Altcoin

Ethereum Faces a Supply Oversupply as China Expects $1.3 Billion ETH Sale – What Now?

Credit : ambcrypto.com

- Chinese language authorities have moved 7,000 ETH to exchanges within the final 24 hours.

- These cash are a part of the 542,000 ETH seized in a crypto Ponzi scheme in 2018 that might be dumped available on the market.

Ethereum [ETH] buying and selling at $2,401 on the time of writing, after a value drop of just about 2% in 24 hours. This decline coincided with bearish sentiment within the broader cryptocurrency market Fear and greed The index plunges to a seven-day low of 39, indicating merchants are in a state of concern.

Nonetheless, Ethereum holders have extra to fret about amid a potential sell-off of 542,000 ETH, valued at over $1.3 billion, by Chinese language authorities.

Ethereum’s “sudden” provide surplus

In keeping with onchain researcher ErgoBTCETH faces an sudden provide glut after 7,000 ETH moved to exchanges. These tokens are a part of the 542K ETH seized by the PlusToken crypto-Ponzi scheme in 2018.

This scheme had collected over 194K Bitcoin [BTC] and 830K ETH on the time of closing. A lot of the Bitcoin was most likely offered between 2019 and 2020. A 3rd of ETH was offered later in 2021.

The remaining steadiness of 542,000 ETH was consolidated throughout a number of addresses in August 2024. In keeping with the researcher, a few of these cash at the moment are shifting.

On October 9, 15,700 ETH was withdrawn from these addresses, and virtually half of that was deposited on the BitGet, Binance, and OKX exchanges.

In keeping with the researcher, the transfers observe an identical sample to when authorities offered Bitcoin in 2020. This places ETH in a precarious scenario the place promoting stress may improve considerably within the coming weeks.

