Ethereum

Ethereum’s 4-month decline on THIS front is not good news

Credit : ambcrypto.com

- ETH registered a reasonable enhance, rising 3.39% on the month-to-month chart

- Ethereum’s MVRV rating has fallen over the previous month

Over the previous month, Ethereum has seen a turnaround in its fortunes. Beforehand, the altcoin gave the impression to be fully unable to keep up any upward momentum.

Nonetheless, on the time of writing, Ethereum was buying and selling at $2441. This marked a 3.39% enhance on the month-to-month charts, with the altcoin additionally gaining on the weekly and day by day charts.

As anticipated, the prevailing market situations have made many within the Ethereum group rethink the trajectory of the altcoin. One in all them is the analyst from Cryptoquant Burak Kesmeci. In response to him, ETH’s present MVRV ranges might present a shopping for alternative.

Ethereum MVRV rating drops for 4 months

In his evaluation, Kesmeci said that Ethereum’s MVRV rating has continued to say no over the previous 4 months. In response to him, ETH MVRV has didn’t surpass the March stage of two.25 factors, whereas the identical now stands at 1.22 factors.

Supply:

To place it in context, ETH’s MVRV rating has fallen over the previous 120 days, reaching a low of 1.93. What this implies is that for the altcoin to register one other rally, it should regain its March stage of two.25.

Merely put, for ETH to climb the charts once more, the MVRV rating should register a rise. By extension, this additionally signifies that because the altcoin didn’t report any rise on the charts, there’s little potential for a bull run at this level.

What does the chart of ETH say?

Whereas Kesmeci’s evaluation factors out the situations that have to be met for ETH to rise, it’s important to verify different market fundamentals and decide what the present state of affairs is.

