Ethereum

$9.3 Billion Stablecoin Influx Sparks Bullish Hopes

Credit : ambcrypto.com

- Deposits of $9.3 billion into ERC-20 stablecoins on main exchanges may sign a bullish Ethereum rally.

- The elevated exercise on Ethereum’s energetic addresses indicated growing retail curiosity within the asset.

Ethereum [ETH] is driving a wave of optimistic momentum, mirroring the broader cryptocurrency market’s current features.

Though Ethereum has not but reached its earlier all-time excessive, it has made a big rebound. In current days, the alt coin has risen by over 8%, reaching a excessive of $2,872 on the time of writing.

This marks a notable restoration, leaving the asset some 42.7% beneath the November 2021 document excessive of $4,878.

The current features indicated growing investor curiosity and highlighted the alt-coin’s resilience because it continues to seize the market’s consideration alongside Bitcoin’s current upward motion.

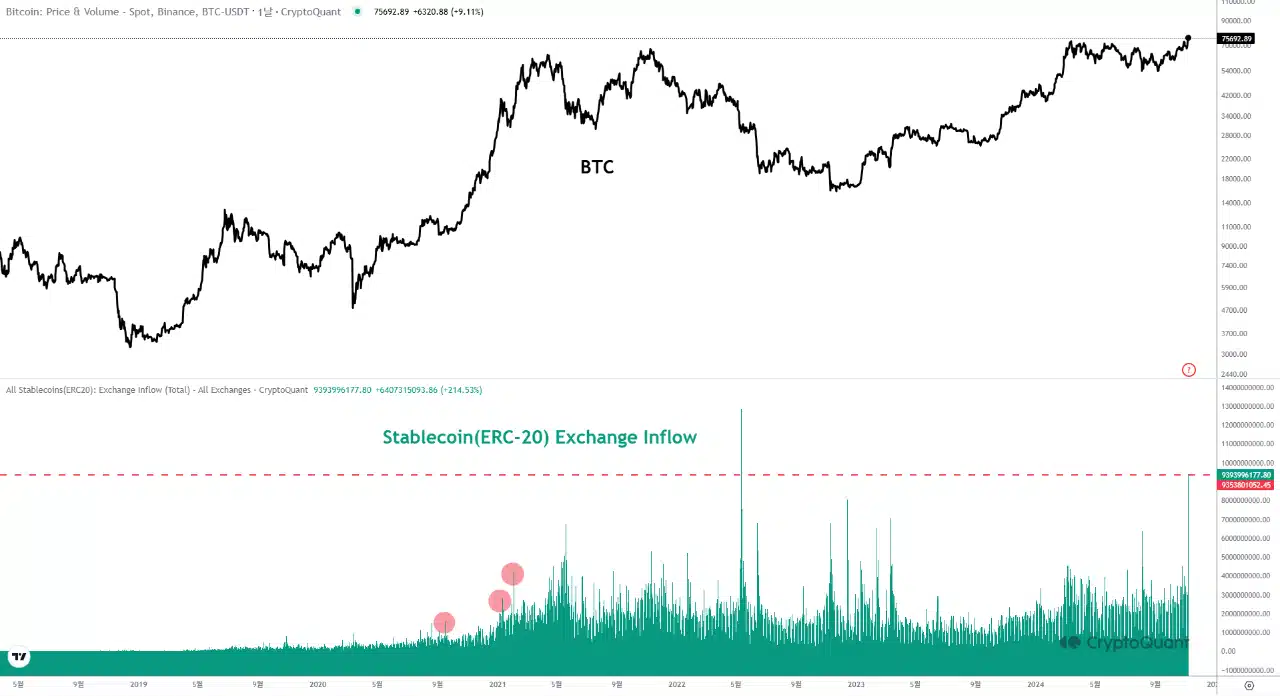

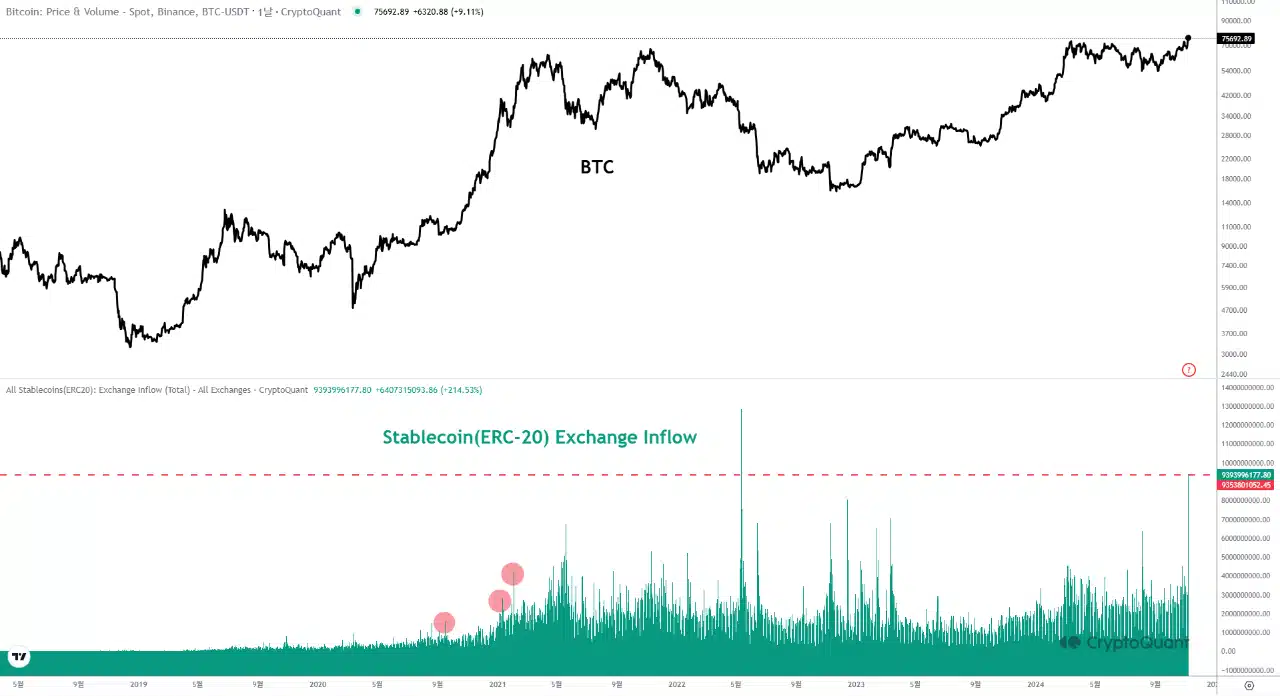

In the meantime, an intriguing one development inside the Ethereum community has been recognized by a CryptoQuant analyst generally known as Mac.D.

In keeping with the analyst, a big $9.3 billion price of ERC-20 stablecoins flowed into cryptocurrency exchanges within the wake of the US presidential election.

This represents the second largest inflow of ERC-20 stablecoins since their inception.

By breaking down these deposits, Binance obtained about $4.3 billion, whereas Coinbase noticed inflows of about $3.4 billion. The remainder was divided amongst smaller festivals.

Supply: CryptoQuant

Traditionally, giant inflows of this magnitude have been correlated with bullish rallies available in the market, as seen within the interval between September 2020 and February 2021.

If this sample holds, Ethereum and the broader market could also be poised for a brand new uptrend.