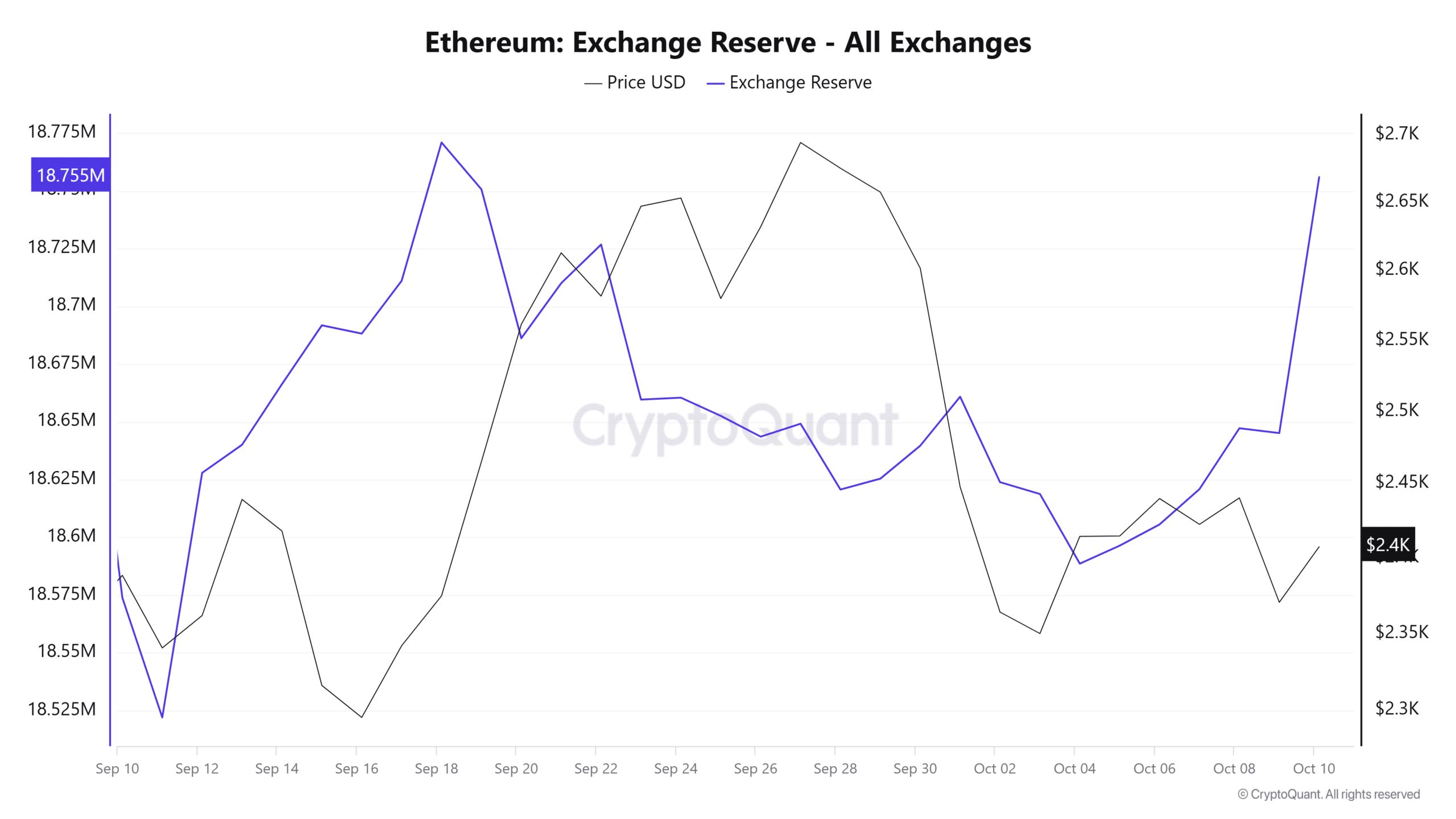

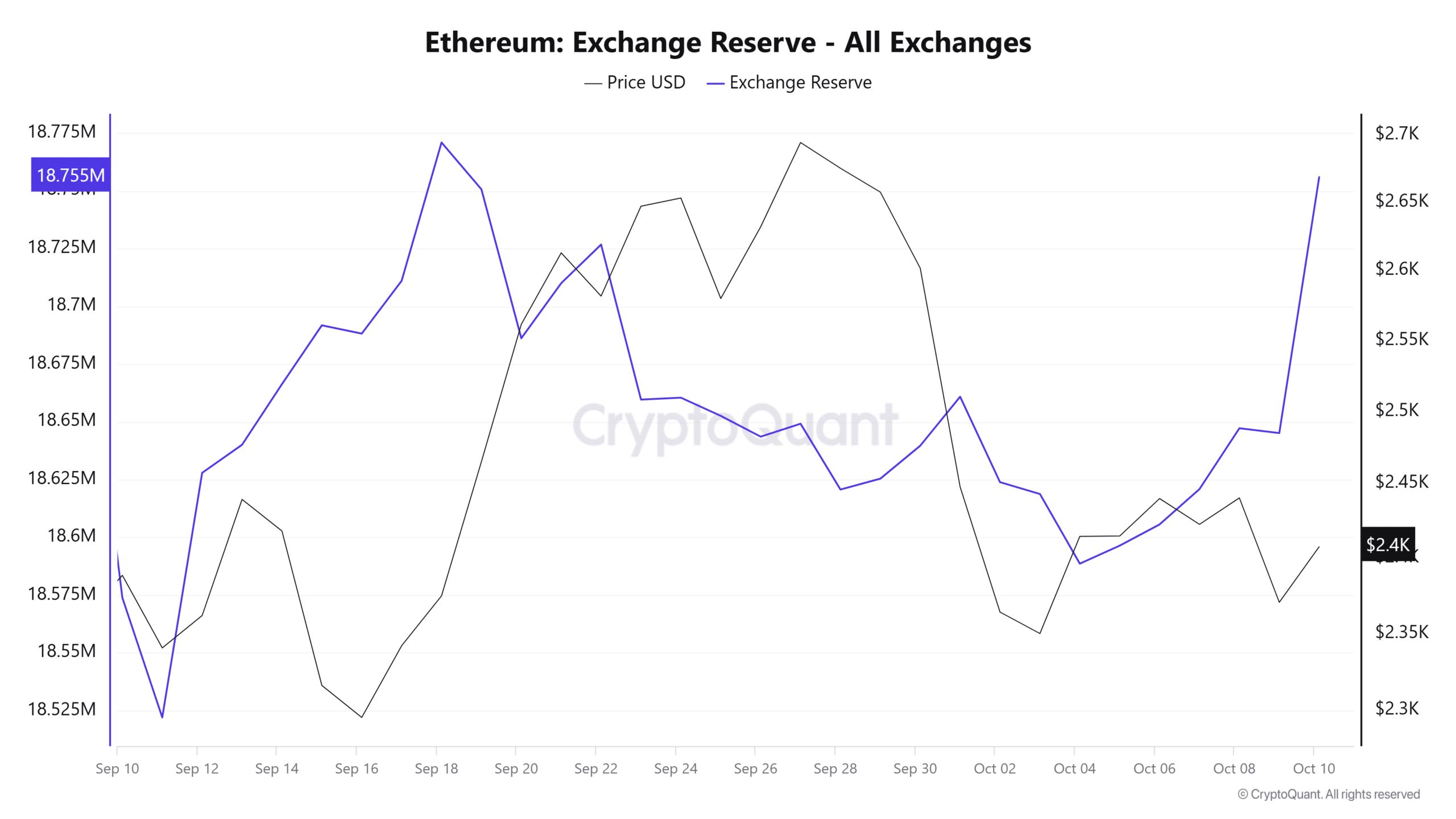

Ethereum alternate reserve hit a three-week excessive

These deposits have led to a surge in Ethereum alternate reserves to a three-week excessive, as seen on CryptoQuant.

Prior to now 24 hours, the entire variety of ETH held on exchanges elevated by over 110,000 tokens to achieve a three-week excessive.

Supply: CryptoQuant

This knowledge exhibits that many merchants transfer their cash to exchanges with the intention of promoting them. Furthermore, the most important improve in reserves occurred on derivatives exchanges. This might end in a spike in Ethereum’s volatility.

