Ethereum

Ethereum Futures signal bullish shift despite price drop – What’s next for ETH?

Credit : ambcrypto.com

- Ethereum funding charges underlined the rising optimism, however sentiment stays cautious

- Declining energetic addresses and rising leverage ratios revealed combined developments in Ethereum’s retail and futures markets

Ethereum has seen important worth volatility just lately, which has led to combined reactions amongst buyers. After rallying above $2,700 on October 30, Ethereum renewed investor optimism. Nevertheless, this sentiment has been examined just lately by the newest downward motion.

Over the previous 24 hours, Ethereum’s worth fell 5.1%, reaching a low of $2,475 earlier than stabilizing round $2,496 on the time of writing. This worth drop sparked discussions about Ethereum’s market energy, with a selected deal with investor sentiment in Ethereum Futures.

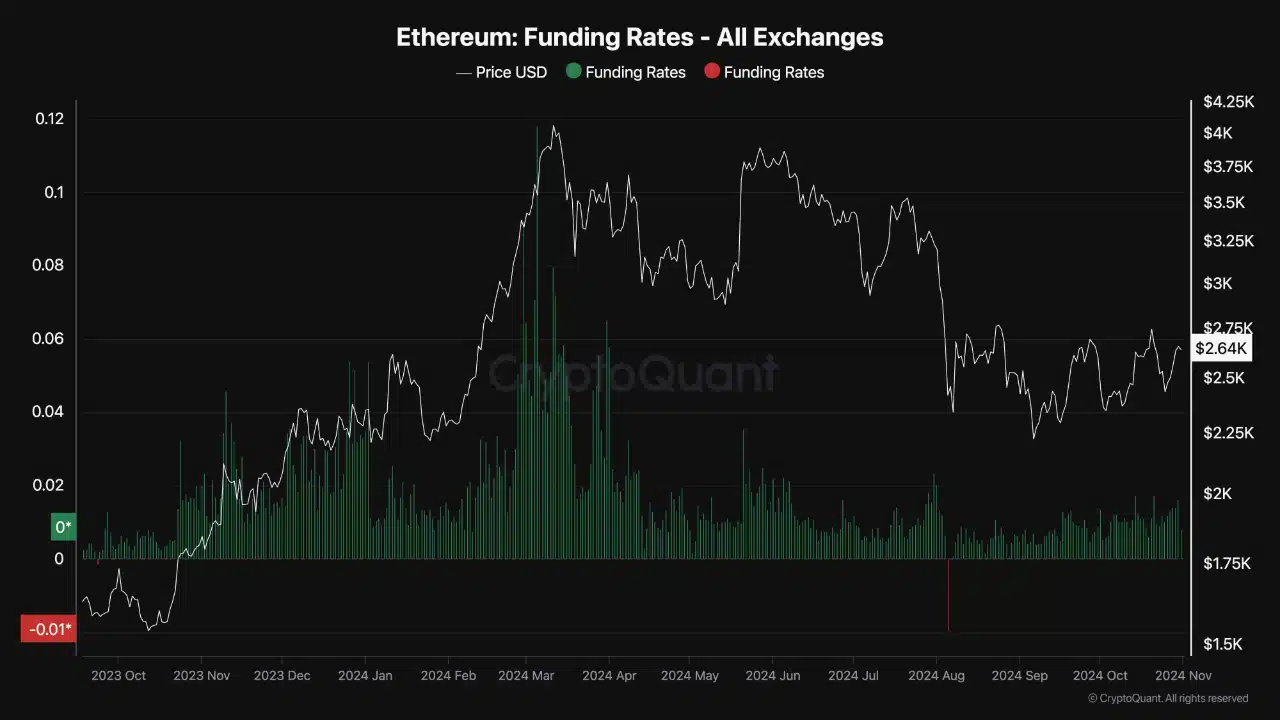

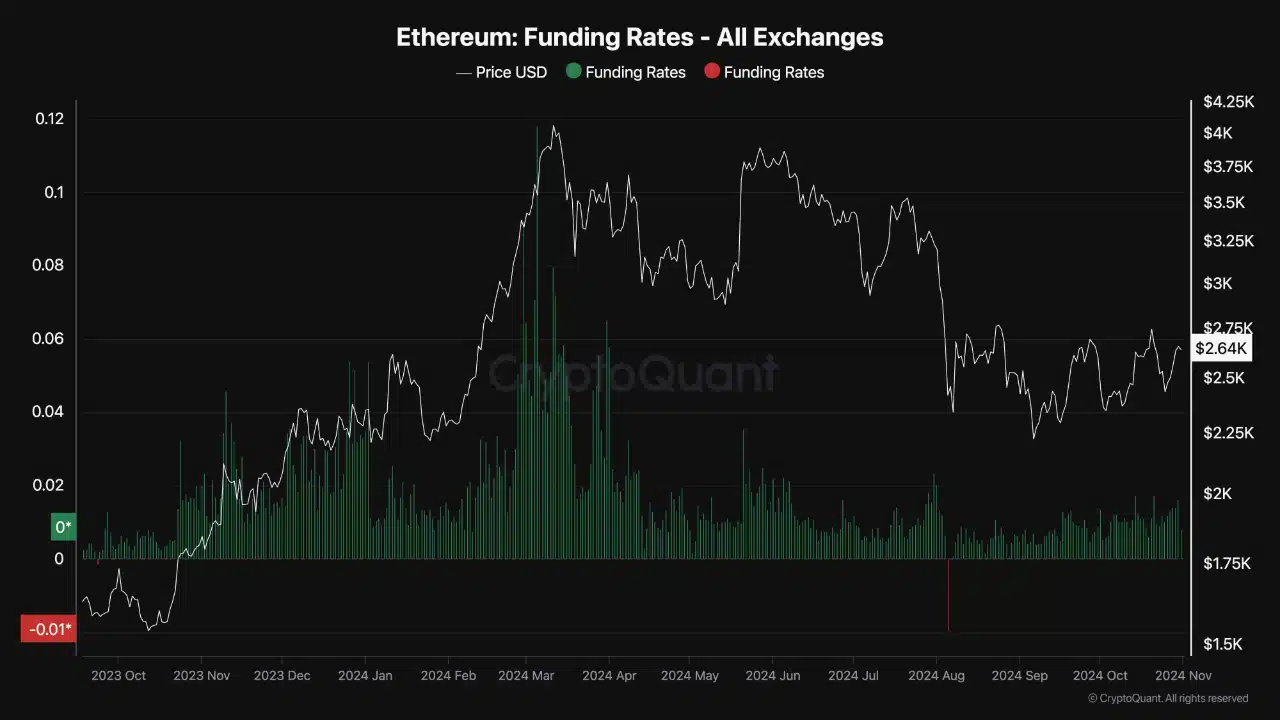

Nevertheless, regardless of the current worth drop, a CryptoQuant analyst marked that funding charges for the Ethereum futures market confirmed a optimistic outlook amongst merchants. The financing fee, which displays the steadiness between purchaser and vendor optimism, just lately confirmed an upward pattern.

Funding Charges and Investor Sentiment in Ethereum Futures

