Bitcoin

Bitcoin fear and greed index settles into neutral zone as prices settle

Credit : ambcrypto.com

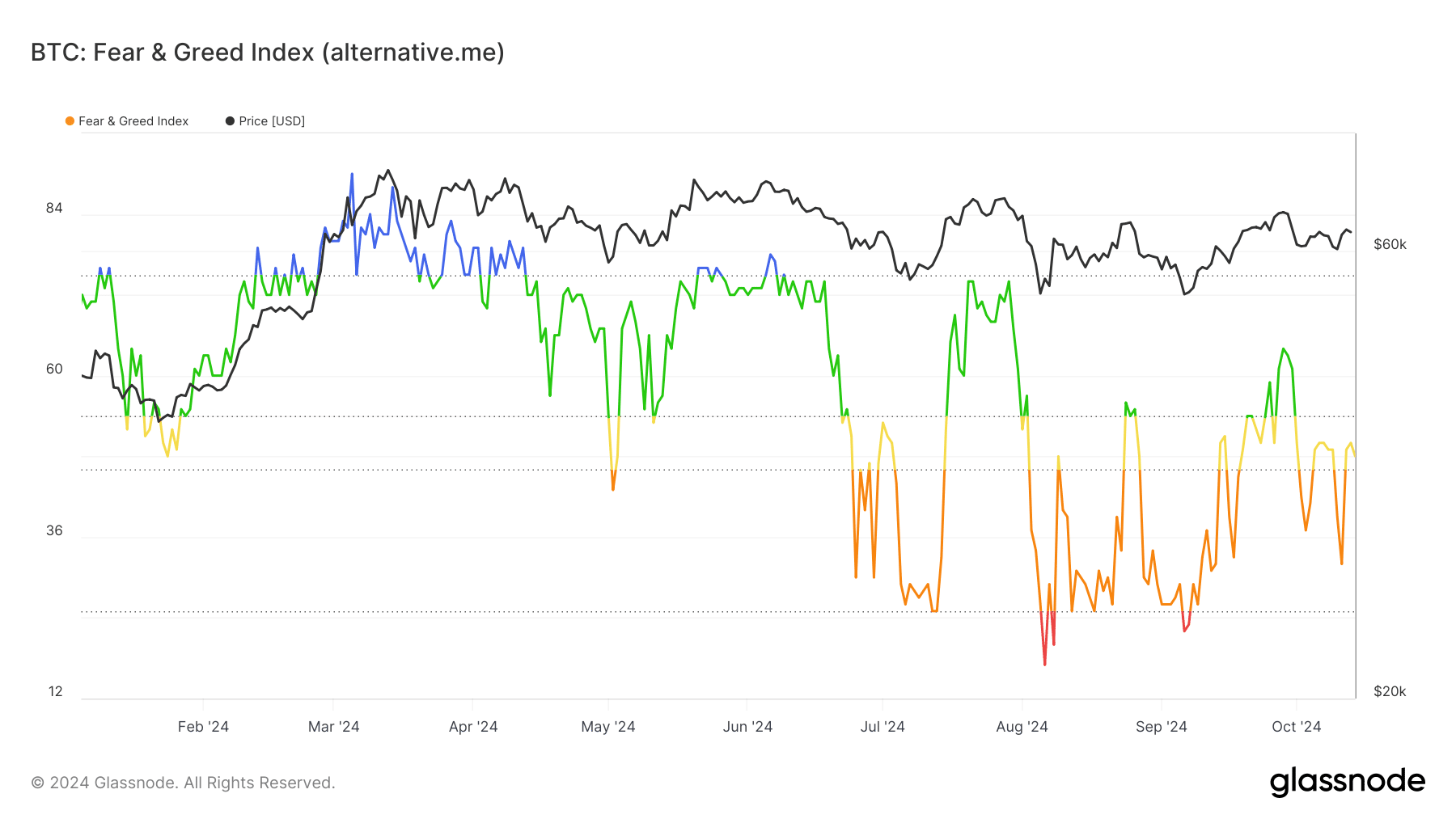

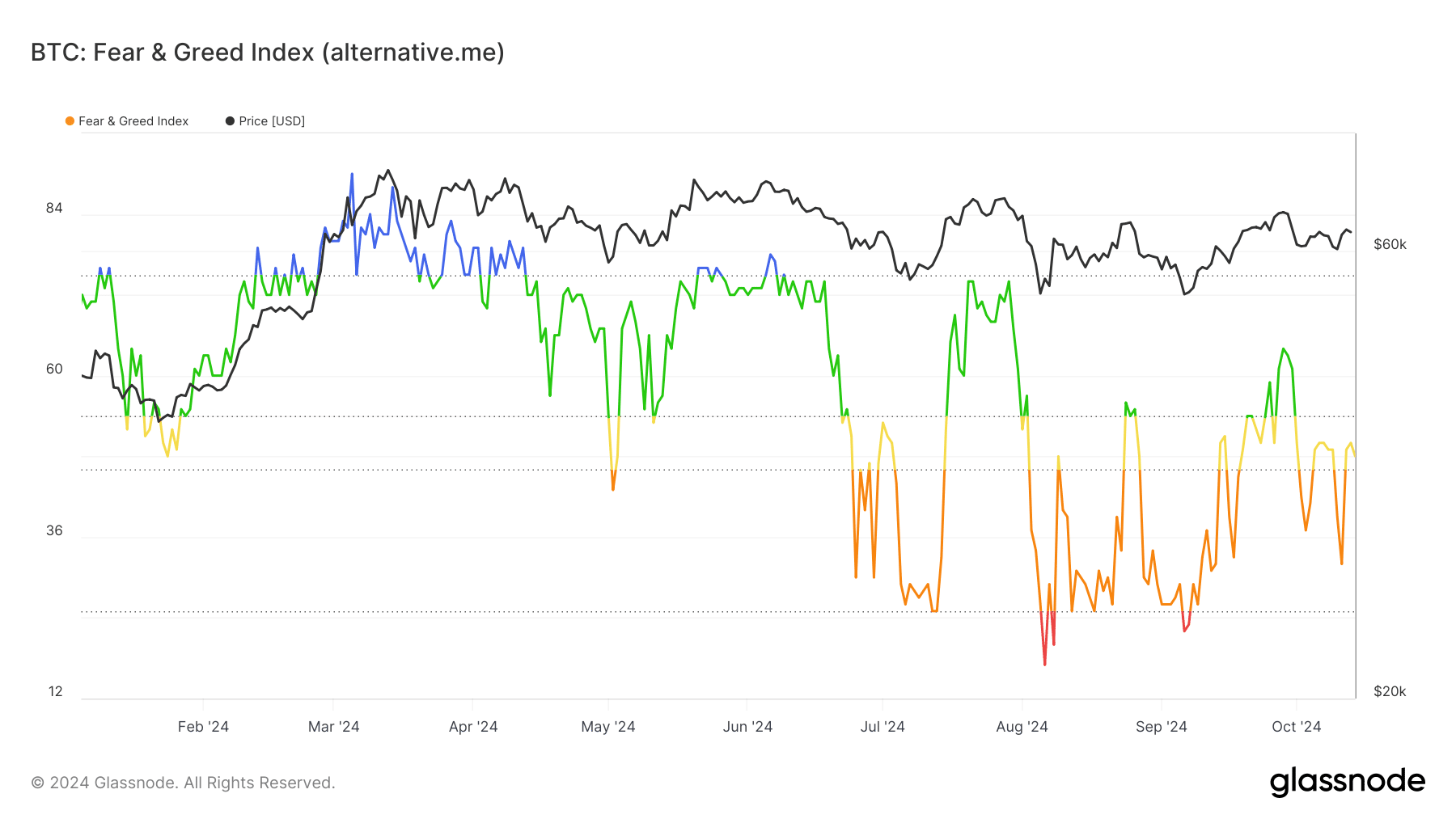

- The Bitcoin Worry and Greed Index has shifted to a impartial rating of 48, indicating balanced market sentiment.

- Bitcoin has surpassed its 200-day shifting common and is presently buying and selling round $64,850 after rising 3%.

The previous few days have been a rollercoaster for Bitcoin [BTC]the place the worth strikes via unstable developments. Nevertheless, latest information signifies that market sentiment is beginning to stabilize.

The Bitcoin Worry and Greed Index exhibits that merchants’ emotional response has shifted from extremes of concern and greed to a extra impartial outlook.

Bitcoin’s concern and greed index turns impartial

Based on Glass junctionThe Bitcoin Worry and Greed Index stood at 48 on the time of writing, indicating impartial sentiment out there. This marks a shift from the elevated concern and greed that adopted latest worth swings.

The index, which measures market sentiment primarily based on elements similar to volatility, quantity and social media developments, suggests merchants are taking a wait-and-see strategy after a interval of intense market motion.

