Ethereum

Bitcoin, Ethereum ETF reshaped: Grayscale finalizes reverse share splits

Credit : ambcrypto.com

- Grayscale carried out reverse inventory splits of Bitcoin and Ethereum ETF.

- Choices buying and selling for the corporate’s BTC ETFs begins right this moment.

Grayscale Investments, a digital forex asset supervisor, has accomplished the reverse inventory cut up for its Bitcoin [BTC] Mini Belief ETF (BTC) and Ethereum [ETH] Mini Belief ETF.

The adjustments took impact on November 20, following the reverse inventory cut up that came about the evening earlier than.

David LaValle, Grayscale’s World Head of ETFs, acknowledged in a latest publication blogging after,

“Primarily based on our shoppers’ suggestions, we imagine that is the correct choice and helpful for our shoppers and the funding group.”

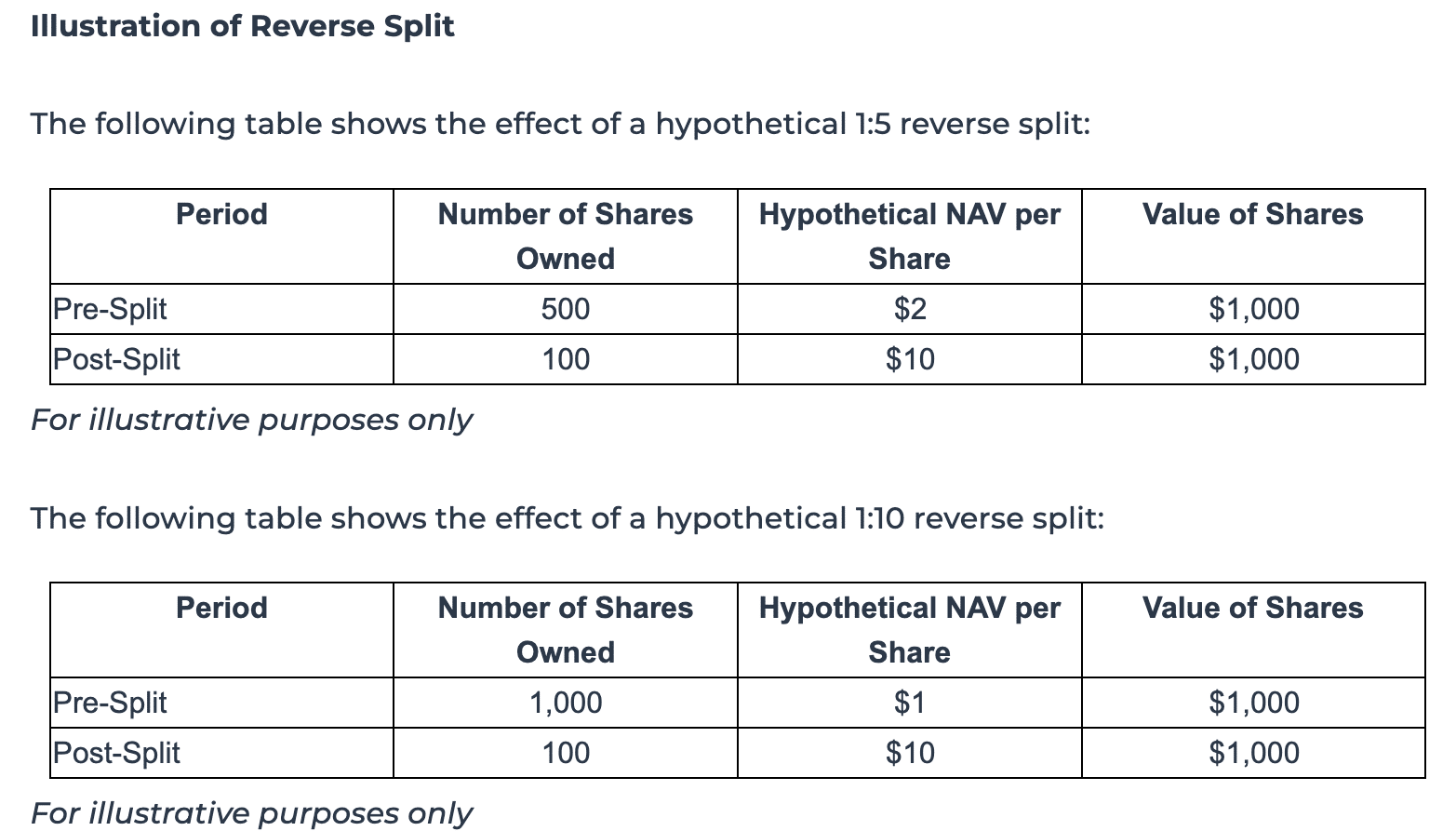

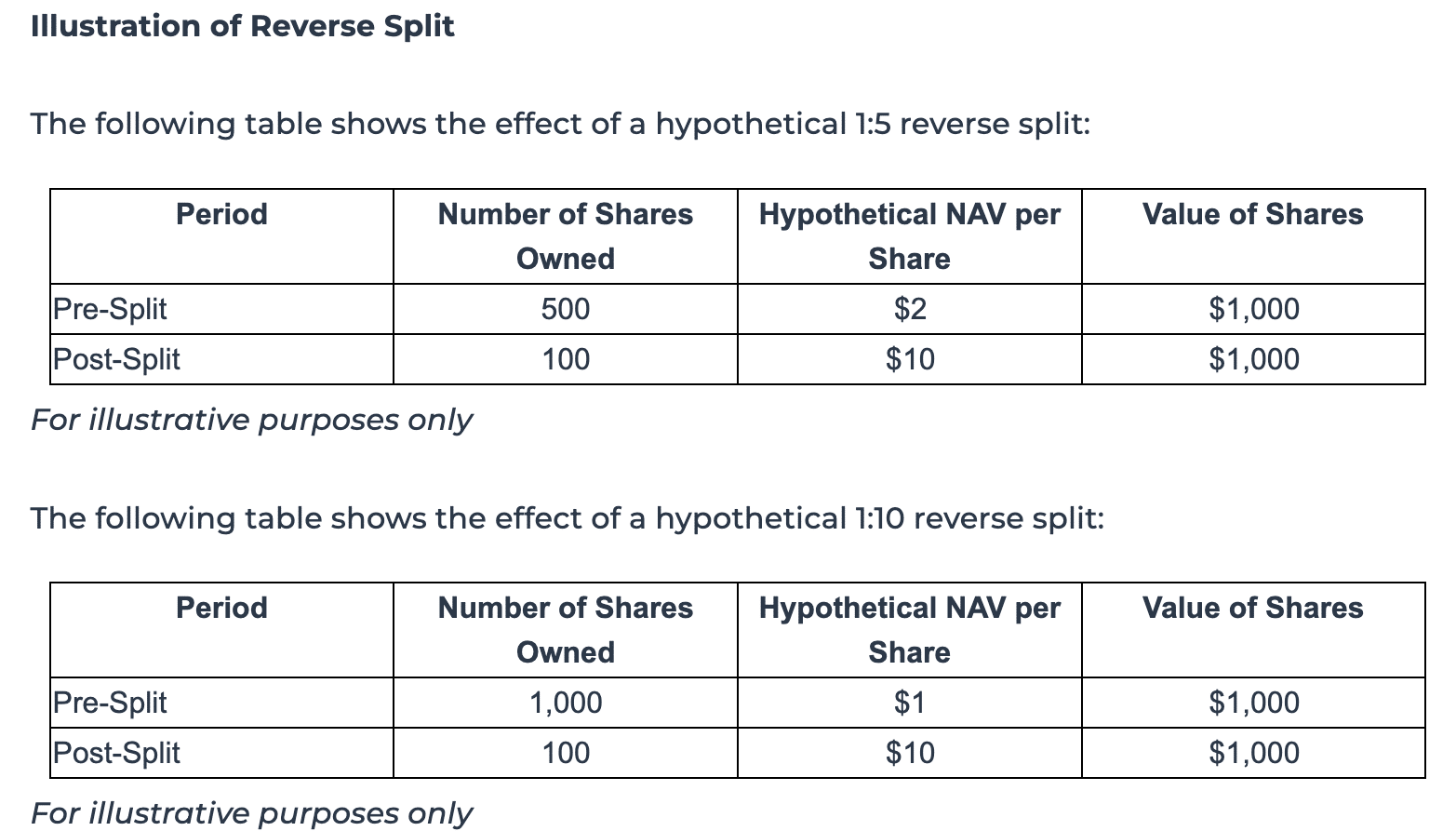

For context, a reverse inventory cut up combines a number of shares into one, lowering the overall variety of shares however rising the inventory value.

Penalties of the reverse inventory cut up

The corporate identified the advantages of reverse inventory splits, highlighting its means to streamline buying and selling and make it “cheaper” for market individuals.

On account of this newest transfer, Grayscale Ethereum Mini Belief ETF underwent a 1:10 reverse inventory cut up.

This elevated the value per share to 10 occasions the online asset worth (NAV) earlier than the cut up, whereas the variety of shares excellent was proportionally lowered.

Equally, Grayscale Bitcoin Mini Belief ETF carried out a 1:5 reverse cut up, rising its value per share to 5 occasions its pre-split web asset worth, with a corresponding lower within the variety of shares excellent.

Supply: grayscale

Nonetheless, the asset supervisor emphasised that shareholders will be capable to maintain fractional shares after the cut up.

Relying on the coverage of the Depository Belief Firm (DTC) participant, these fractional shares could also be tracked internally or pooled and offered, with shareholders receiving a money proceeds.

Notably, fractional shares will not be eligible for buying and selling on the NYSE Arca.