Constructive funding charges are an indication that that is the case larger demand to go lengthy Ethereum Futures, indicating optimism amongst Futures merchants. Nevertheless, these costs stay under the bullish peak of March, when Ethereum’s worth was on a robust uptrend. This implied that whereas optimism exists, it has not but reached ample ranges to set off a serious breakout.

The funding charges in Ethereum Futures present perception into market sentiment by exhibiting the extent of bullish or bearish stress amongst merchants. Constructive funding charges point out a higher willingness amongst merchants to carry lengthy positions – an indication of bullish sentiment. Adverse charges indicate one thing totally different.

Supply: CryptoQuant

The present upward pattern in Ethereum’s funding fee hinted at a rising tendency to go lengthy within the futures market. Particularly as a result of buyers anticipate potential worth positive factors. Nevertheless, decrease funding charges in comparison with ranges seen earlier this yr indicated that whereas sentiment has improved, sentiment might not but be sturdy sufficient to set off a big worth improve.

The potential for ETH to beat resistance and preserve upward momentum relies upon partly on a sustained improve in funding charges. Greater rates of interest would replicate higher demand for lengthy positions, doubtlessly rising shopping for stress on ETH.

For a sustained restoration, a rise in these financing charges would point out stronger investor confidence. This might assist Ethereum overcome the present resistance ranges, doubtlessly pushing the value larger.

