Altcoin

The number of Bitcoin bulls increases as the funding rate shows steady growth – Details

Credit : www.newsbtc.com

This text is offered in Spanish.

Bitcoin has rebounded strongly from the $65,000 mark after a 6% dip from Monday’s peak round $69,500. Regardless of the latest pullback, BTC stays in a bullish development that has been occurring since early September. This restoration reveals resilience and helps preserve the bullish market construction.

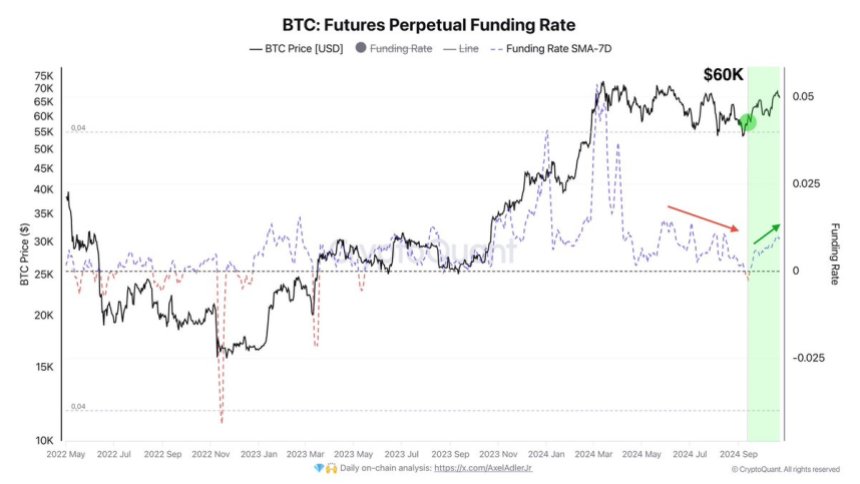

Key information from CryptoQuant reveals that the common funding fee has grown steadily since September, indicating that bullish sentiment is rising as extra merchants are actively taking part out there.

Associated studying

The following two weeks shall be essential for Bitcoin because it approaches its all-time excessive in March. Traders and analysts are carefully watching worth actions as BTC builds momentum towards breaking key resistance ranges.

If the bullish development continues, Bitcoin may very well be poised for one more main rally, with the potential to succeed in new highs quickly. Nevertheless, any incapability to keep up present ranges might result in new volatility.

Bitcoin reveals power

Regardless of a latest dip, Bitcoin stays strongly above key demand ranges, sustaining its total bullish construction. Analysts and traders are carefully watching the worth motion to substantiate that the present part is just a bullish consolidation earlier than the following transfer increased.

CryptoQuant analyst Axel Adler shared data on Xhighlighting the perpetual funding fee for BTC futures, which has proven regular development since Bitcoin reached the $60,000 stage. This means that increasingly more bulls are getting into the market, with optimism rising as the worth goes increased.

Adler advised that bullish momentum is prone to proceed so long as this funding fee will increase, reinforcing that BTC is in a wholesome consolidation part. Nevertheless, this doesn’t assure a right away outbreak. There may be nonetheless a major likelihood that Bitcoin will commerce sideways within the coming days. Sideways worth motion may be important for constructing liquidity, permitting the market to collect power for a much bigger transfer.

Associated studying

Whereas market sentiment stays optimistic, particularly with the continued enhance in bullish exercise, traders ought to put together for doable swings. The following main worth motion might go both approach, however the regular help above key ranges is a constructive indicator for these betting on an additional rise in Bitcoin’s worth.

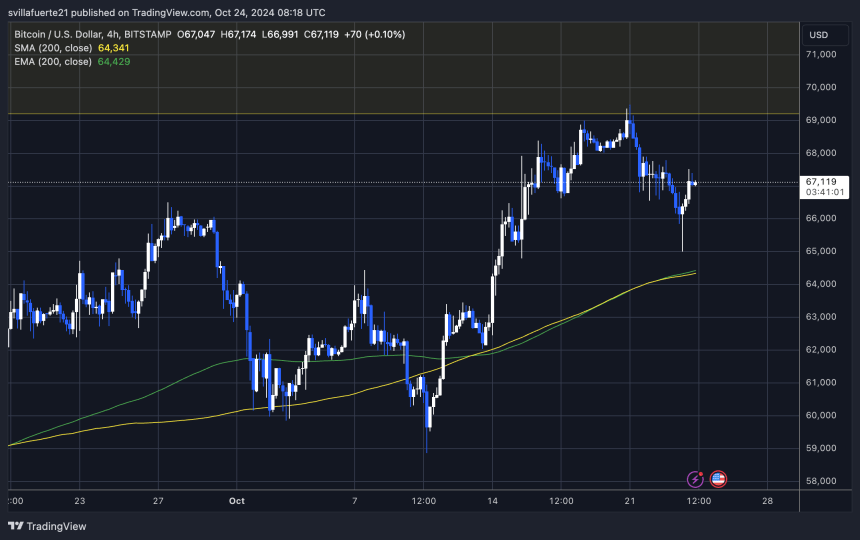

BTC stays above key demand

Bitcoin stays robust above the USD 66,000 stage after discovering help round USD 65,000. At the moment buying and selling at $67,100, the market seems to be in a consolidation part and it could take a while to interrupt above the essential $70,000 stage.

To take care of the bulls’ momentum, it’s important that the worth stays above $65,000 or finds help round $64,300, the place each the 4-hour exponential transferring common (EMA) and the transferring common (MA) align.

Associated studying

If Bitcoin fails to keep up these help ranges, a deeper correction may be anticipated, with the worth probably returning to decrease demand zones round $60,000. However, if BTC manages to interrupt and maintain above $70,000 within the coming days, it might set off a powerful rally in the direction of difficult all-time highs.

With traders conserving an in depth eye on key help and resistance ranges, the approaching days shall be essential in figuring out Bitcoin’s route.

Featured picture of Dall-E, chart from TradingView

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024