Ethereum

Ethereum breaks $3,000: Can ETH hold support at THIS level

Credit : ambcrypto.com

- Ethereum just lately broke the $3,000 value stage.

- Over 2.8 million addresses bought ETH on the present value stage, making this a key stage.

Whereas Bitcoin[BTC] made headlines with its all-time excessive, Ethereum[ETH]usually known as the ‘digital silver’, additionally made a exceptional step.

The second-largest cryptocurrency by market capitalization broke above the $3,000 mark, a resistance stage that has remained robust for months.

This breakout coincided with record-breaking optimistic flows in Ethereum’s spot ETF, marking a brand new section of bullish momentum.

Can Ethereum maintain this rally because it enters new territory?

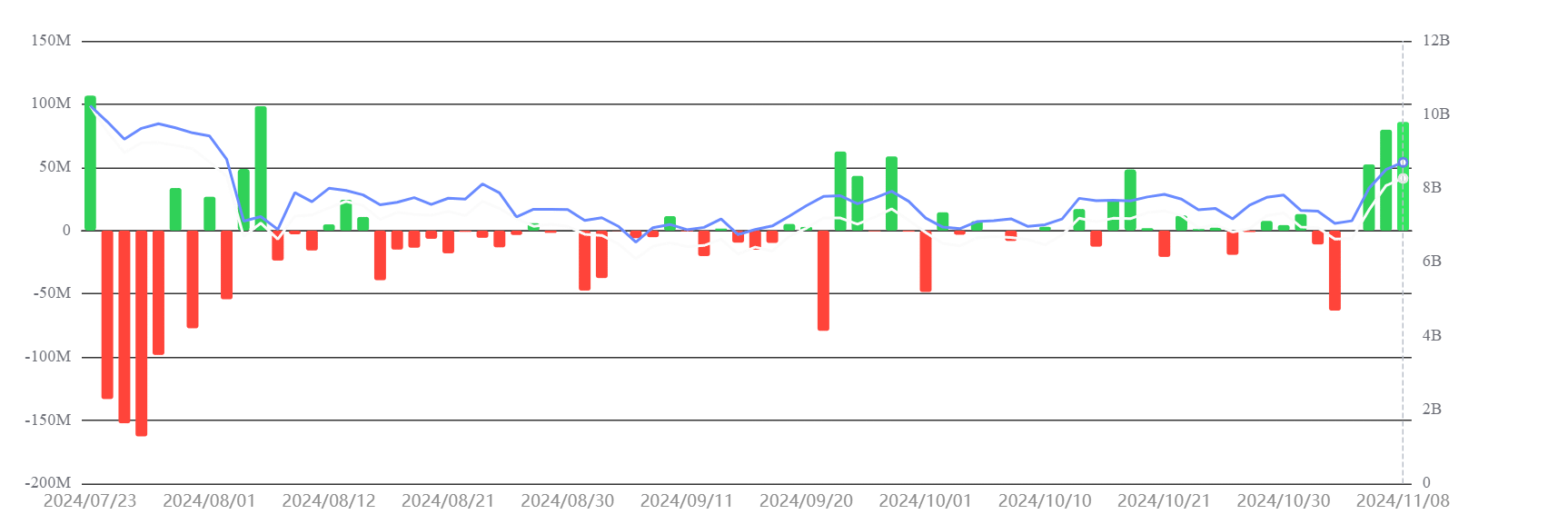