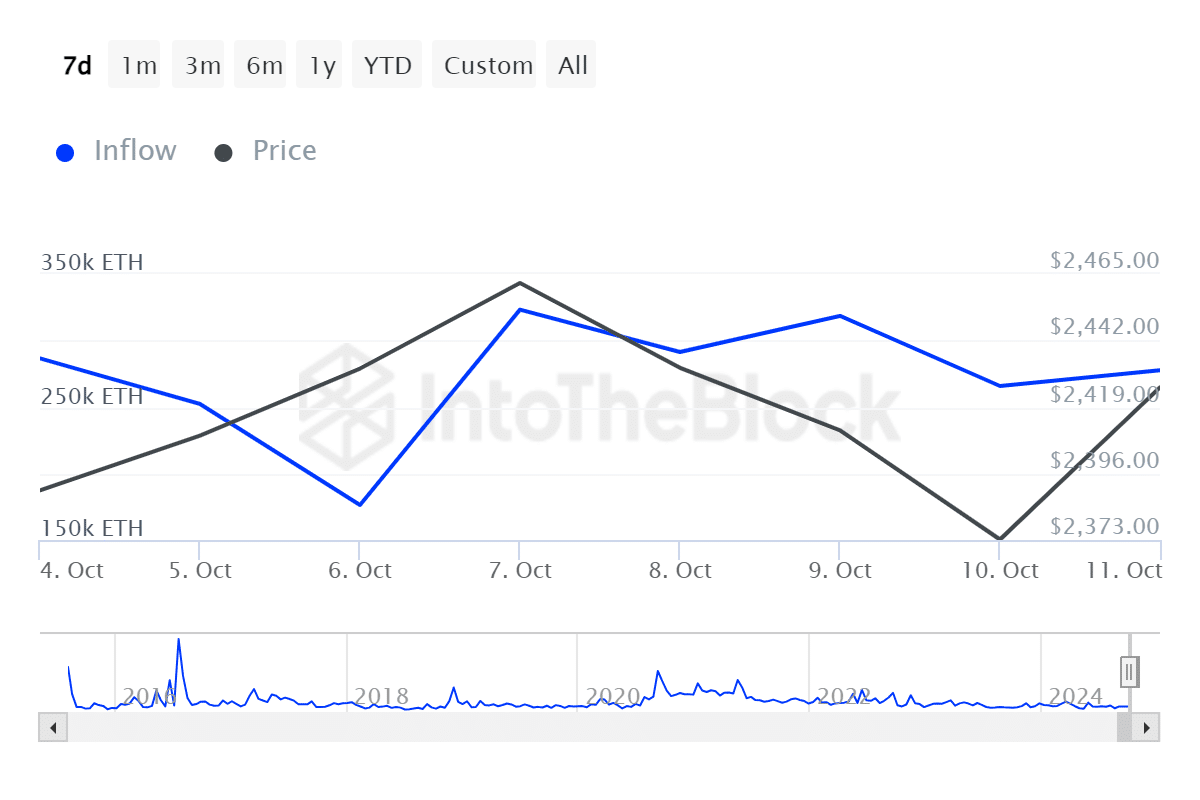

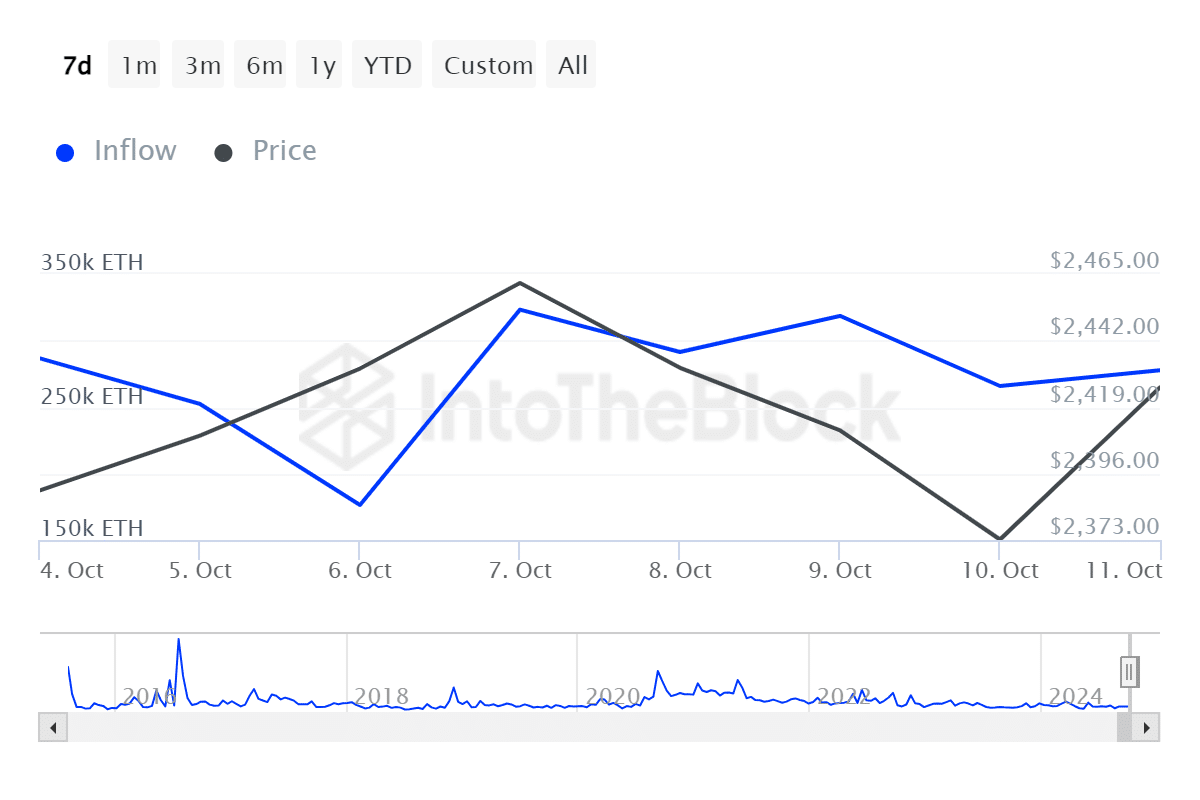

Supply: IntoTheBlock

For starters, inflows from massive Ethereum holders have elevated by 57.46% over the previous week, from a low of 176.29k to 277.58k.

