Altcoin

LCX crypto rises 90% in 7 days with 120% volume increase: next stop?

Credit : ambcrypto.com

- LCX breaks a descending channel and targets $0.31732, with bullish momentum quickly growing.

- On-chain indicators and rising exercise assist the rally, however the overbought RSI requires warning.

LCX crypto [LCX] has taken the crypto market by storm with a staggering 90% rally in simply seven days, capturing the eye of merchants all over the world.

On the time of writing, LCX is buying and selling at $0.20528, with a buying and selling quantity enhance of 120% within the final 24 hours. However what fuels this exceptional achievement, and may the momentum proceed?

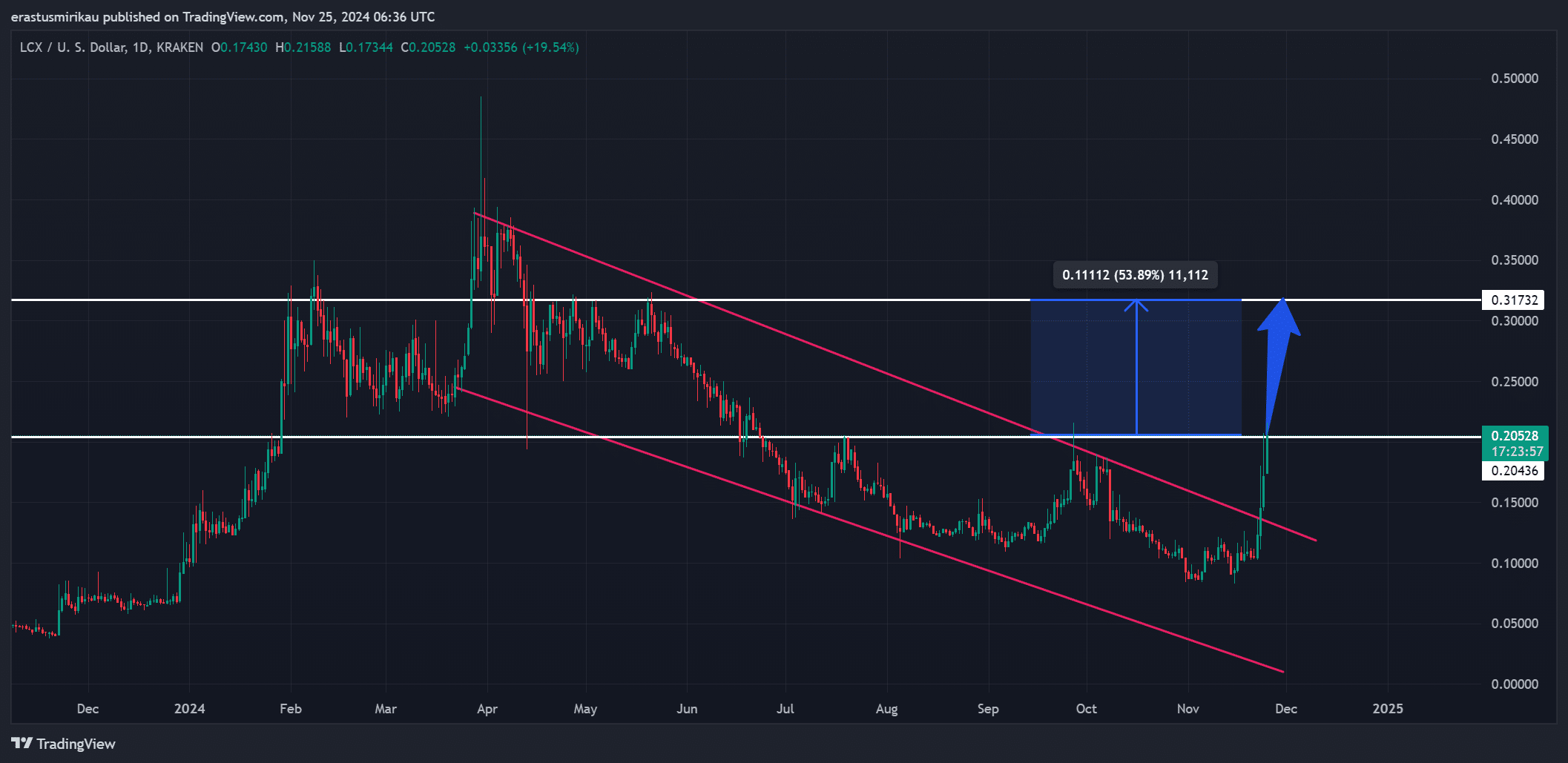

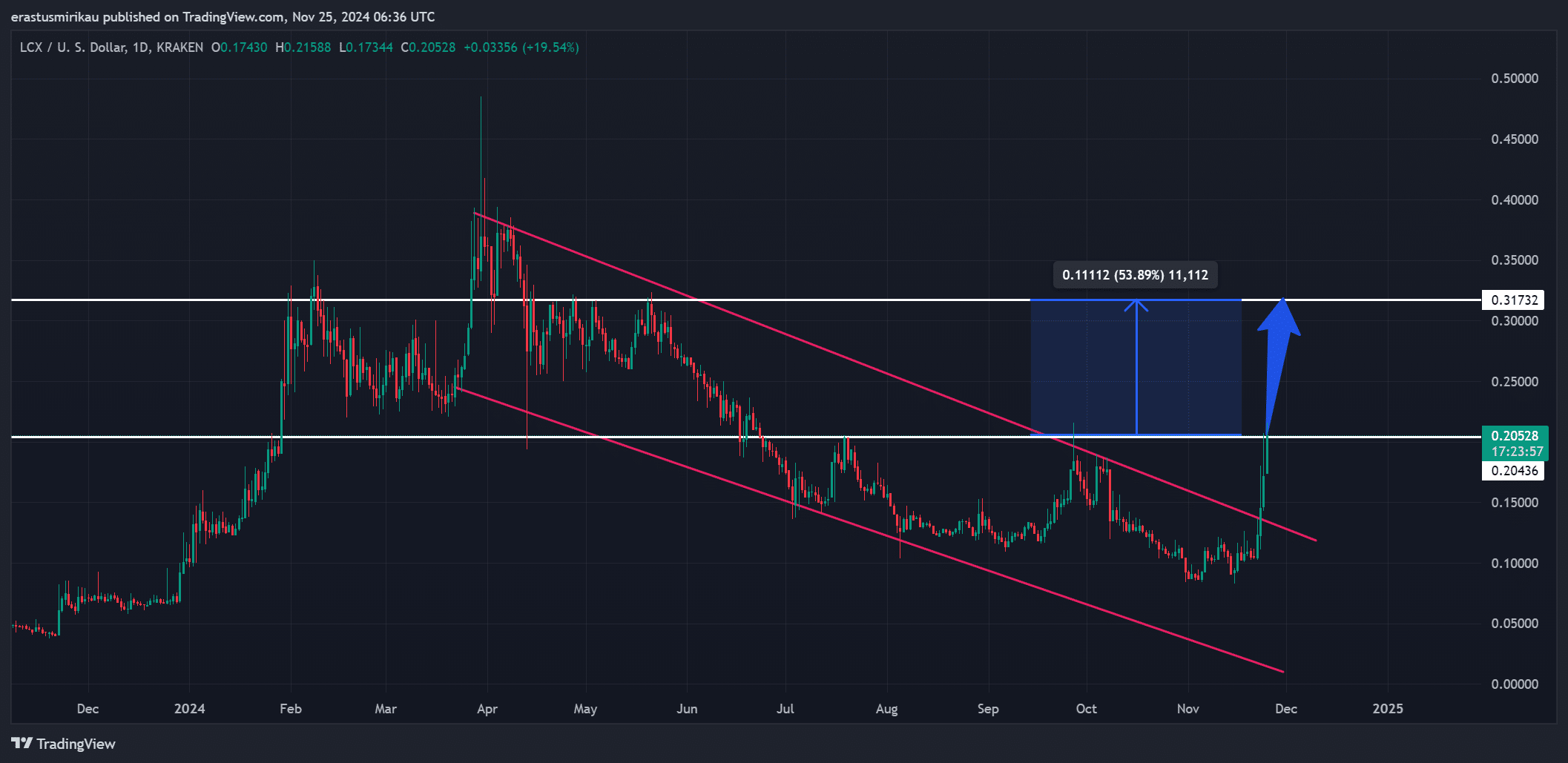

Breaking the descending channel with main resistance in sight

LCX just lately broke away from a long-term bearish channel that had capped its value since early 2024. This breakout marks a transparent shift in momentum as bulls pushed the worth up 19.54% intraday.

In consequence, the main target now shifts to the essential resistance stage at $0.31732, which represents a possible upside of 53%.

If LCX can keep this upward trajectory, it may imply a long-term bullish rally. Nevertheless, a failure to carry above the earlier assist, which has changed into resistance, at $0.173 may result in bearish strain.

