Ethereum

Ethereum’s MVRV at 1.2 – A sign of overvaluation or buying opportunity?

Credit : ambcrypto.com

- Ethereum’s MVRV ratio stands at 1.2, indicating a refined overvaluation.

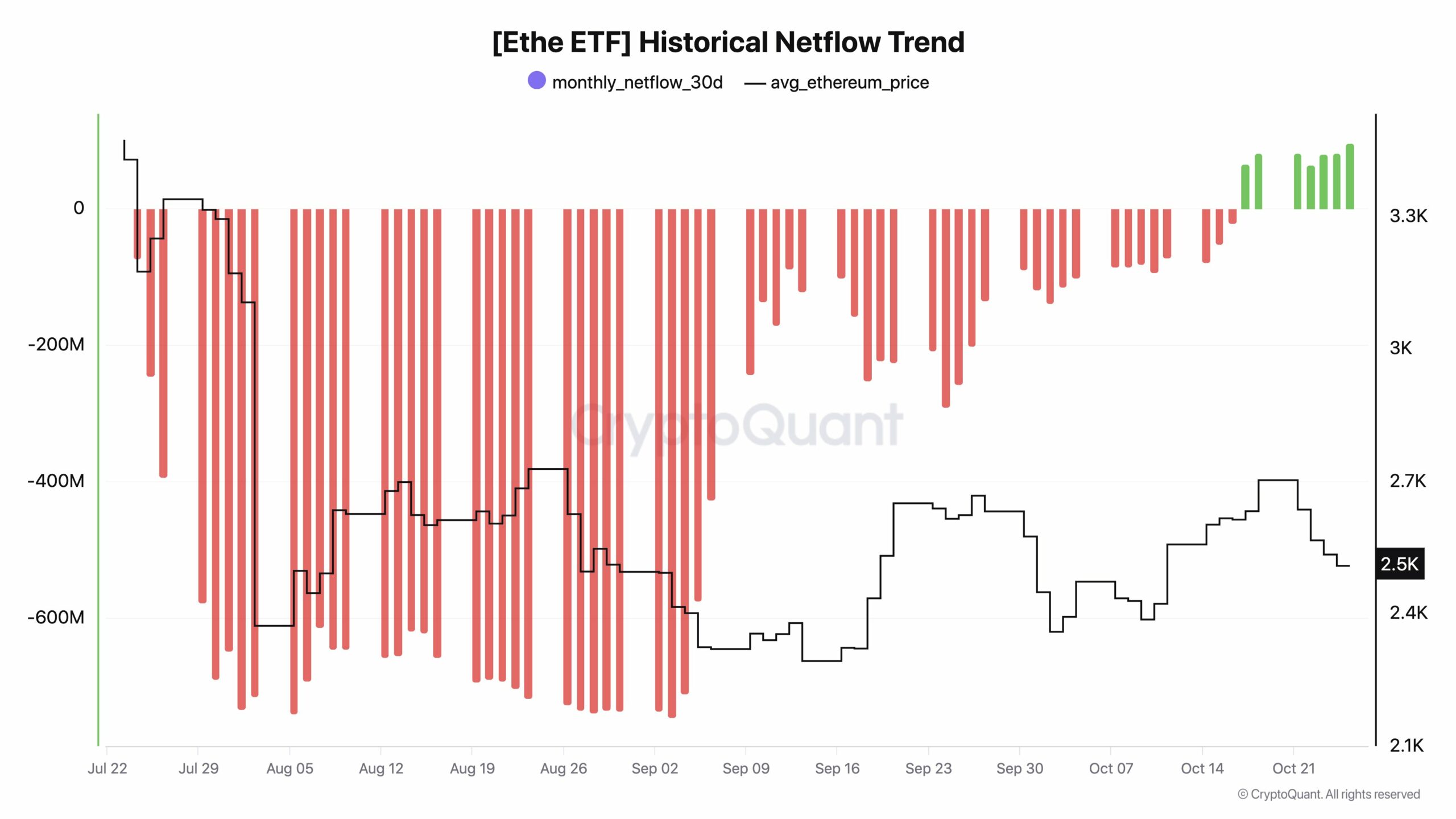

- Ethereum noticed constructive month-to-month web flows for the primary time since July.

