Bitcoin

Election day boost: BlackRock’s Bitcoin ETF hits record $4B in volume

Credit : ambcrypto.com

- BlackRock’s Bitcoin ETF achieved a document buying and selling quantity of $4.1 billion.

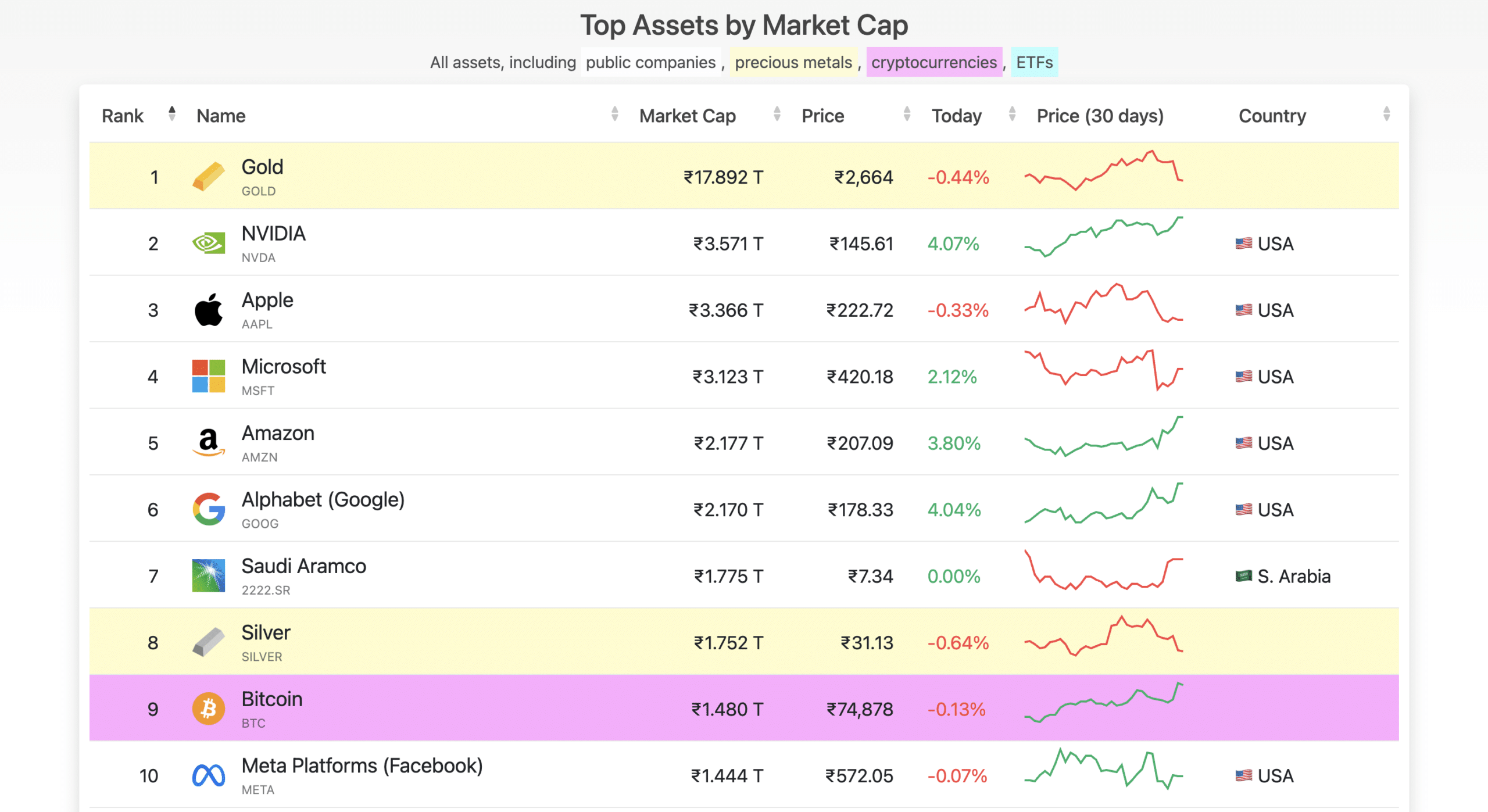

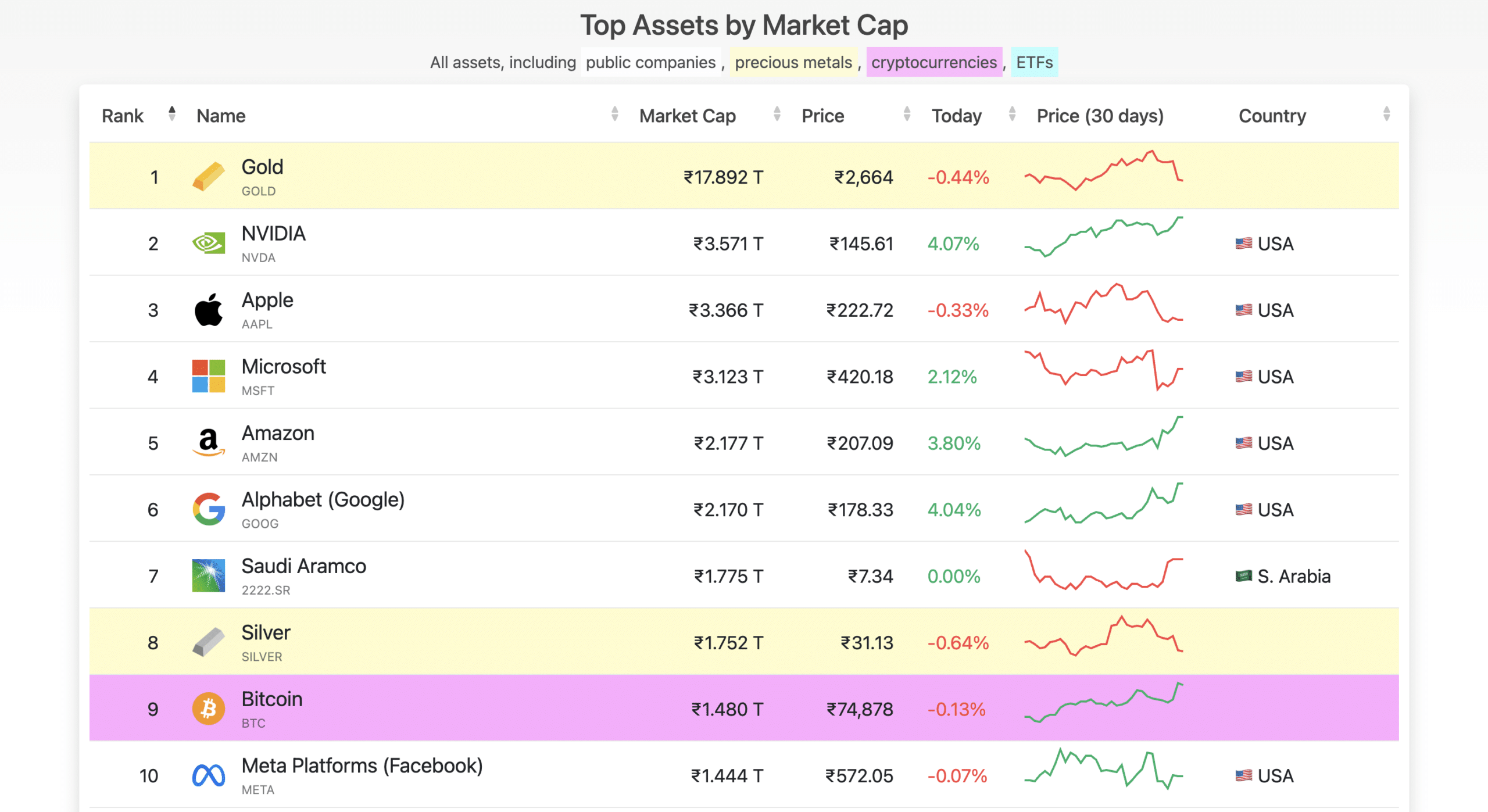

- BTC is the ninth largest asset on this planet.