Supply: Glassnode

Earlier this week, on October 11, the index fell to 32, reflecting a state of concern amongst merchants. Curiously, this coincided with an increase within the worth of Bitcoin to round $62,000.

Regardless of this upward worth motion, sentiment on the time remained cautious, probably in response to earlier worth declines.

BTC strikes with emotions of concern and greed

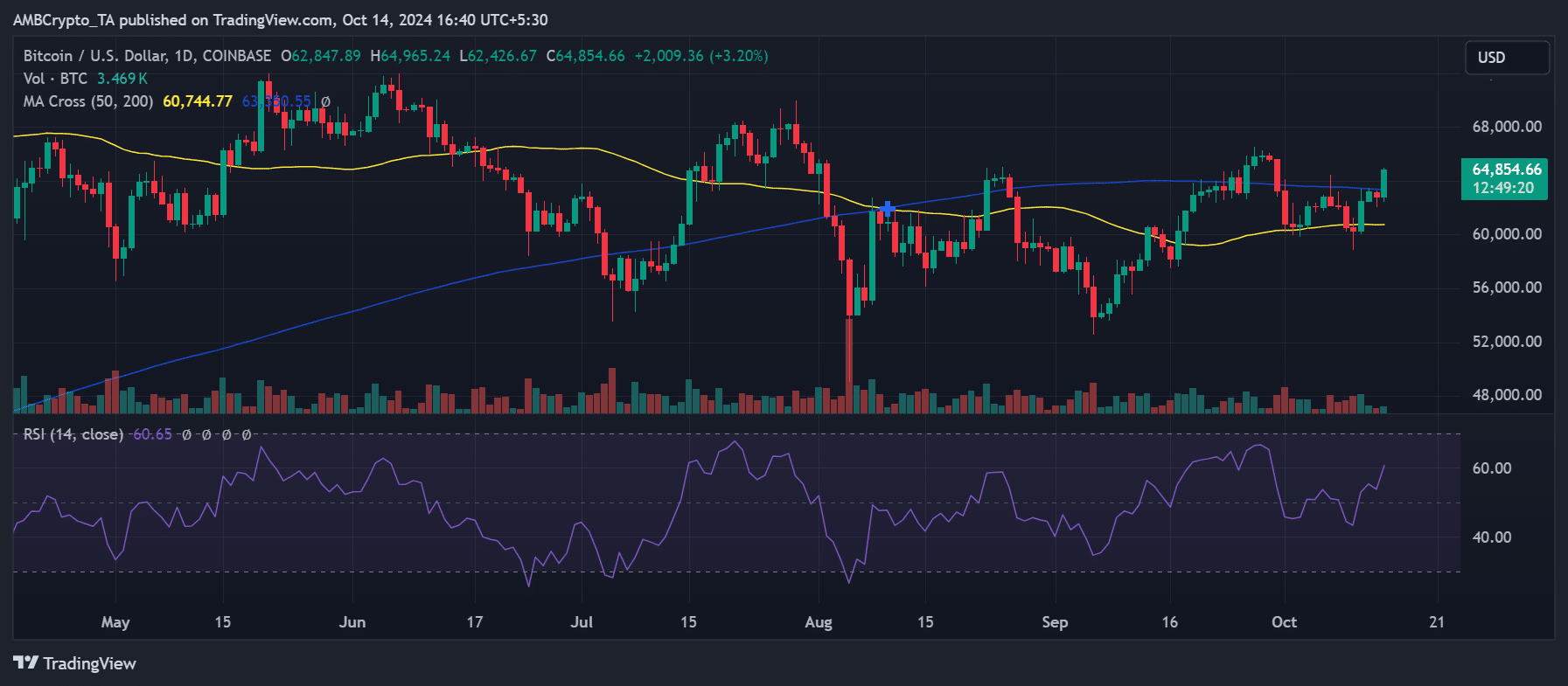

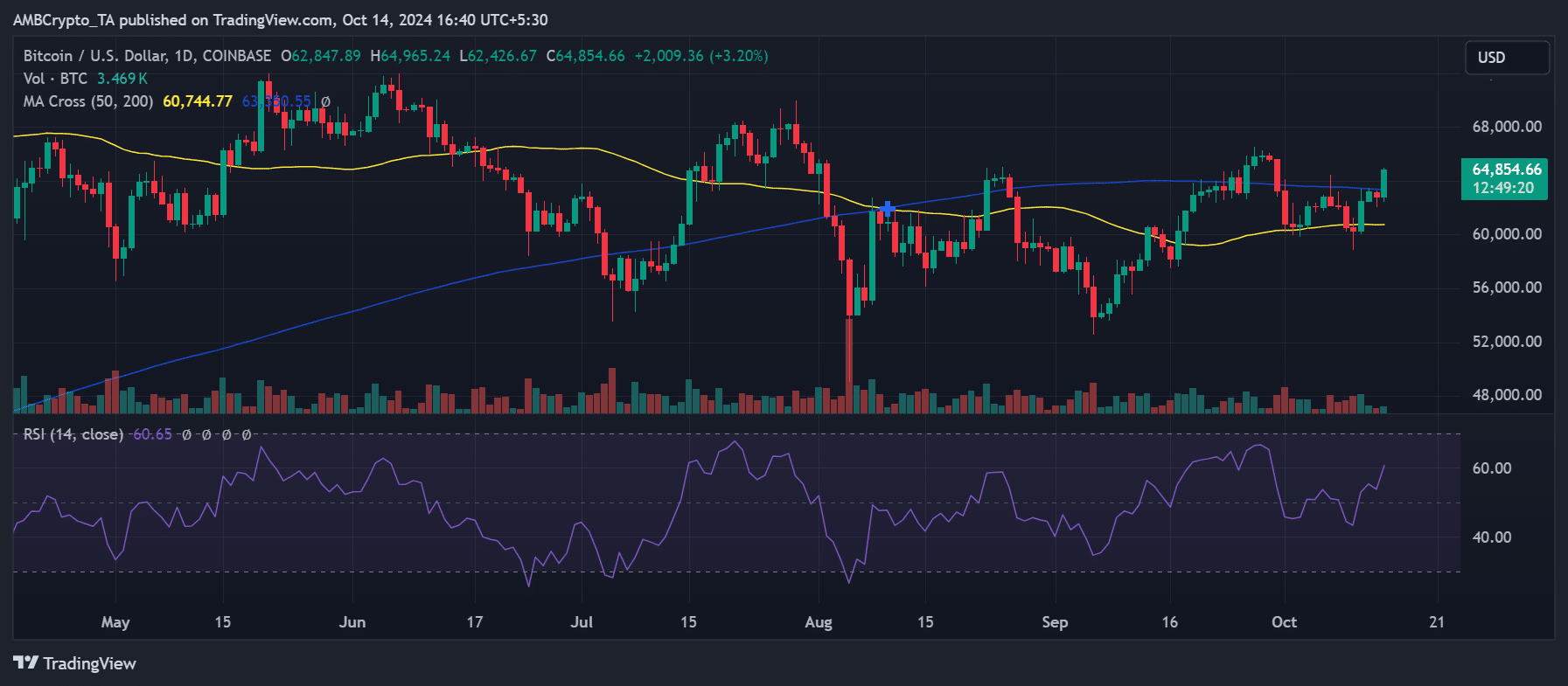

AMBCrypto’s evaluation of Bitcoin’s worth motion revealed that the decline within the Bitcoin Worry and Greed Index on October 11 was in response to earlier worth motion.

Earlier than the worth surge, Bitcoin had suffered a collection of declines, which dropped its worth to round $60,000 – a stage under the 50-day shifting common (yellow line), which acted as a key assist stage.

Supply: TradingView

Nevertheless, on October 11, the market recovered. Bitcoin noticed a 3% enhance, bringing the worth again to $62,500, placing the worth above the 50-day shifting common.

Regardless of this, the worth remained under the 200-day shifting common (blue line), a stronger resistance stage.

On the time of writing, Bitcoin is buying and selling at round $64,850, yielding one other 3%.

This uptrend has allowed BTC to interrupt previous the 200-day shifting common, which had served as resistance across the $63,000 worth.

The mixture of those worth actions and the impartial sentiment on the Bitcoin Worry and Greed Index means that the market is in a state of cautious optimism.

Energetic addresses stay steady

Though the Bitcoin Worry and Greed Index mirrored impartial sentiment, the variety of lively addresses has remained remarkably steady.

Santiment information confirmed that the seven-day common of lively addresses had remained constant, with round 3.5 million lively addresses.

On the time of writing, there have been roughly 3.52 million lively addresses, reflecting continued engagement with the community.

Supply: Santiment

Learn Bitcoin’s [BTC] Worth forecast 2024-25

This regular variety of lively addresses indicated continued curiosity from long-term holders, which may function a foundation for future worth will increase.

Regardless of the altering sentiment, the steadiness of community exercise could possibly be an indication that Bitcoin’s long-term prospects stay constructive.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now