Ethereum

A Trump win is good for Ethereum ETFs – Analyst

Credit : ambcrypto.com

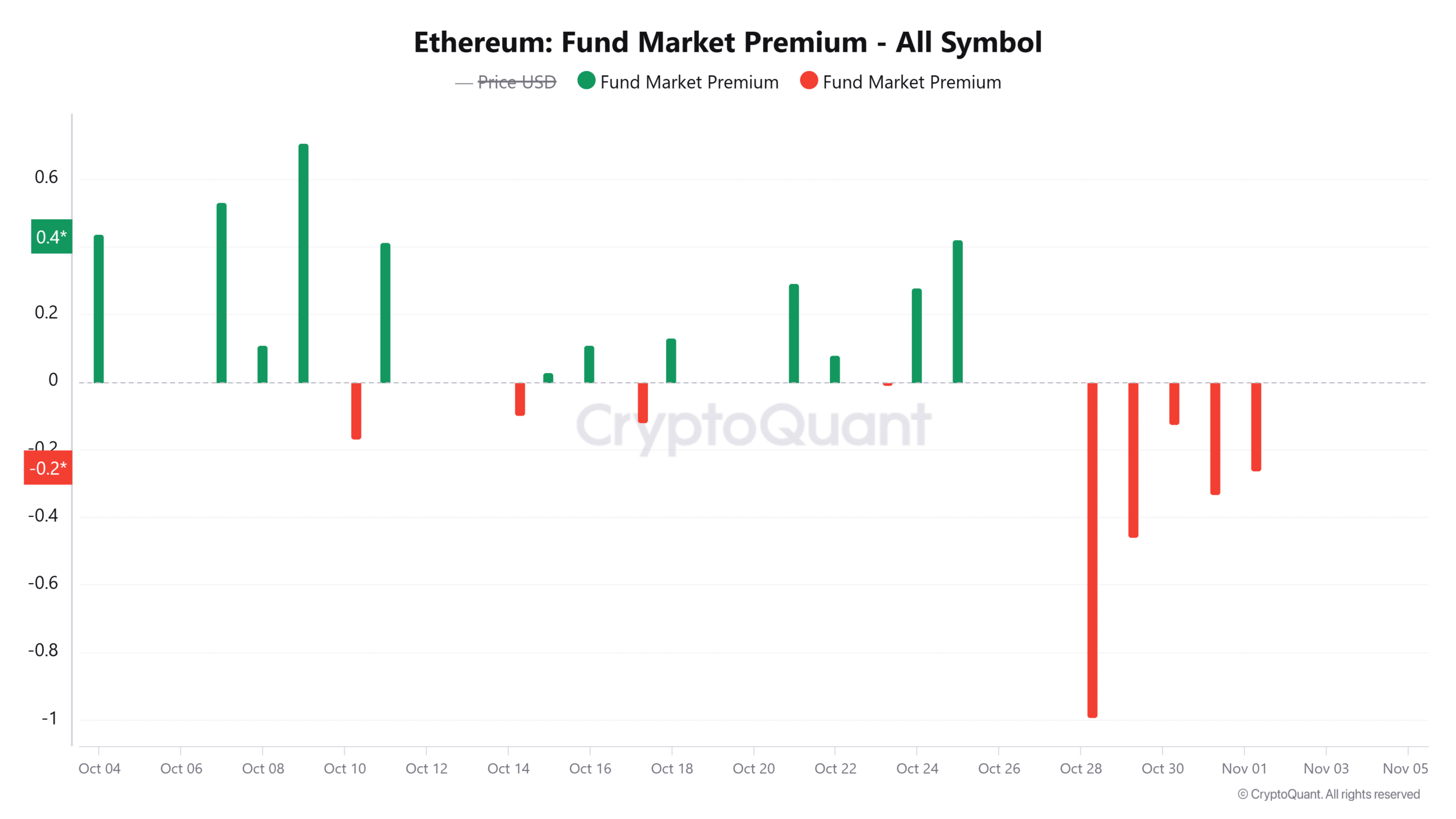

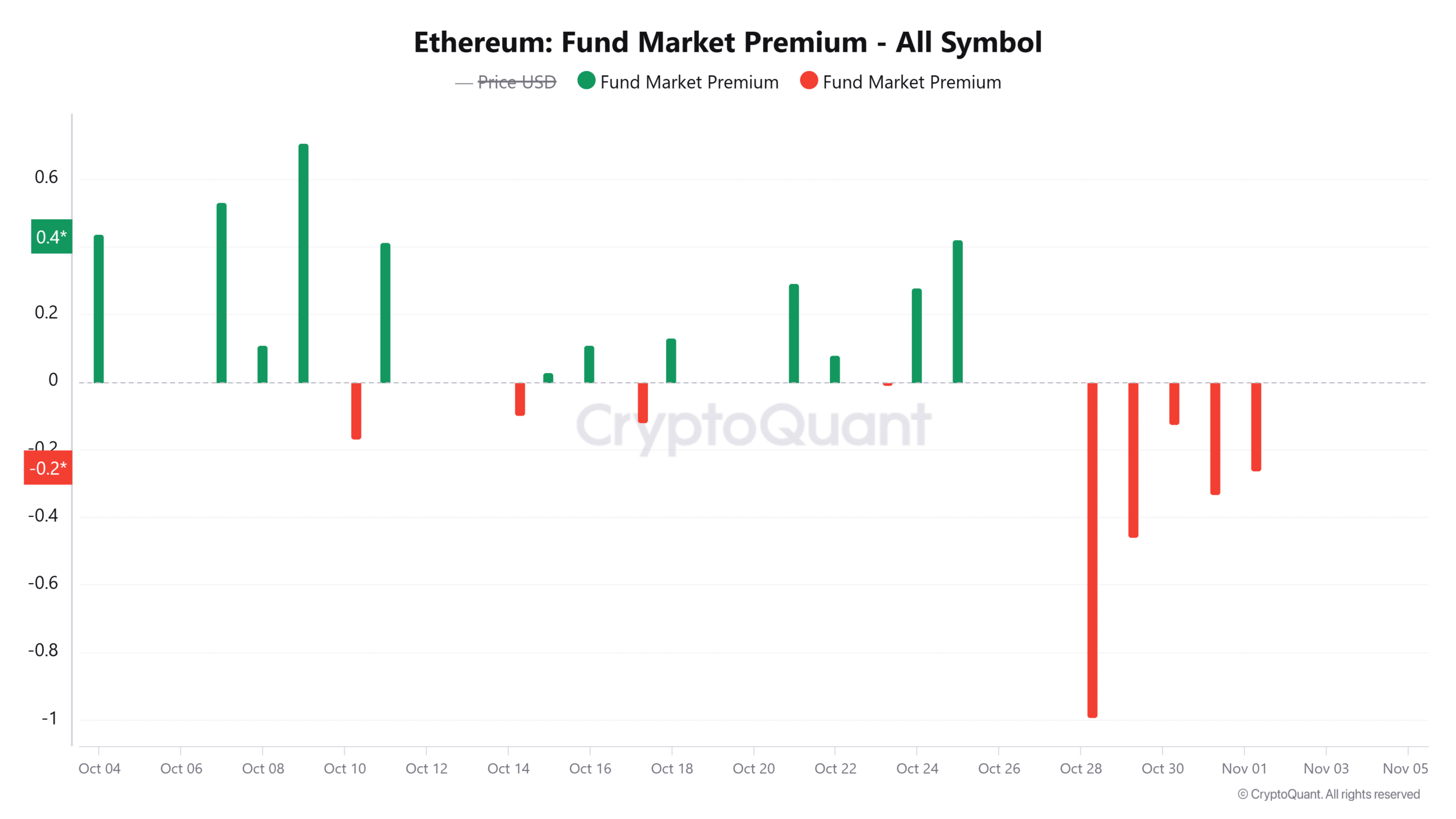

- The Ethereum Fund Market Premium turned unfavourable, indicating weak institutional demand for ETH merchandise

- Nate Geraci believes betting on Ethereum ETFs may occur sooner beneath the Trump administration

Ethereum (ETH) has fallen 10% prior to now two weeks beneath bearish stress. Resulting from its disappointing efficiency in comparison with Bitcoin (BTC)ETH’s dominance has additionally fallen to a low of lower than 13%.

One issue contributing to Ethereum’s lack of beneficial properties is weak institutional demand. This may be seen within the suppressed inflows into ETH Change Traded Funds (ETFs). Ethereum ETFs have solely seen 4 weeks of complete constructive web flows since launch SoSoValue. This lack of demand has led to a declining premium on the fund market.

In truth, information from CryptoQuant confirmed that the Ethereum fund market premium was principally unfavourable final week. This may be interpreted as an indication that ETH is buying and selling at a reduction within the ETF market.

(Supply: CryptoQuant)

The unfavourable information additional confirmed promoting stress and weak demand for ETH within the ETF market. This indicated bearish sentiment as main traders have remained cautious.

However why are Ethereum ETFs underperforming, on condition that Bitcoin ETFs proceed to publish robust numbers with inflows of over $2 billion prior to now week alone?

