Bitcoin

Bitcoin – Here’s what its new ‘5-year low’ means for BTC’s run to $100K

Credit : ambcrypto.com

- Regardless of corrections, Bitcoin’s worth has remained firmly across the $90,000 zone

- The worth of Crypto might quickly rise nicely above this degree

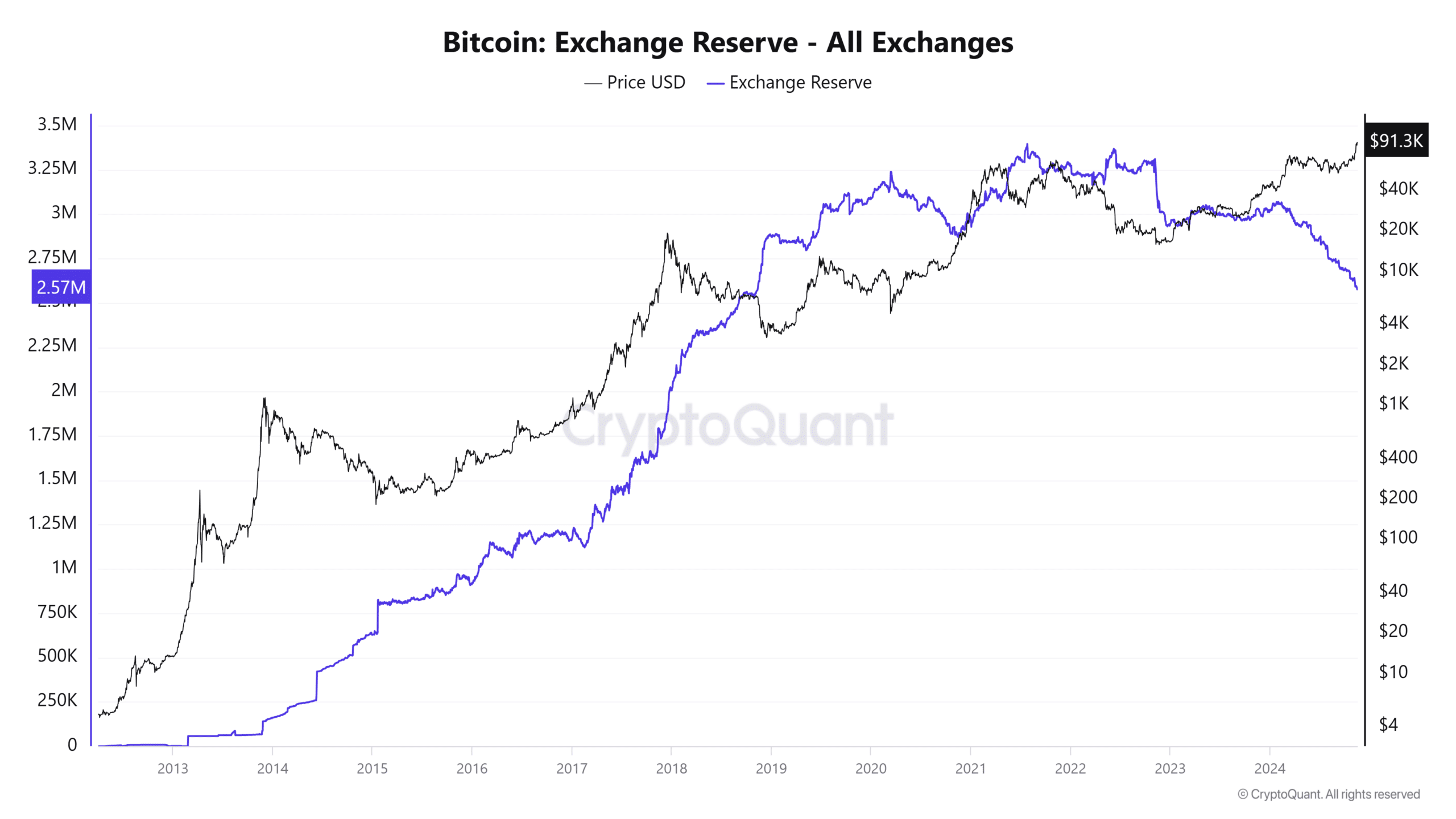