This sentiment, mixed with market developments, may decide Ethereum’s trajectory within the coming weeks.

Energetic addresses and leverage ratios point out market developments

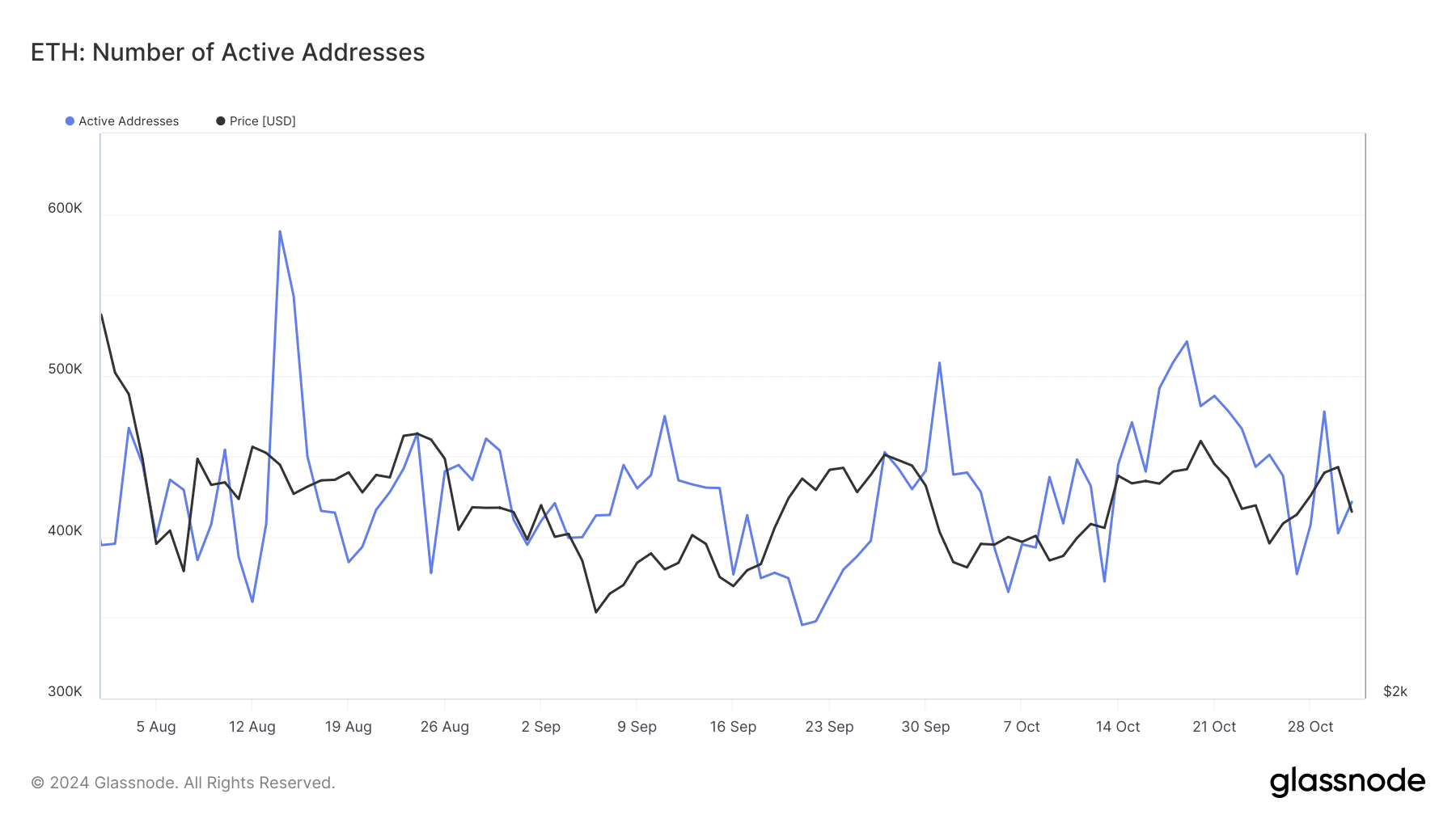

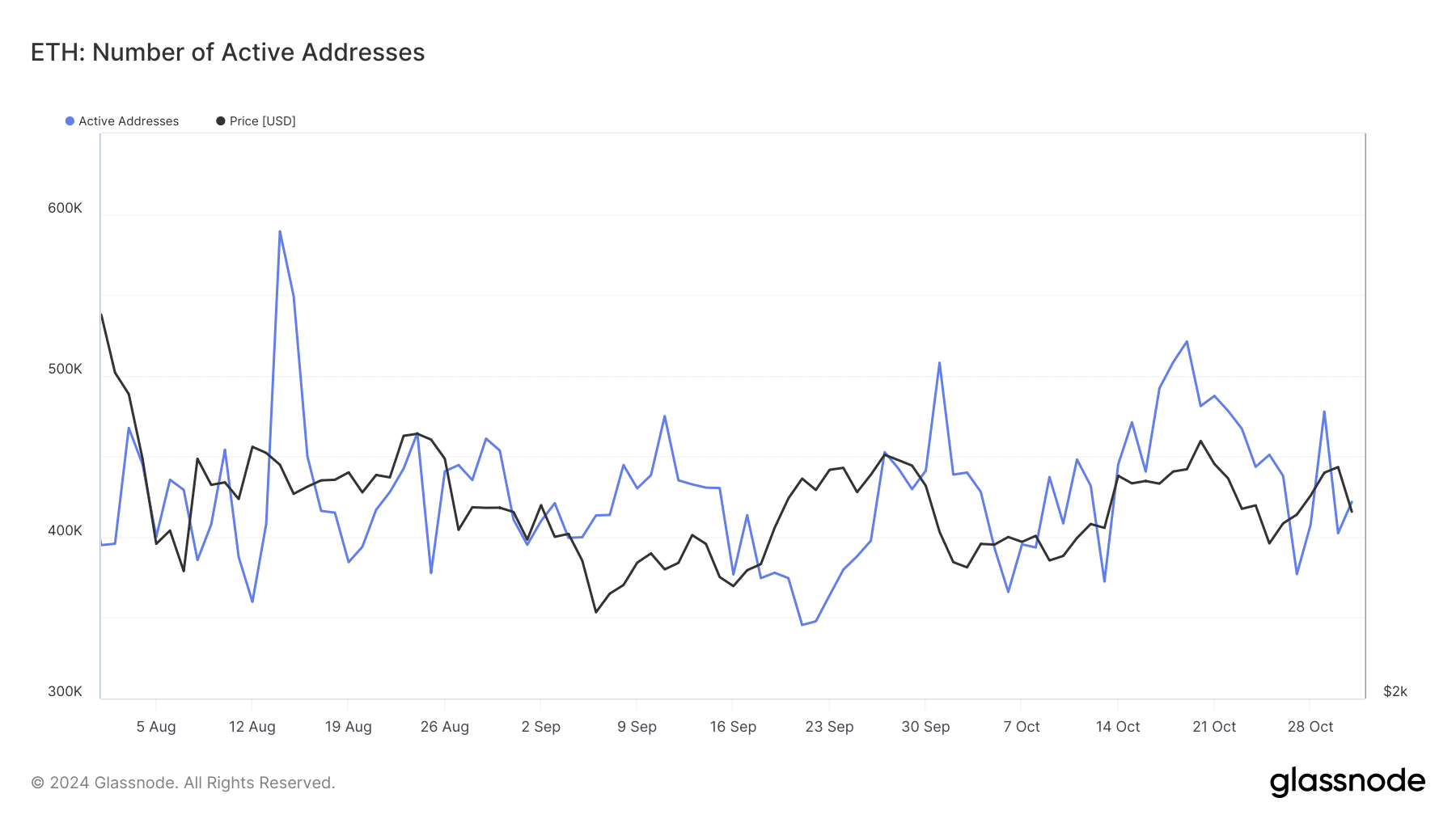

Exterior of the futures market, Ethereum’s energetic addresses – a measure of shopper curiosity – predicted a downward pattern. Glassnode data indicated that energetic addresses fell from over 550,000 on August 14 to roughly 421,000 on the time of writing.

Supply: Glassnode

Such a decline within the variety of energetic addresses may very well be an indication of waning curiosity amongst retail buyers, presumably reflecting warning within the broader market. Energetic addresses are a measure of participation and involvement. And a decline may point out fewer buyers are actively buying and selling or transferring ETH, which may dampen shopping for momentum.