For this reason Ethereum ETFs are struggling

Nate Geraci, President of ETF Retailer, shared his insights on numerous components that would trigger weak inflows into ETH ETFs apart from bearish market sentiment.

He famous that since Bitcoin ETFs have been first launched, that they had a first-mover benefit and “stole some thunder” from Ethereum.

Moreover, outflows from the Grayscale Ethereum Belief (ETHE) ETF have additionally dampened the prospects of ETH ETFs. Since launch, ETHE has posted $20 billion in outflows. Geraci additionally mentioned there is not sufficient advisor coaching round ETH. As such, establishments are much less interested in the asset.

“Guess it is solely a matter of time earlier than ETH ETF inflows begin to enhance. It simply may take some time.”

A Trump victory is sweet for ETH ETFs

Geraci continues thought that if former US President Donald Trump wins the November 5 election, it may bode properly for Ethereum ETFs.

Earlier than approving Spot ETH ETFs, the U.S. Securities and Change Fee (SEC) ordered issuers to take away the staking provision. Nonetheless, Geraci believes that placing would probably be allowed beneath the Trump administration.

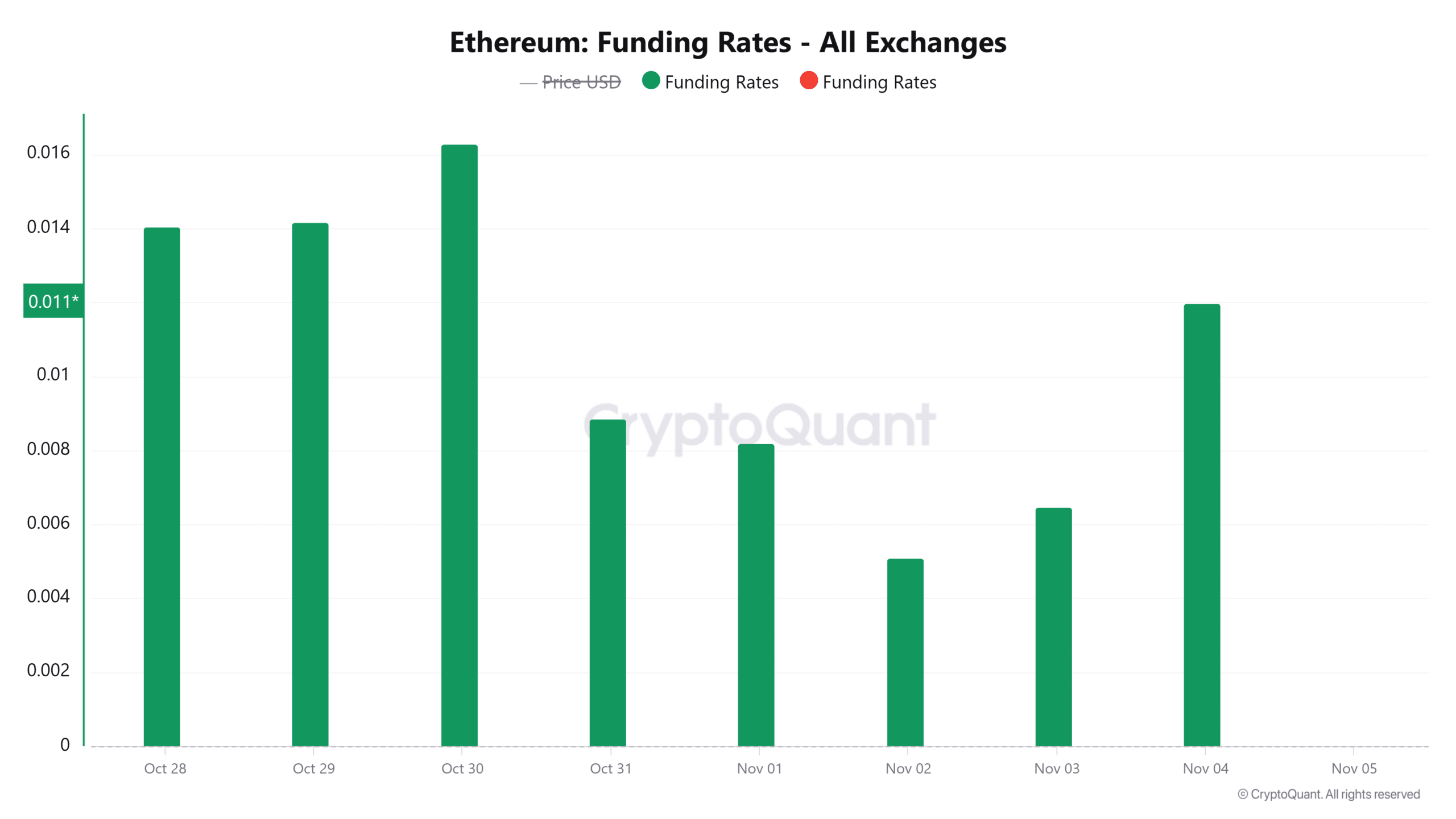

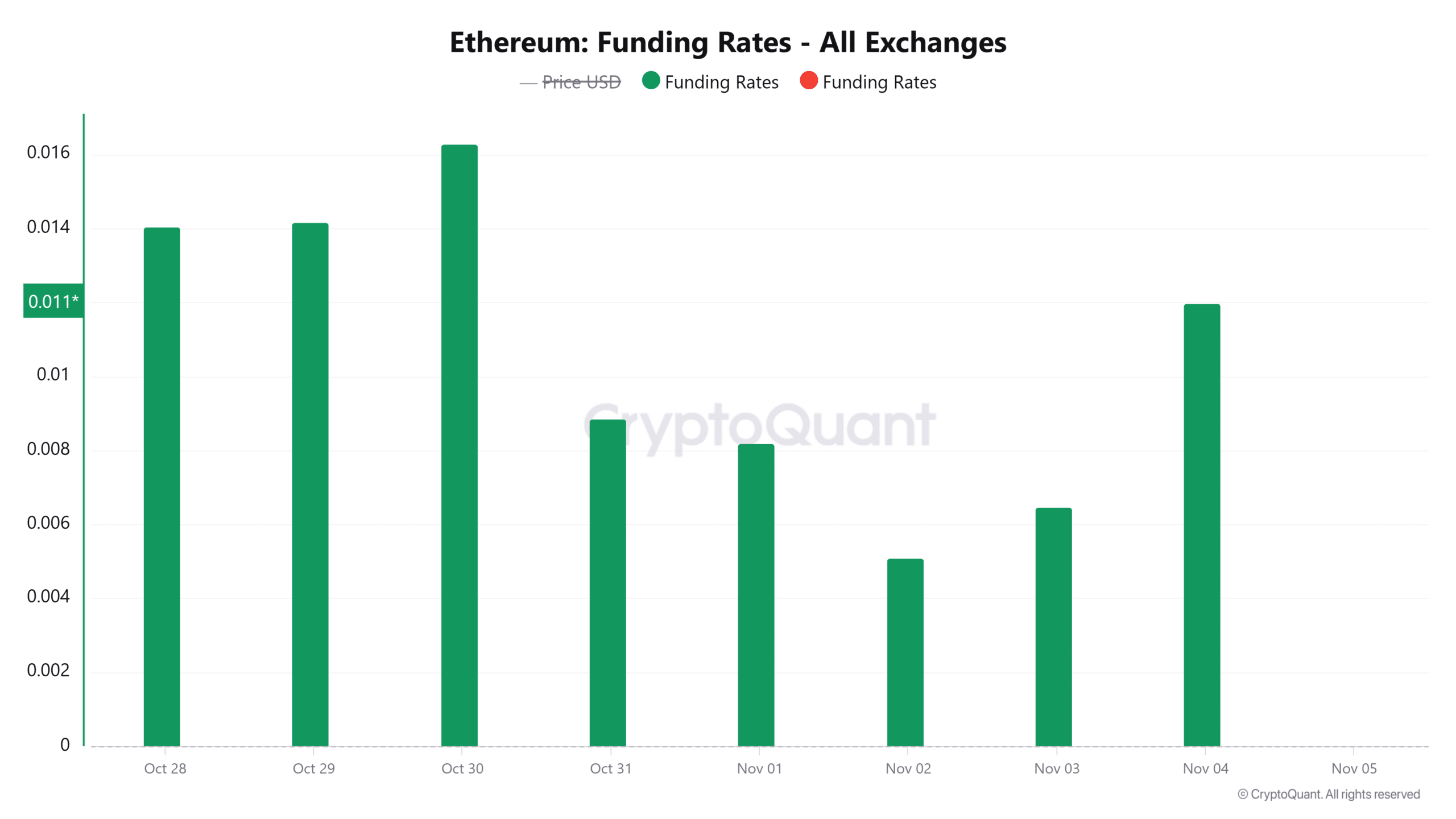

Ethereum merchants seem like pricing in a Trump victory for the American presidency. On the time of writing, Ethereum funding charges had risen 85% to 0.0119. This indicated rising bullish sentiment within the futures market, the place demand for lengthy positions was excessive.

(Supply: CryptoQuant)

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024