Analysis

Here’s Why Bitcoin is not returning to $65k in 2024!

Credit : coinpedia.org

Through the previous unstable week within the crypto market, Bitcoin worth resonated between $69,000 and $65,000. At present, Bitcoin worth is buying and selling at $68,217 with an intraday acquire of 0.41%.

With a bullish turnaround, will BTC worth peak above the $70,000 threshold this week? Try our Bitcoin worth evaluation to search out out now!

Bitcoin (BTC) worth evaluation

The small restoration within the Bitcoin (BTC) worth marks a constructive begin to this week and continues the bullish momentum gained this weekend. After Friday’s large 2.31% drop, Bitcoin rose 0.64% and 1.40% on Saturday and Sunday, respectively.

The Bitcoin restoration rally is gaining momentum and has maintained a dominant place above the $68,000 mark. Within the every day chart, the small pullback earlier than the weekend serves as a retest of the resistance trendline break.

Based mostly on the Fibonacci degree, the reversal began at 78.60% Fibonacci and located assist on the 61.80% Fibonacci degree at $66,167. The bullish reversal is poised to problem the 78.60% degree as BTC worth recovers. In the meantime, the rising bullish affect will increase the opportunity of a continuation of the uptrend.

Double backside reversal in BTC worth

On the 4-hour chart, BTC worth motion reveals a double backside reversal with large divergence within the RSI line, teasing a bullish comeback. At present, BTC worth is retesting the neckline at $68,200 because it has given up takeouts with out bullish engulfing candles.

Based mostly on the trend-based Fibonacci degree, the uptrend has but to surpass the 23.60% degree at $68,359 on the 4-hour chart. A bullish breakout is more likely to cross the $70,000 mark to achieve the 60% Fibonacci degree at $70,817.

With the restoration rally gaining momentum, the near-term upside targets are the 78.60% and 100% Fibonacci ranges of $73,500 and $75,500.

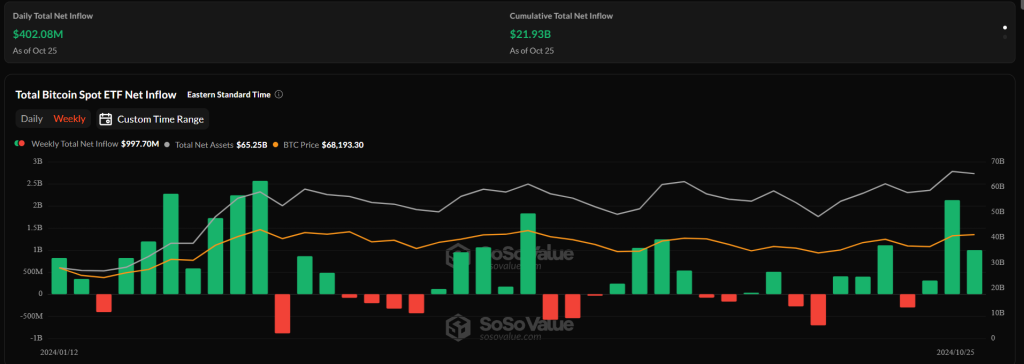

Bitcoin ETFs witness internet inflows of ~$3.5 billion in 3 weeks

Because the bullish pattern in Bitcoin step by step positive aspects momentum, institutional assist continues to develop. For the previous three weeks, US spot Bitcoin ETFs have recorded internet inflows each week.

Over the previous three weeks, internet inflows have been ~$3.5 billion and this pattern is more likely to proceed this week. IBIT at the moment owns $26.98 billion price of BTC tokens and stays the most important US spot Bitcoin ETF. Subsequently, growing assist from establishments will doubtless gas the following bull run in Bitcoin (BTC) costs.

Questioning if Bitcoin will attain $100,000 in 2024? Discover a technical and logical reply in Coinpedia’s BTC Value Prediction for 2024 to 2030!

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024