Blockchain

L2 Scaling Challenges May Undermine Ethereum and Bitcoin’s Long-Term Security

Credit : cryptonews.net

Ethereum and Bitcoin, two of the biggest blockchains on this planet, face vital challenges in scaling their networks. As extra customers and transactions transfer to layer two (L2) options, these methods can undermine the safety and sustainability of the bottom layer (L1), lowering charges and rewards for miners and validators.

The rising adoption of L2 raises issues for base layers

Each Ethereum and Bitcoin are grappling with a elementary downside: learn how to scale their networks to accommodate rising numbers of customers with out sacrificing safety or decentralization. Not too long ago, Cybercapital founder Justin Bons offered his concept that Layer 2 (L2) platforms are ‘parasitic’ to Ethereum. Bons has lengthy warned in regards to the rising affect of Ethereum L2 options on the primary chain, in addition to different blockchains that use L2 scaling strategies. The next is an outline of the dilemma confronted by Layer 1 (L1) blockchains reminiscent of Bitcoin and Ethereum.

Of their present state, neither blockchain can course of transactions at speeds similar to centralized methods like Visa or Mastercard, and the price of utilizing the bottom layer may be prohibitively excessive. Since 2015, tweaking Bitcoin’s consensus layer to enhance scalability has sparked ongoing debate, with proponents more and more favoring L2 options just like the Lightning Community. Ethereum core builders have additionally strived to assist L2s reminiscent of Arbitrum, Optimism, Base, and Linea flourish.

These L2s promise quicker transactions and decrease charges, but additionally introduce a brand new set of challenges. Layer two options, by design, transfer transactions from the bottom layer, or L1, to a secondary layer. For Ethereum, L2s reminiscent of Arbitrum and Optimism bundle a number of transactions right into a single L1 transaction, lowering prices and growing throughput. For Bitcoin, the Lightning Community permits customers to conduct off-chain transactions, solely selecting the primary blockchain when completely mandatory. Whereas these options are praised for enhancing transaction velocity and lowering prices, they pose a possible risk to the safety and financial mannequin of L1 blockchains.

