Bitcoin

Bitcoin, Ethereum options expire: Mixed sentiments as BTC nears ATH

Credit : ambcrypto.com

- Bitcoin choices are seeing bullish sentiment, with rising whales pointing to potential positive factors in November.

- Ethereum choices are exhibiting indecisiveness as costs hover close to a low, which contrasts with Bitcoin’s sturdy momentum.

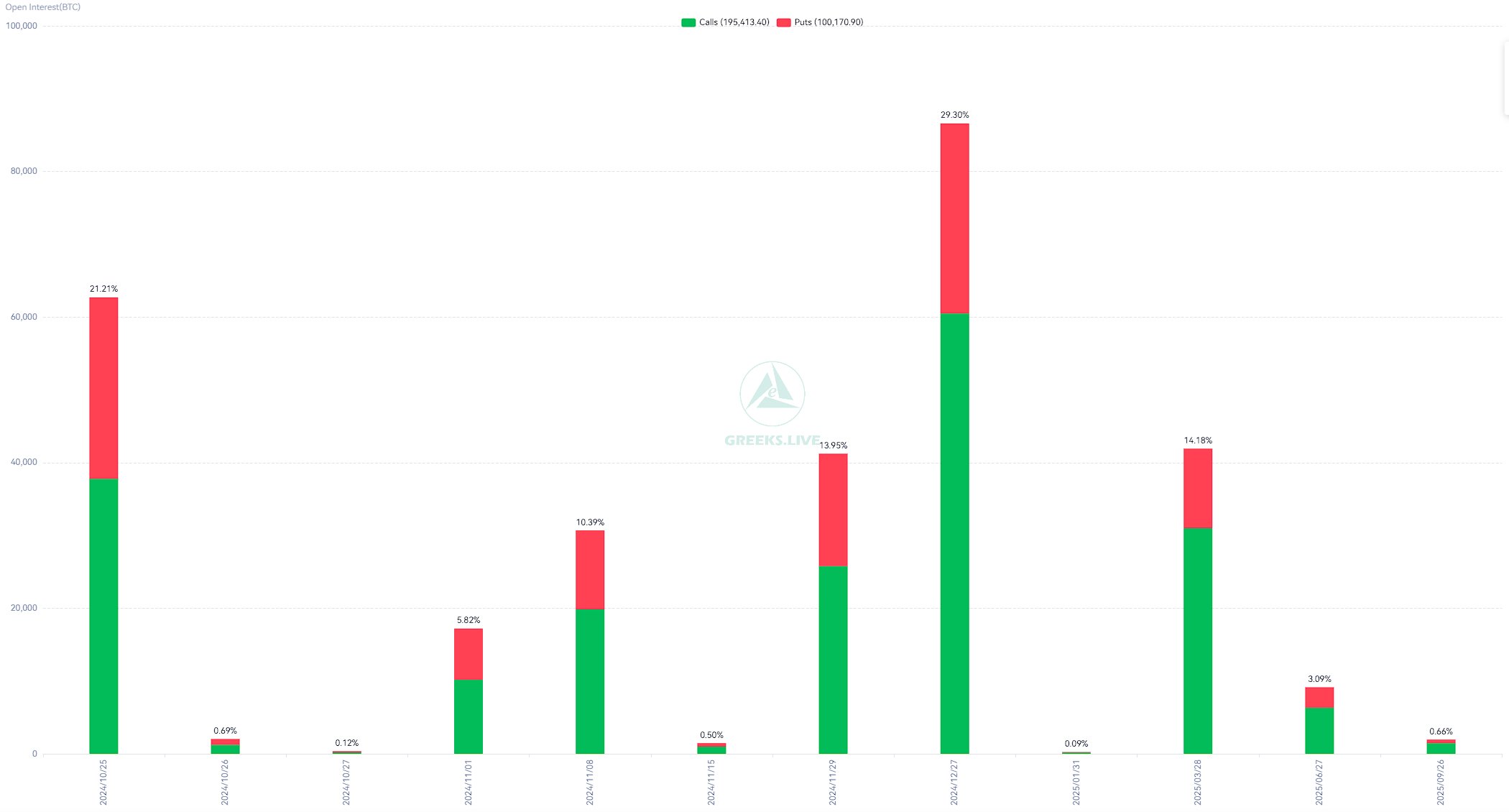

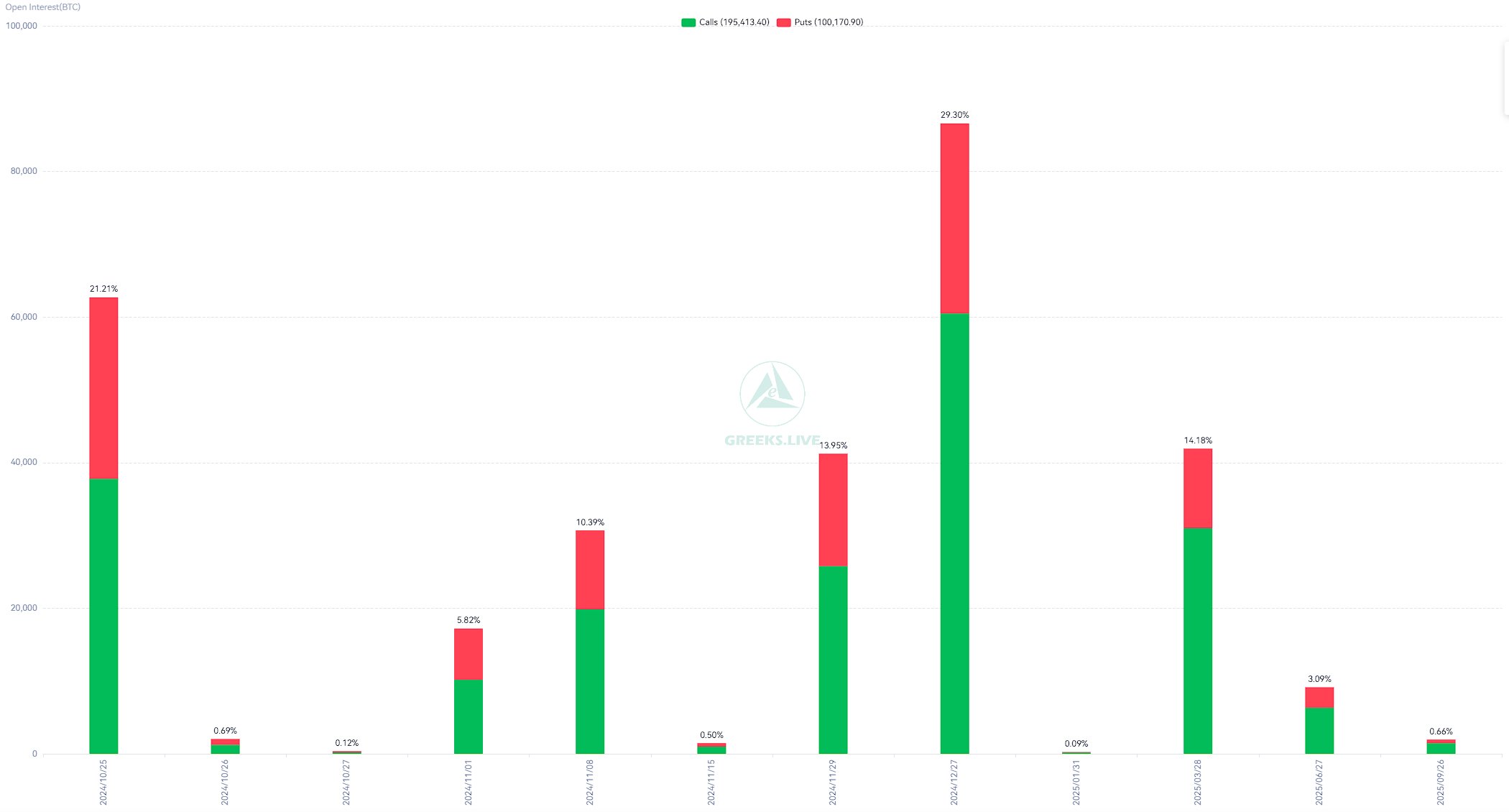

The crypto choices expiration date, dated October 25, yielded blended outcomes Bitcoin [BTC] And Ethereum [ETH]in line with information from Greeks.live.

The expiration occasion, which concerned a mixed notional worth of $5.28 billion, illustrated totally different investor habits for the 2 main cryptocurrencies.

BTC choices expire

On October 25, 63,000 Bitcoin Choices contracts expired, exhibiting a Put-Name Ratio of 0.66, indicating usually bullish sentiment amongst merchants.

The ratio indicated that the variety of name choices was better than the put choices, indicating that merchants have been extra inclined to upward worth actions.

In the meantime, the Max Ache level, the place most choices would expire nugatory, was quoted at $64,000.

The full notional worth of expired BTC choices was $4.26 billion, indicating important exercise out there.

Bitcoin was buying and selling round $67,000 at expiration, right down to a latest excessive of $68,000. Nonetheless, BTC remained near its all-time excessive of $70,000.

Supply:

Bitcoin’s implied volatility (IV) – dated November 8 – has stabilized at 55%, signaling a possible alternative for merchants anticipating the US election, which might set off important market shifts.

Rise of Bitcoin Whales