Usually, a spike in inflows from massive buyers signifies robust shopping for exercise and generally is a signal of optimistic momentum.

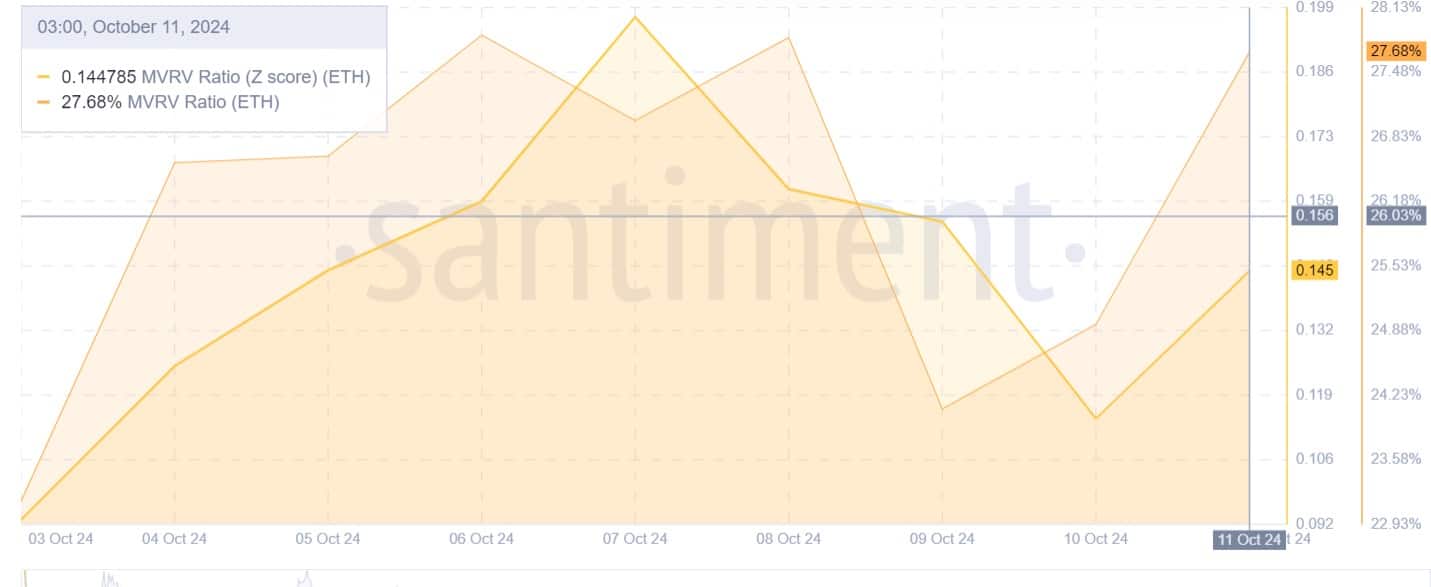

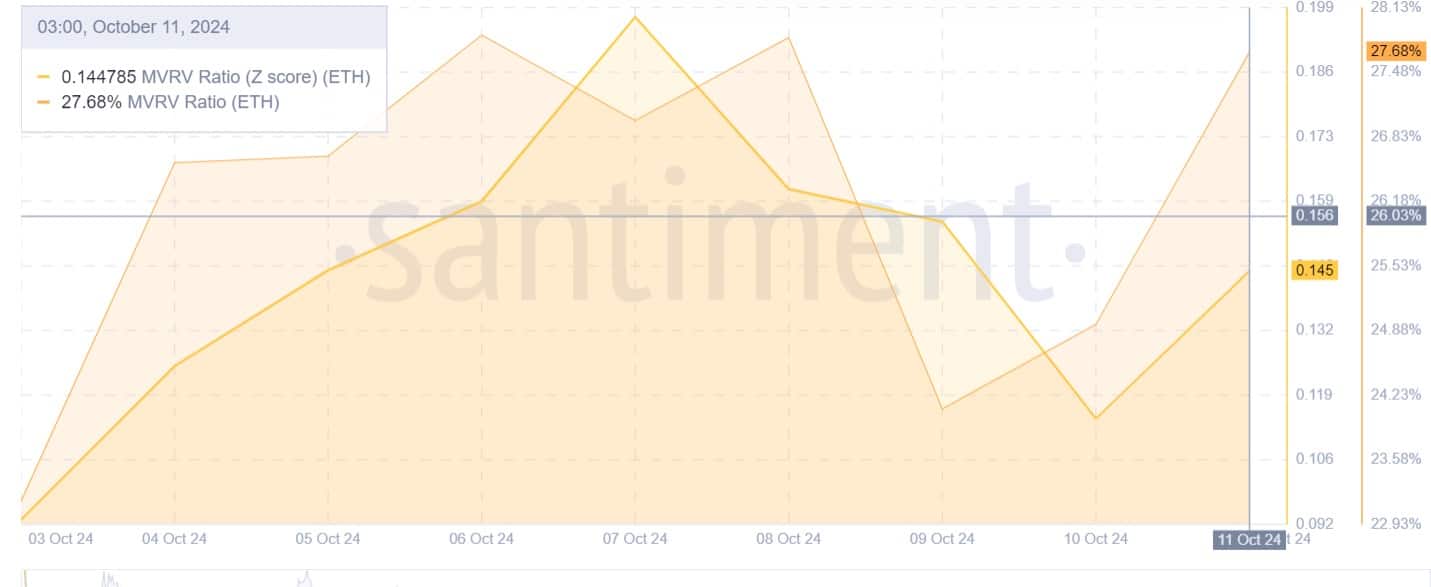

Supply: Santiment

Moreover, Ethereum’s per-exchange open curiosity rose 8.89% from $2.25 billion to $2.4 billion.

This prompt that buyers have been constantly opening new positions whereas sustaining present positions.

Supply: Santiment

Moreover, Ethereum’s MVRV Z-score of 0.145 indicated that ETH has skilled a wholesome market setting.

Costs stabilize at this stage after a market correction. Thus, it implied that the prevailing market situations are neither a speculative bubble nor undervalued.

