Bitcoin

Bitcoin whales refuse to sell—Is $100K closer than we think?

Credit : ambcrypto.com

- Bitcoin whales continued to build up regardless of the worth improve, which is an indication of long-term confidence in its potential.

- Bitcoin ETFs noticed large inflows, boosting market confidence and elevating questions on future developments.

The post-election impression on the crypto market has been simple, with Bitcoin [BTC] skilled a exceptional improve. BTC was buying and selling at $93,515.07 on the time of writing, up virtually thirtyfold in a month. CoinMarketCap.

Because the cryptocurrency approaches the psychologically vital $100,000 mark, many are speculating that this milestone might be reached at any time.

Bitcoin Whale Motion Alerts…

Nonetheless, regardless of Bitcoin’s spectacular rally, its largest holders, sometimes called “whales,” have didn’t money in on the features.

As a substitute, they proceed to build up Bitcoin at these excessive worth ranges. This indicated a probably bullish outlook for the digital belongings going ahead.

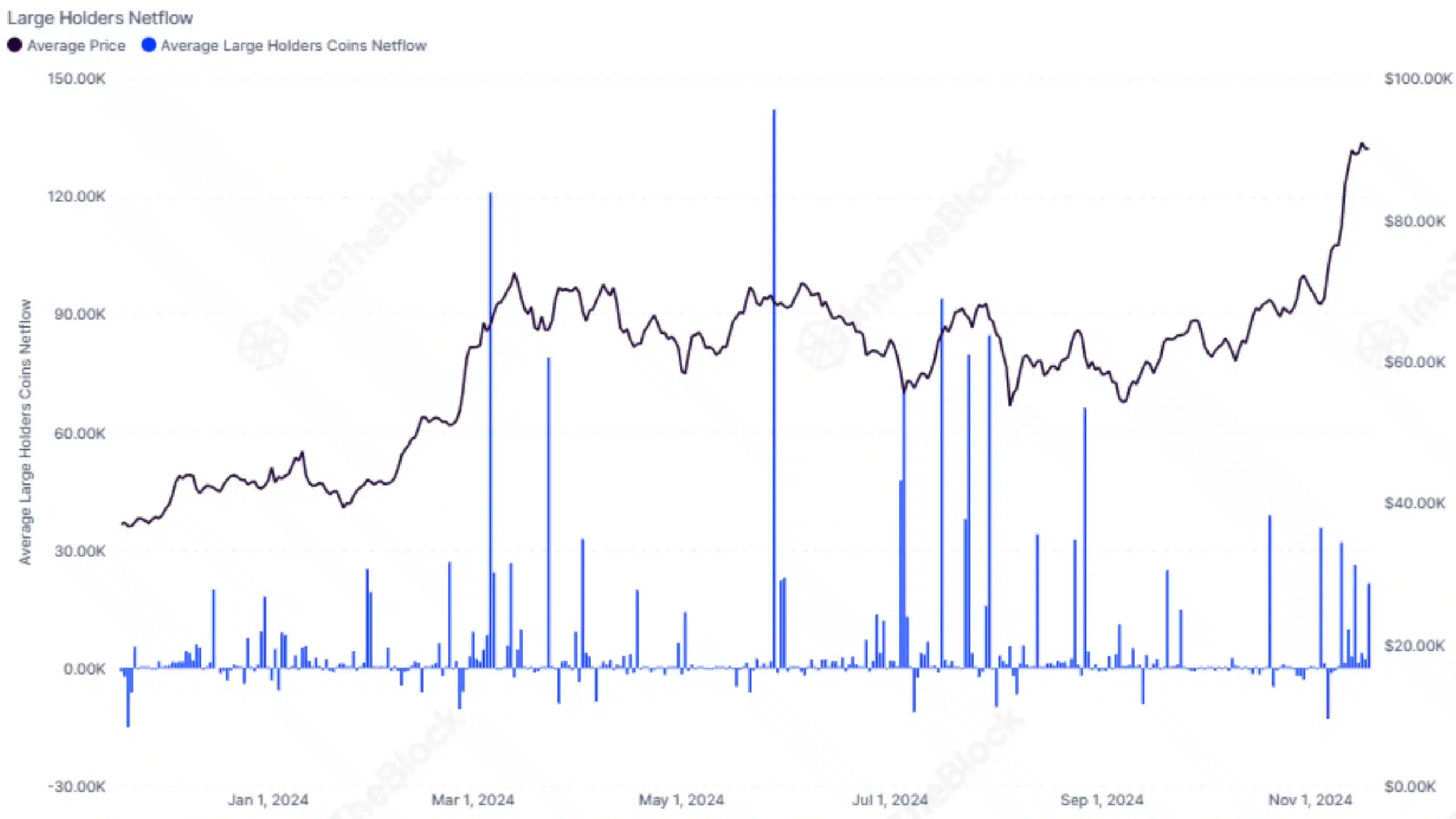

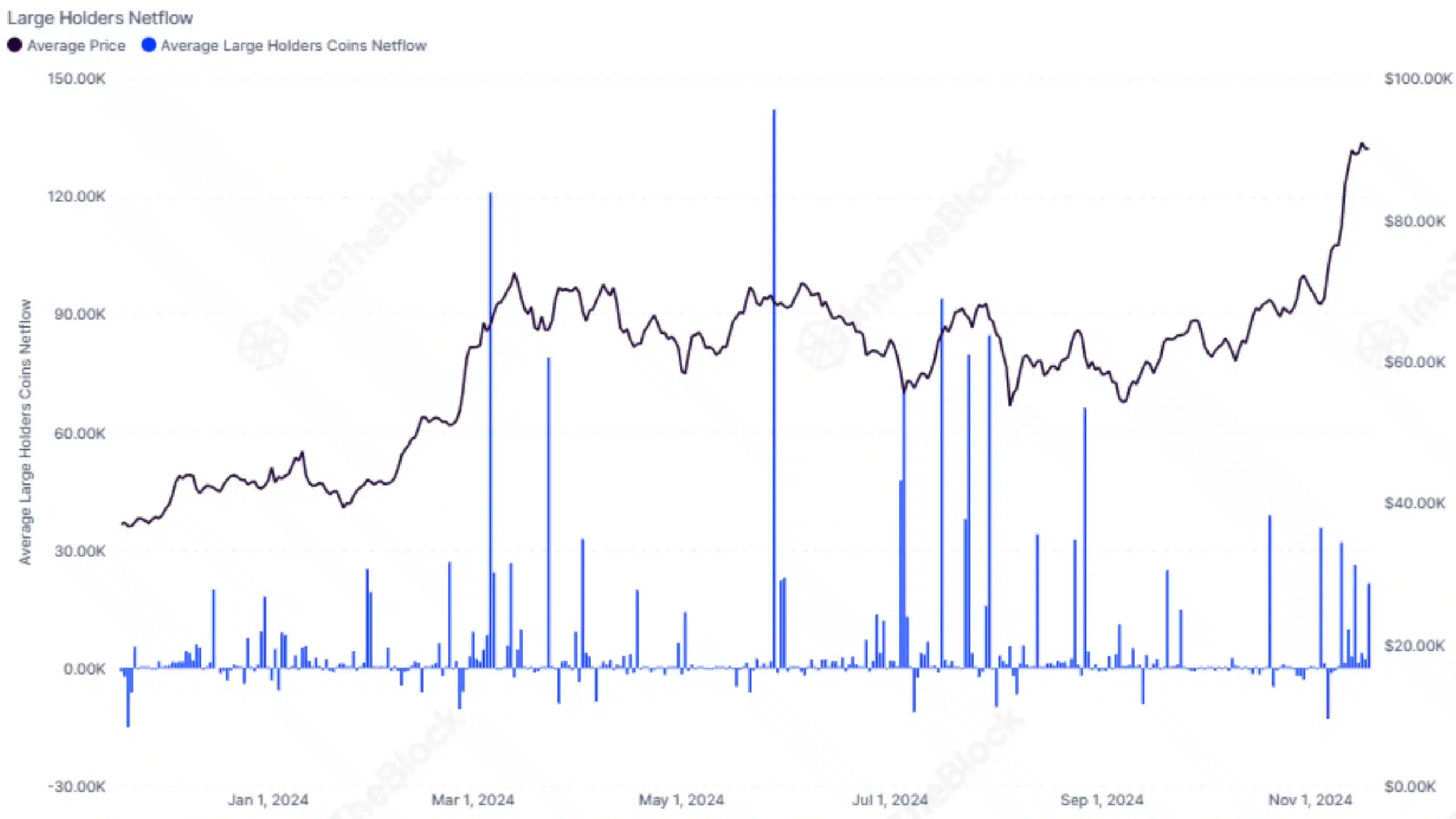

Information from an evaluation firm within the chain InHetBlok revealed that web outflows from the biggest Bitcoin portfolios have remained remarkably low all year long.

This implies that the whales didn’t promote their positions regardless of Bitcoin’s spectacular worth improve.

Slightly, they proceed to build up, which alerts robust confidence within the cryptocurrency’s long-term potential and additional signifies that these massive gamers can place themselves for even larger features sooner or later.

