Bitcoin

Bitcoin’s $100K dream on hold: How bears are keeping BTC stuck in a loop

Credit : ambcrypto.com

- Bitcoin stays caught under $100,000 regardless of an 81% likelihood of reaching this.

- Bears have proven that reaching this milestone is not going to be simple; persistence can be examined.

Bitcoin [BTC] buyers have had a rollercoaster week, with excessive hopes for the cryptocurrency’s historic $100,000 milestone. Regardless of high analysts assign With an 81% chance that BTC would obtain this aim, the weekend ended with out the anticipated breakout, leaving the market tense.

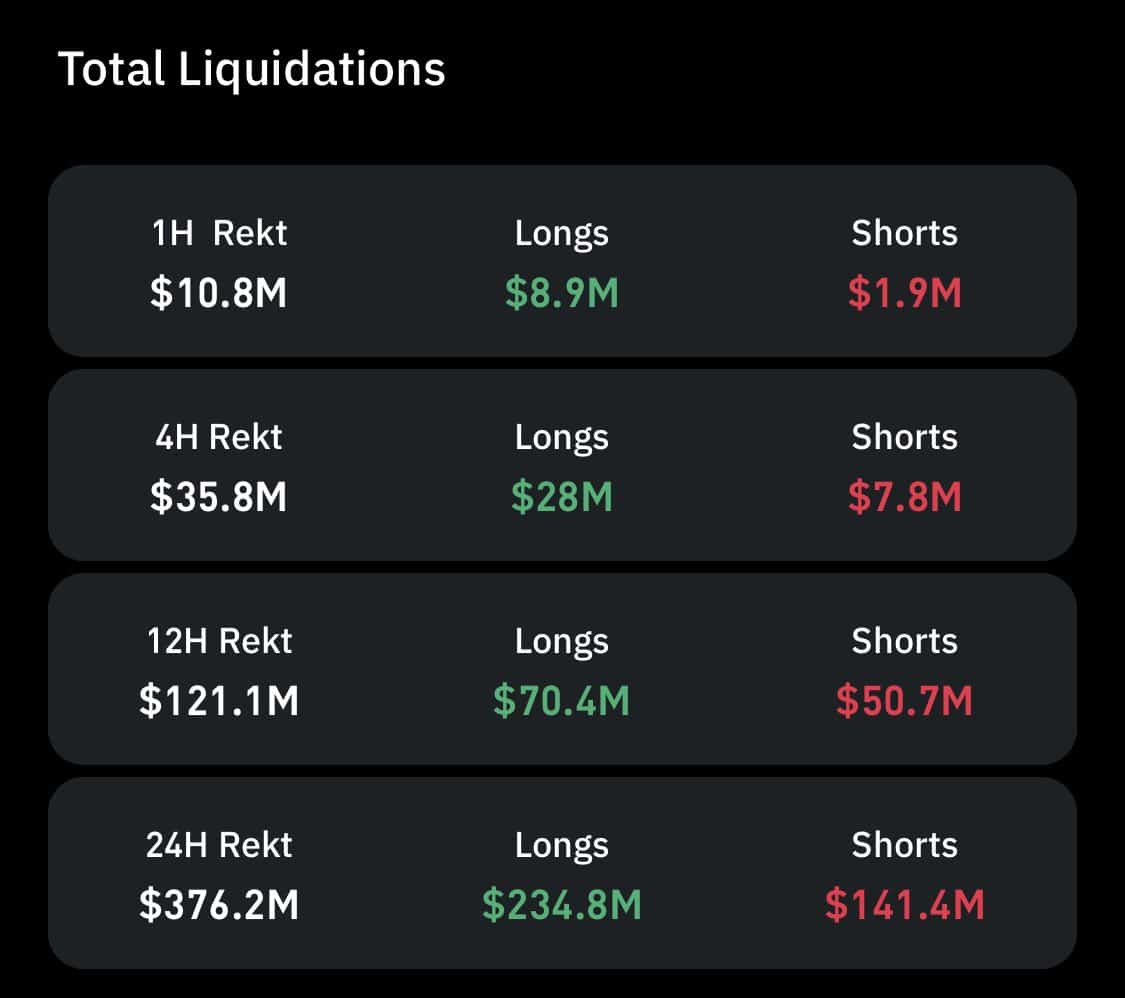

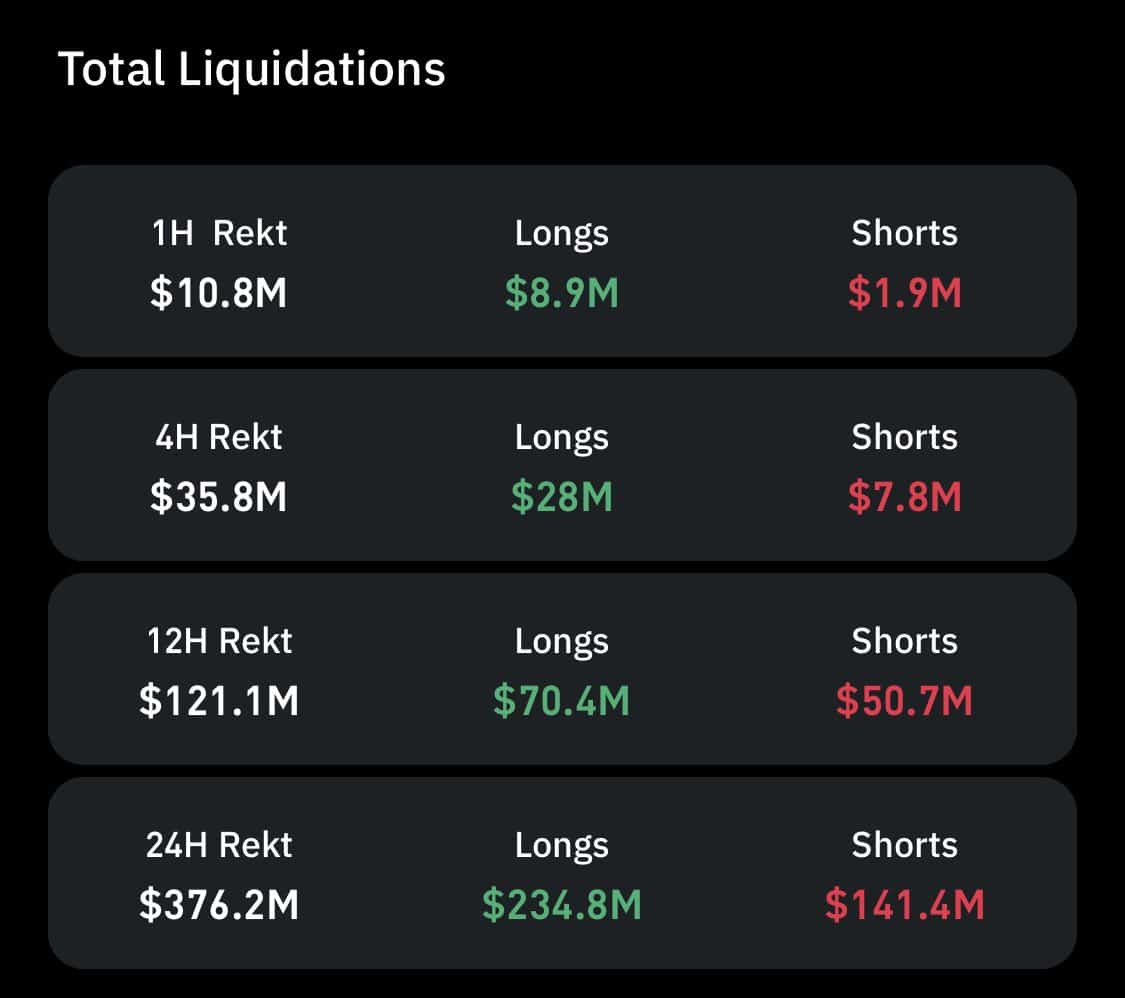

The previous 24 hours have solely elevated the drama. As many as 160,527 merchants had been liquidated, accounting for $376.22 million in losses, as risky worth actions disrupted each lengthy and quick positions.

This enhance in liquidations highlights the extreme volatility gripping the derivatives market. Is that this a warning of an even bigger market shift forward?

Lengthy squeeze is activated because the bear technique performs out

Present lengthy/quick proportions reveal a bearish tilt, with merchants closely shorting Bitcoin.

This imbalance comes with a warning: Extreme leverage within the derivatives market might result in sudden corrections or perhaps a long-term squeeze – a hidden catalyst that could be driving Bitcoin’s current turnaround.

Over $234 million in lengthy positions had been liquidated within the final 24 hours – a staggering 65.96% enhance in comparison with $141 million briefly liquidations.

Supply: Coinglass

This large disparity underlines the volatility within the recreation, as “longs” (bets on worth rises) had been compelled to shut their positions following Bitcoin’s dip from its all-time excessive of $99,317 simply two days in the past.

In easy phrases, when Bitcoin skilled a minor downturn, merchants to leave their positions to attenuate losses – a rational transfer given the excessive stakes at present worth ranges. Bears seized this chance, possible triggering a cascade of long-term liquidations.

