Ethereum

300K Ethereum withdrawn in a week: What it means for ETH prices

Credit : ambcrypto.com

- Greater than 300,000 ETH had been withdrawn from the exchanges final week alone.

- The ETH worth has continued its slight upward pattern.

Ethereums [ETH] The current worth motion round $2,500 is because of a major decline in overseas change reserves. The decline highlights attainable adjustments in investor sentiment.

A decline in reserves is usually a sign that buyers are withdrawing their property from the inventory exchanges. This transfer normally signifies a long-term technique relatively than an intention to promote. This shift may very well be key to stabilizing ETH’s worth and shaping its future efficiency.

Greater than $4 billion in Ethereum withdrawn from exchanges

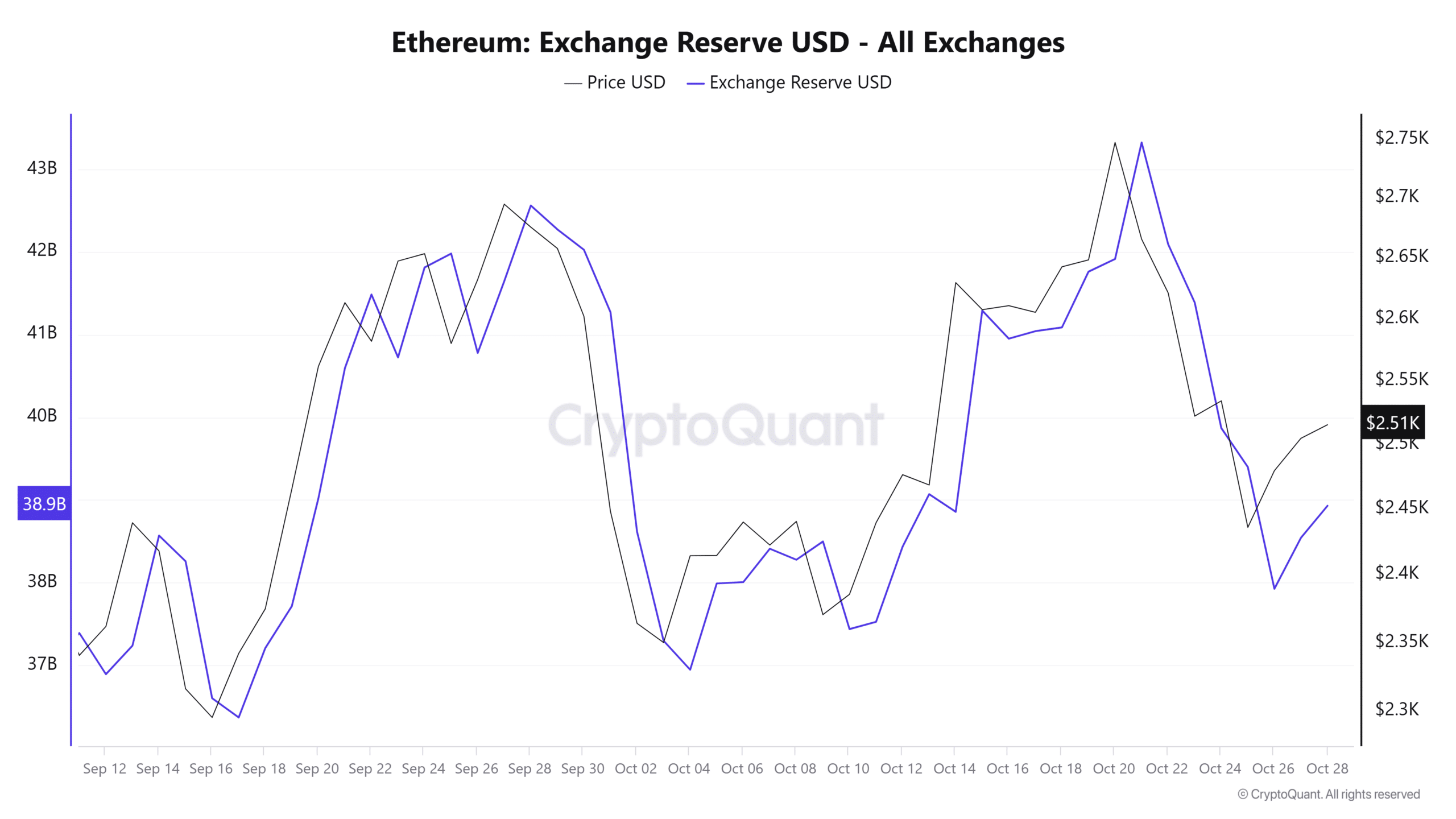

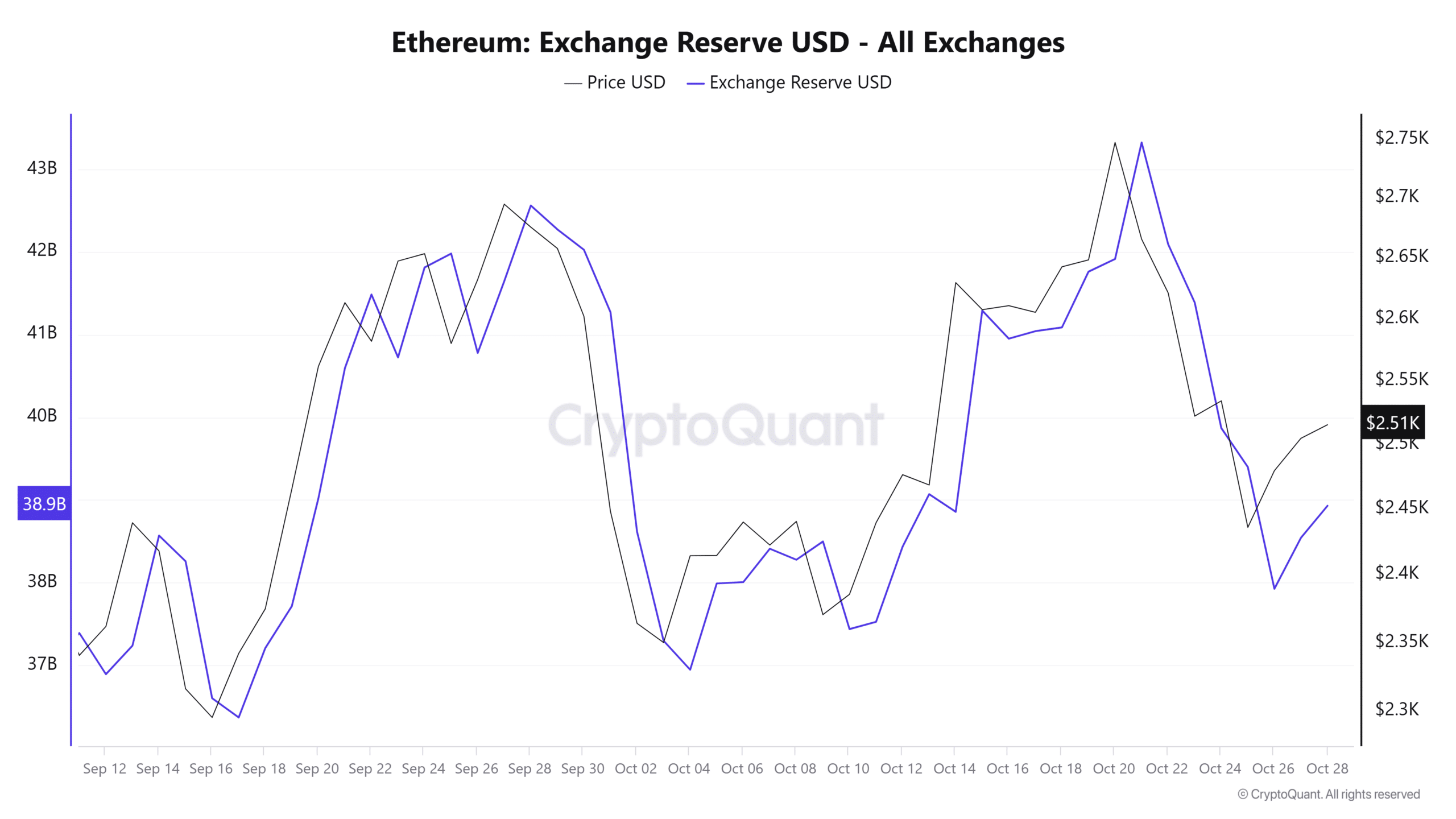

In keeping with CryptoQuant In keeping with knowledge, Ethereum’s overseas change reserves have fallen sharply. Information confirmed a drop from over $42 billion to round $38.9 billion inside a couple of weeks. This represents over $4 billion value of ETH being taken off the exchanges.