Supply: IntoTheBlock/X

Bitcoin’s long-term viability

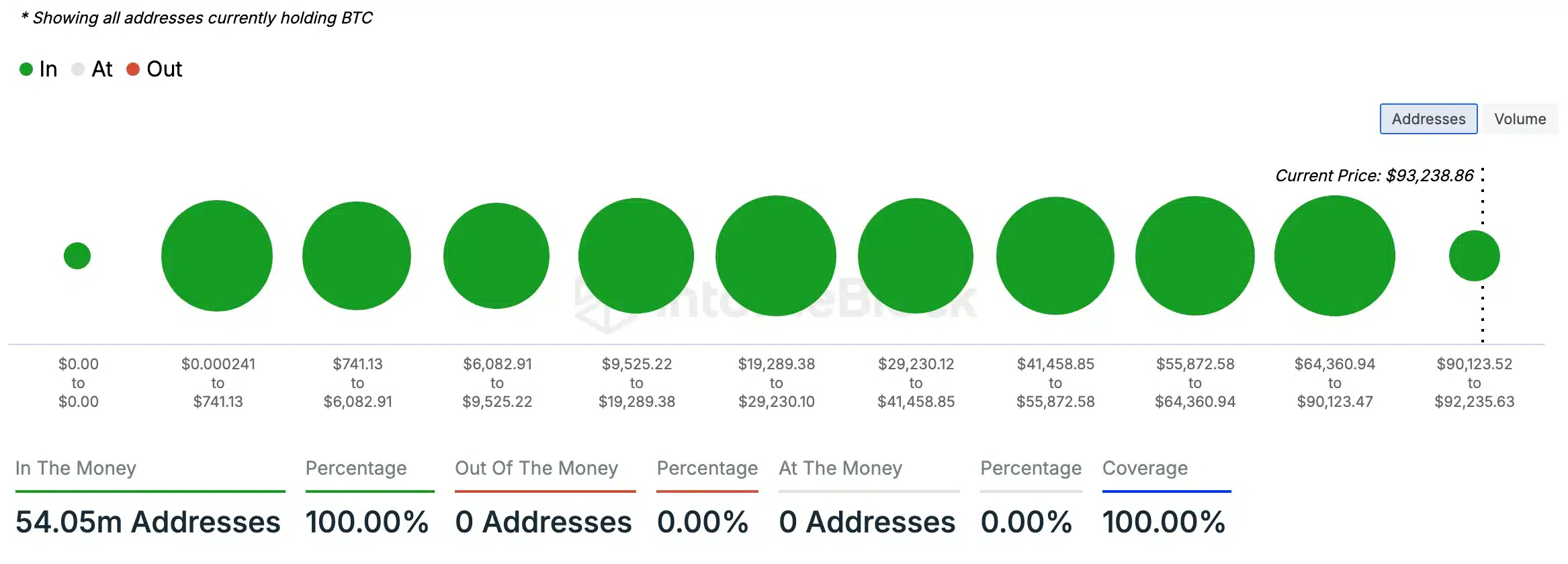

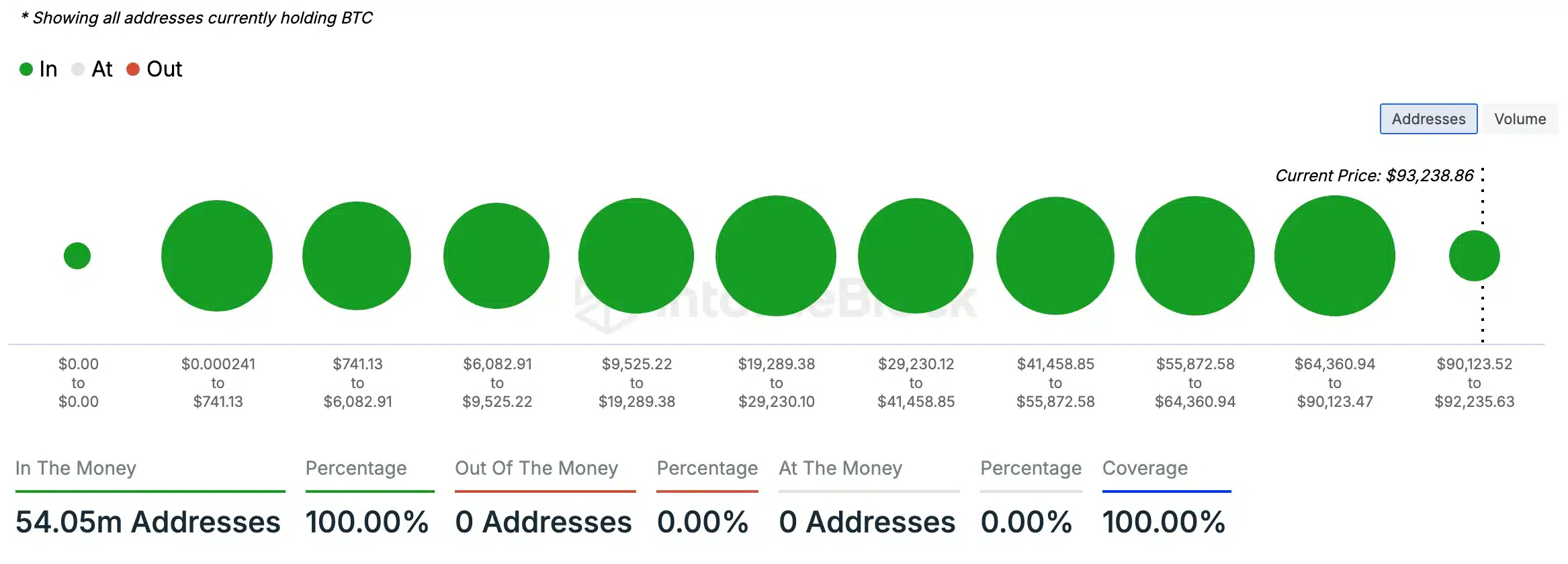

AMBCrypto’s evaluation of IntoTheBlock information additional helps this bullish outlook, displaying that 100% of Bitcoin holders at present personal tokens price greater than their unique buy worth.

Which means all BTC holders are within the cash, a transparent indication of widespread profitability.

Conversely, there have been no holders within the ‘out of the cash’ class, reinforcing the prevailing bullish sentiment round Bitcoin. This means a possible for additional worth will increase within the quick time period.

Supply: IntoTheBlock

Nonetheless, in mild of this exponential rise, some merchants are urging warning and warning of potential dangers forward.

Supply: Ash Crypto/X

Cryptocurrency inflows are rising

This follows every week by which cryptocurrency funding merchandise noticed a notable influx of $33.5 billion. Greater than $2.2 billion flowed in final week alone.

The rising momentum in cryptocurrency funding merchandise, with belongings beneath administration reaching a file $138 billion, underlines the rising confidence available in the market.

Bitcoin ETF additionally makes information

Bitcoin ETFs are seeing vital inflows, with $816.4 million coming into BTC ETFs on November 19, in response to Farside Investors.

A latest one 13F application from a number one Wall Road agency unveiled $710 million in spot Bitcoin ETFs, together with a considerable stake in BlackRock’s iShares Bitcoin Belief.

As Bitcoin’s dominance will increase, it will likely be fascinating to see how these developments form the cryptocurrency panorama. These modifications will impression the methods of each institutional and retail traders.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024