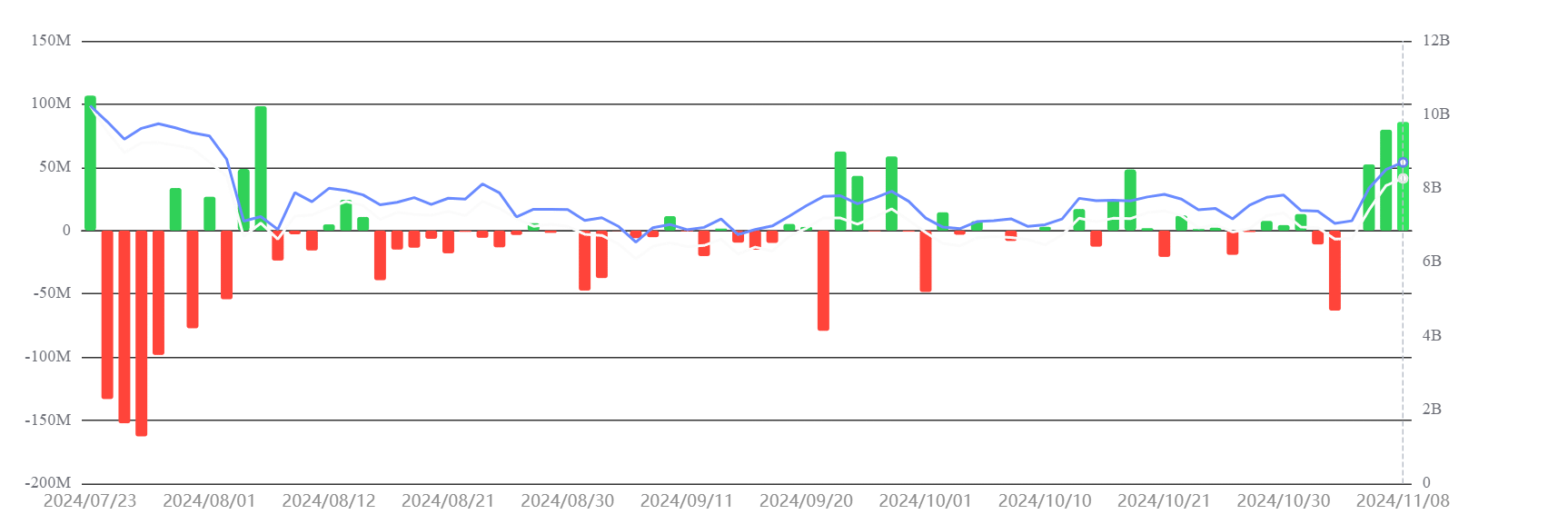

File inflow of spot ETFs fuels Ethereum’s breakout

Ethereum’s ETF stream evaluation over the previous week revealed internet inflows of $154.66 million. This set a brand new excessive for weekly optimistic flows.

Knowledge from SosoValue confirmed that that is the second consecutive week of internet inflows into Ethereum – a historic milestone for the ETF.

Supply: SosoValue

The biggest weekly internet stream for the Ethereum ETF occurred throughout launch week, with unfavourable flows of $341.35 million. Now the pattern has definitively shifted into optimistic territory, with successive inflows supporting ETH’s value appreciation.

This surge in institutional help has pushed ETH previous the $3,000 mark, reinforcing its upward momentum.