Supply: TradingView

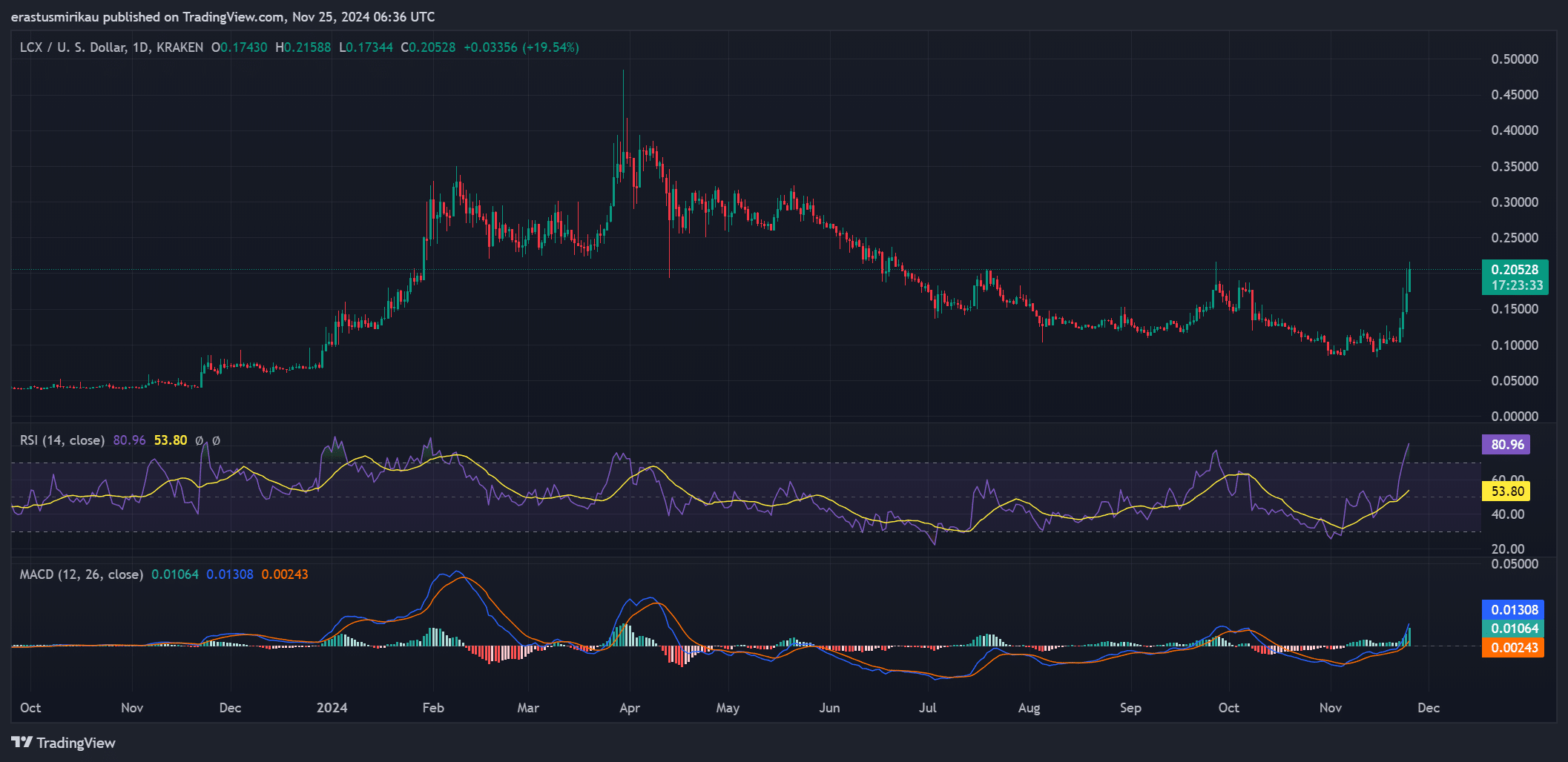

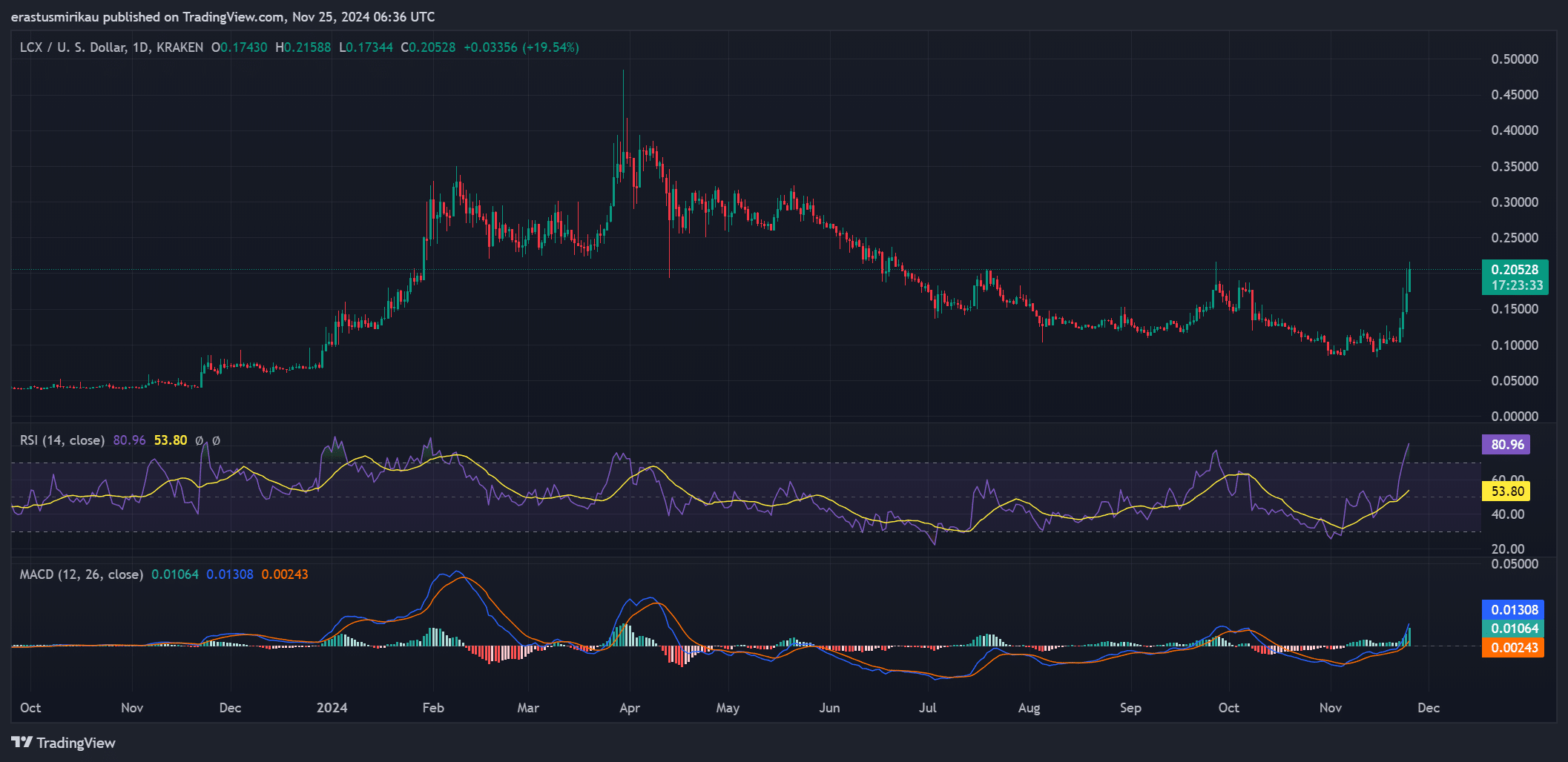

MACD and RSI paint a bullish however cautious image

The MACD indicator is exhibiting robust upward momentum. The MACD line has crossed the bullish space above zero, and the widening hole between the MACD and the sign strains confirms the client’s dominance.

Moreover, the RSI has risen to 80.96, indicating an overbought state of affairs. Whereas this displays the extreme shopping for exercise, it additionally warns of a potential near-term pullback as merchants begin to make earnings.

Whereas momentum stays on the bulls’ aspect, warning is suggested.

