Ethereum

Ethereum nears YTD high after a 29% surge – Can ATH be far behind?

Credit : ambcrypto.com

- Ethereum rose 29% final week, hitting a three-month excessive of $3,184.

- The altcoin might be approaching its YTD excessive, which may gas hypothesis a couple of potential Ethereum ATH.

Ethereum [ETH] has had a outstanding rise over the previous week, rising 29% to succeed in a three-month excessive of $3,184. With this robust upward momentum, the cryptocurrency is on the verge of hitting a year-to-date (YTD) excessive, drawing the eye of traders and market observers alike.

With Bitcoins [BTC] $89,000 improve, discussions about the potential of a brand new ATH for Ethereum are intensifying. Might the main altcoin be poised for even greater good points, or is that this rally a brief spike?

Ethereum Rally Powered by Merchants and Holders

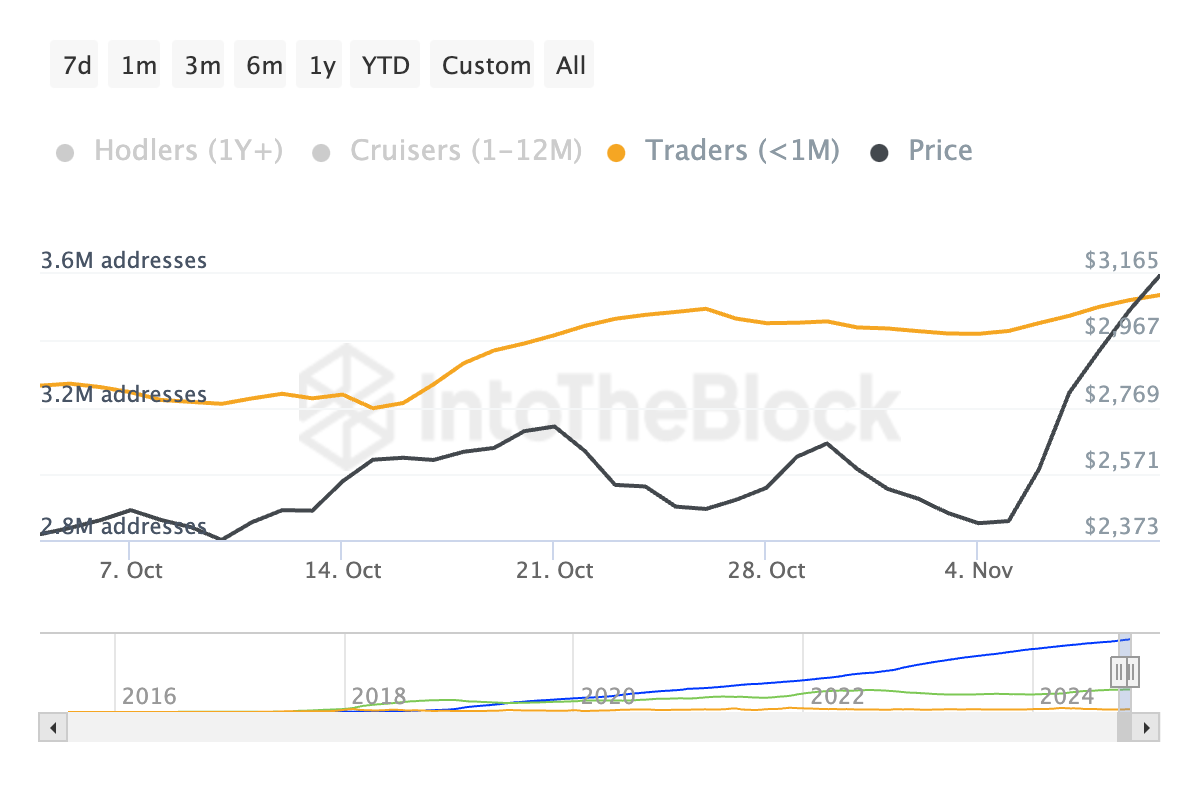

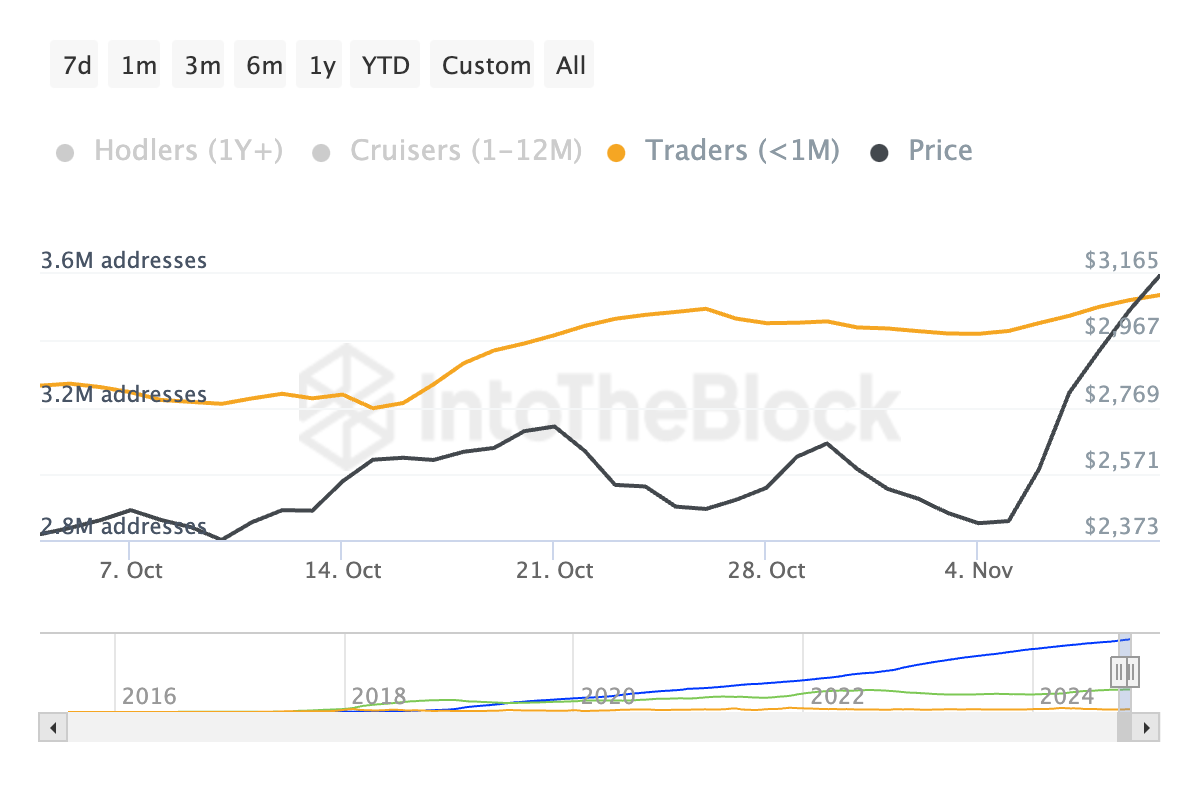

Ethereum’s latest rally has been supported by a rising common holding time, indicating higher participation from long-term holders. This development signifies higher confidence in continued worth appreciation and will point out a steady base for additional good points.

Supply: Into The Block

The simultaneous improve in each holding time and worth factors to a continued rally, fueled by stronger market sentiment and diminished promoting strain. Whether or not this momentum results in an ATH stays to be seen, however investor optimism is evident.

Moreover, Ethereum’s worth rise was additionally fueled by a rise within the variety of short-term merchants, with roughly 3.6 million addresses lively for lower than a month.

Supply: Into The Block

This spike in speculative exercise alerts a possible short-term restoration, however long-term and medium-term bonds stay steady, offering a steady base.

Is an Ethereum ATH potential?