Ethereum’s rising retail curiosity and community exercise

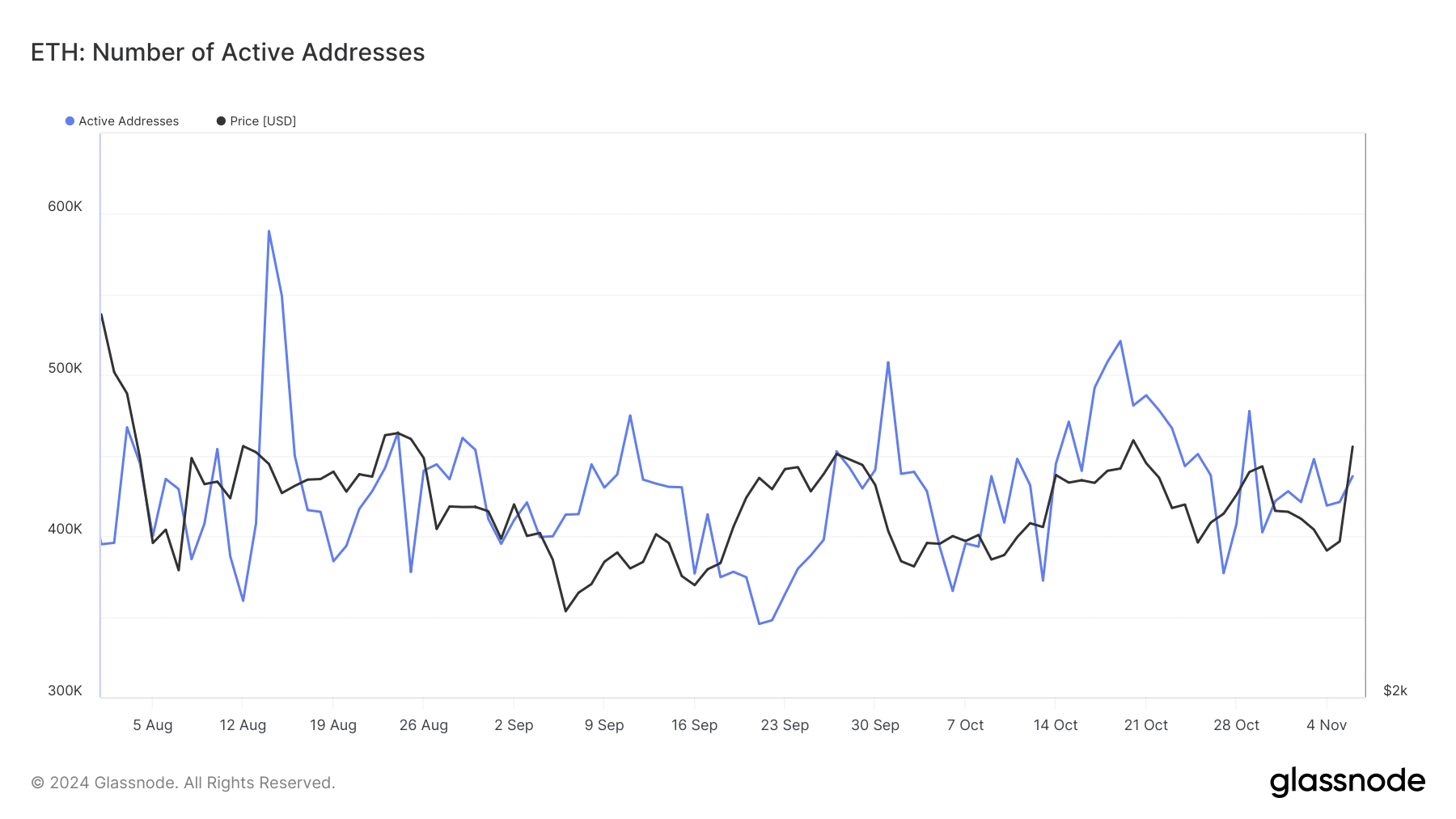

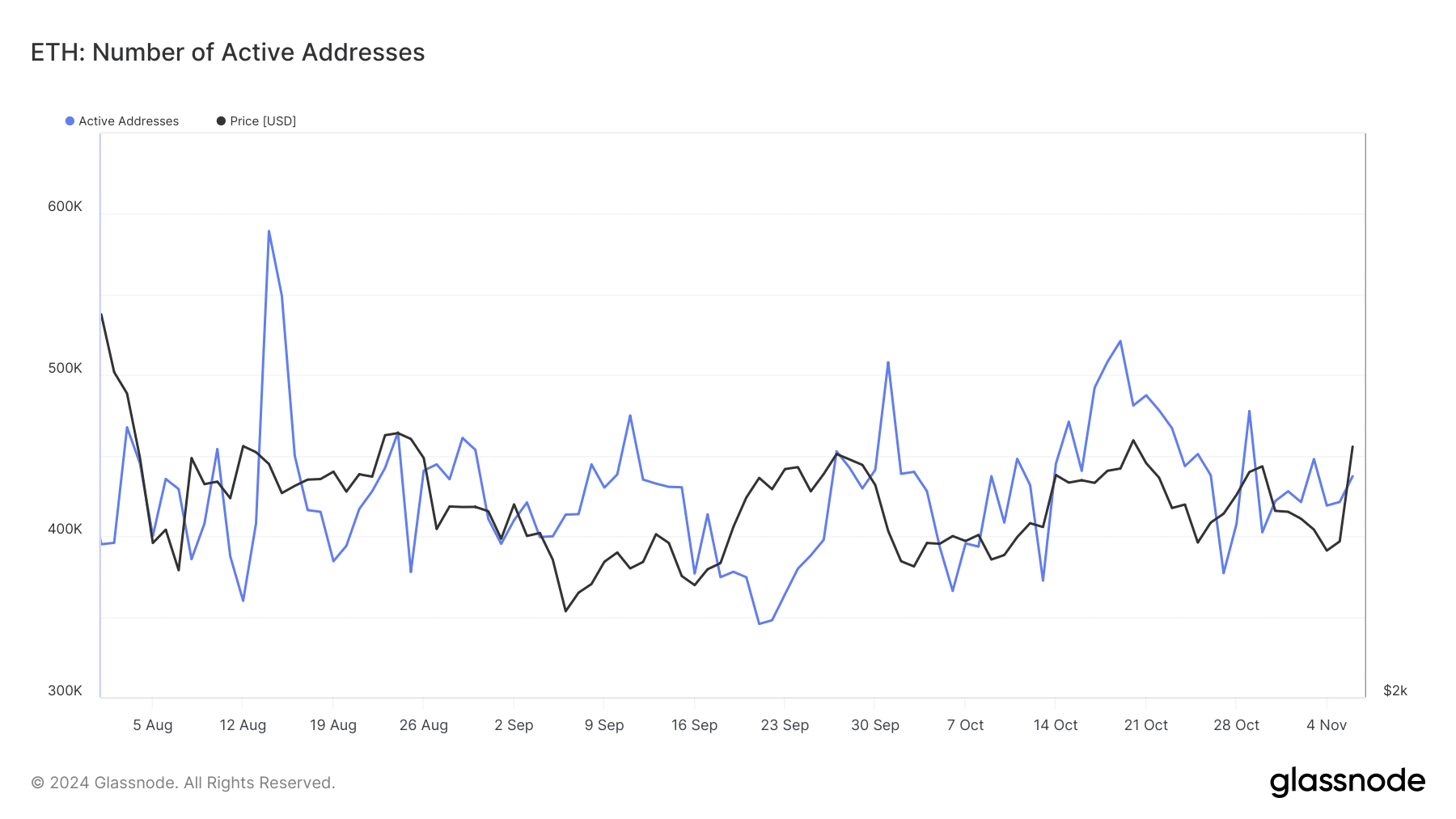

Along with the surge in inflows of ERC-20 stablecoins, one other promising development for Ethereum has emerged in its retail operations.

Facts from Glassnode indicated an increase in Ethereum’s energetic addresses, a key metric for measuring retail curiosity and community utilization.

Supply: CryptoQuant

After a dip beneath 400,000 energetic addresses on the finish of October, the quantity has now risen to greater than 430,000.

This improve displays elevated exercise on the community, indicating renewed curiosity from particular person individuals and a doable improve in community demand.

The expansion within the variety of energetic addresses may have significant implications for Ethereum’s worth trajectory.

Elevated exercise typically signifies better demand and utilization of the community, which might put upward stress on asset values.

Learn Ethereum’s [ETH] Worth forecast 2024–2025

Retail traders changing into extra concerned with Ethereum may enhance liquidity and worth stability whereas signaling rising confidence available in the market.

This development, mixed with rising stablecoin inflows and powerful trade exercise, paints an optimistic image of Ethereum’s near-term potential.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024