Bitcoin

Bitcoin finally breaches $80K: What will BTC’s next ATH be?

Credit : ambcrypto.com

- About 4.27% of Bitcoin’s provide was to again exchange-traded funds on the time of writing.

- Analysts predict a market peak between November 2024 and February 2025.

Bitcoin [BTC] continues to point out the crypto market why it’s the king’s coin. After practically a month of consolidation and sideways strikes, the market chief hit a brand new all-time excessive after surpassing $80,000.

The cryptocurrency is up greater than 5% in 24 hours and greater than 18% prior to now seven days, AMBCrypto famous utilizing CoinMarketCap information.

Bullish surroundings for development

Bitcoin’s transfer comes on the Common’s again market bullish, particularly after the SEC’s approval of Bitcoin Trade Dealer Funds (ETFs) in January.

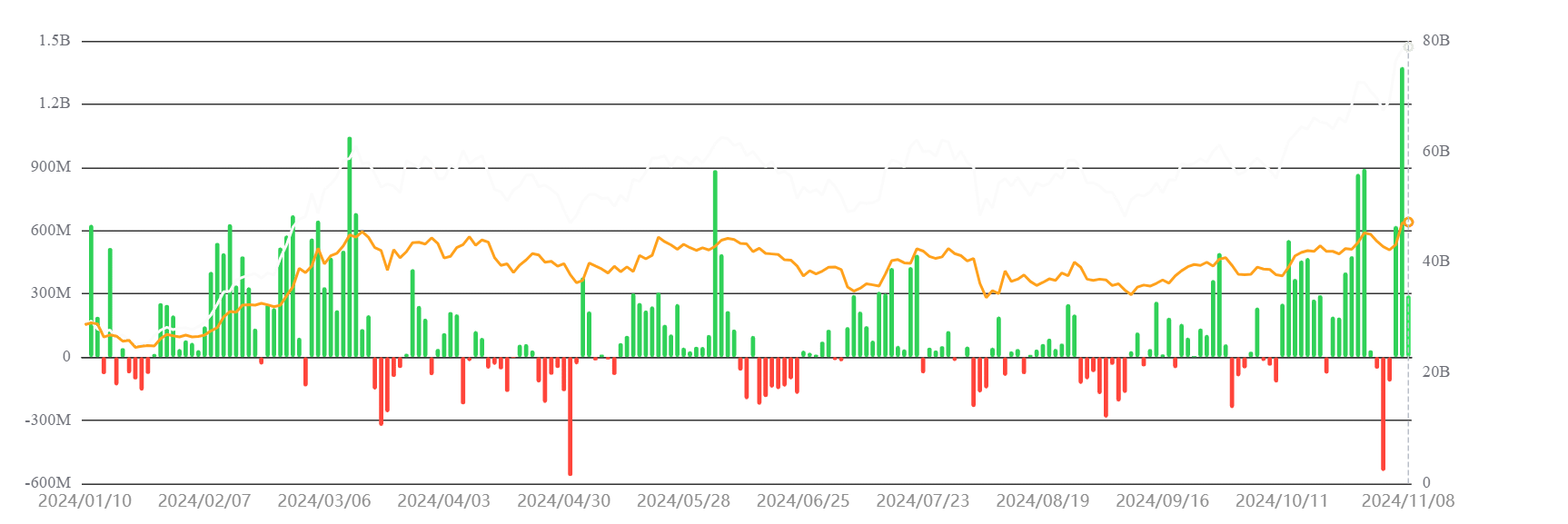

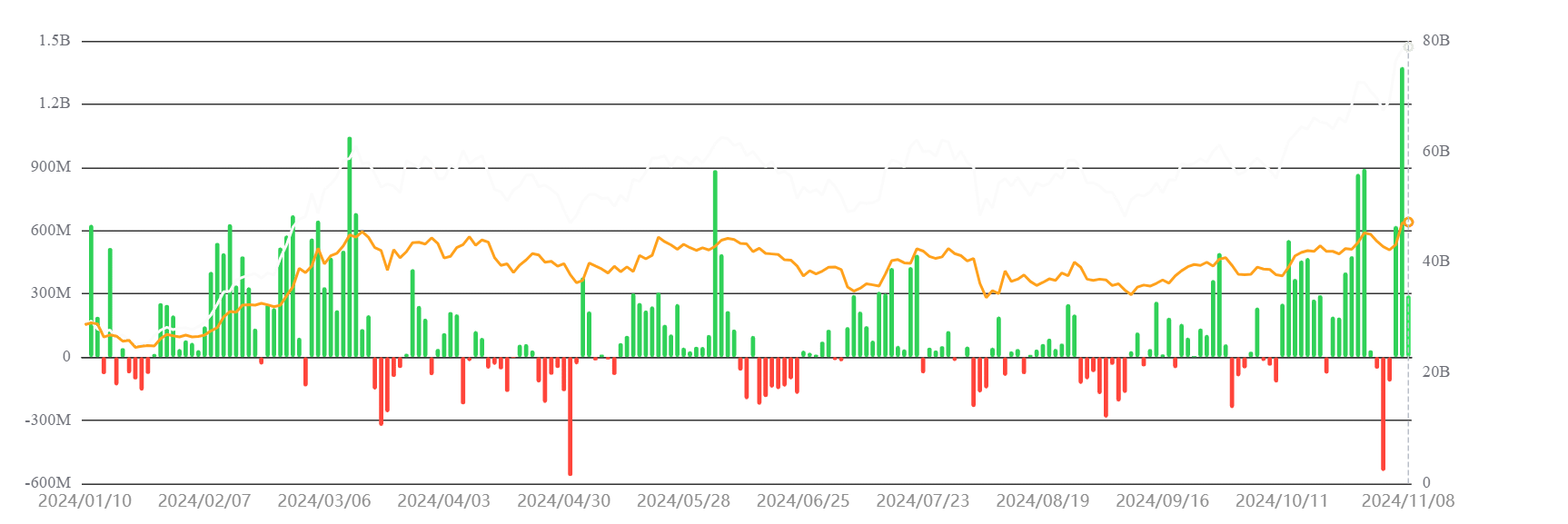

Based on AMBCrypto’s evaluation of SoSo Worth information, practically $26 billion price of BTCs have flowed into these funds since they had been listed.

Additionally, inflows have elevated dramatically after an preliminary burst of outflows from the Grayscale Bitcoin Belief (GBTC).

Moreover, on the time of writing, property underneath administration or AUMs for Bitcoin spot ETFs had been practically $79 billion, accounting for five.21% of Bitcoin’s complete provide.

Supply: SosoValue

There are different causes past crypto that would clarify Bitcoin’s efficiency.

Inflation has decreased considerably in current months. The labor market has additionally improved.

This led TThe US Federal Reserve (Fed) opts for a comparatively versatile method and leaves rates of interest unchanged stable throughout final month’s FOMC assembly.

The broad consensus amongst traders and policymakers was that charges would stay unchanged on the subsequent assembly, with the potential for a charge reduce later this yr if inflation stays underneath management.

What this has achieved is that folks have began spending cash on dangerous property like shares and cryptocurrencies.

Is Bitcoin changing into scarcer and dearer?

