Altcoin

FET’s Roadmap to $2 – THIS could be the key!

Credit : ambcrypto.com

- The FET remained flat in October, however the bulls brought about charges to consolidate.

- Now it is primed for an outbreak if the suitable circumstances come up.

The market was buzzing with post-election hype as buyers diversified to restrict dangers. This has pushed Bitcoin[BTC] to a brand new all-time excessive of $77,000. AI tokens additionally reaped rewards, posting spectacular weekly features, with many seeing double-digit will increase.

Nevertheless, Synthetic Superintelligence Alliance [FET] remained consolidated regardless of a 15% achieve this week. On the time of writing, it was buying and selling at $1.42, nonetheless under the $2 goal.

Sometimes, a bull rally like the present one would place FET for a breakout from the four-month stoop. Nevertheless, its lagging efficiency has caught the eye of AMBCrypto.

Is FET prepared for a rebound?

Apparently, the FET has been on a downward pattern since October. Regardless of Bitcoin’s 5% rise, which closed the month round $72,000, it had little to no impression on FET’s worth motion.

One issue that has contributed to that is the memecoin-led “supercycle,” with giant liquidity flowing into meme-based tokens. For instance, DOGE posted a formidable day by day achieve of 11%.

Not like earlier cycles, this one is characterised by a extra balanced capital allocation. Small-cap tokens are additionally displaying double-digit features, a pattern that FET bulls could need to capitalize on, in line with information from CoinMarketCap.