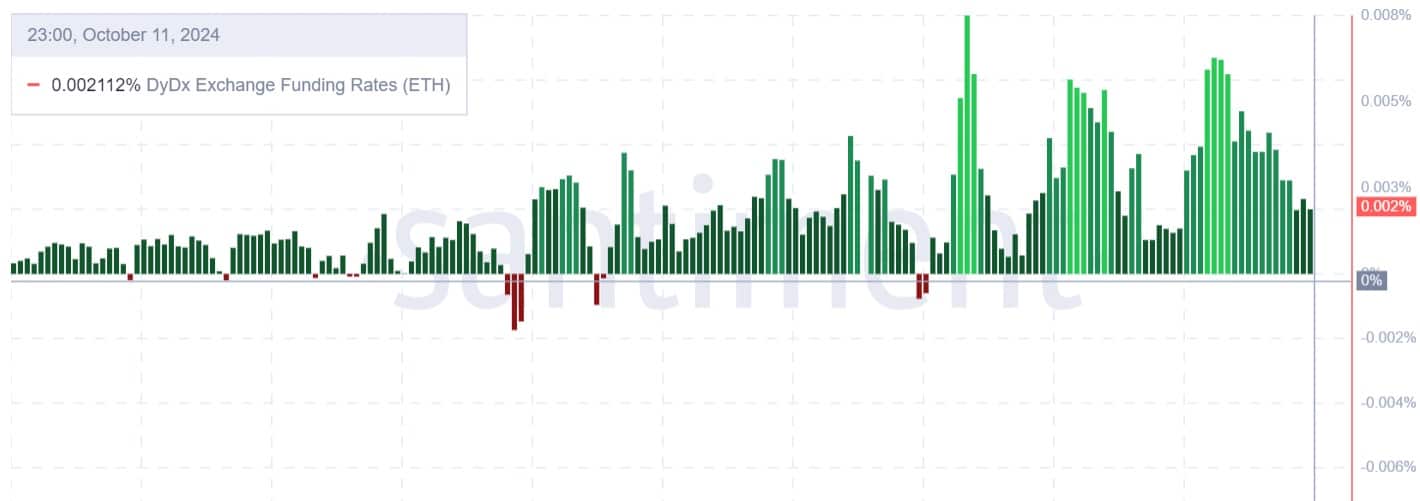

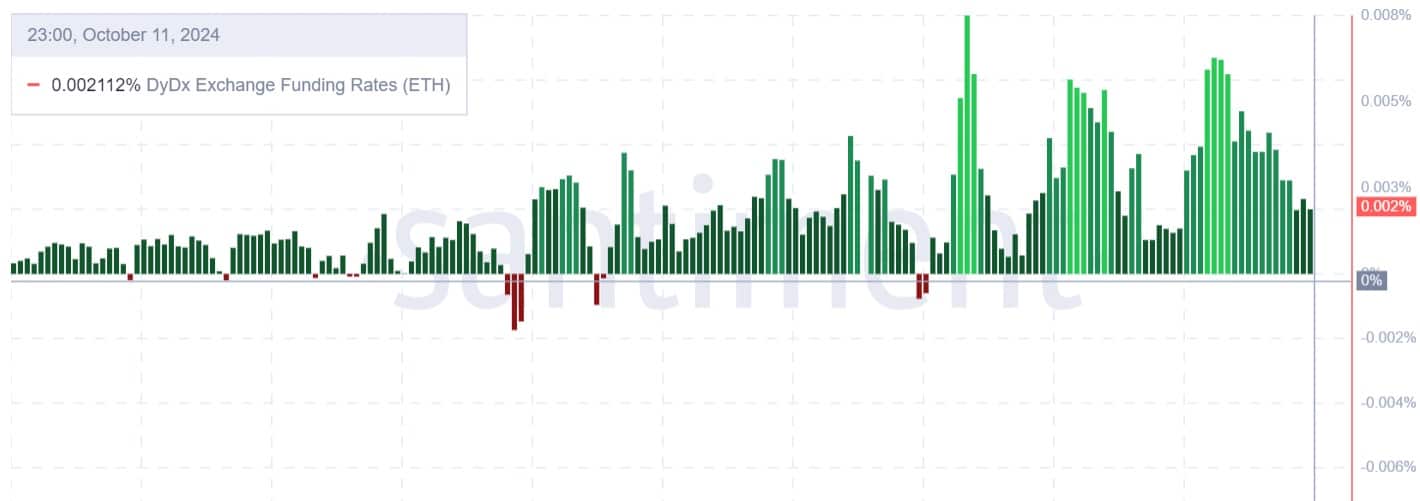

Supply: Santiment

Lastly, Ethereum’s DyDx Trade funding fee has remained optimistic over the previous week. This refers back to the excessive demand for lengthy positions, with buyers prepared to pay premiums for his or her positions throughout market downturns.

Merely put, whereas ETH has but to rise and it’s too early to name a rally, present situations present a positive setting for a possible rebound. Subsequently, if present market situations persist, ETH will attain its resistance stage of $2557 within the close to time period.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024