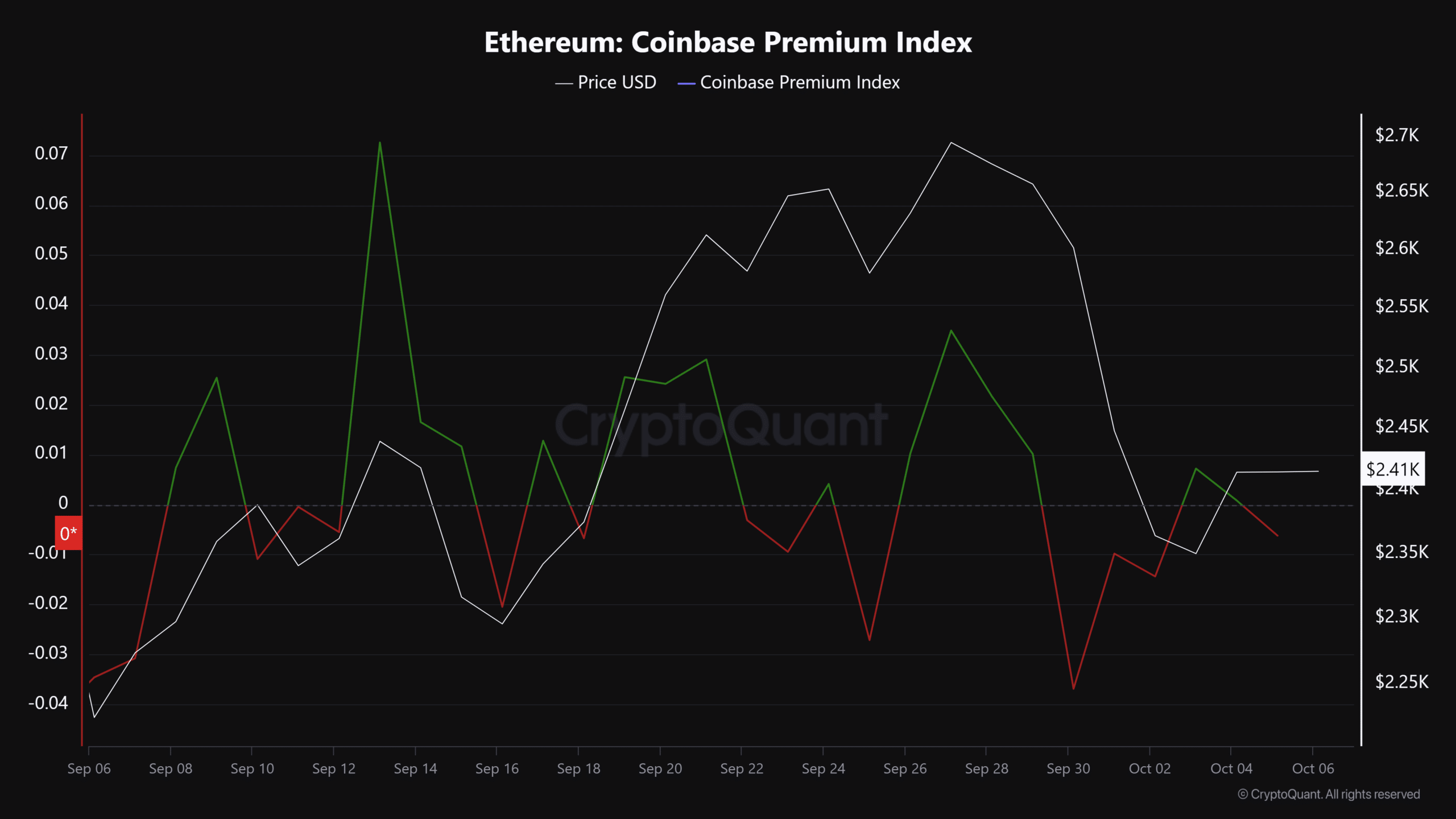

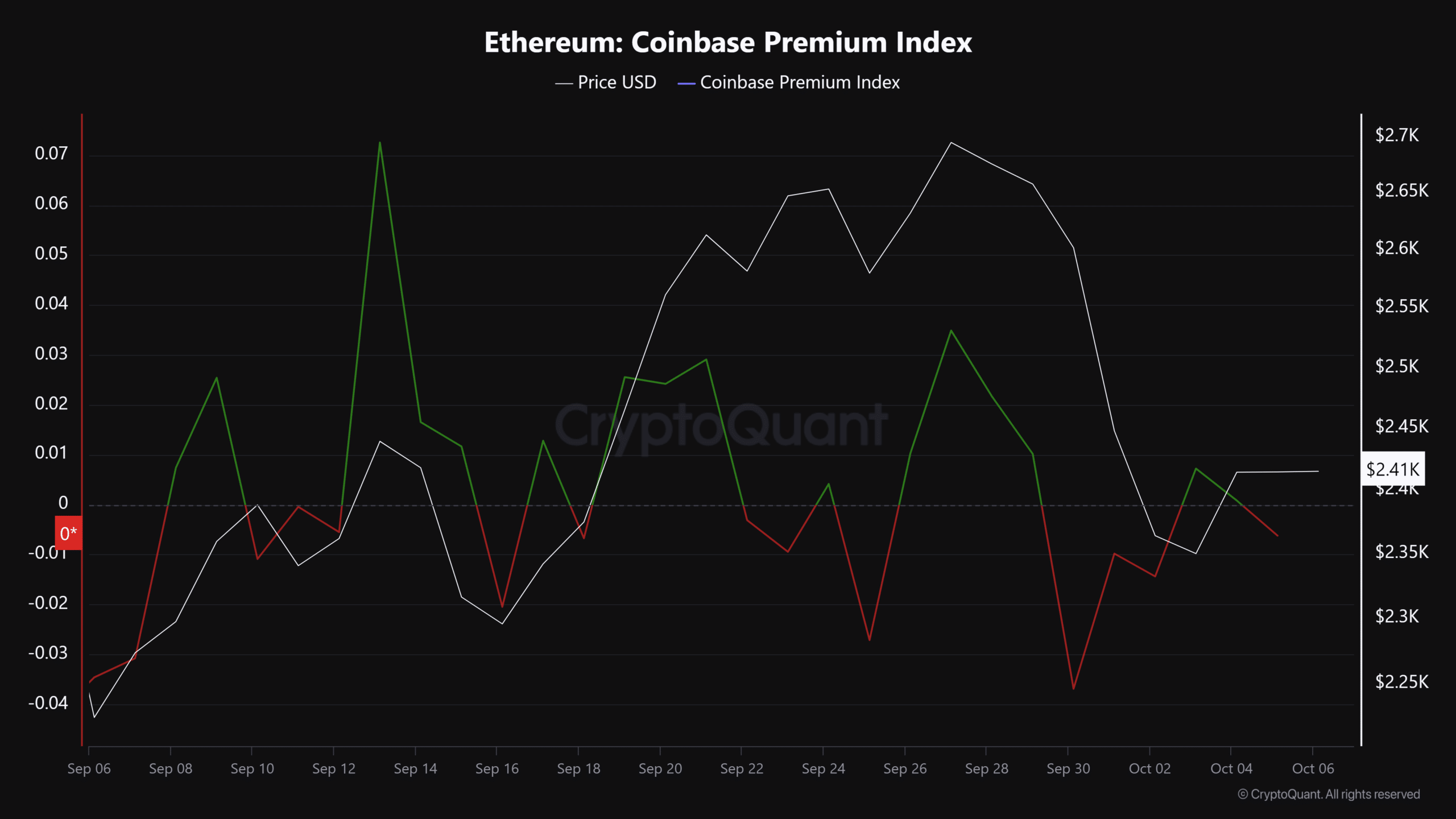

That mentioned, there was no important demand from US buyers, as evidenced by a detrimental studying of the Coinbase Premium Index. As a rule, will increase within the Coinbase Premium Index correlate with a robust ETH restoration.

Supply: CryptoQuant

Ergo, regardless of the potential stability within the ETH market, monitoring demand from US buyers may very well be a sign of whether or not the underside has been reached and whether or not a reduction restoration might observe.

