Ethereum

Ethereum exchange inflows spike: Will U.S. elections spark a bounce?

Credit : ambcrypto.com

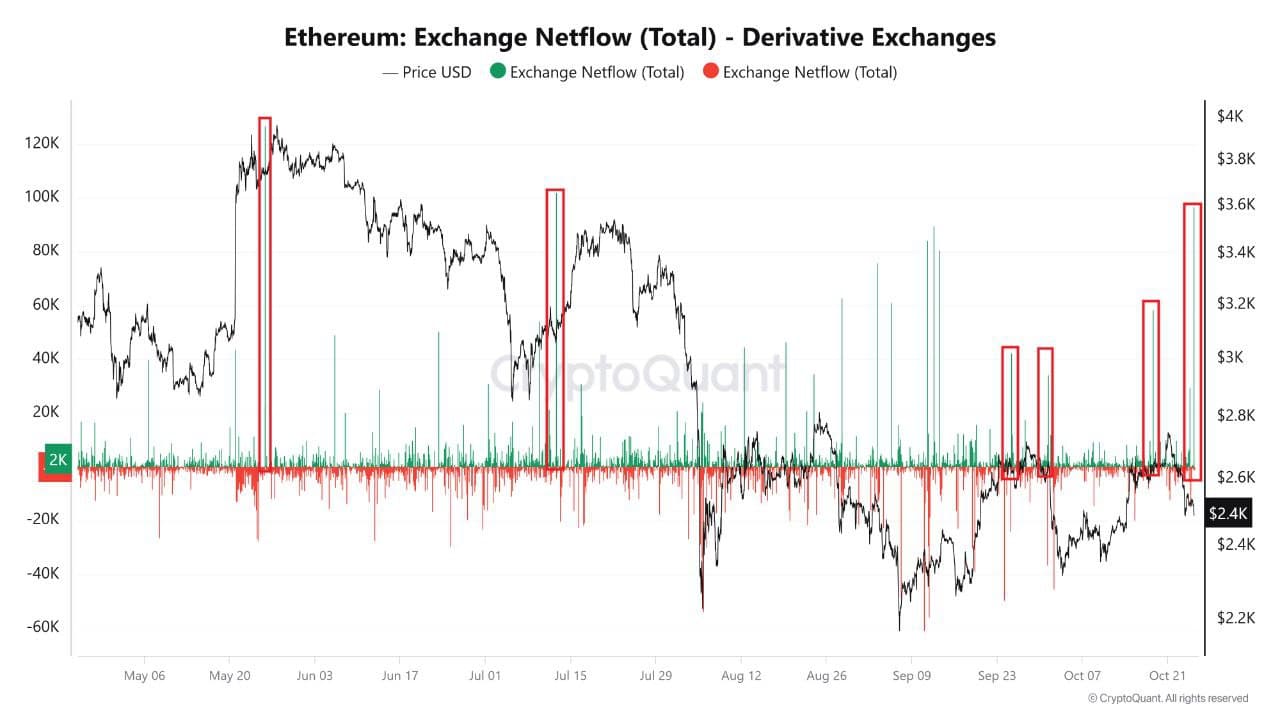

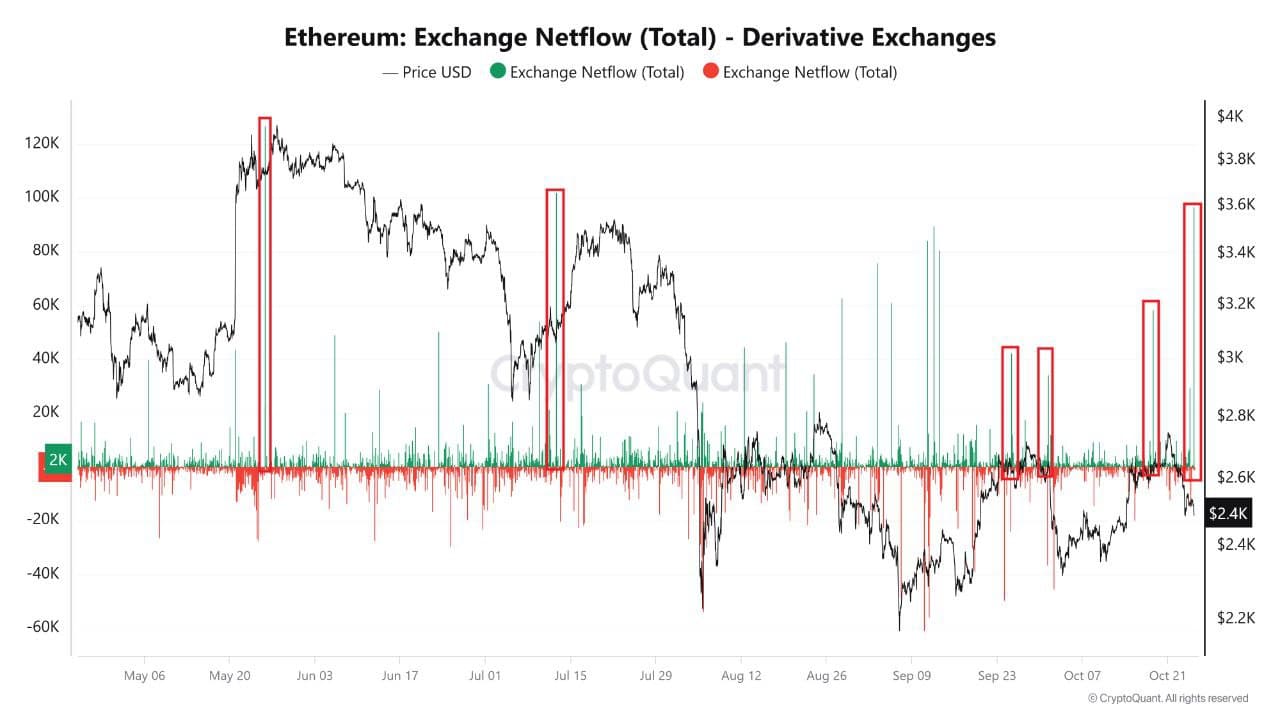

- The markets noticed an inflow of Ethereum into derivatives exchanges.

- Latest charts confirmed a potential four-hour bullish divergence on ETH.

Ethereum [ETH]one of the vital cryptocurrencies, has been the topic of dialogue as an influx of 96,000 ETH into derivatives exchanges lately indicated a notable improve in market exercise.

Traditionally, comparable inflows have led to ETH value fluctuations or declines, as we noticed in Might and July of this 12 months. This improve might sign one other value correction or doubtlessly set off a serious market shift.

As the ultimate quarter of the 12 months progresses, Ethereum’s efficiency might intently comply with Bitcoin’s latest breakout from a long-term consolidation, fueling optimism within the crypto markets.

Supply: CryptoQuant

US elections accompanied by a divergence sign

Ethereum’s value motion throughout earlier US election cycles additionally supported this pattern. Through the 2020 elections, ETH soared and broke out of consolidation.

With the election simply days away, an analogous sample might emerge.

Ethereum might see a restoration if historical past repeats itself, particularly as many anticipate optimistic insurance policies in direction of crypto underneath potential adjustments within the US authorities.

Nevertheless, this final result stays speculative as the general financial and crypto panorama has advanced since 2020.