Current information from Santiment helps the bullish sentiment revealed a rise within the variety of Bitcoin whales up to now two weeks.

DThroughout this era, 297 new wallets holding at the least 100 BTC have been added, reflecting a rise of 1.93% and bringing the entire variety of such wallets to 16,338.

Traditionally, a rise within the variety of massive Bitcoin holders usually corresponds to upward worth momentum, signaling potential additional positive factors for Bitcoin.

Supply:

The rise in whale addresses coincided with Bitcoin’s latest worth motion, the place its worth briefly exceeded $68,000 earlier than a small correction to $67,000.

This accumulation of whales might point out continued curiosity amongst main buyers, probably supporting Bitcoin’s resilience forward of anticipated market volatility in November.

ETH choices expire

October 25 additionally noticed 403,426 Ethereum choices contracts expire, with a Put-Name ratio of 0.97, reflecting a near-balanced sentiment between bullish and bearish positions.

The Max Ache level was set at $2,600, indicating the place the most important variety of choices would expire nugatory.

The notional worth of expired ETH choices reached $1.02 billion, highlighting Ethereum’s important market presence, though its efficiency has been stagnant in comparison with Bitcoin.

Supply:

Reasonable or not, right here is the market cap of ETH by way of BTC

On the time of writing, Ethereum was buying and selling at $2,468close to the Max Ache level, indicating restricted worth motion.

This contrasted with Bitcoin’s stronger worth dynamics, as the previous’s market habits confirmed indicators of investor indecision, exacerbated by challenges related to spot Ethereum ETFs.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024