Supply: CryptoQuant

This transfer alerts that many buyers will shift their technique to holding relatively than buying and selling within the close to time period. This pattern emerges at a time when Ethereum’s worth is fluctuating between $2,400 and $2,700.

Ethereum’s retreat coincides with worth consolidation

This pattern of withdrawals is according to Ethereum’s current wrestle to surpass resistance ranges round $2,600. By taking holding corporations off the inventory exchanges, buyers can specific confidence of their long-term worth.

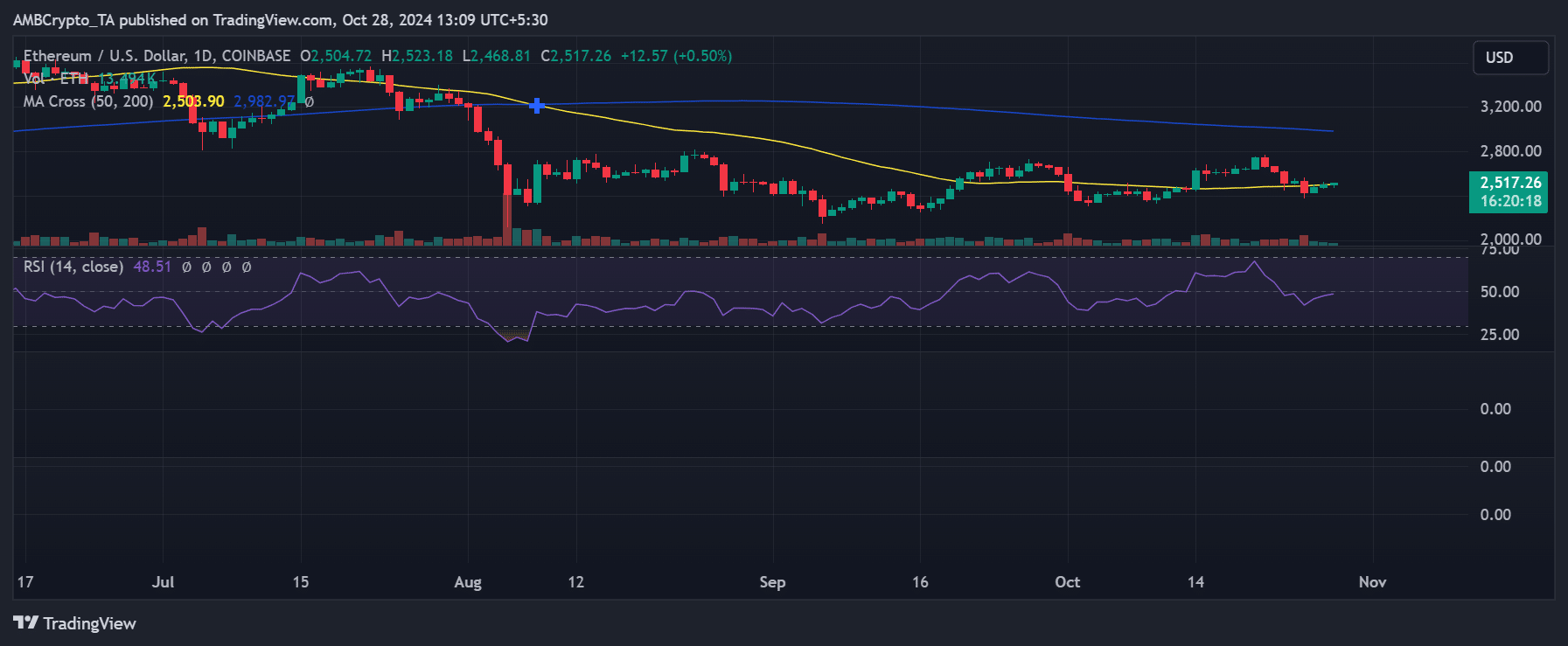

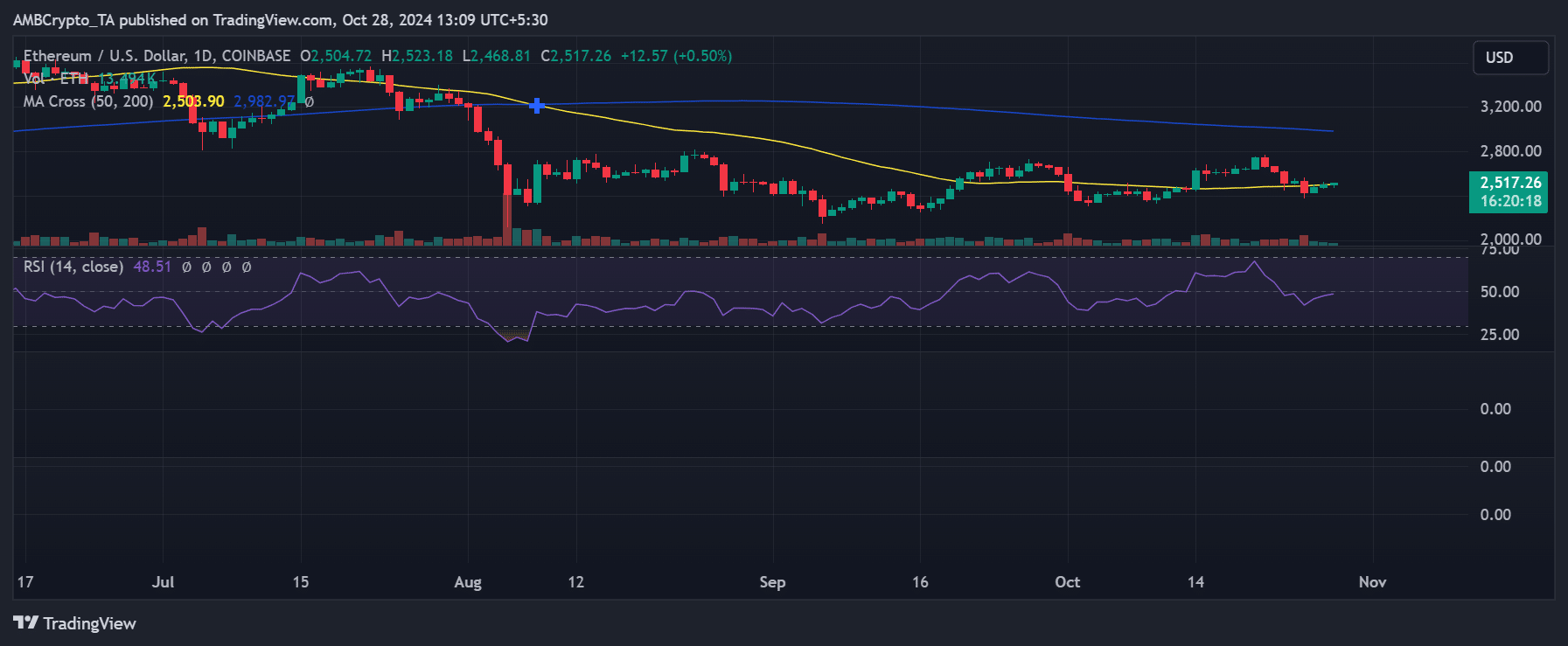

Supply: TradingView

This conduct may cut back promoting strain, particularly if overseas change reserves proceed to say no within the coming days, permitting the value to consolidate and stabilize. The value may stabilize if there are fewer tokens obtainable for quick buying and selling, particularly if demand stays steady.

How declining Ethereum reserves may influence worth stability

Lowered overseas change reserves typically end in decrease obtainable liquidity. This might contribute to cost stability or upward motion if demand stays constant. When there are fewer tokens available on exchanges, any enhance in shopping for curiosity could cause bigger worth results.

As Ethereum seems to be to regain traction after current dips, these forex outflows point out a shift in sentiment. It reveals that holders usually tend to maintain onto shares, lowering the chance of large-scale sell-offs.

Nevertheless, a steady stage of demand will likely be essential. If demand weakens, ETH could proceed to wrestle in opposition to resistance ranges, probably resulting in an prolonged consolidation interval.

Brief-term outlook for Ethereum

The present decline in overseas change reserves alerts a interval of worth consolidation, with the potential for upward momentum. Holding the $2,500 assist stage and a gentle decline in reserves may assist lay a basis for a sustainable restoration.

Learn Ethereum (ETH) worth forecast 2024-25

Ought to market situations favor better demand, Ethereum may see elevated shopping for curiosity, permitting for additional worth will increase.

Nonetheless, if market situations change and demand decreases, ETH may nonetheless be below strain at resistance ranges. The newest knowledge suggests cautious optimism, with long-term bonds displaying resilience resulting from continued market fluctuations.

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Solana6 months ago

Solana6 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?