That is in step with the present bull cycle, the place BTC, regardless of fast positive factors, has averted overheating hypothesis because of the dominance of lengthy positions.

Nevertheless, even a small deviation from the bullish path offered a gap for bears to use strain. The end result? An extended-term strain that compelled merchants to liquidate their positions, resulting in an almost 2% drop in Bitcoin’s worth.

Whereas a breakout to $100,000 might nonetheless occur, market volatility is changing into more and more obvious.

As BTC nears a historic milestone, buyers are adjusting their portfolios – both shifting consideration to different extremely capitalized belongings or cashing out with spectacular positive factors.

If this development continues, bears will possible profit from the ensuing volatility each time BTC posts a brand new ATH, inflicting lengthy worth will increase. This might push BTC right into a long-term loop until an exterior catalyst disrupts this sample and causes a breakout.

The $100,000 dream could possibly be on maintain for now

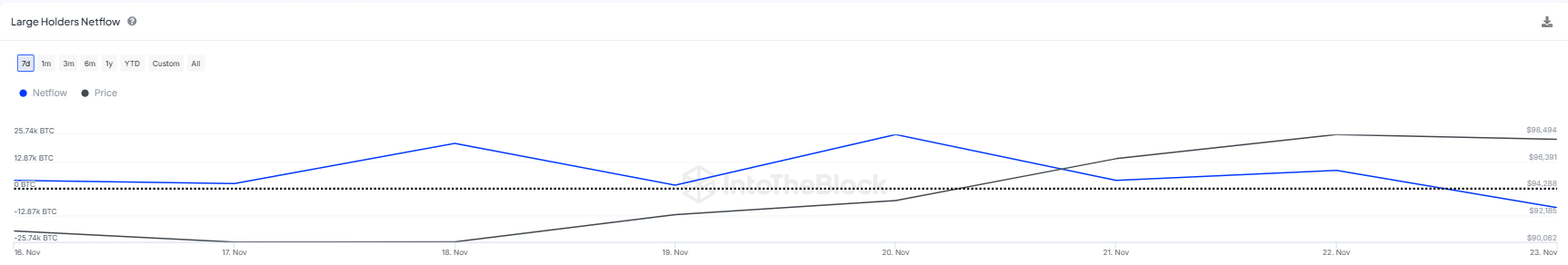

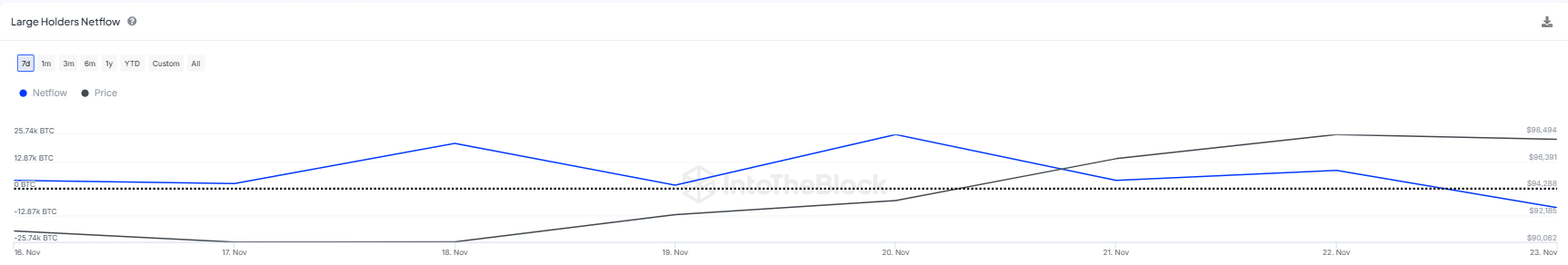

Apparently, Whales have deposited roughly 10,000 Bitcoins over the previous two days at a worth of $98,121, which quantities to a major complete of roughly $981 million.

Supply: IntoTheBlock

Extra particularly, this reinforces AMBCrypto’s earlier evaluation highlighting how bears benefited from the seismic shift as whales misplaced their belongings.

The maneuver prompted a worth drop, permitting quick sellers to take management. This compelled lengthy positions to be liquidated in an try to attenuate threat.

Learn Bitcoin’s [BTC] Worth forecast 2024-25

So whereas anticipation for the $100,000 milestone is rising, it will not be a straightforward journey.

Each time Bitcoin approaches that worth goal, a wave of exits – from huge HODLers, swing merchants or miners – creates the right surroundings for bears to take management. This cycle retains Bitcoin caught in a perpetual loop, stopping a clean climb to its historic milestone.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now