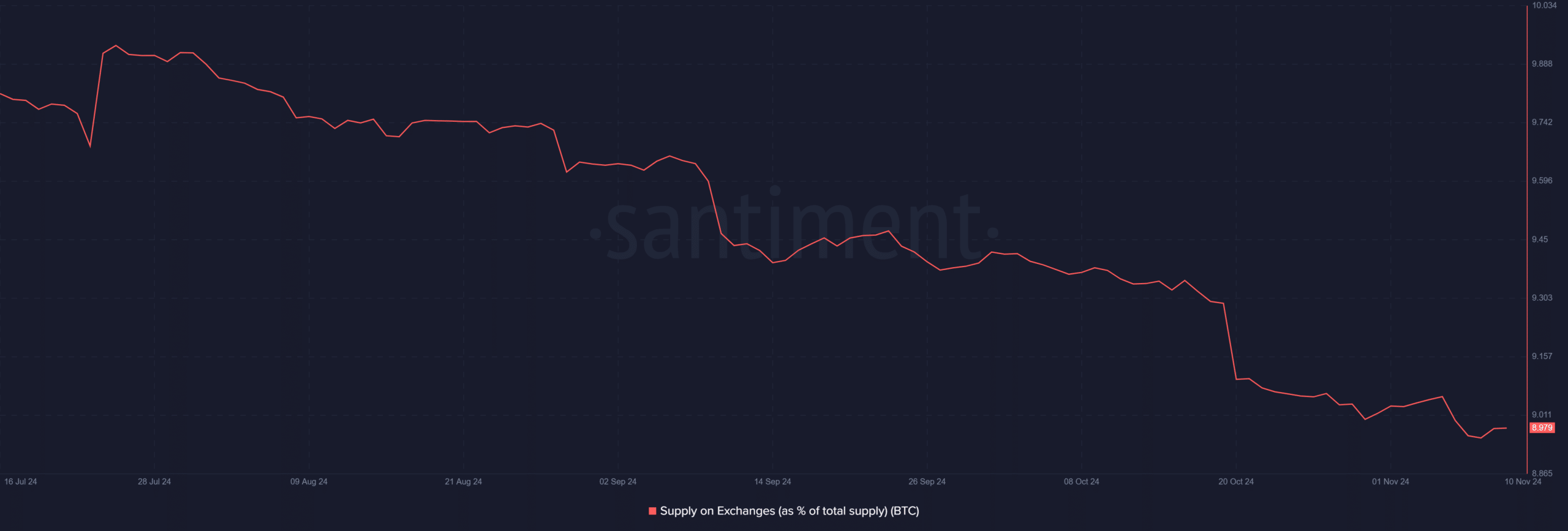

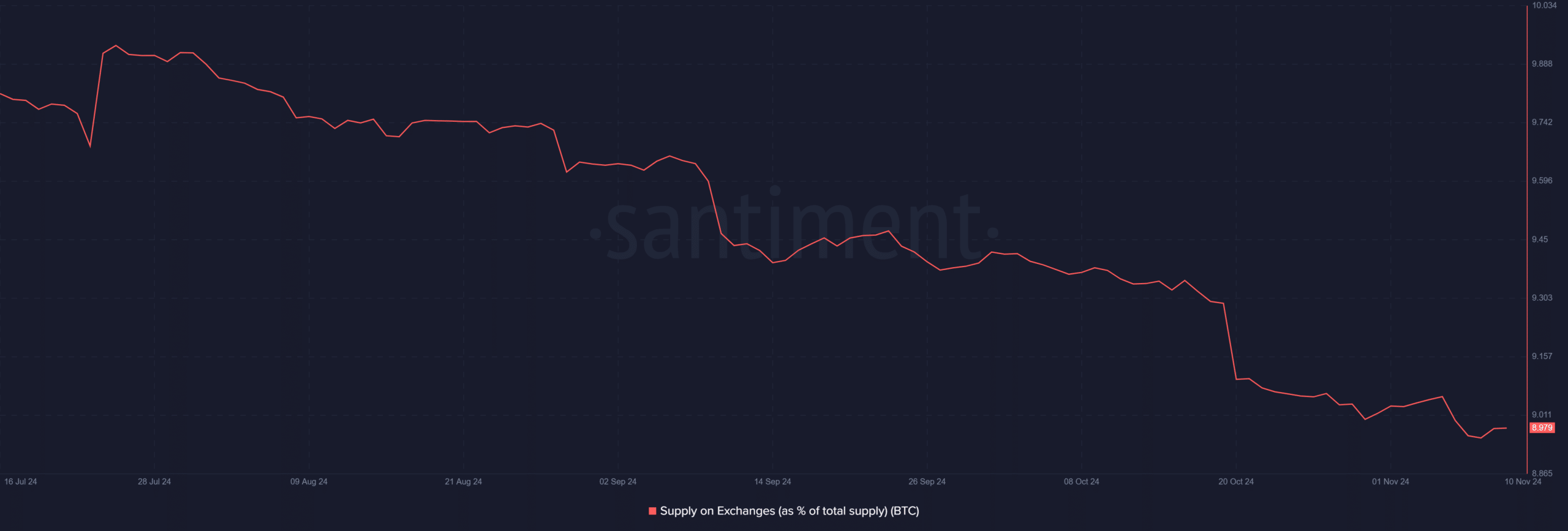

The growing variety of Bitcoins getting locked up in spot ETFs created shortage within the broader market.

To that extent, provide on the exchanges continued to say no, in accordance with AMBCrypto’s examination of Santiment information.

Moreover, on the time of writing, roughly 9% of Bitcoin’s complete circulating provide was held on exchanges, up from nearly 12% firstly of 2024.