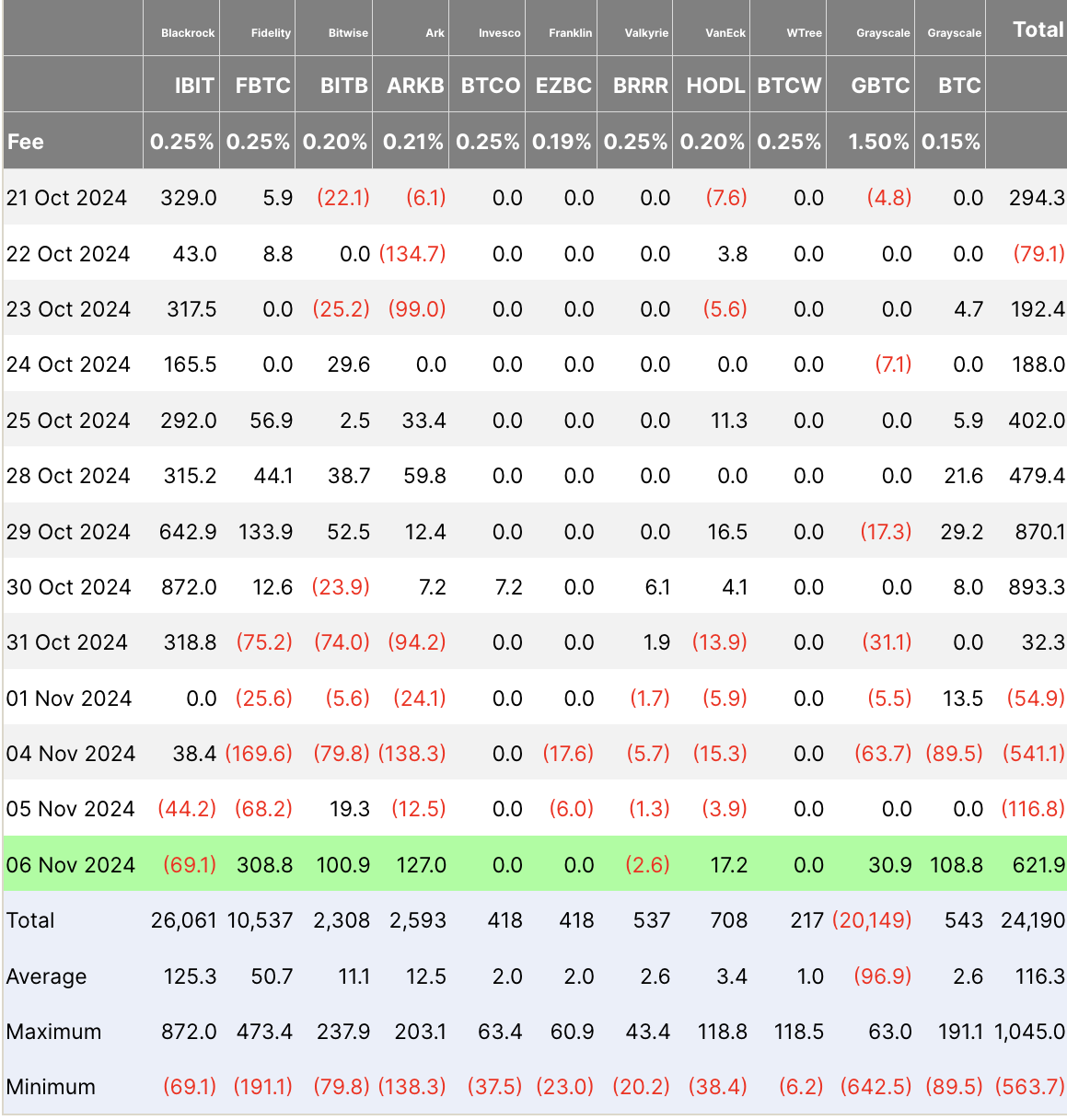

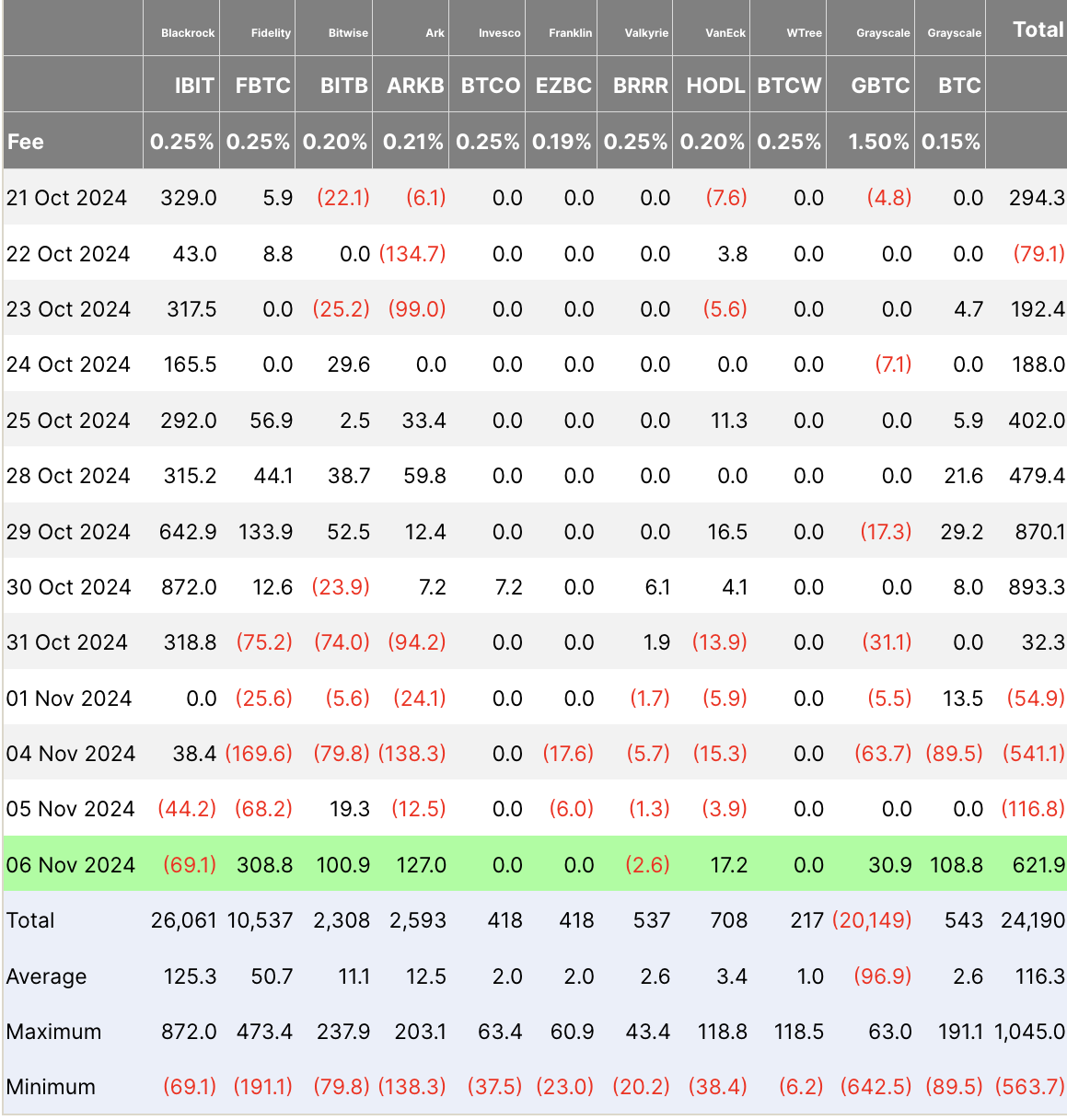

Bitcoin [BTC] Change Traded Funds (ETFs) acquired off to a tough begin in November. Nevertheless, after three straight days of outflows, the ETFs lastly registered huge inflows.

In response to facts from Farside Traders, each day complete internet inflows rose to $621.9 million on November 6, successfully breaking the earlier streak of outflows.

This improve coincided with that of Donald Trump yield to the presidency for a second time period.

Trump had promised regulatory reforms and robust assist for the crypto business, which could possibly be one more reason for this surge.

IBIT sees outflow

Surprisingly, this time IBIT didn’t lead the current improve in inflows.

As a substitute, it posted each day internet outflows of $69.1 million, following an outflow of $44.2 million the day earlier than.

IBIT was joined by BRRR, which noticed each day outflows of $2.6 million.

Supply: Farside Traders

Then again, ETFs comparable to GBTC, FBTC, ARKB, BITB, BTC and HODL recorded constructive inflows, whereas the remainder of the funds skilled no inflows in any respect.

BlackRock’s Bitcoin ETF is making historical past once more

Regardless of the dip, Eric Balchunas, senior ETF analyst at Bloomberg, says marked on X (previously Twitter) that IBIT reached an unprecedented buying and selling quantity of $1 billion throughout the first 20 minutes of market opening.

This improve, which equaled regular each day quantity, contributed to IBIT’s document day with a traded worth of $4.1 billion. He famous:

“It was additionally up 10%, the second finest day since launch”

Balchunas elaborated that the collective group of Bitcoin ETFs recorded a buying and selling quantity of $6 billion.

As well as, most ETFs doubled their common quantity. The analyst described it as:

“An all-round implausible day for a child class that by no means ceases to amaze.”

On the time of writing, IBIT stated held 433,644 BTC price over $30 billion, cementing its place because the main Bitcoin ETF at the moment listed within the US

BTC’s efficiency after the elections

Within the aftermath of Trump’s re-election, IBIT was not the one one to set new highs.