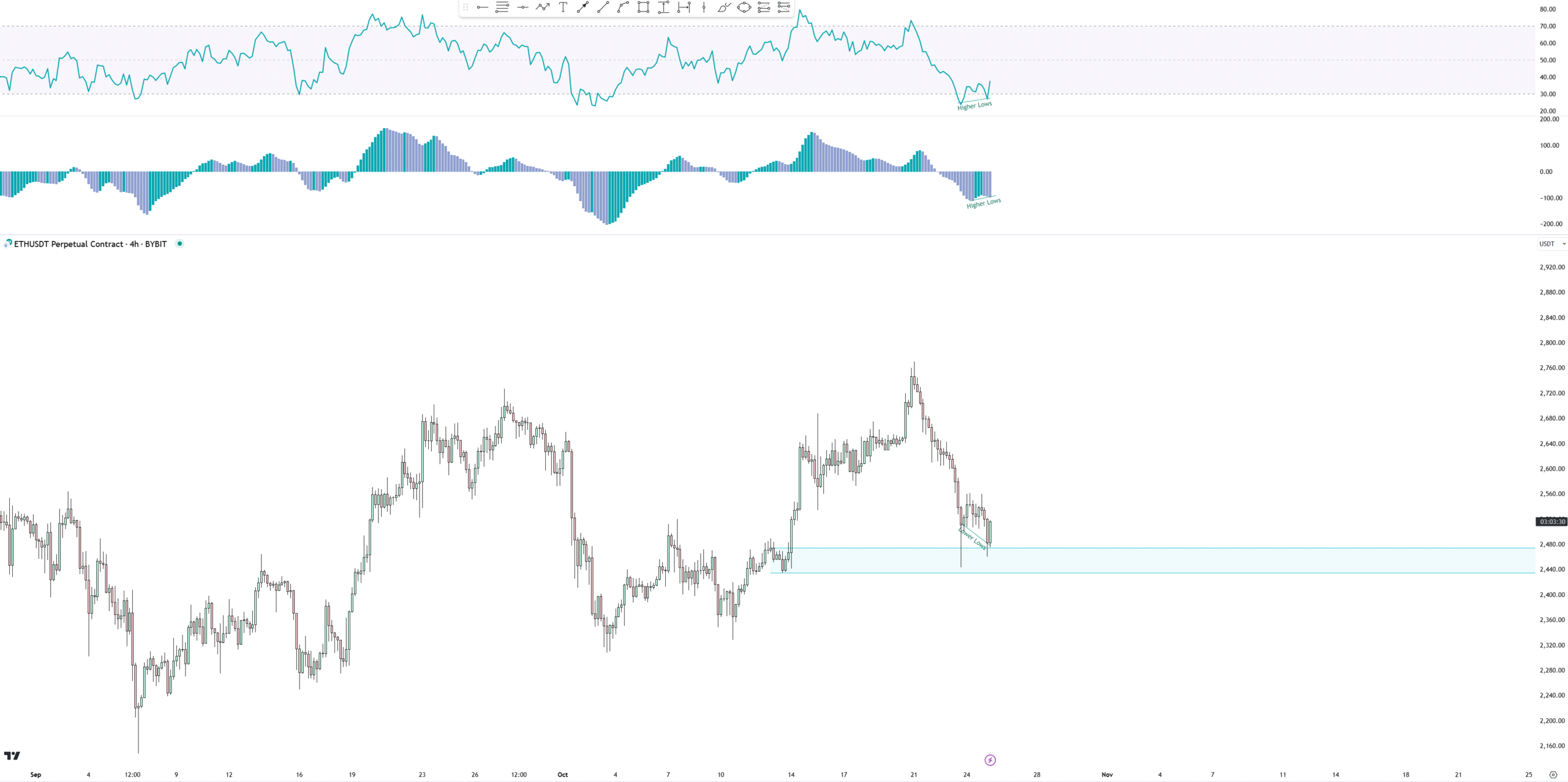

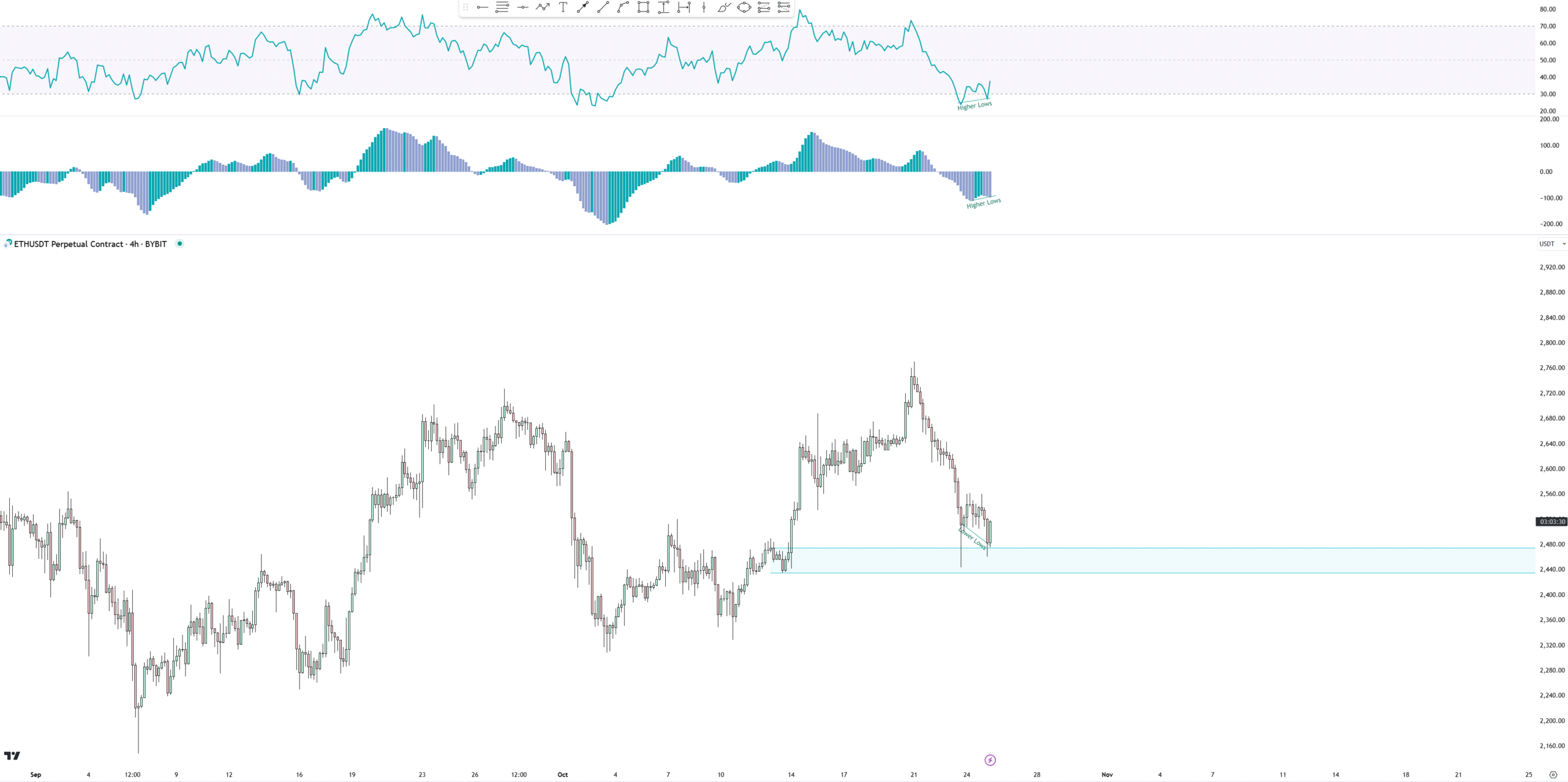

Supply: TradingView

Latest charts supported a possible bullish flip for ETH, displaying a potential four-hour bullish divergence, signaling a shift in demand.

Though the construction of this demand stage appeared irregular, Ethereum confirmed responses that might point out energy.

The divergence construction was clear and confirmed a double divergence with a clear arc formation, giving a optimistic image.

Supply: TradingView

Many of the unfavorable delta occurred through the first leg of this sample, which typically signifies much less promoting strain on the second leg.

Nevertheless, analysts urged warning and suggested merchants to attend for a powerful inexperienced candle confirming a reversal earlier than assuming it could negate the bearish outlook.

ETH/BTC checks its 2016 highs

In one other main improvement, Ethereum examined its 2016 highs towards Bitcoin. At the moment, ETH is buying and selling under a long-standing falling wedge sample, which represents a excessive time-frame assist stage.

Many merchants anticipate ETH to proceed correcting towards Bitcoin, particularly if it struggles to interrupt above this stage.

Though Ethereum has proven resilience within the latest market, investor curiosity has remained subdued, leaving future value motion unsure.

Supply: TradingView

If ETH have been to respect this assist, it might appeal to new market curiosity, doubtlessly inflicting a market shift within the remaining months of the 12 months or early subsequent 12 months.

Learn Ethereum’s [ETH] Worth forecast 2024–2025

Nevertheless, till ETH confirms a breakout, a cautious outlook stays cautious for traders.

Whereas important inflows, election 12 months developments, and a potential bullish divergence have fueled hopes for a rally, ETH should navigate key resistance ranges towards Bitcoin.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024