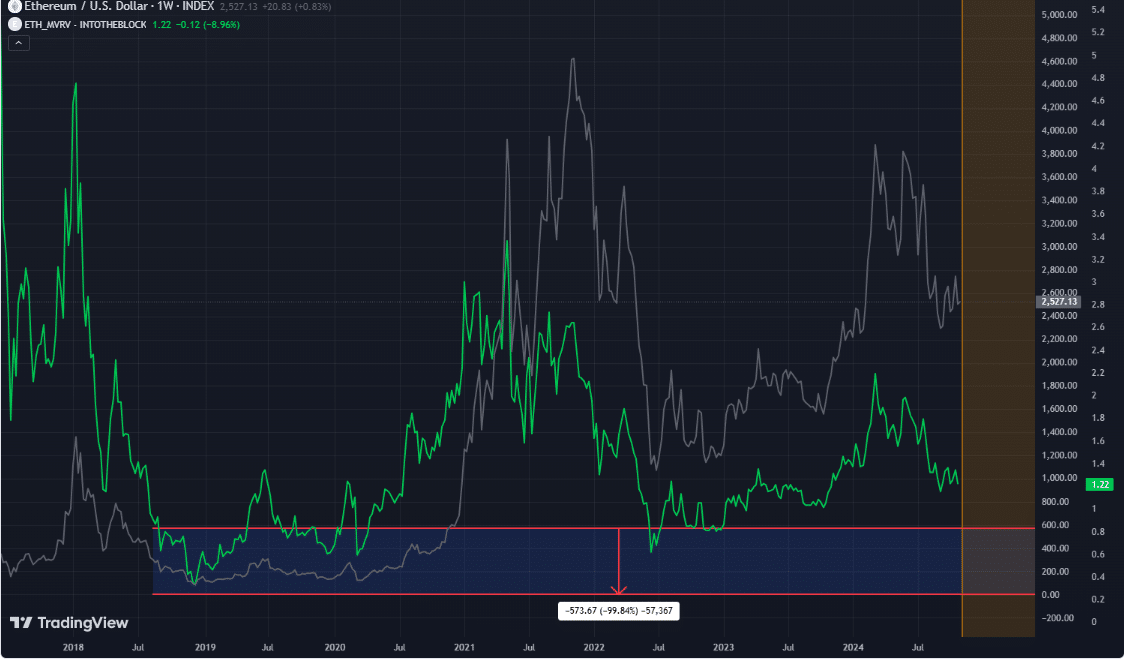

Ethereums [ETH] The market worth just lately exceeded the realized worth, with an MVRV ratio of 1.2, indicating a refined overvaluation.

Traditionally, Ethereum has proven help close to MVRV ranges round 1, marking a major accumulation part for traders trying to purchase low.

Ethereum’s MVRV metric can typically predict key shopping for zones, with dips beneath 1 indicating a part of investor capitulation and elevated shopping for alternatives.

If the value of ETH falls additional, it may create a super scenario for value-oriented merchants trying to purchase in periods of potential underpricing.