Supply: Santiment

Although provide fell, there was no drop on the demand facet. Quite the opposite In contrast to earlier bull cycles, the 2024 Bitcoin rally was pushed by each personal and institutional curiosity.

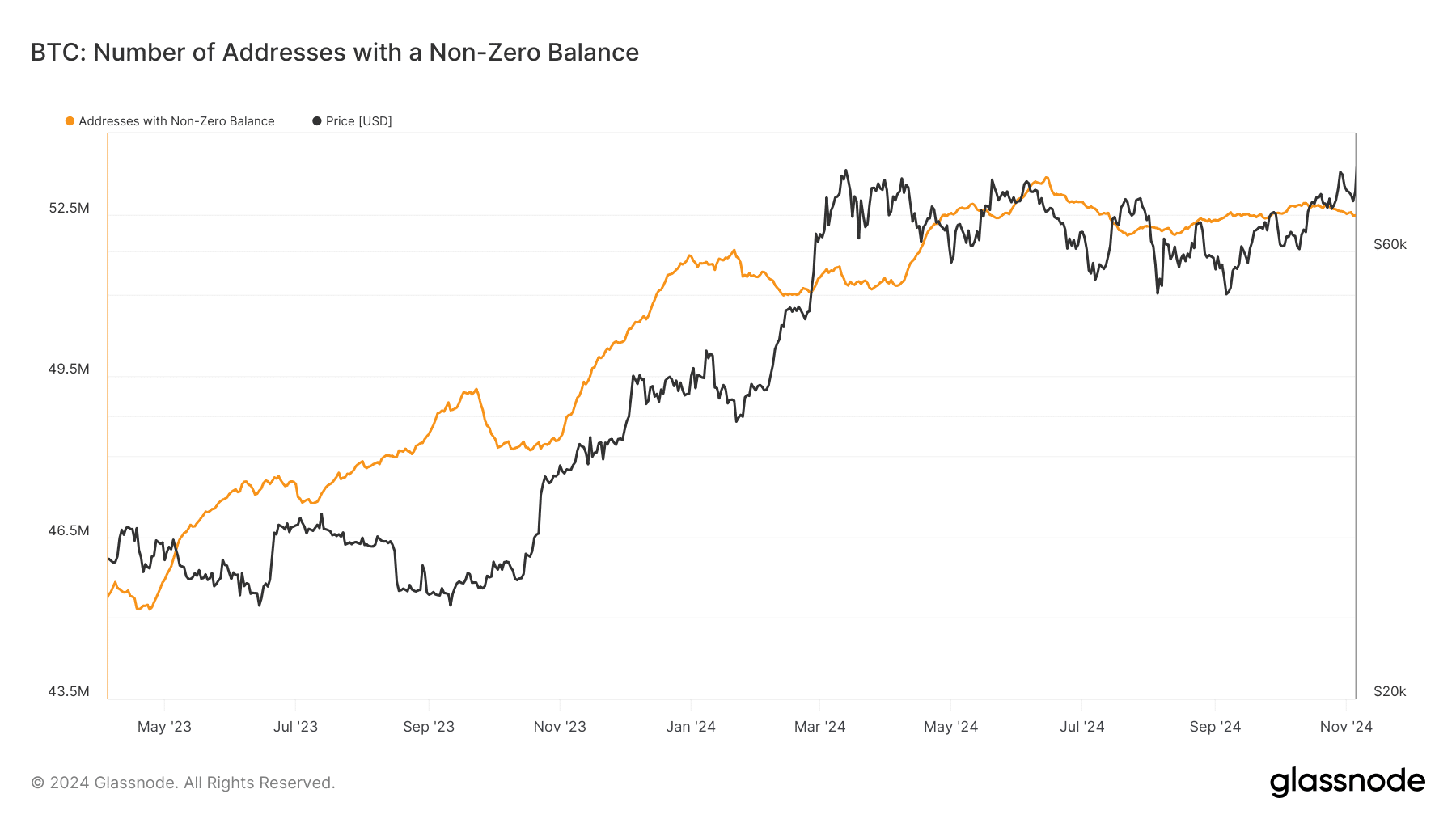

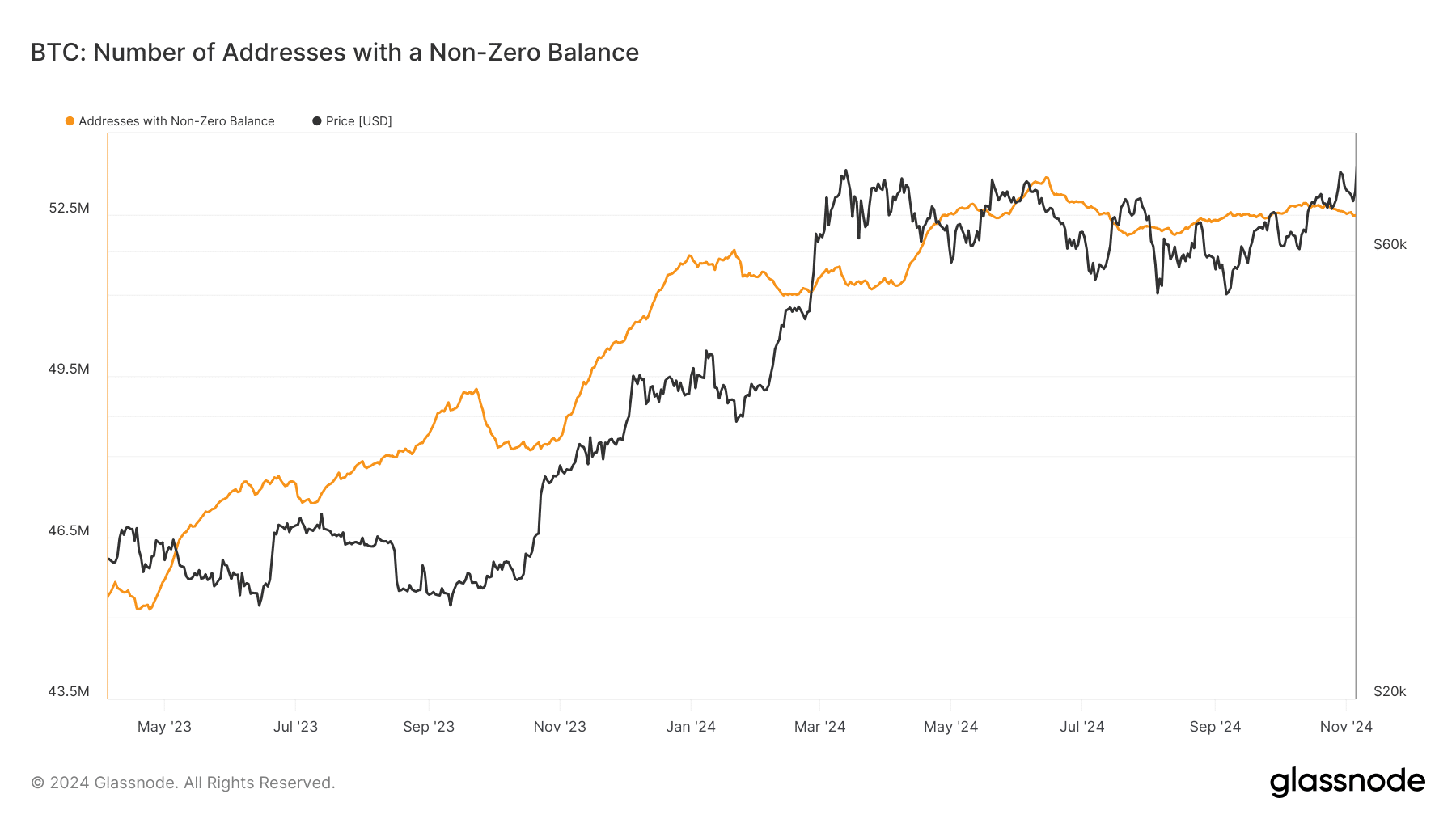

Utilizing Glassnode, AMBCrypto noticed a marked enhance within the variety of whale entities with 1K cash, whereas addresses with non-zero balances additionally elevated for the reason that begin of 2024.

Supply: Glassnode

Rocket prepared for the moon?

This bullish state of affairs of reducing provide and growing demand had the potential to push Bitcoin to all-time highs this cycle.

Learn Bitcoin’s [BTC] Worth forecast 2024-25

Effectively-known technical analyst Ali Martinez had beforehand predicted that the market peak can be reached someday between November 2024 and February 2025.

So $80,000 looks like only the start as we launch from the bottom up. The rocket has sufficient gas for the moon, it appears!

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now