Supply: TradingView

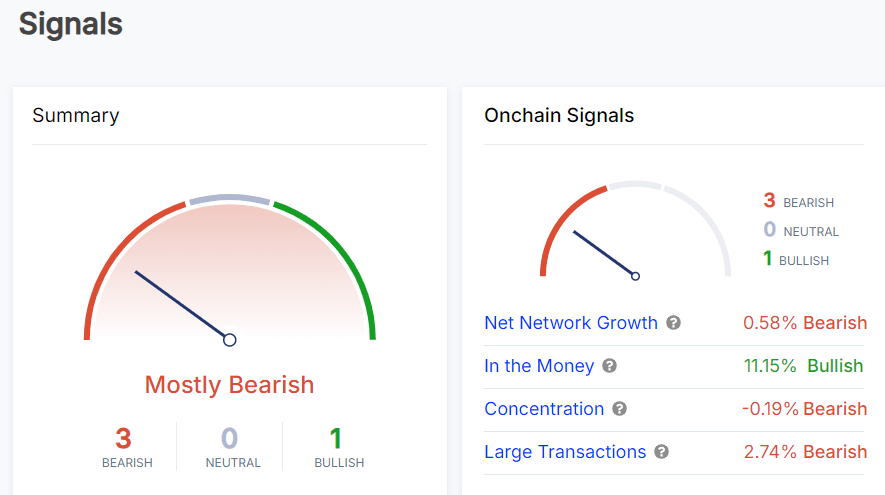

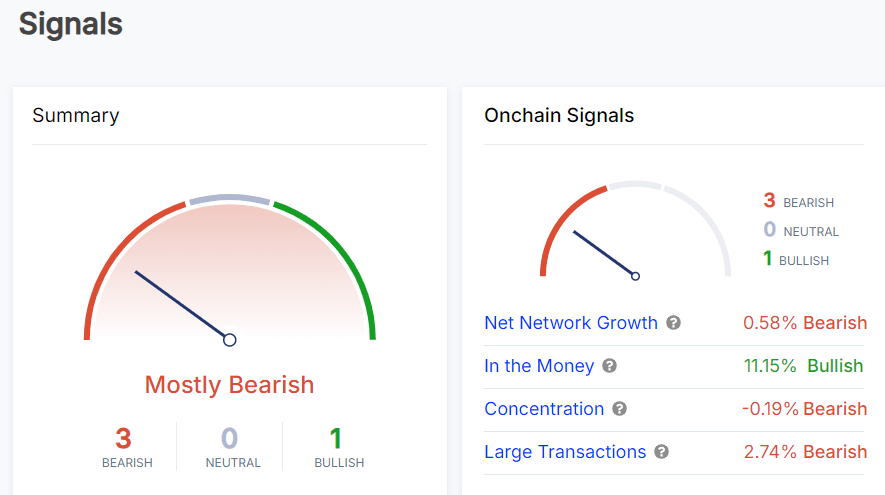

Alerts on the chain present blended statistics

Information concerning the chain offers a nuanced image. Whereas 11.15% of buyers are within the cash, indicating profitability, different figures point out warning.

For instance, web community development is up simply 0.58%, whereas massive transactions are down 2.74%, indicating declining curiosity amongst bigger buyers. Thus, whereas retail exercise seems sturdy, institutional participation could also be restricted.

