Bitcoin

Bitcoin ETFs surpass $100B in assets: A preview of BTC’s move to $100k?

Credit : ambcrypto.com

- The entire internet belongings of Bitcoin ETFs reached $100 billion.

- The king coin is approaching a six-figure valuation.

Place Bitcoin [BTC] ETFs have reached a significant milestone: surpassing $100 billion in belongings below administration (AUM).

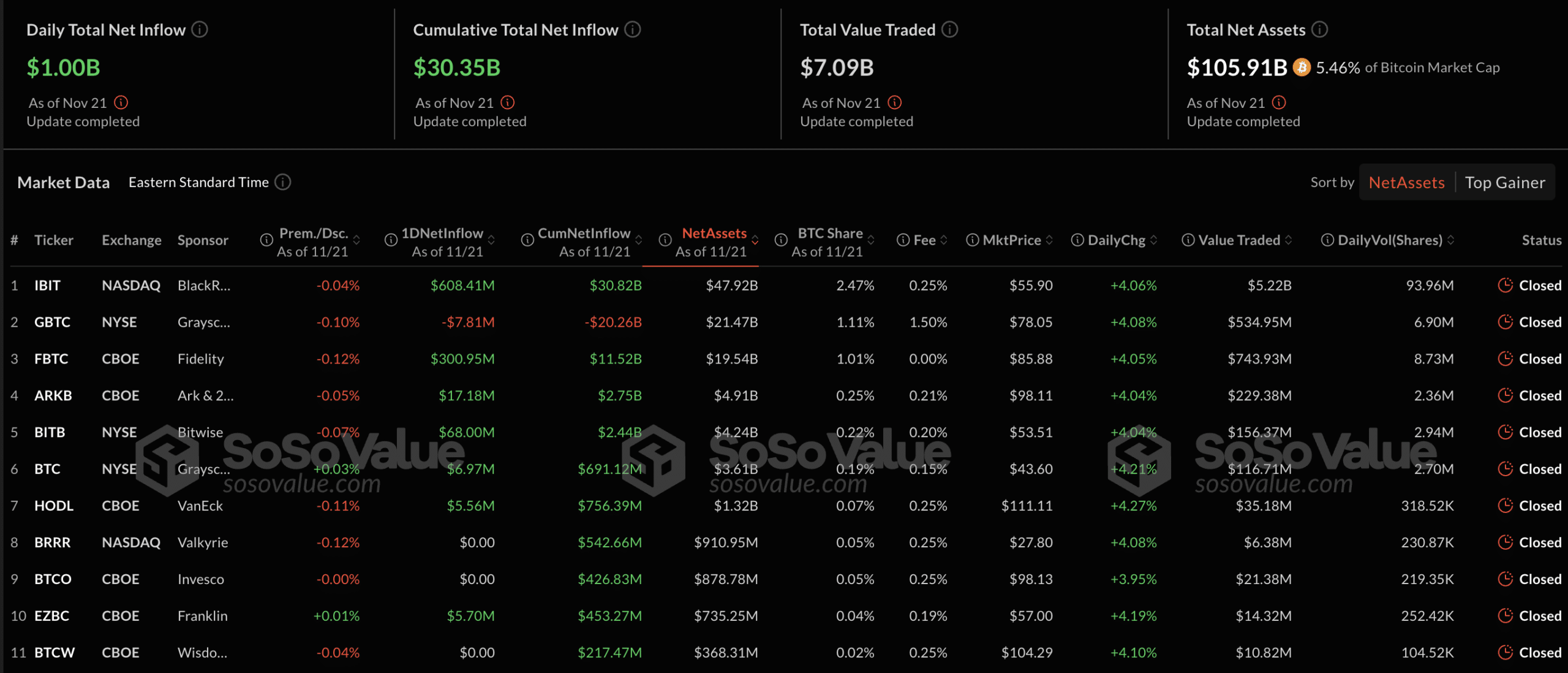

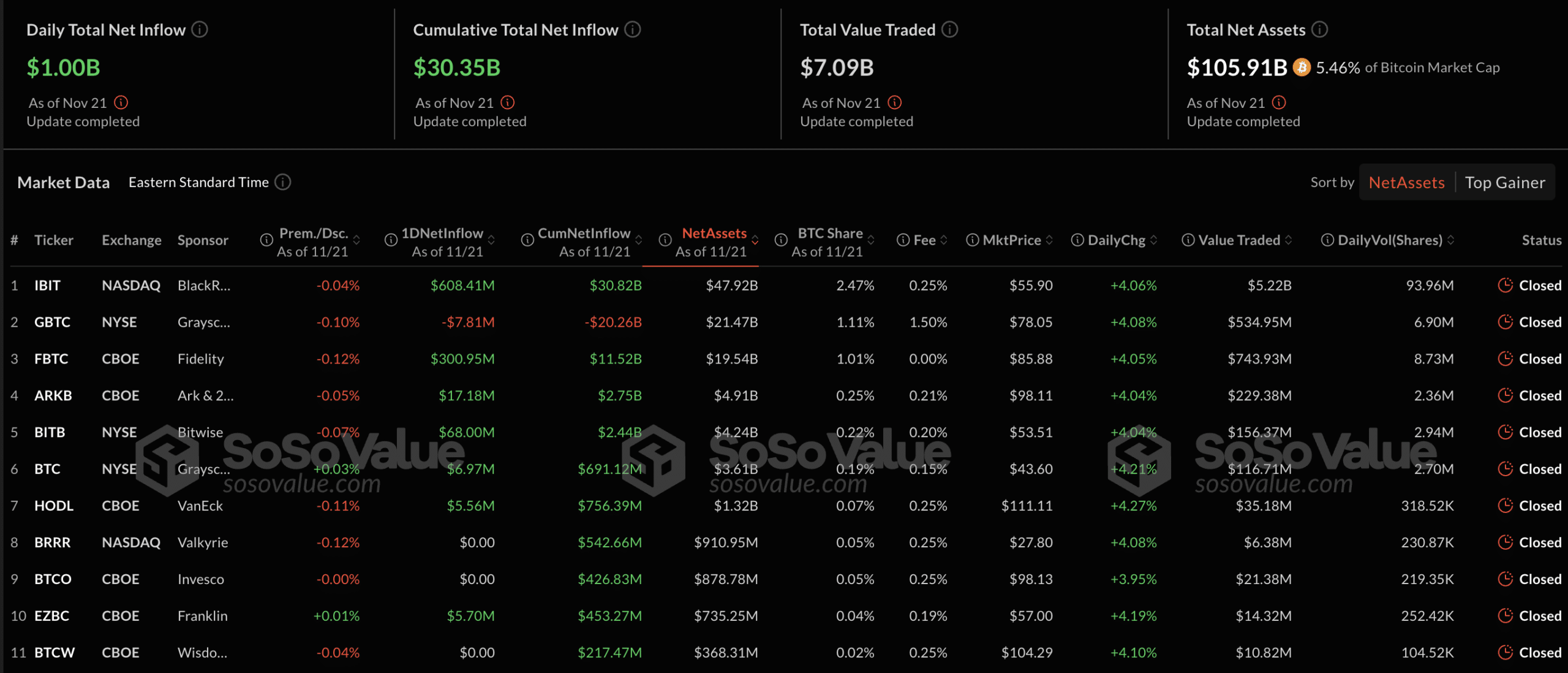

This week’s complete internet flows additionally set a document, reaching $2.89 billion with one buying and selling day remaining. Furthermore, the whole internet inflows amounted to $30.35 billion.

Eric Balchunas, Bloomberg senior ETF analyst, taken to social media platform

“Double our estimate.”

Balchunas famous that Bitcoin ETFs are actually 97% on observe to surpass Satoshi Nakamoto as the most important BTC holder and 82% nearer to overtaking gold ETFs.

Bitcoin ETF Inflows

Facts from SoSo Worth confirmed that this necessary milestone was preceded by a considerable influx because the starting of this week, which continued to strengthen because the week progressed.

On November 20, 2024, inflows rose to $796 million. On the identical time, the whole internet value exceeded the $100 billion mark. Furthermore, day by day internet inflows reached $1 billion on November 21.

Supply: SoSo worth

Notably, on the time of writing, complete internet belongings stood at $105.91 billion, representing 5.46% of Bitcoin’s market capitalization.

Unsurprisingly, IBIT was the most important contributor, with virtually half of the whole belongings value $47.92 billion. It additionally dominated the influx figures, accounting for $608 million.

IBIT additionally made a robust impression within the choices market. According to In accordance with James Seyffart, ETF analyst at Bloomberg, 97% of Bitcoin ETF choices quantity was focused on IBIT.

BTC to $100,000?