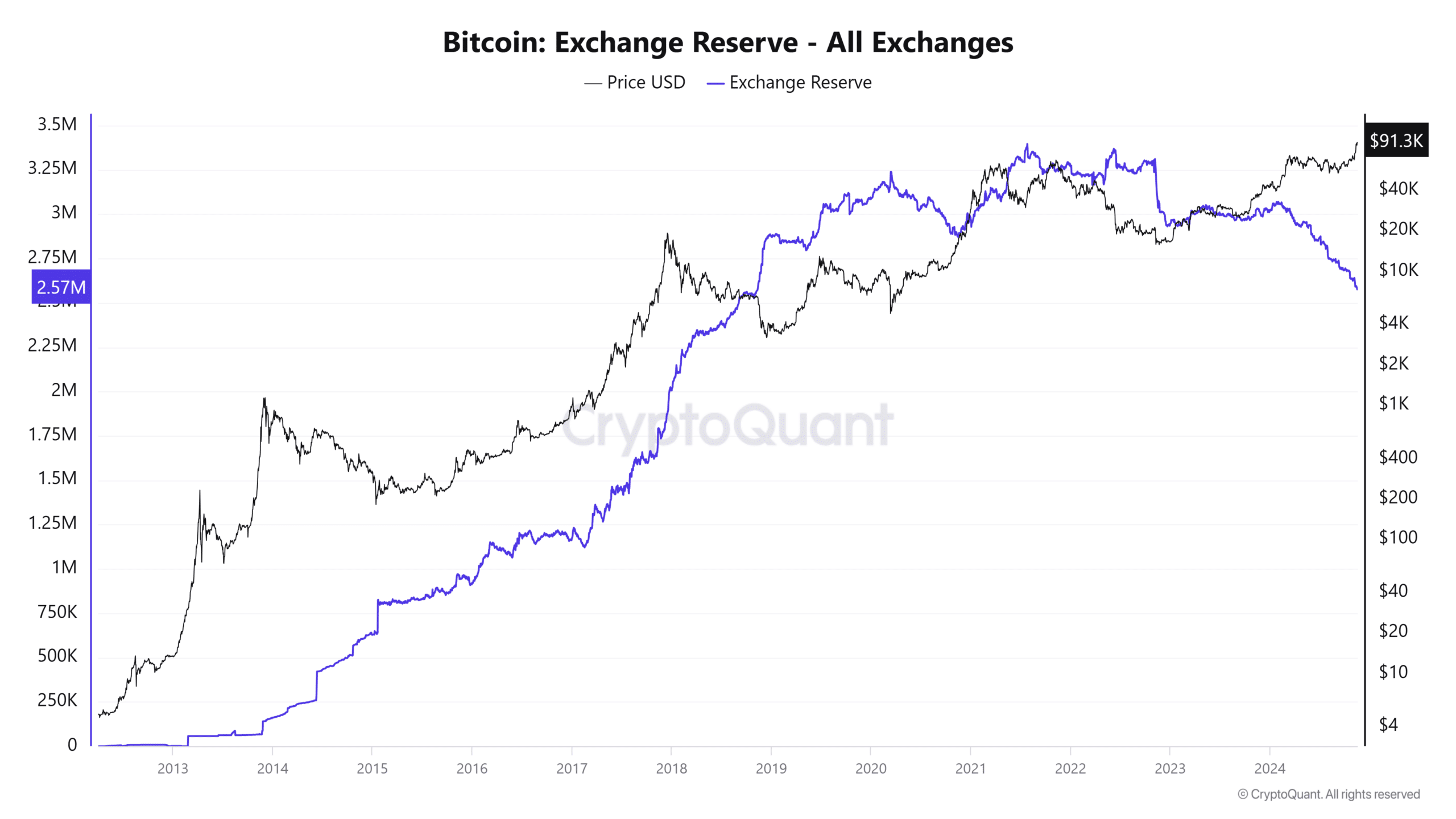

Bitcoin (BTC) international alternate reserves have fallen to their lowest degree since November 2018, reflecting a big shift in market dynamics. This milestone was recorded shortly after the crypto’s worth rose above $91,000, supported by surging demand.