Supply: buying and selling view

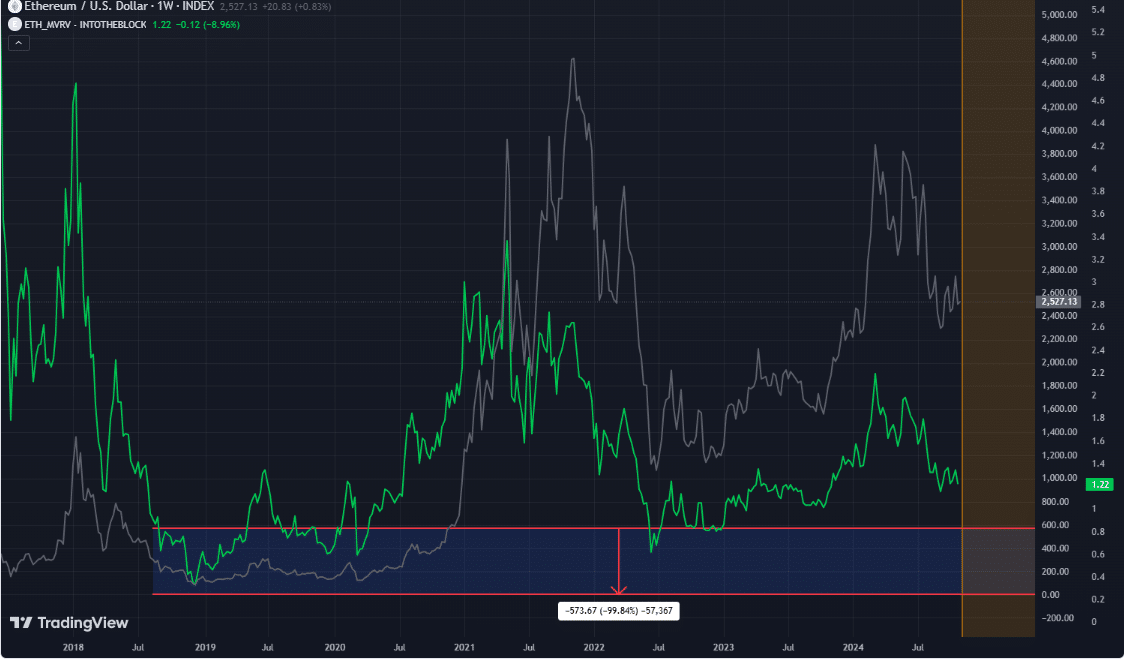

In October, Ethereum additionally noticed constructive month-to-month web flows for the primary time since July. This alteration in liquidity traits was a departure from earlier cycles, with capital flows into Bitcoin reaching document highs and having a dominance of round 60%.

Some Ethereum holders are viewing this era as a possibility and positioning themselves for potential good points as soon as momentum will increase.

Nonetheless, others urge warning, noting {that a} vital worth improve might solely happen as soon as Bitcoin’s dominance begins to considerably decline.

Supply: CryptoQuant

The ETH Supertrend indicator is bullish

Regardless of rising inflows into Bitcoin, Ethereum’s efficiency remained resilient, supported by the Supertrend indicator, which maintained a bullish stance.

Even after Ethereum fell to $2,640, it continued to indicate increased lows, boosting confidence amongst long-term traders and signaling the potential for a continued uptrend.

Ethereum’s supertrend help prompt that bulls may push the value increased offered ETH breaks above the $2,570 stage.

For a lot of market watchers, Ethereum’s present stage represents greater than an funding alternative; additionally it is a degree of strategic anticipation.

Supply: buying and selling view

The continued resilience amid fluctuating market situations has drawn comparisons to comparable sentiment shifts seen in earlier cycles with property like Solana recovering from prolonged lows.