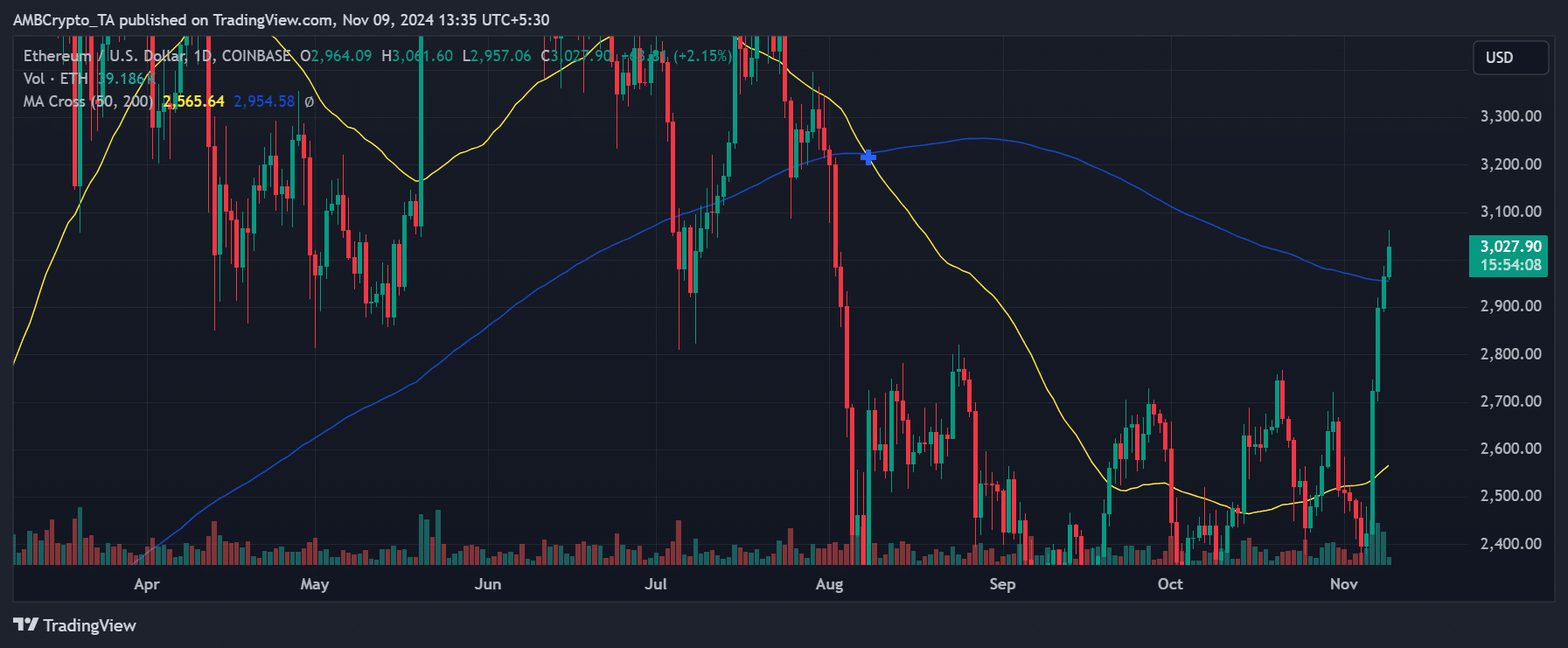

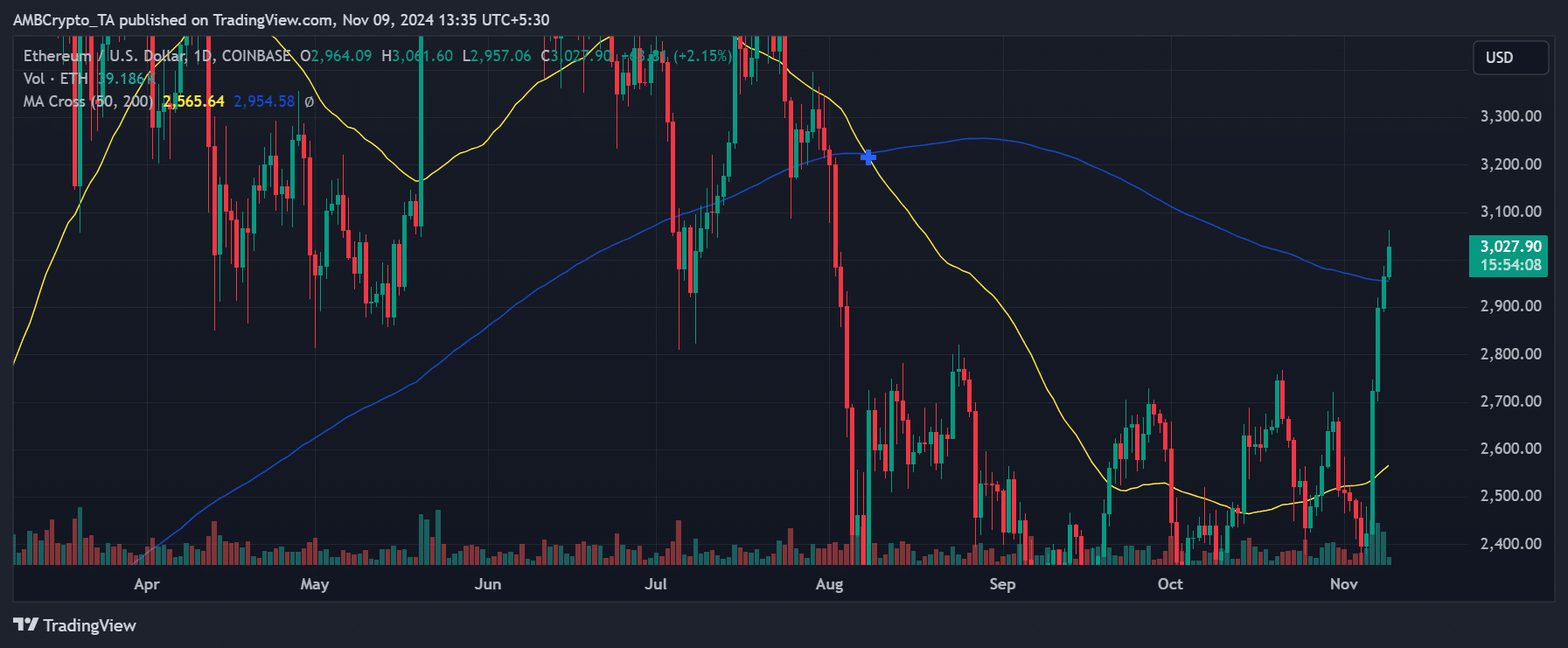

Ethereum strikes to safe its place above $3k

On the time of writing, Ethereum rose to $3,027.90 and skilled a robust bullish breakout. It has comfortably exceeded each its 50-day and 200-day transferring averages (MA).

This transfer marked a major rally as ETH surpassed the psychological resistance at $3,000. This means momentum indicating investor confidence within the asset.

Supply: TradingView

The 50-day MA was positioned at $2,565.64 and the 200-day MA at $2,954.58, each serving as help ranges for the present bullish run. Quantity additionally elevated, underscoring the robust buying curiosity.

Given this pattern, ETH might goal larger ranges if it continues this bullish momentum, with the subsequent resistance zones probably round $3,200 or larger.

A pullback to check help on the 200-day MA may be seemingly, which may very well be a possible entry level for merchants maintaining a detailed eye on this pattern.

Ethereum’s break by the $3,000 resistance stage is a significant achievement, supported by report ETF inflows and robust technical indicators.

If this momentum continues, ETH might proceed to rise, with $3,000 establishing itself as a brand new help stage as the top of the 12 months approaches.