For sure, the confluence of those components raises vital questions in regards to the liquidity of the market and what this pattern means for the way forward for Bitcoin.

Bitcoin alternate reserves and liquidity dynamics

Complete Bitcoin reserves on exchanges fell to 2.57 million BTC, as highlighted by CryptoQuant’s graphic. This degree was final seen throughout the accumulation part earlier than the 2020-2021 bull run.

Traditionally, declining international alternate reserves point out a decline in promoting strain as extra BTC strikes into personal wallets. This may be interpreted as an allusion to a powerful accumulation pattern amongst long-term holders.

Supply: CryptoQuant

With the worth of Bitcoin rising to $91,000, this drop in international alternate reserves underlines the restricted provide in opposition to a backdrop of rising demand.

If reserves proceed to say no, liquidity might tighten additional, probably rising worth volatility within the brief time period. Nonetheless, this might additionally pave the best way for a continued rally, particularly because the BTC accessible for buying and selling decreases.

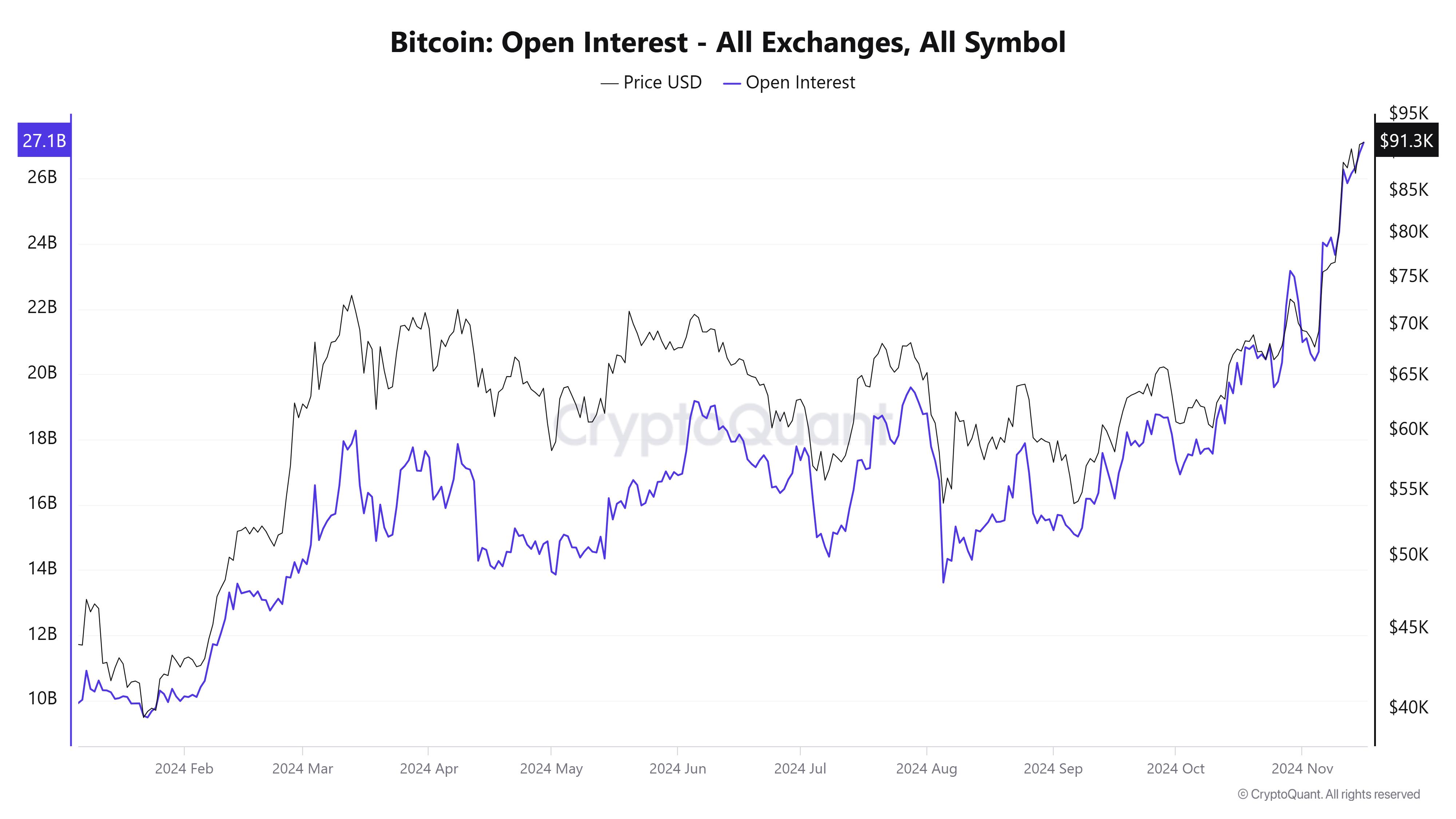

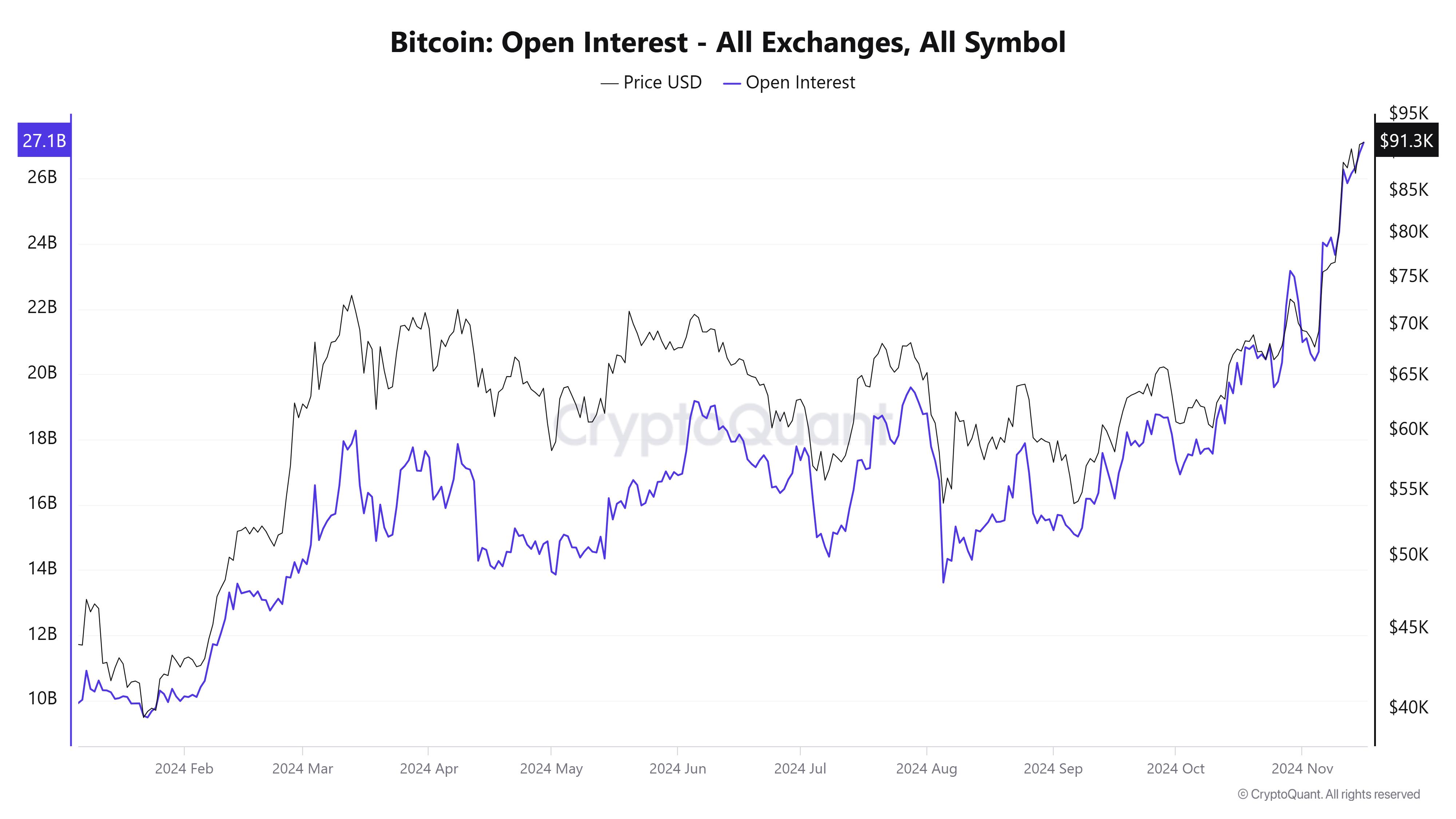

Derivatives Information – Bitcoin Open Curiosity Reaches New Highs

Open Curiosity throughout all exchanges rose to $26.8 billion, in response to CryptoQuant information. Such a pointy enhance mirrored elevated speculative exercise, particularly as Bitcoin’s worth seems to be approaching uncharted territory.

Open curiosity rising together with a rising worth is often a bullish indicator: an indication of rising market participation and optimism.

Supply: CryptoQuant

Nonetheless, such excessive Open Curiosity ranges warrant warning. Traditionally, sharp worth actions typically result in liquidations, particularly when debt ranges enhance.

Monitoring funding charges alongside Open Curiosity shall be key to assessing whether or not the market stays overheated or is gearing up for additional upward momentum.

Accumulation over distribution

Alternate internet move information highlighted the continued outflows, with -7.5K BTC leaving the exchanges, in comparison with an influx of 4.2K BTC. Constant internet outflows align with the buildup story, particularly as buyers transfer Bitcoin to chilly wallets or custody options.

In earlier market cycles, prolonged outflows have preceded main rallies, reflecting market dynamics through which provide on exchanges is turning into more and more scarce. These tendencies recommended that market members are holding onto Bitcoin in anticipation of upper costs – one other bullish signal.