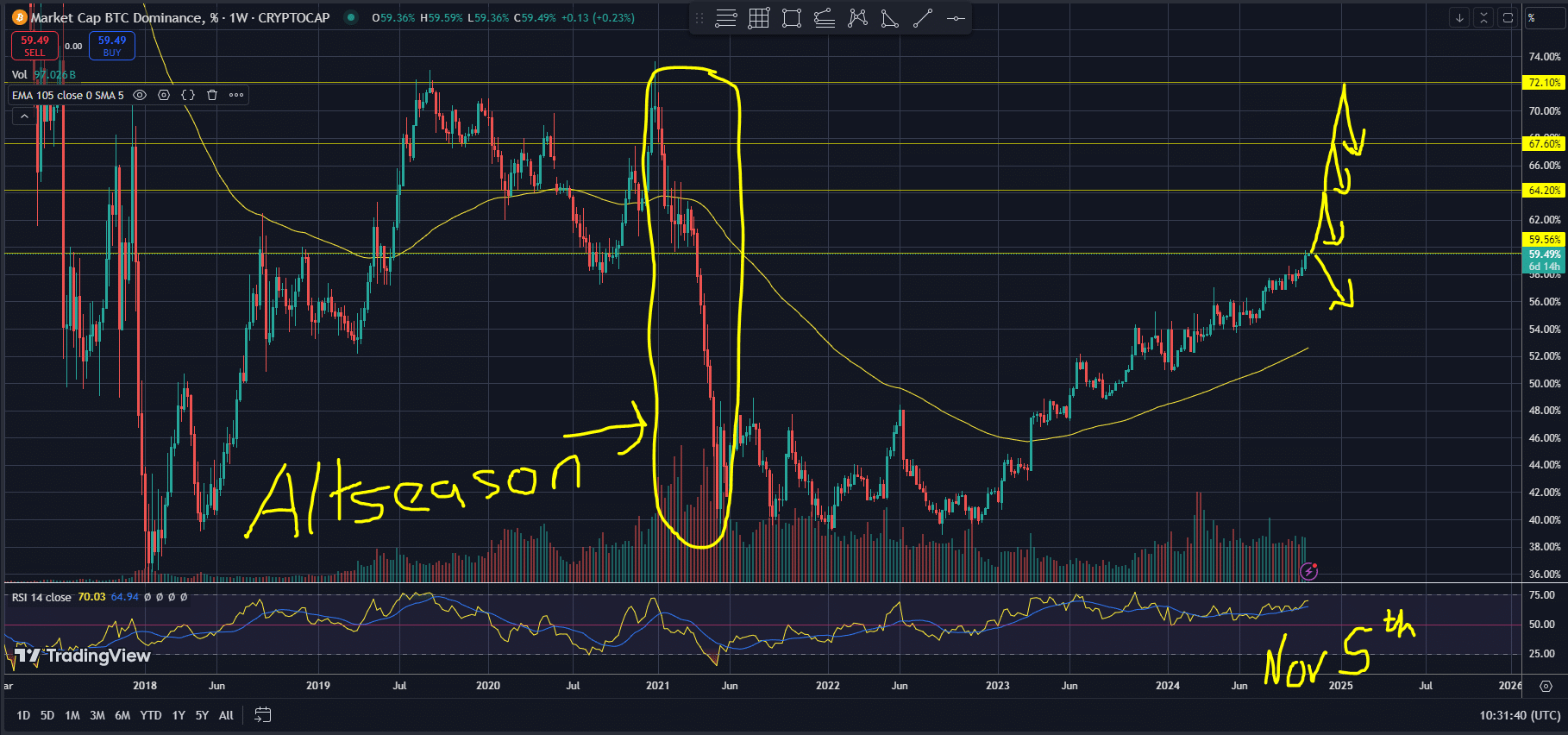

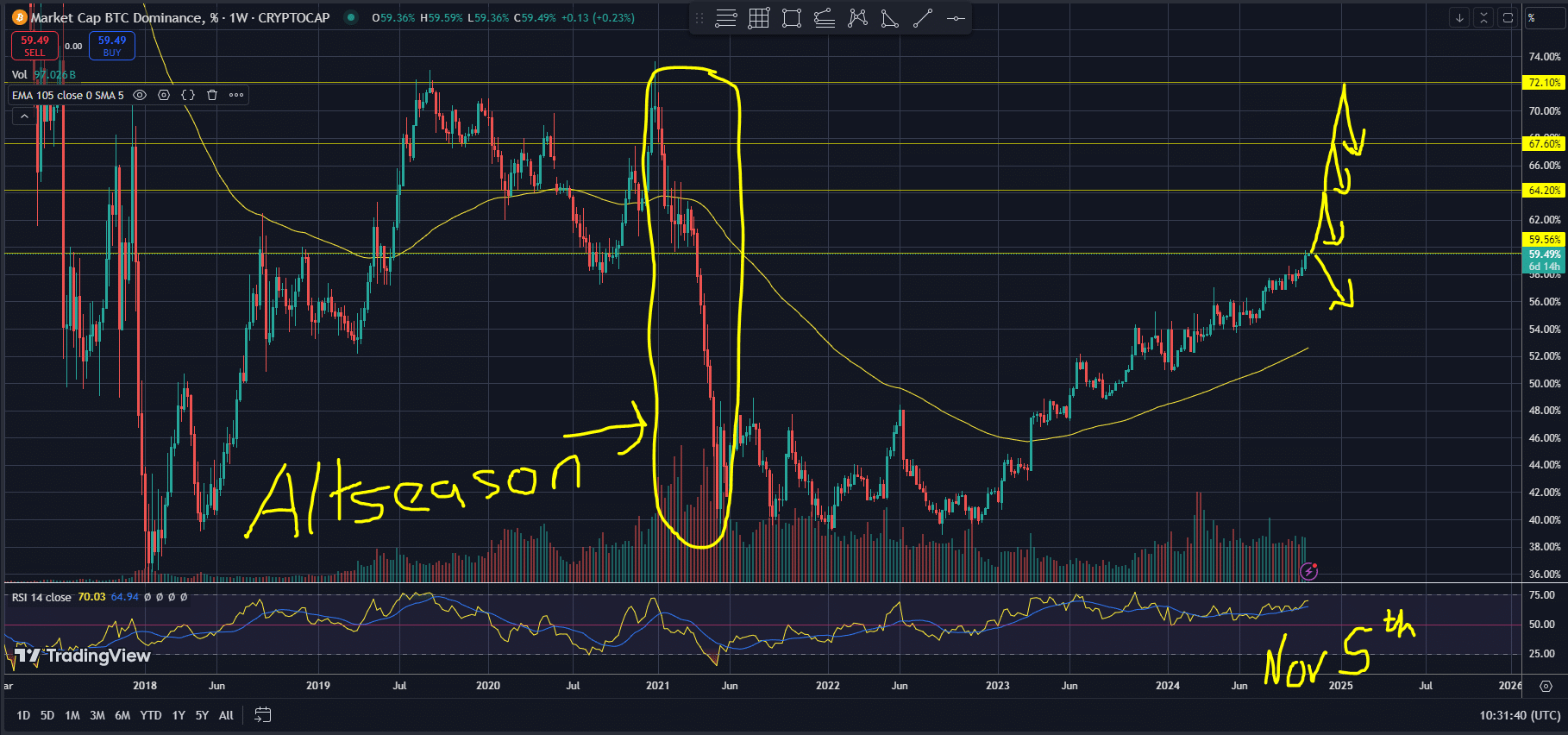

An “altseason” is also within the offing, a time period many merchants use to explain a interval when Ethereum and different altcoins outperform Bitcoin.

For now, Bitcoin’s dominant presence at over 60% stays a key indicator of the present demand for safety available in the market.

As November approaches, elements such because the US election may gasoline volatility, inflicting an increase and finally a fall in Bitcoin’s dominance.

Supply: buying and selling view

Learn Ethereum’s [ETH] Worth forecast 2024–2025

Analysts count on this shift may create situations for a attainable altseason as liquidity strikes to Ethereum and different altcoins, which might set off a broader rally.

Going ahead, ETH worth exercise will proceed to be a focal point for merchants. Many speculate that if Bitcoin’s dominance wanes, Ethereum may witness its personal rise, particularly if momentum and capital begin flowing out of Bitcoin.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024