Supply: IntoTheBlock

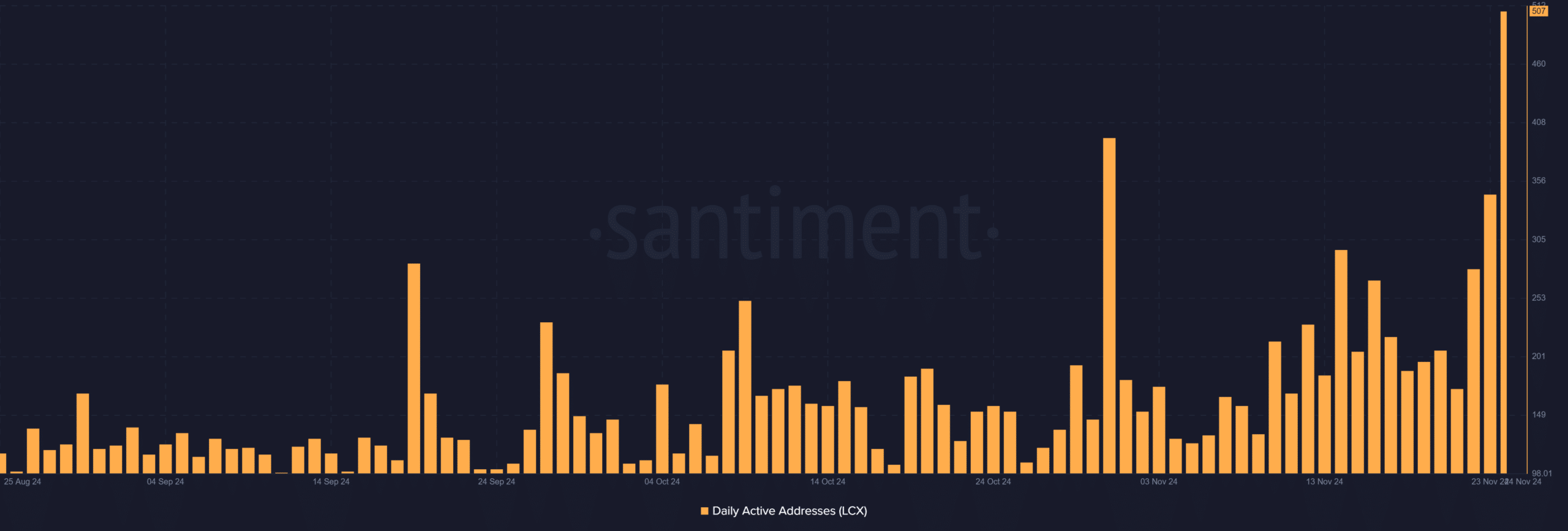

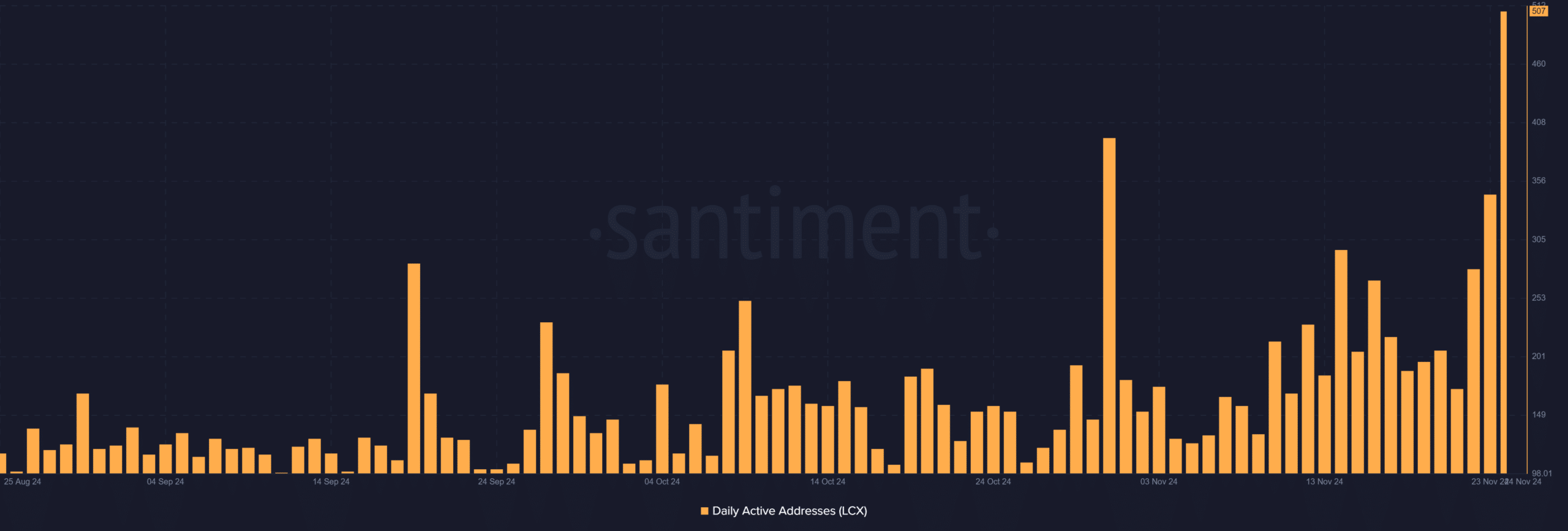

Day by day energetic addresses enhance together with the worth

LCX’s day by day energetic addresses just lately rose to 507, a big enhance that aligns with the token’s current rally. This development in person exercise provides credibility to the rally, as elevated community engagement usually comes with value will increase.

Supply: Santiment

Can LCX keep its momentum?

LCX’s present rally is fueled by technical points and growing person exercise. Nevertheless, overbought RSI ranges and blended indicators within the chain elevate questions on sustainability. If LCX manages to beat the resistance at $0.31732, it may present additional upside potential.

Nevertheless, if present ranges are usually not maintained, it may result in a relapse. For now, LCX seems poised to proceed its bullish trajectory, however merchants ought to hold a detailed eye on key resistance ranges and market sentiment.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024