Altcoin

Ethereum ETFs Hit Record Inflows of $515 Million, But Problems with ETH Remain

Credit : ambcrypto.com

- Ethereum ETFs noticed report weekly inflows of $515 million.

- In the meantime, ETH is down 1.85% over the previous week.

Because the adoption of Ethereum [ETH] ETFs in July, the market has struggled to register sustained inflows. Nonetheless, the previous two weeks Ethereum ETFs have seen elevated curiosity.

A serious motive for this was the continued inflow of institutional traders in anticipation of a bull run.

Spot Ethereum ETFs See Inflows

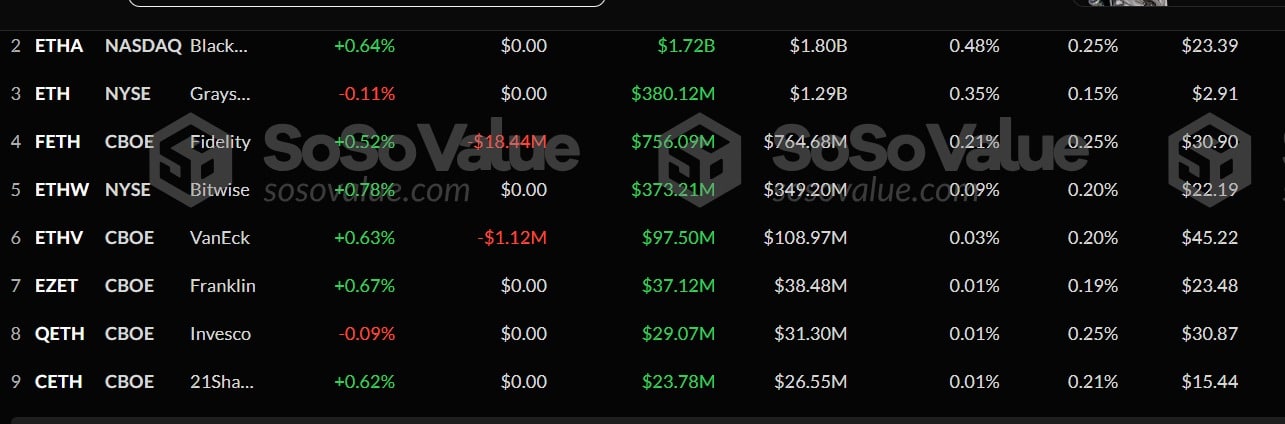

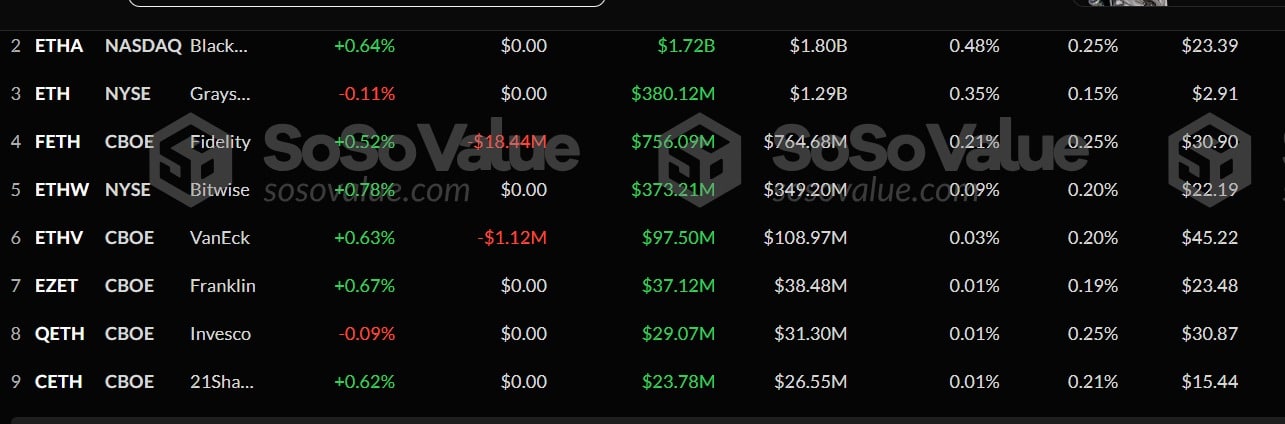

In response to AMBCrypto’s evaluation of Soso valueEthereum ETFs have seen large inflows between November 9 and 15. Throughout this era, ETH ETFs noticed report inflows of $515.17 million.

Supply: Sosowaarde

This degree provisionally arises after a sustained optimistic influx for 3 weeks. Whereas the weekly inflows have been a notable report, November 11 noticed the most important each day inflows, peaking at $295.4 million.

Amid this, Blackrock’s ETHA witnessed the very best whole inflows of $287 million, growing its whole to $1.7 billion.

In second place was Constancy’s FETH, which noticed its market develop to $755.9 million with inflows of $197 million throughout the interval.

In the meantime, Grayscale’s ETH inflows reached $78 million, whereas Bitwise’s quantity reached $54 million.

These have been the most important winners throughout this era, whereas others akin to ETHV and 21 Shares noticed modest inflows. With these elevated inflows, Ethereum ETFs stood at $9.15 billion.