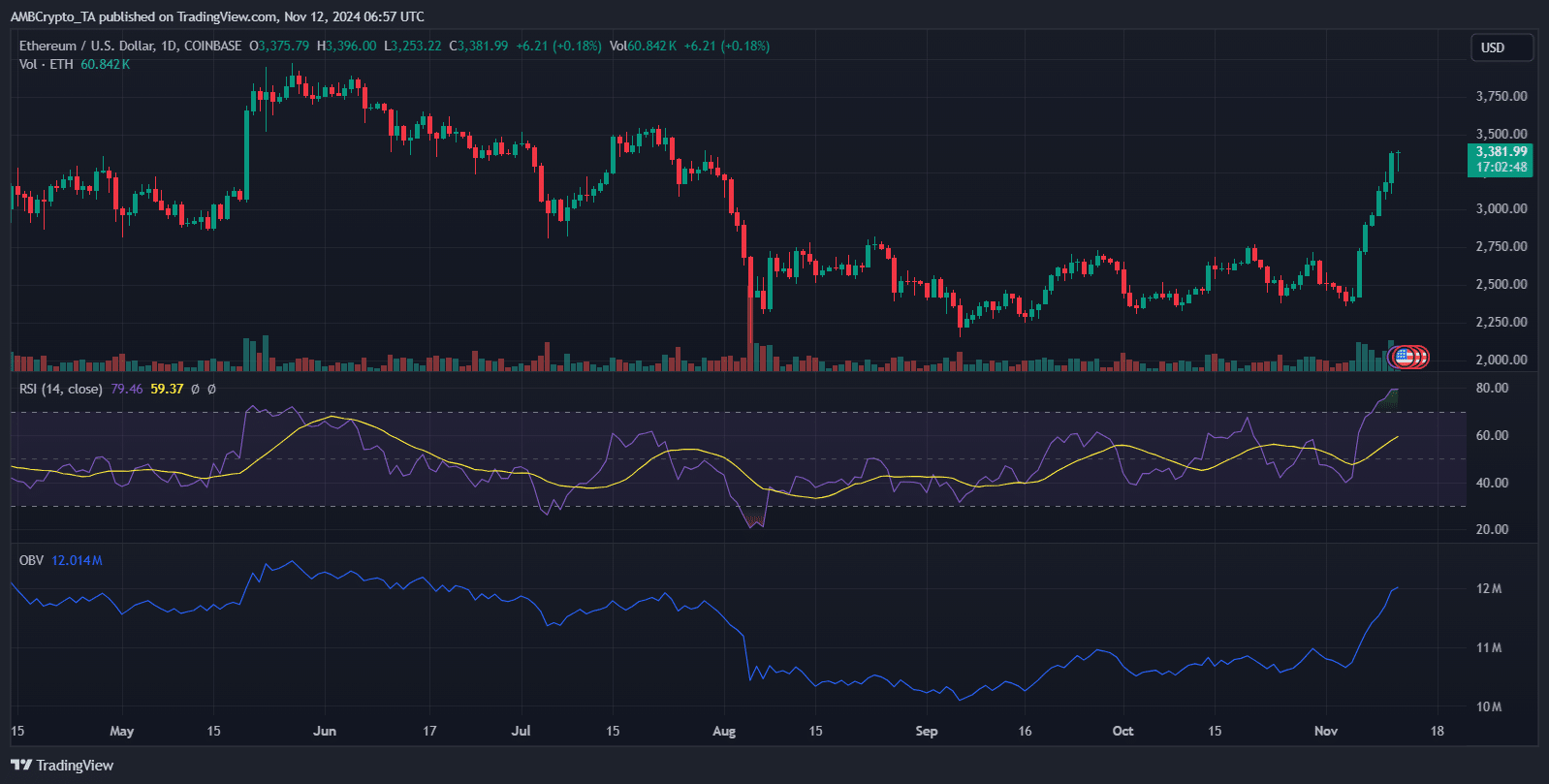

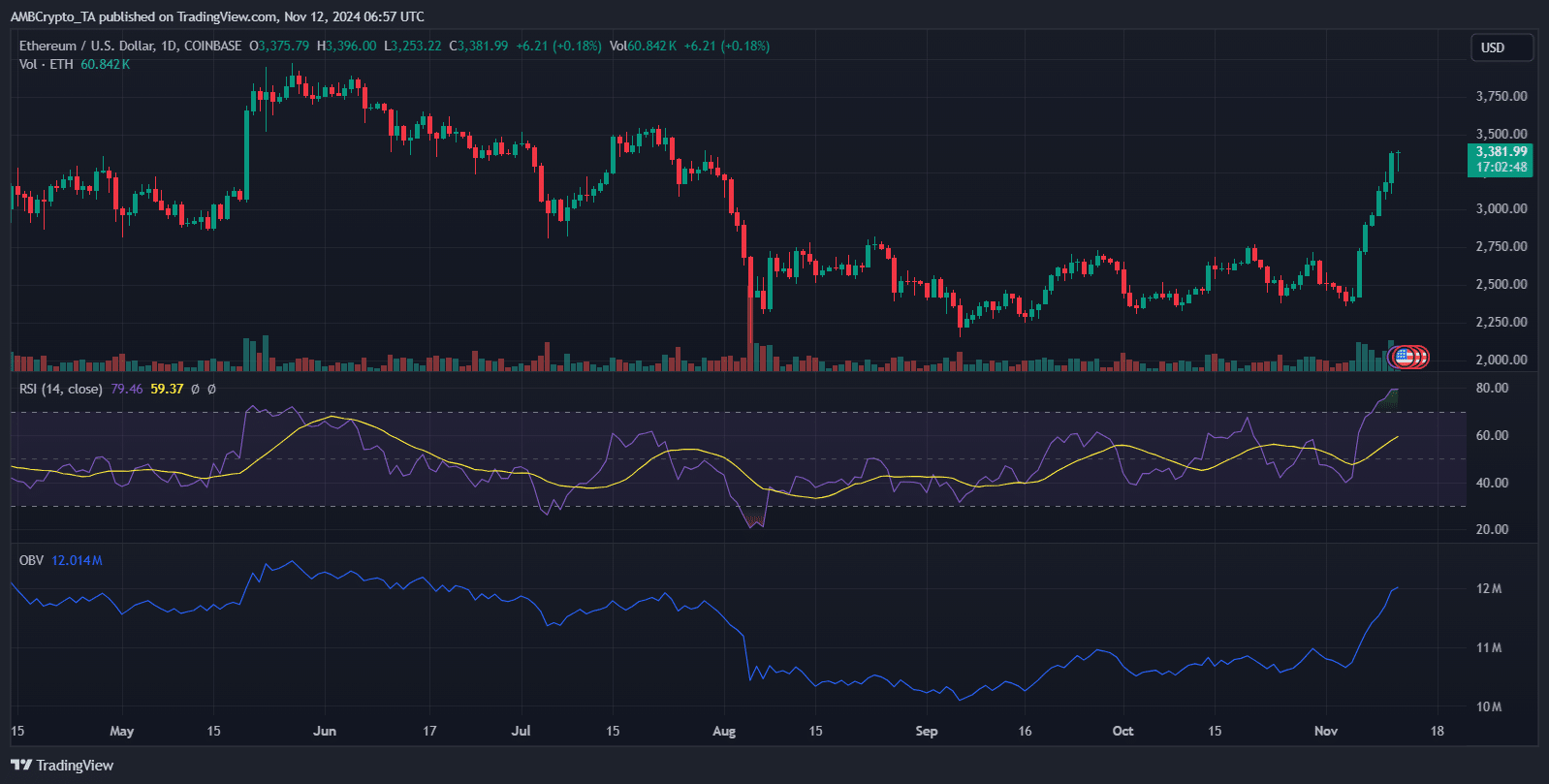

Supply: TradingView

Ethereum’s worth rise pushed the RSI to 77.45, indicating overbought situations, which may result in a short-term correction. Value momentum is supported by rising OBV, which displays robust shopping for curiosity.

If Ethereum rises above the present degree of $3,348, it may most definitely transfer in direction of the YTD excessive.

Nevertheless, given the overbought RSI, a pullback to $3,000 may happen earlier than additional upward motion happens. Merchants must be cautious and look ahead to consolidation round present ranges or potential retests earlier than making an attempt to succeed in a brand new ATH.

Market sentiment and institutional dedication

Ethereum’s rally is pushed by robust market sentiment and growing institutional curiosity, with main gamers attracted by its rising function in DeFi and Web3..

Establishments add liquidity and stability, strengthening Ethereum’s long-term prospects and decreasing volatility.

Learn Ethereum Value Prediction 2024-25

Nevertheless, with the RSI now at an overbought degree, any shift in sentiment – maybe attributable to macroeconomic or regulatory modifications – may set off a pullback.

If institutional confidence stays excessive, Ethereum can keep its good points and strategy a brand new ATH. This continued institutional assist might be vital to sustaining the present rally and offering a basis for potential future highs.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024