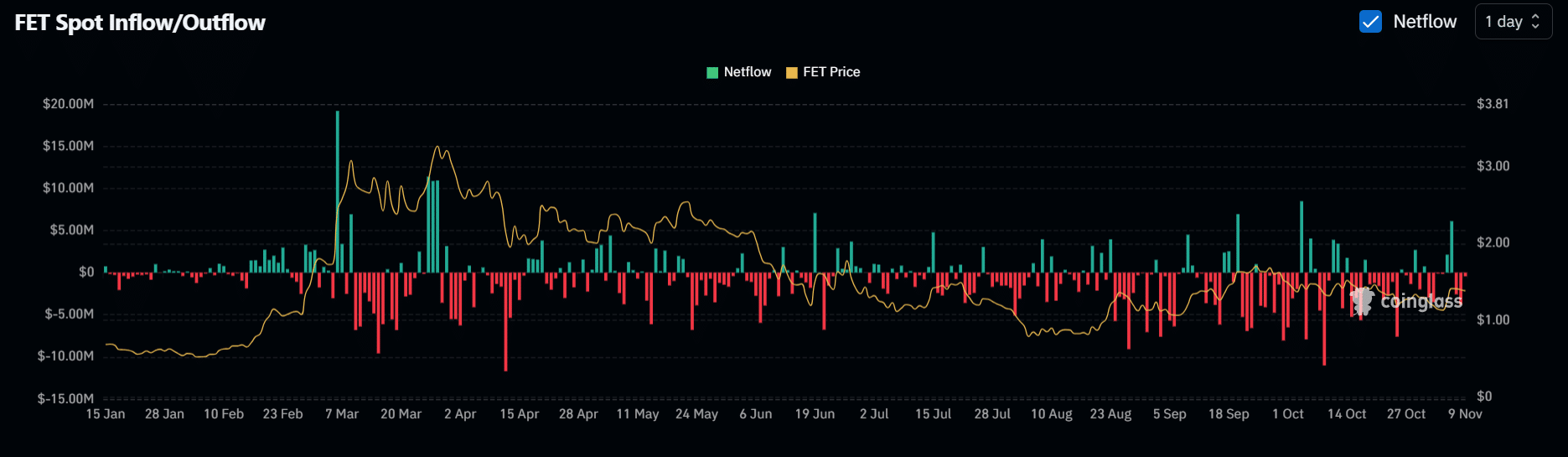

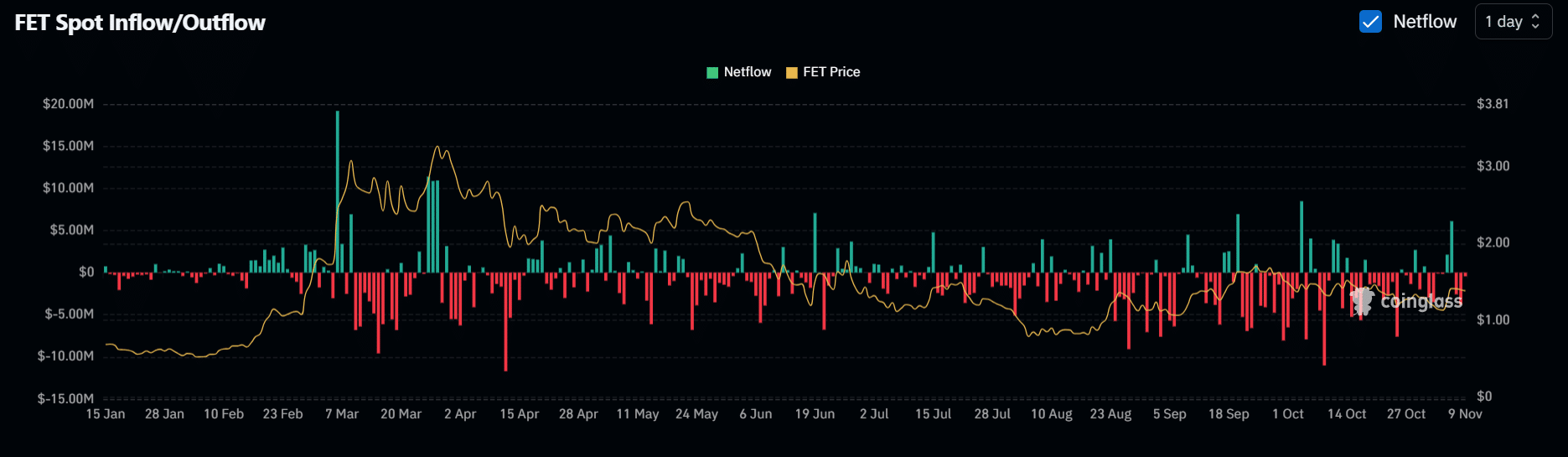

Supply: Coinglass

Since mid-June, FET bulls have made 4 makes an attempt to interrupt the $0.17 resistance, getting into an accumulation section, as proven by on-chain information.

A few month in the past, buyers withdrew about $11 million price of FET tokens from the exchanges. This helped hold the FET in a secure vary and mitigate potential pullbacks.

Nevertheless, regardless of these aggressive buyouts, the anticipated impression on FET’s worth has but to materialize – pointing to a potential thirdparty affect that may counteract the bullish momentum.