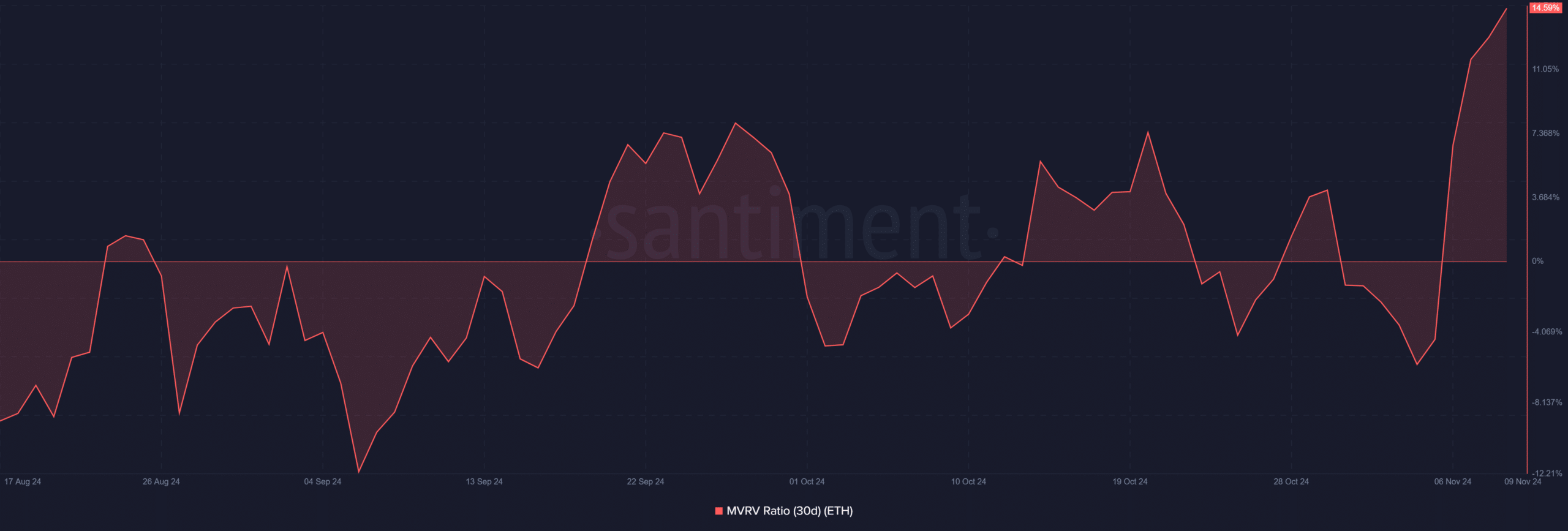

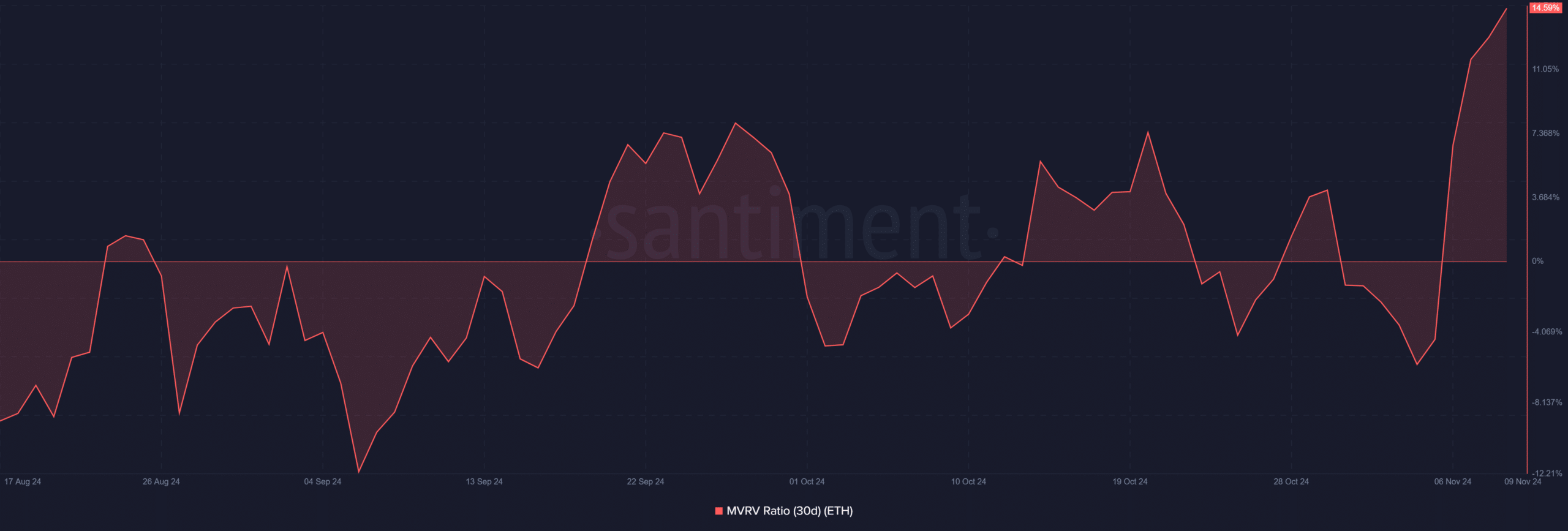

The MVRV ratio exhibits rising profitability amongst holders

The 30-day market worth to realized worth (MVRV) ratio for Ethereum indicated that many holders are making income as ETH trades above $3,000.

A rising MVRV ratio steered that profit-taking might happen quickly, which might set off promoting stress.

On the time of writing, the MVRV was virtually 15.6%, the best stage since Could.

Supply: Santiment

Moreover, IntoTheBlock evaluation discovered that 2.86 million addresses bought ETH across the present value. This makes the present stage crucial, as an increase above it might trigger an ATH.

– Is your portfolio inexperienced? Try the Ethereum revenue calculator

If the MVRV ratio continues to rise, extra holders will discover themselves in worthwhile positions and the market could endure pure corrections.

With rising institutional curiosity, Ethereum’s new help stage might method the $3,000 mark, decreasing the influence of minor sell-offs.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024