Implication on the ETH value chart

Whereas such inflows are anticipated to have a optimistic affect on ETH’s value chart, that was not the case on this event. Throughout this era, ETH fell from a excessive of $3446 to a low of $3012.

Even on November 11, when the inflows have been the most important on the each day charts, ETH fell.

This pattern has continued whilst of this writing. The truth is, on the time of writing, Ethereum was buying and selling at $3,122, marking a average decline on the each day and weekly charts, down 1.22% and 1.85% respectively.

Supply: TradingView

These market situations advised that ETH was fighting bearish sentiment in a bull market.

Such market habits was evidenced by ETH’s RVGI line making a bearish crossover and falling beneath the sign line. This implies that the upward momentum is weakening, indicating a possible pattern reversal.

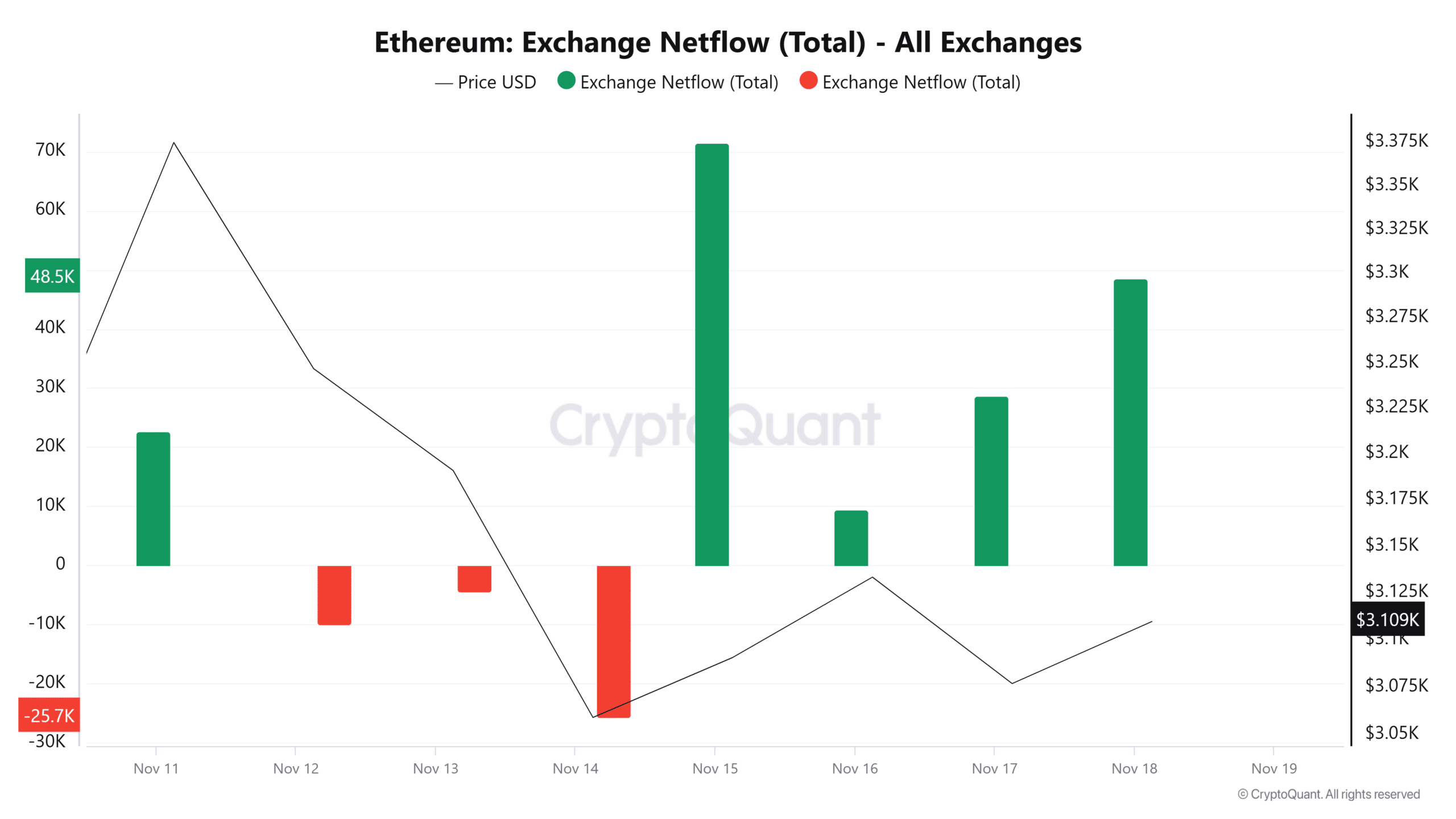

Supply: CryptoQuant

Furthermore, Ethereum’s web movement has remained optimistic over the previous 4 days, implying that there have been extra inflows into exchanges than outflows. Occasions like these present that traders lacked confidence.

Though Ethereum ETFs have skilled report inflows, this has not but had a optimistic affect on the ETH value charts. Quite the opposite, the altcoin has declined in worth throughout this era.

Learn Ethereum’s [ETH] Value forecast 2024–2025

Prevailing market situations indicated a potential pullback. If this occurs, ETH will discover assist round $3000.

Nonetheless, for the reason that crypto market continues to be in an uptrend if the bulls regain management, ETH will regain the resistance at $3200 within the close to time period.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024