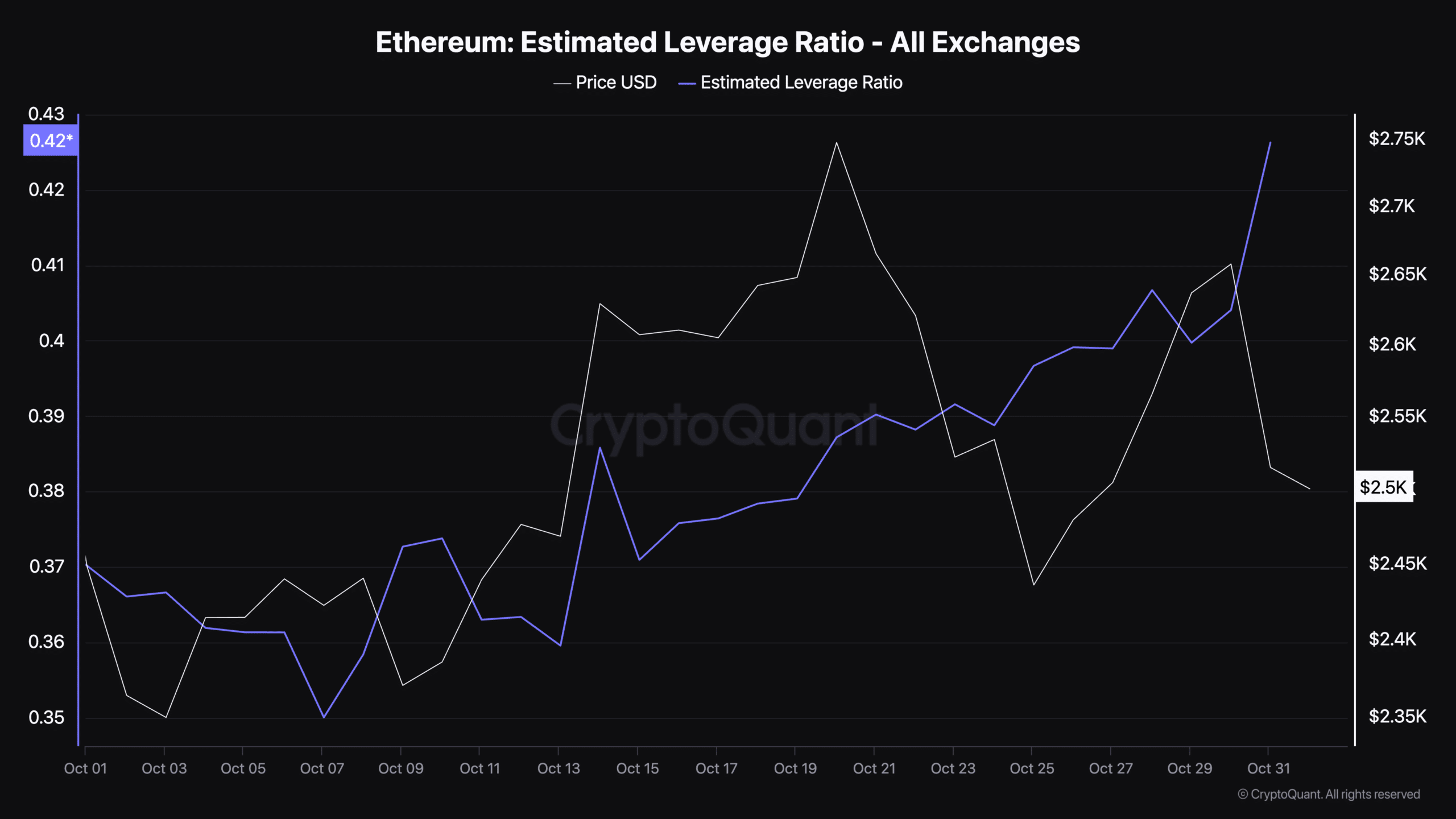

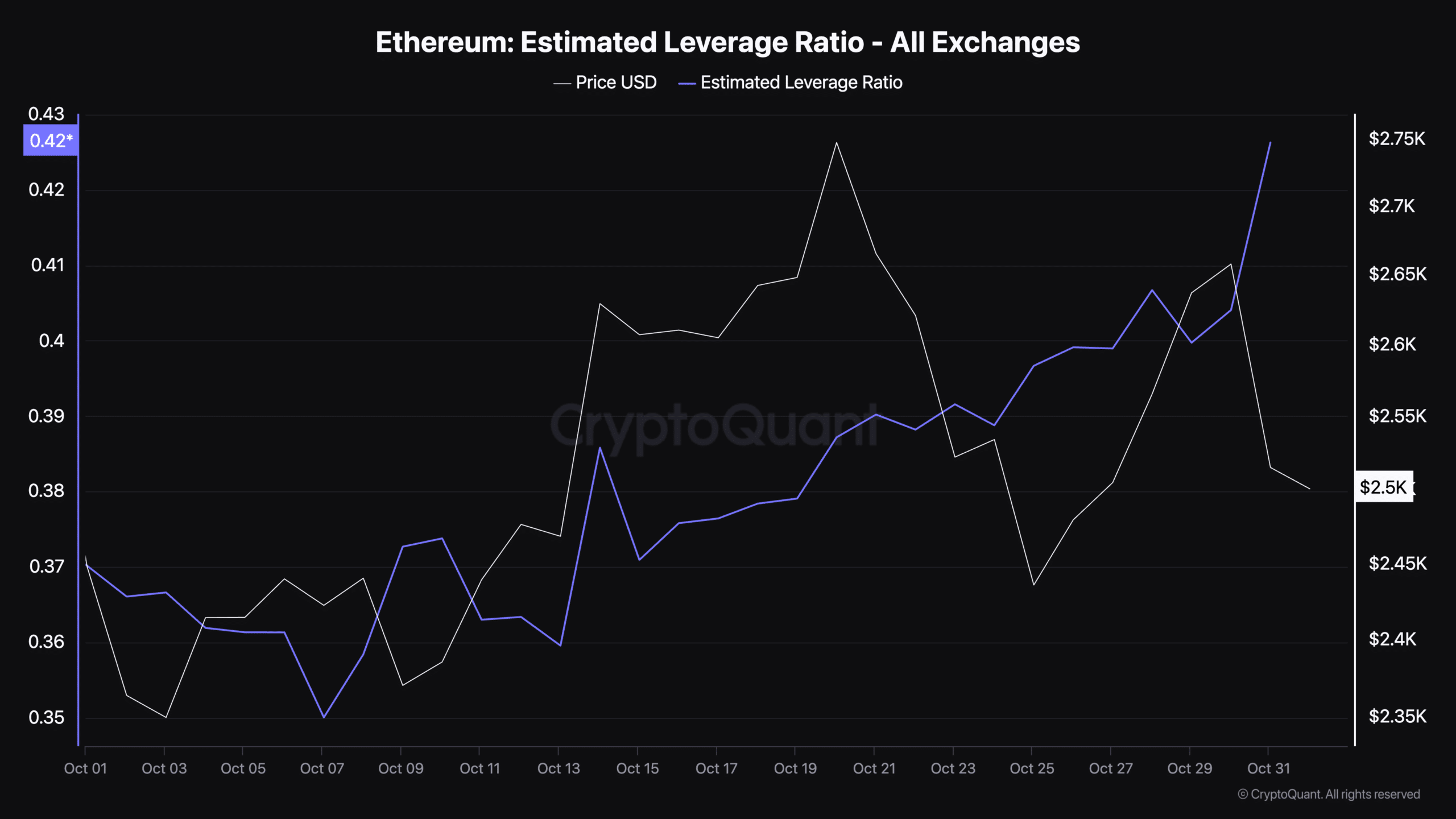

Lastly, facts from CryptoQuant revealed that Ethereum’s estimated leverage ratio elevated, from 0.35 in early October to 0.42 on the time of writing. This metric highlights the extent of leverage or borrowed cash utilized by merchants, with the next ratio indicating extra borrowing.

Supply: CryptoQuant

An upward pattern within the leverage ratio may point out that merchants are taking extra danger and presumably anticipating worth positive factors.

Nevertheless, the next leverage ratio also can deliver volatility, as positions with excessive leverage are extra delicate to cost fluctuations. This might result in sharper strikes if Ethereum’s worth adjustments unexpectedly.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024