Grayscale’s Bitcoin and Ethereum ETF Efficiency

After the cut up, the corporate’s ETFs for Bitcoin and Ethereum confirmed combined efficiency, in accordance with Yahoo Finance.

The Bitcoin Mini Belief ETF Closed at $41.84, up 1.80% throughout common buying and selling hours.

Alternatively, the Ethereum Mini Belief ended at $28.93, representing a 0.92% depreciation. Nonetheless, it noticed a pre-market enhance to $29.58, a acquire of two.25%.

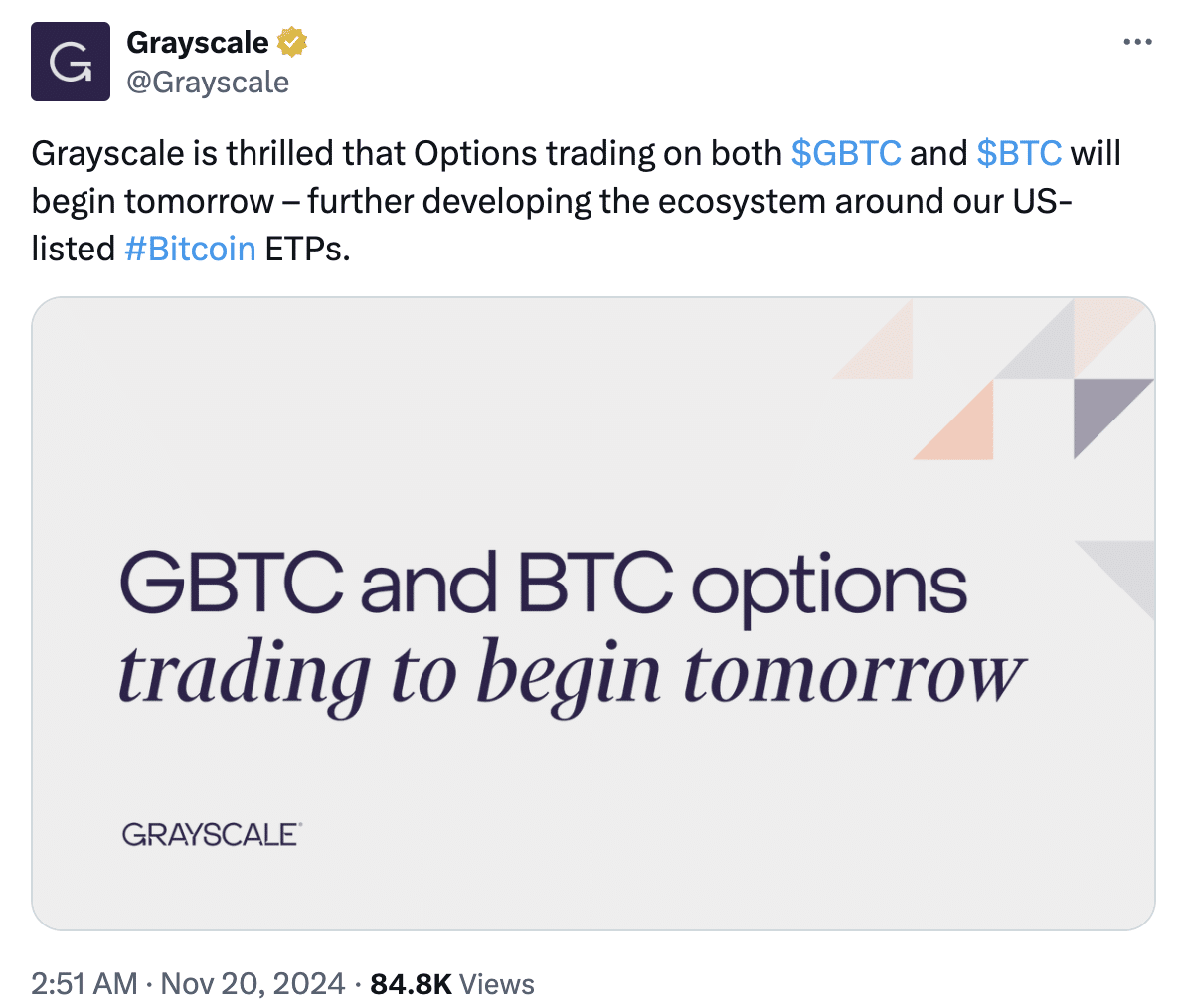

BTC ETF choices begin buying and selling

The reverse inventory cut up precedes an essential improvement for the corporate. Grayscale will launch Bitcoin ETF choices for its Grayscale Bitcoin Belief (GBTC), the Mini Belief, on November 21, marking a major growth into the US market.

The asset supervisor just lately shared its enthusiasm about this milestone after on X.

Supply: Grayscale/X

This transfer follows that of BlackRock IBIT choices debut, which noticed buying and selling quantity of almost $1.9 billion on its opening day.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024