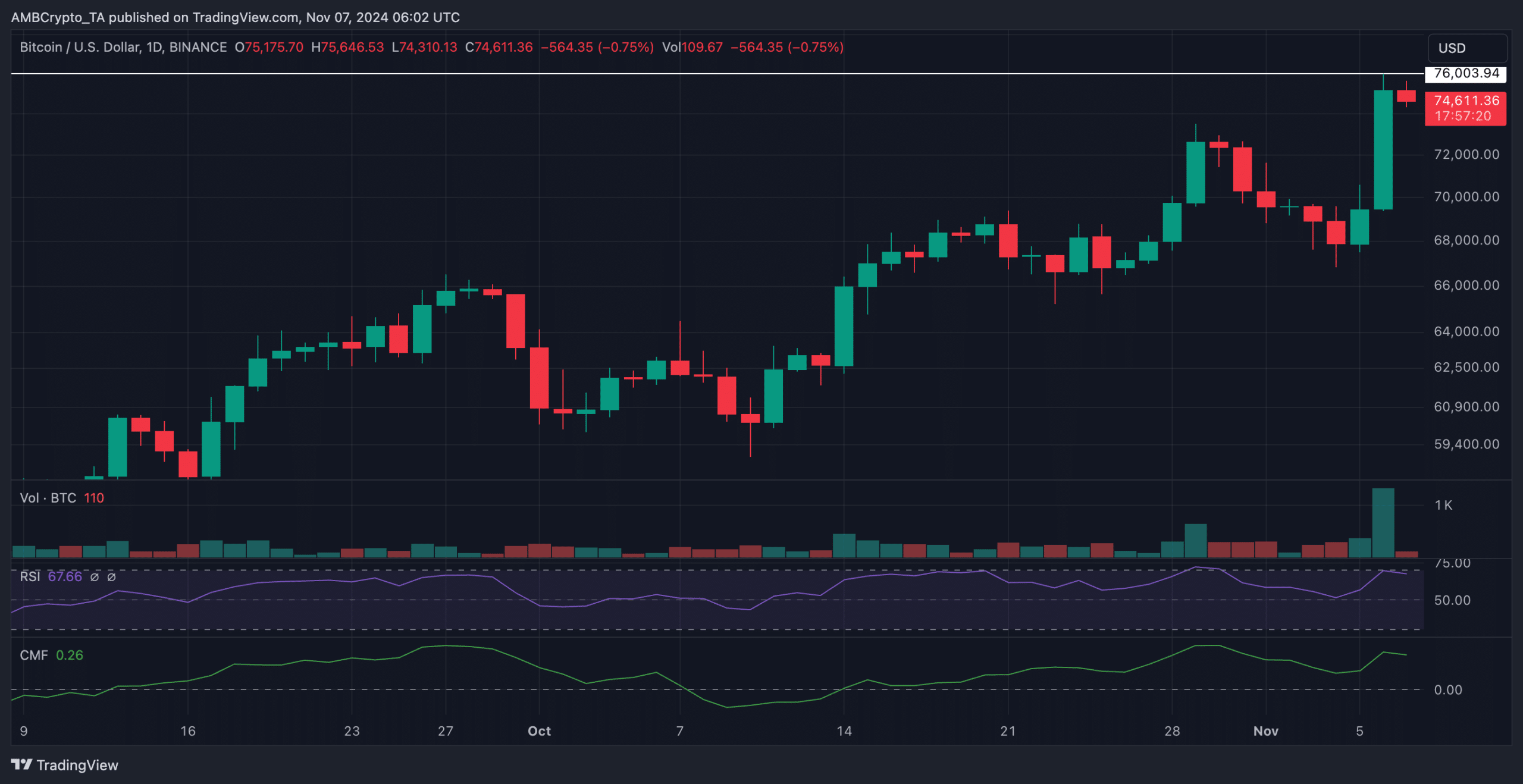

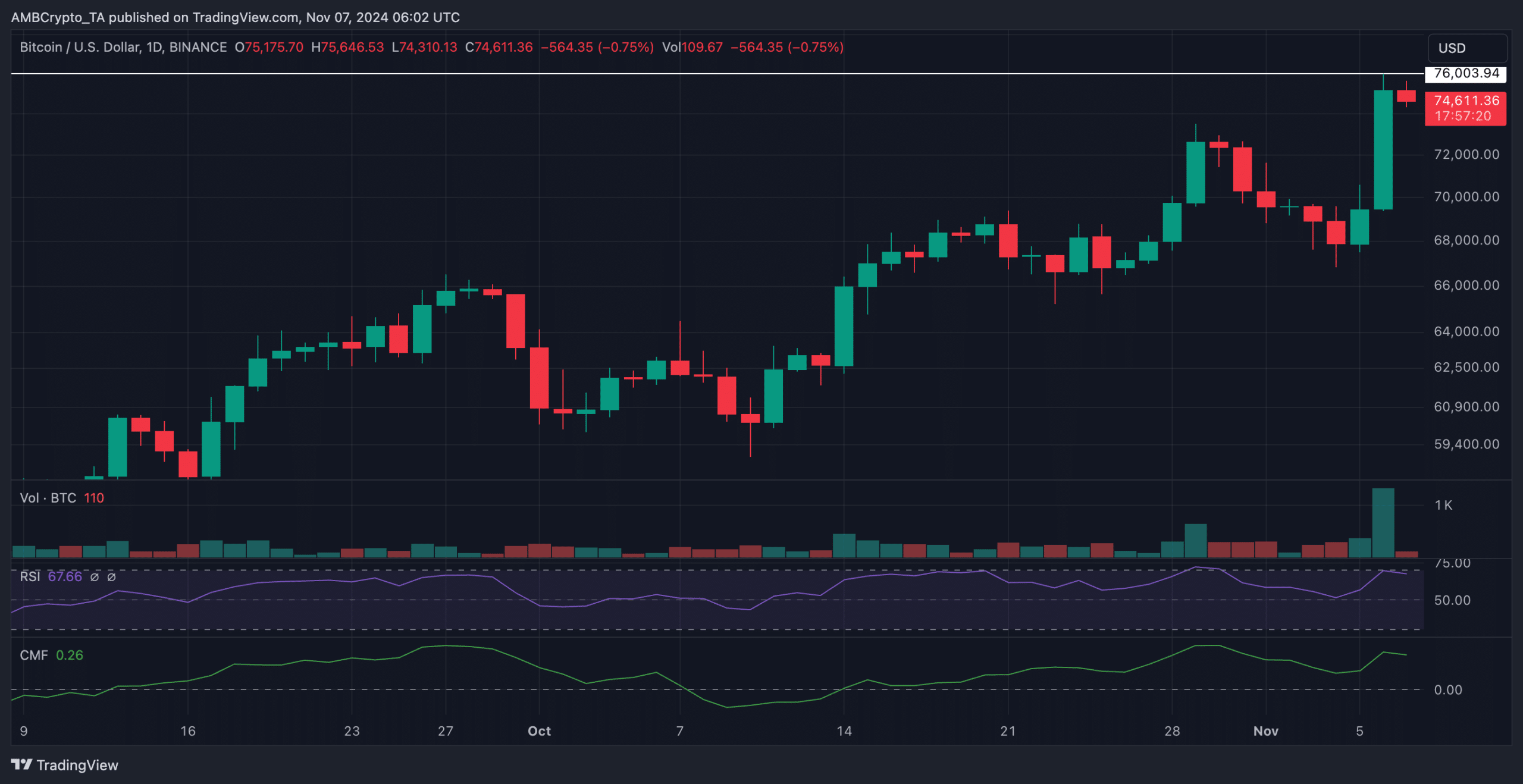

Bitcoin additionally noticed a big improve, setting a brand new all-time excessive at over $76,000. This got here shortly after BTC reached an all-time excessive of $75,000 earlier than the election outcomes.

On the time of writing, the value of BTC had fallen to $74,611, reflecting a decline of 1.83% from the height.

There was a small decline of 0.32% up to now 24 hours CoinMarketCap.

In the meantime, the each day chart’s RSI stood at 67.66, signifying sturdy bullish momentum.

This studying indicated that whereas BTC stays beneath the overbought threshold, there’s nonetheless potential for extra upside if shopping for strain continues.

Supply: TradingView

Furthermore, the CMF indicator stood at 0.26. This indicated sturdy capital inflows into BTC and bolstered the general constructive development.

BTC overtakes Meta

Notably, the value rally has pushed BTC’s market cap to a formidable $1.48 trillion on the time of writing. This allowed it to surpass Meta, which has a market cap of $1.44 trillion.

Because of this, the king’s coin secured its place because the ninth largest asset on this planet CompaniesMarketCap.

Supply: CompaniesMarketCap

The IBIT and the value milestone underlined BTC’s rising recognition as a significant participant within the international monetary panorama.

This marked a historic second for the cryptocurrency market because it continues to problem conventional property for dominance.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024