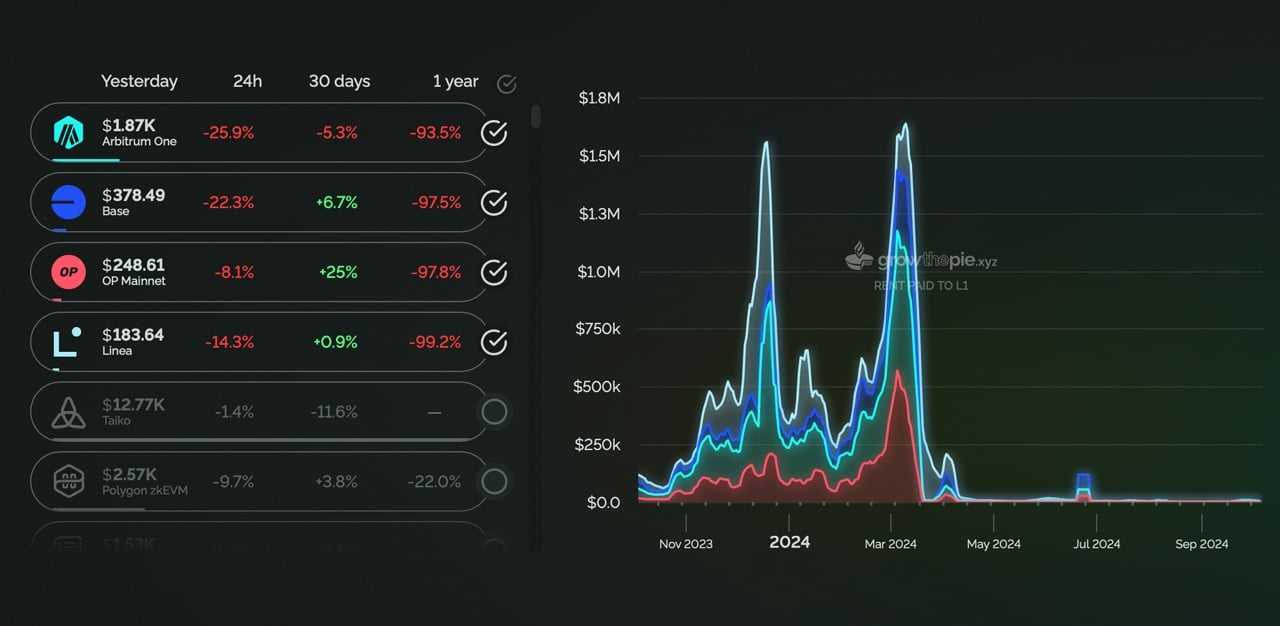

Lease paid to L1 (Ethereum) in keeping with growthepie.xyz.

Ethereum’s first layer as soon as benefited considerably from exercise on these L2s. As of November 2023, L2 options reminiscent of Arbitrum, Base, Optimism, and Linea contributed an estimated $200,000 in each day rents to Ethereum’s L1. By December, these charges had risen to as a lot as $1.5 million per day. Nonetheless, monetary help has declined since then. From December 2023 to March 2024, L2 funds to Ethereum fell to lower than $250,000 per day, earlier than peaking at round $1.7 million in early March. By the top of April 2024, these charges had dropped dramatically, with lower than $10,000 per day being paid to the Ethereum mainnet. This decline raises questions in regards to the long-term sustainability of Ethereum’s L1 infrastructure if most exercise shifts to L2s completely.

Bitcoin faces the same downside. As soon as Bitcoin (BTC) is moved to the Lightning Community or different Bitcoin sidechains, transactions bypass the primary chain, releasing miners from the charges they’d historically earn from processing transactions. Bitcoin’s financial safety relies on the incentives given to miners, each by means of transaction charges and the block reward, which halves roughly each 4 years. As charges transfer off-chain, issues are rising that Bitcoin miners could now not have ample financial motivation to proceed securing the community, probably making it much less safe over time.