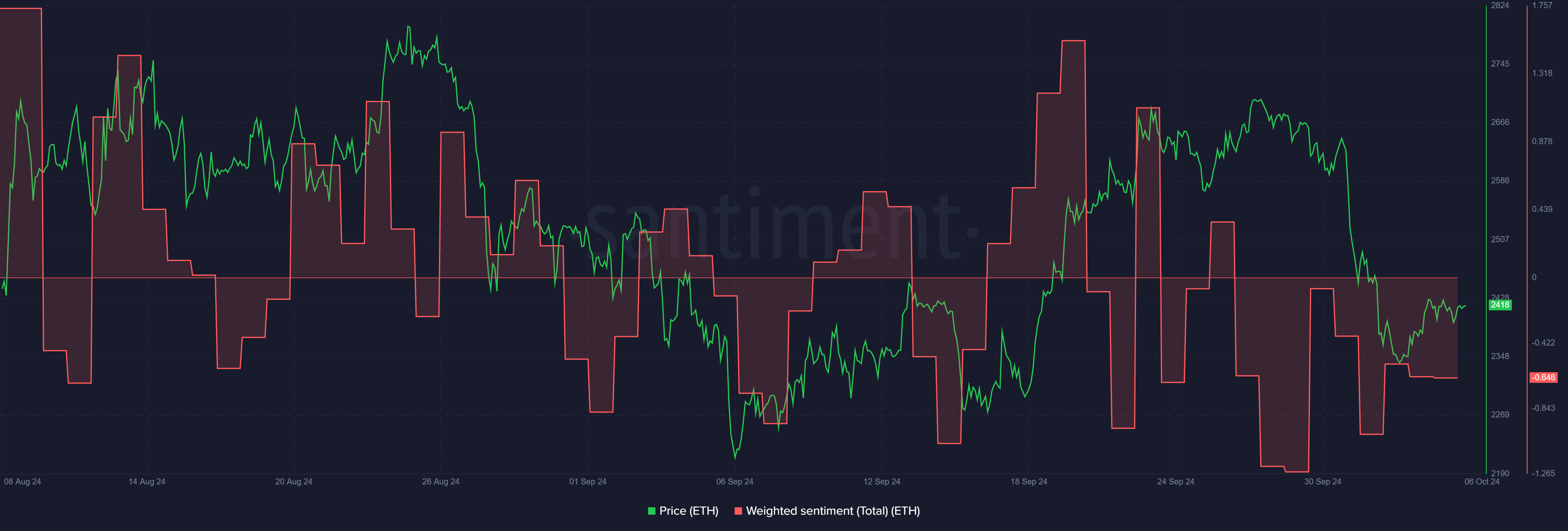

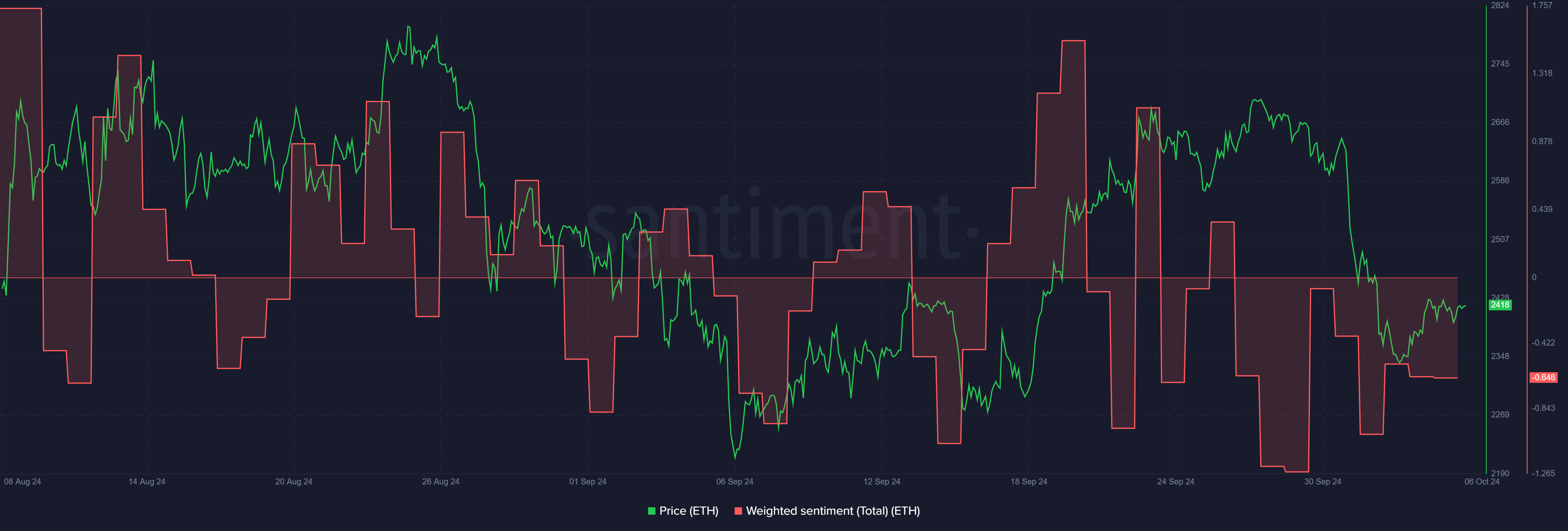

Furthermore, there was nonetheless a cautious outlook, as evidenced by ETH’s detrimental market sentiment.

Supply: Santiment

This highlighted that buyers have been on the sidelines, possible ready for Israel’s reactions to final week’s Iranian motion. On the time of writing, ETH was buying and selling at $2.4K, down 8.4% within the final seven buying and selling days.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024