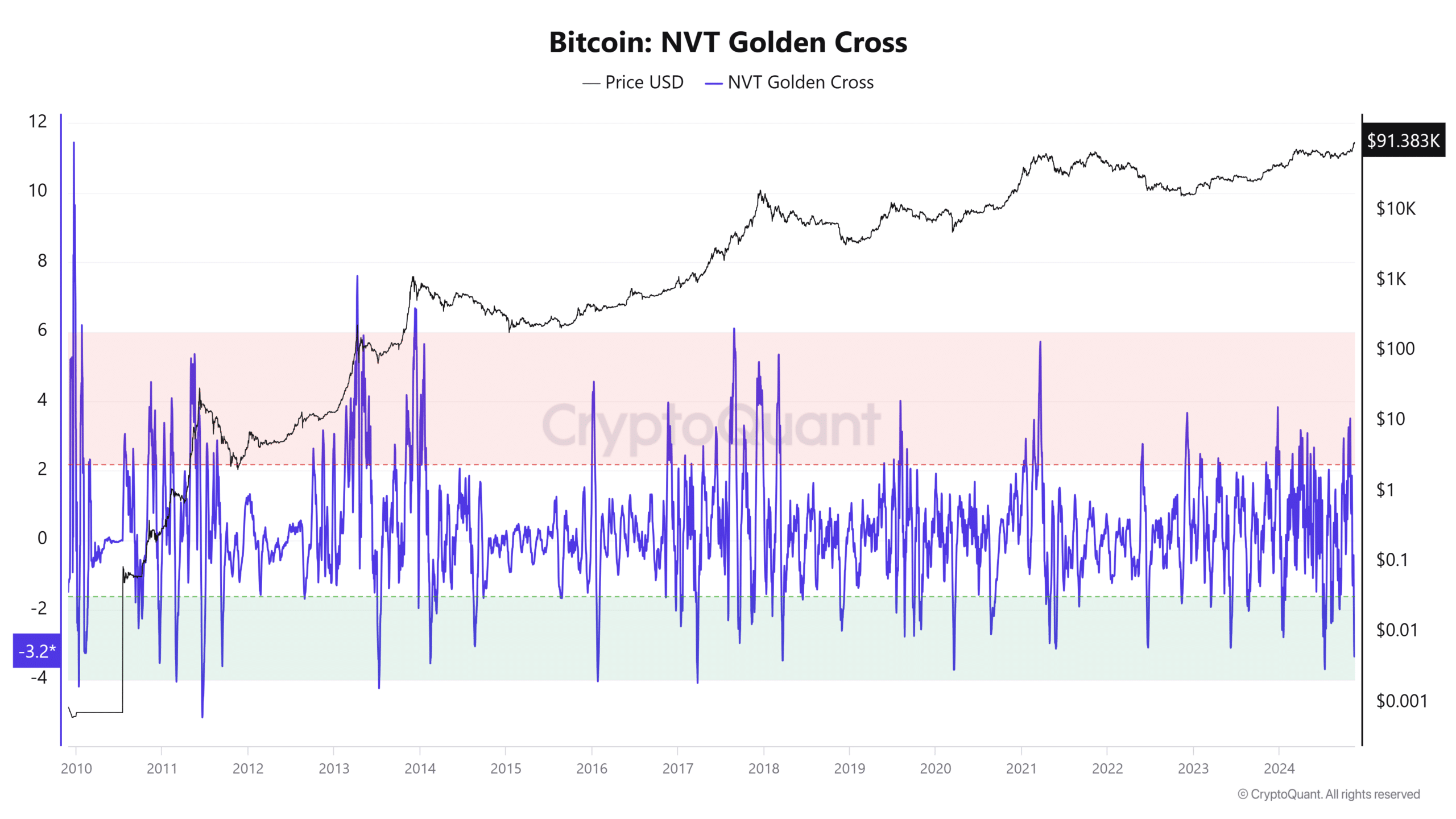

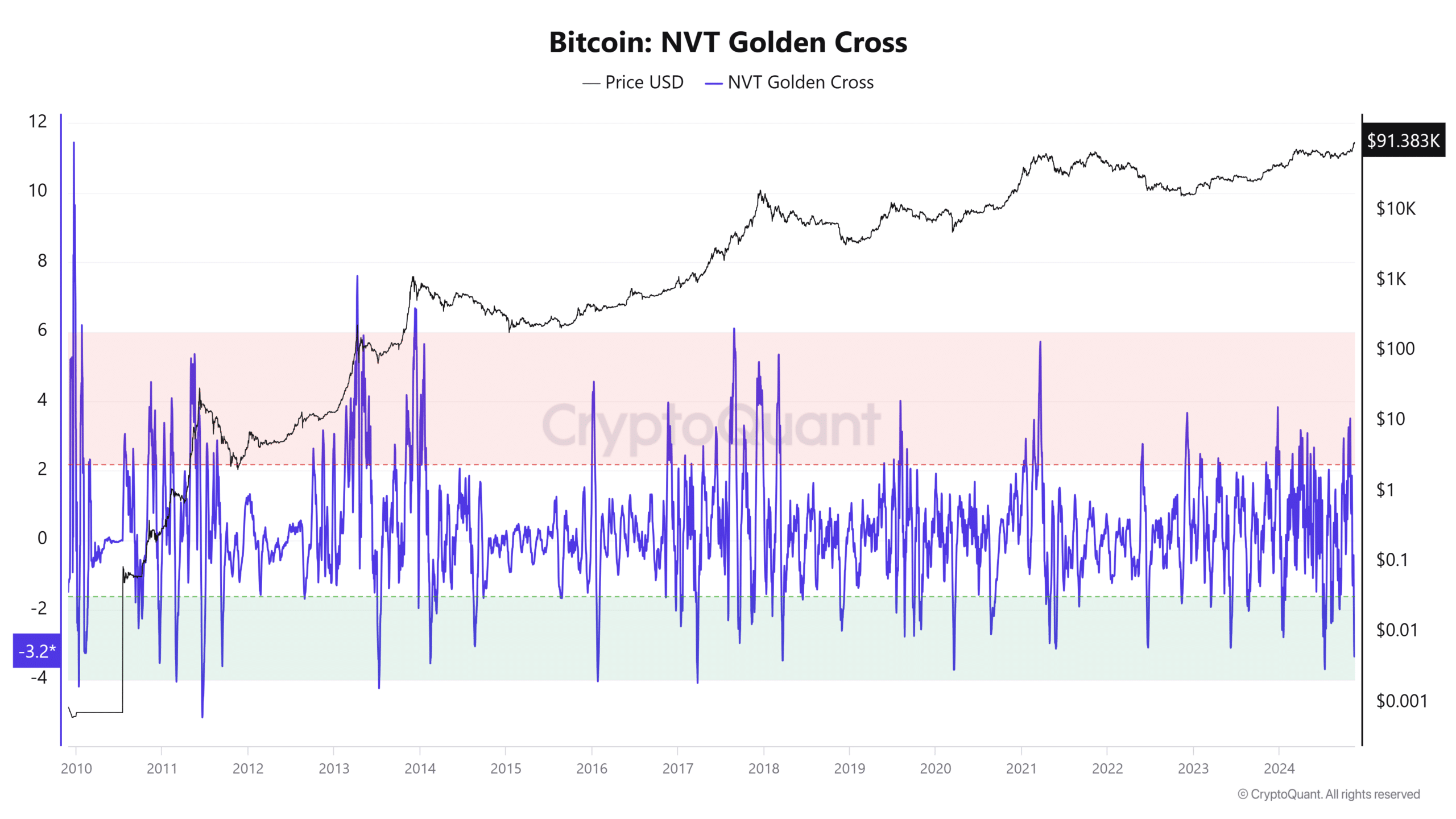

Bitcoin NVT Golden Cross – A sign of market energy

Bitcoin’s NVT (Community Worth to Transactions) Golden Cross additionally lately entered bullish territory, with the identical underlined by CryptoQuant’s charts.

Right here it’s value noting that this metric compares Bitcoin’s market capitalization with transaction quantity. It offers perception into whether or not the community’s valuation is supported by its actions.

Supply: CryptoQuant

Traditionally, when the NVT Gouden Kruis falls into the inexperienced zone, it signifies that transaction exercise is excessive relative to Bitcoin’s valuation – an indication of wholesome community utilization and bullish market circumstances.

Conversely, a transfer into the pink zone signifies overvaluation or lowered community exercise. The positioning within the bullish zone bolstered the story of rising adoption and community belief. This appeared to be according to declining international alternate reserves and rising Open Curiosity tendencies.

– Learn Bitcoin (BTC) worth prediction 2024-25

The drop in Bitcoin alternate reserves, coupled with rising Open Curiosity, constant internet outflows and a bullish NVT Golden Cross, underlined a powerful market setup.

Whereas lowered liquidity on inventory markets might result in larger volatility, the info appeared to point that market members could also be positioning themselves for continued upside potential.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024