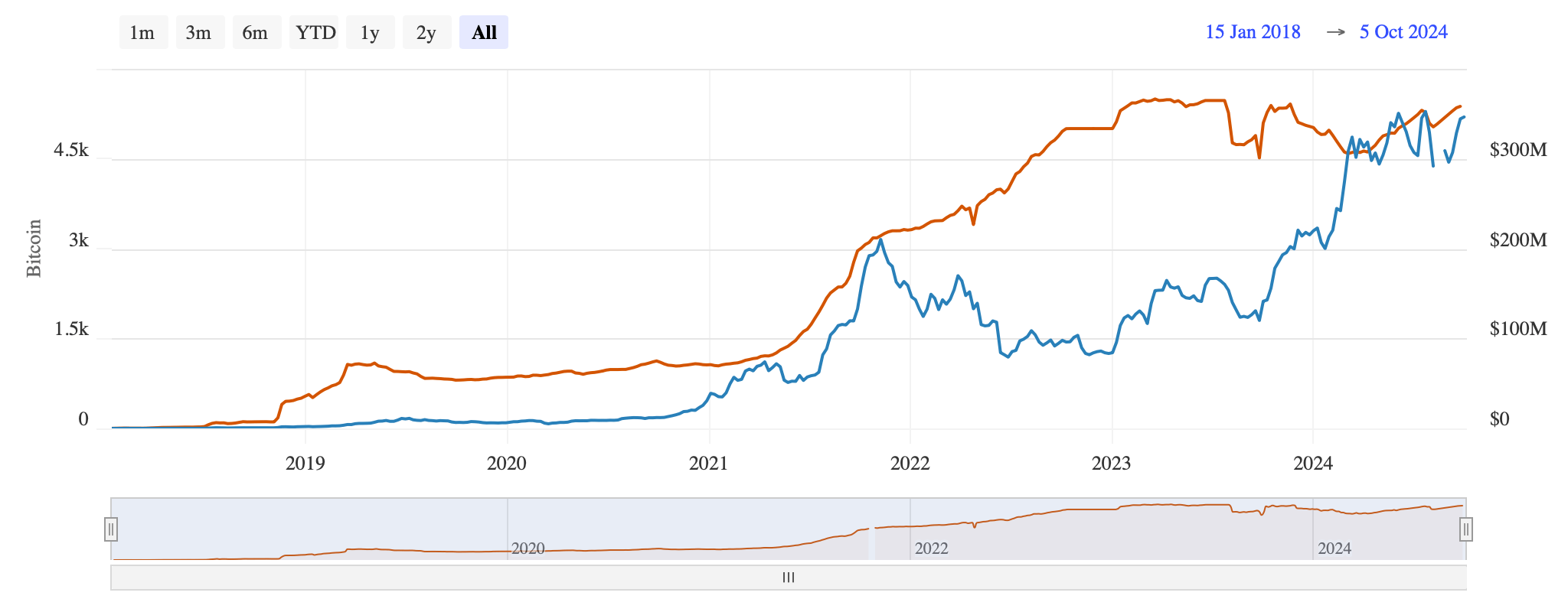

In keeping with information from bitcoinvisuals.com, the capability of Bitcoin’s Lightning Community (LN) is roughly 5,360 BTC as of October 6, 2024. Miners solely obtain charges when bitcoin (BTC) is moved into or out of Lightning Channels, that means no charges are paid to them whereas transactions happen off-chain on LN. Equally, wrapped bitcoin (WBTC) and different tokenized types of bitcoin don’t contribute vital charges to the L1 as soon as transformed.

Along with Bons, Blockchair’s lead developer Nikita Zhavoronkov has expressed issues about Bitcoin’s shrinking safety finances. The elemental downside lies in the truth that each Ethereum and Bitcoin have been designed with the expectation that customers would pay to make use of the bottom layer. These charges are a vital a part of sustaining the safety of the blockchain, particularly as block rewards diminish over time. If too many transactions happen on L2s, the L1 could undergo from inadequate charges, lowering the incentives for validators and miners to safe the community.

L2 options reminiscent of Arbitrum and Optimism, whereas offering speedy advantages when it comes to scalability and cost-efficiency, might undermine the long-term viability of Ethereum’s L1 if they aren’t designed to contribute sufficiently to the bottom layer. Equally, Bitcoin’s Lightning Community, whereas addressing a few of Bitcoin’s scalability points, removes miners from the transaction loop fully, making BTC’s safety mannequin solely depending on diminishing block rewards.

Whereas there isn’t any doubt that L2 options present a brief resolution to the scalability issues of each Ethereum and Bitcoin, they elevate vital questions in regards to the long-term well being of those networks. If L1 blockchains depend on a gradual stream of charges to incentivize miners and validators, and if these charges are more and more captured by L2 options, the financial mannequin of those blockchains might develop into unbalanced.