A brief bias may derail the rally

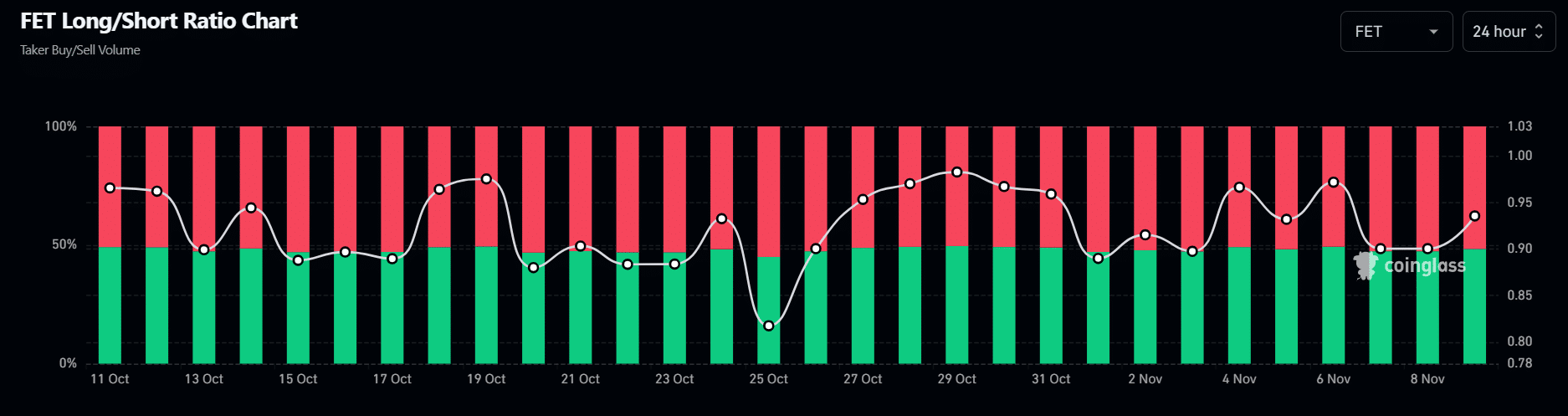

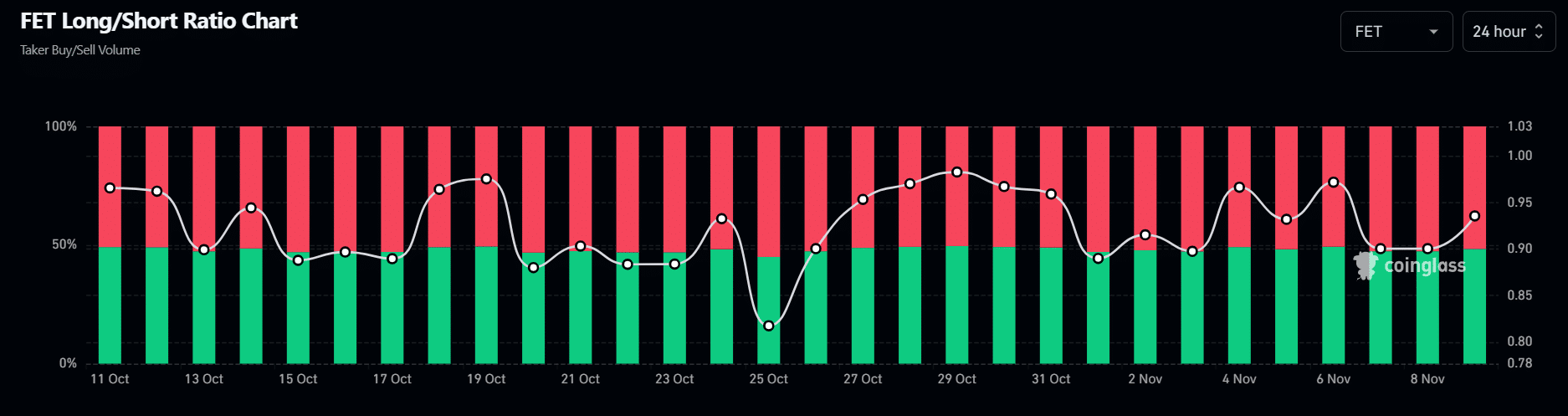

Along with inconsistent order ebook exercise from giant buyers, FET’s breakthrough largely is dependent upon the derivatives market, the place there’s a clear bias in the direction of shorts.

Since October, quick sellers have dominated the FET futures market, appearing as a significant supply of resistance.

There is a twist, although: numerous quick positions may shortly reverse if market momentum turns in opposition to them. And there’s no higher time than now.

Supply: Coinglass

As beforehand talked about, buyers have been diversifying their portfolios, with many specializing in small-cap tokens. This pattern is notable, particularly as BTC approaches a threat zone.

Learn the Synthetic Superintelligence Alliance’s [FET] Value forecast 2024–2025

Whereas spot merchants focusing on the dip is a bullish signal, it is probably not sufficient to set off a breakout. For that to occur, giant holders should keep away from dropping their positions.

Because of this, sturdy shopping for curiosity may set off a brief squeeze and pave the best way for a bullish restoration.

In different phrases, FET has the suitable elements for a possible breakout. With the RSI in a impartial section, just a few circumstances may push the FET above its resistance at $0.17 and put it on target in the direction of a $2 goal.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024