In the meantime, Jeff Park, head of Alpha Methods at Bitwise, celebrated the achievement on to report:

“It is just becoming that we have fun this milestone with Bitcoin reaching $100,000.”

Apparently, this comes as Bitcoin hit a brand new ATH of over $99,300, which was nearer to a six-figure valuation. On the time of writing, BTC was buying and selling at $99,057, reflecting a day by day improve of 1.98%, based on CoinMarketCap.

However how far can BTC go earlier than the rally loses steam? Benjamin Cowen, CEO of Into The Cryptoverse shared insights about this.

He drew parallels between Bitcoin’s trajectory till the launch of QQQ in 1999, which rose from $48-$49 to $120 in 54 weeks regardless of temporary pullbacks.

Cowen famous that Bitcoin ETFs launched at practically $48,000 with a 54-week time period ending January 20, coinciding with Donald Trump’s Inauguration Day and SEC Chairman Gary Gensler’s anticipated expectation. dismissal.

The director famous:

“What are the probabilities that BTC will rise till mid-January (together with #BTC’s dominance), after which BTC/USD will right because it often does in January of post-halving years?”

A brand new milestone for Bitcoin

Including to Bitcoin’s momentum, Balchunas highlighted one other win for the king coin as buying and selling quantity for the “Bitcoin Industrial Complicated” hit a brand new document excessive.

He wrote:

“BITSANITY: Let’s try $70 billion in quantity as we speak for the Bitcoin Industrial Complicated, breaking yesterday’s document”

Of this, Balchunes famous that $50 billion got here from MicroStrategy (MSTR) and associated merchandise, whereas IBIT contributed $5 billion – the second highest buying and selling day.

With Bitcoin ETFs breaking information and the king coin approaching $100,000bullish sentiment available in the market continues to rise.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now