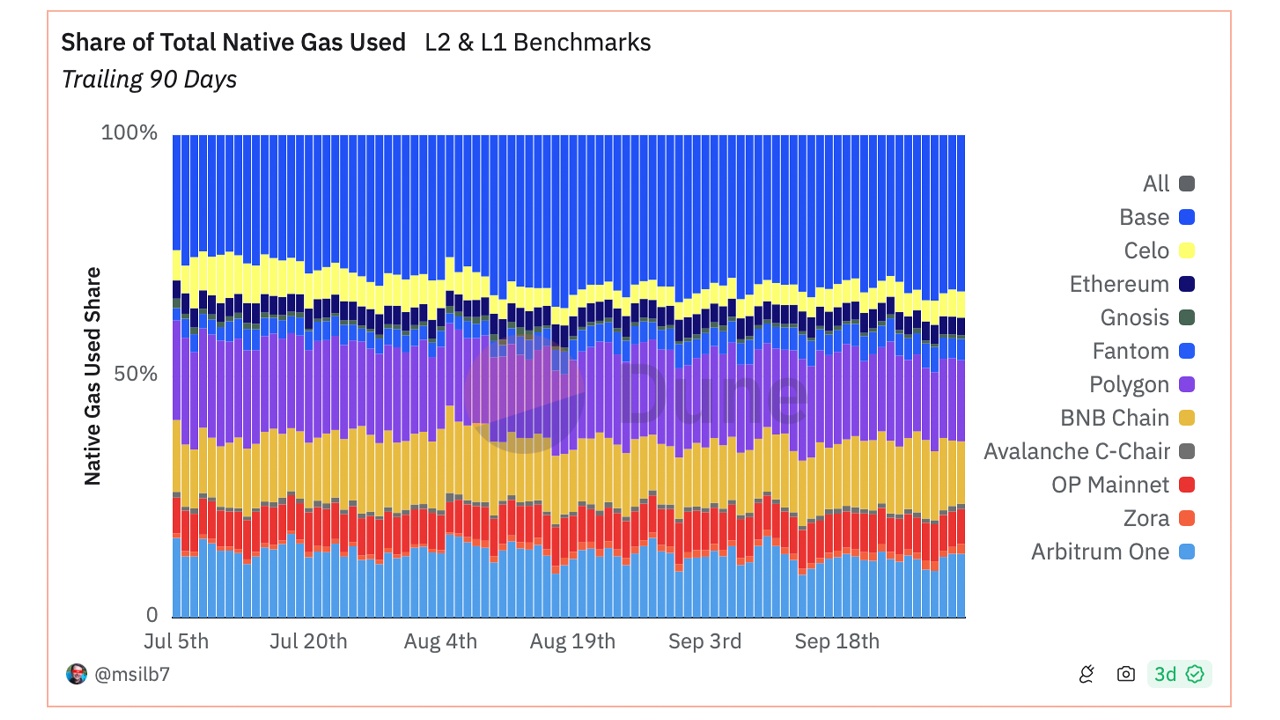

Dune.com statistics on share of complete indigenous fuel used – L2 and L1 benchmarks as of October 6, 2024.

The final word purpose for each Ethereum and Bitcoin has all the time been to create decentralized, safe networks that may deal with international demand. Nonetheless, if L2 options proceed to maneuver transactions away from L1 with out offering ample compensation to the bottom layer, the safety and decentralization of those networks could possibly be compromised. Discovering a steadiness between L1 and L2 exercise is essential for the way forward for blockchain scalability. The difficulty of rewards additionally doesn’t tackle criticisms of T2 ideas, which are sometimes seen as considerably extra centralized than the primary chain, making them extra susceptible to assault and theft.

In conclusion, whereas L2 options supply clear advantages when it comes to transaction velocity and prices, in addition they pose vital dangers to the long-term sustainability of Ethereum and Bitcoin. With out a mechanism to make sure that L2s contribute meaningfully to base layer safety and infrastructure, these options could show to be a workaround quite than a everlasting resolution. Each the Ethereum and Bitcoin communities might want to fastidiously think about learn how to scale their networks with out compromising the elemental ideas that make them distinctive on this planet of decentralized finance.

As mainstream adoption approaches, the urgency for Ethereum and Bitcoin communities to deal with these scaling points will increase. If a sustainable steadiness between L1 and L2 is just not achieved quickly, the safety and decentralization of those blockchains could possibly be in danger within the coming years. Resolving these challenges is crucial to sustaining the integrity of the networks and making certain their long-term viability.

What are your ideas on the L2 points dealing with the Bitcoin community and Ethereum protocol? Inform us within the feedback under.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024