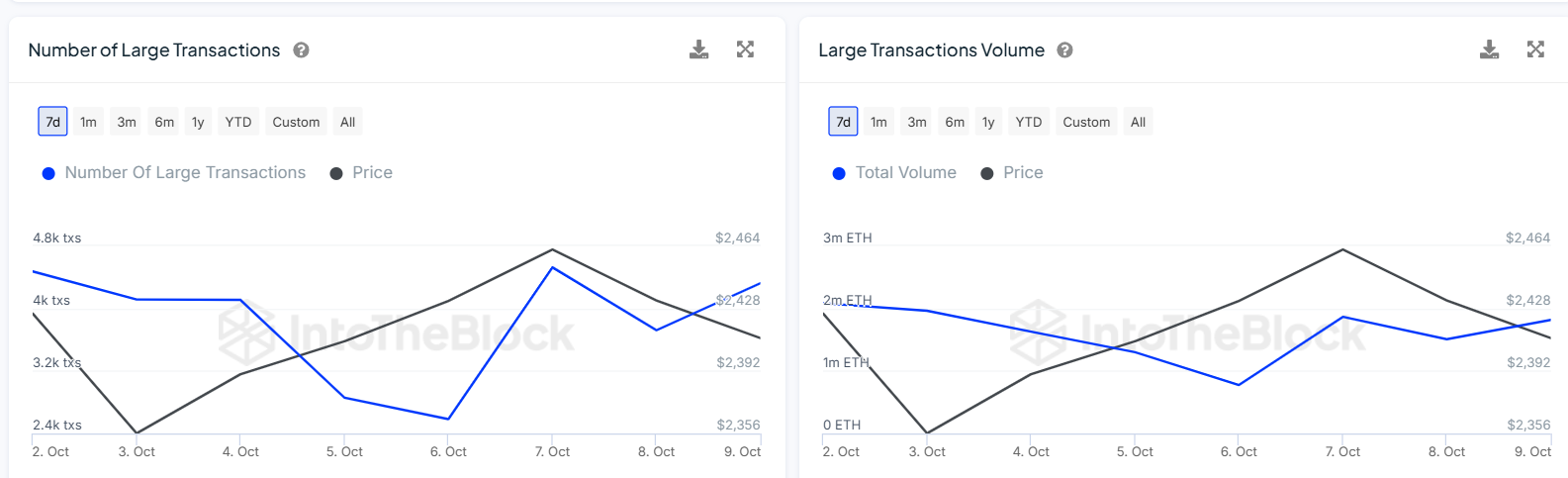

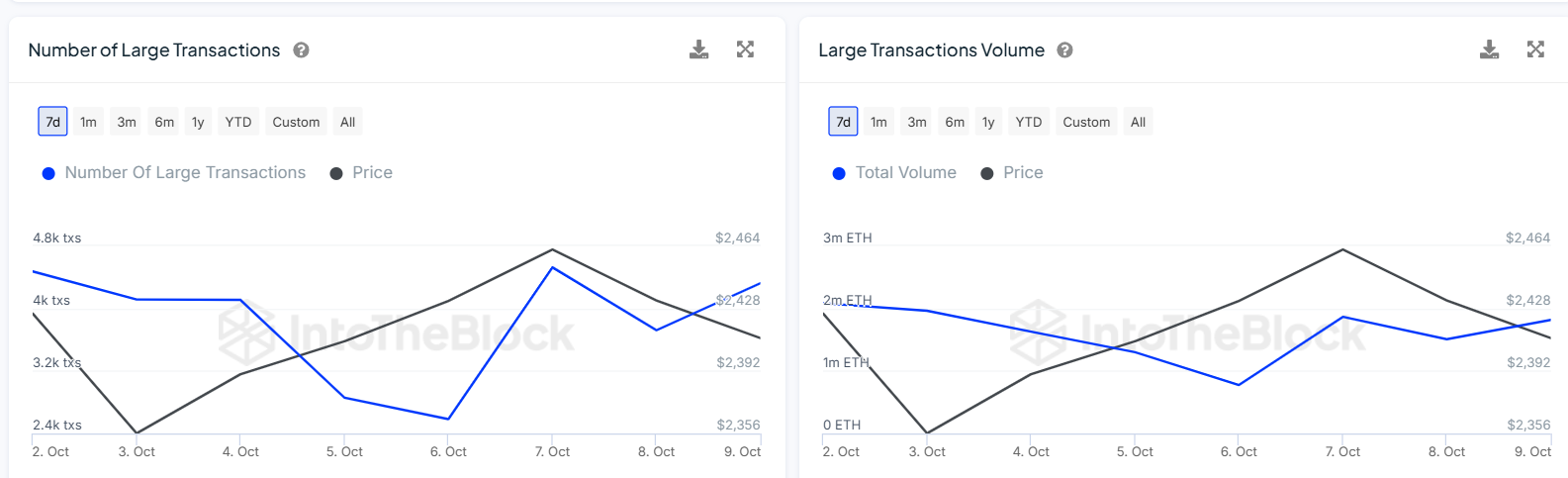

Knowledge from IntoTheBlock additionally exhibits a spike in excessive transaction volumes, indicating whale exercise is growing. Contemplating that Ethereum isn’t making a revenue regardless of a rise within the variety of giant transactions, this might point out that these transactions are occurring on the promote aspect and never on the purchase aspect.

Supply: IntoTheBlock

Liquidation knowledge exhibits that these excessive forex deposits are having a bearish influence on Ethereum. In keeping with Mint glassover $31 million value of ETH was liquidated within the final 24 hours, with $27 million being lengthy liquidations.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024