Altcoin

Ethereum’s Rise to $3.6K: Speculation Grows, But Is a Pullback Still Likely?

Credit : ambcrypto.com

- Ethereum’s rise to $3.6K is extra speculative in nature as whales make the most of the excessive volatility.

- With open curiosity (OI) at an all-time excessive, the $4K goal for ETH appears additional away.

Ethereum [ETH] is up nearly 15% this week, recovering $3,600 for the primary time in seven months. Regardless of every week of revenue taking and consolidation after every lengthy inexperienced fuse, there was no vital pullback.

FOMO-driven shopping for suggests leverage on retracements, with weak palms exiting, positioning ETH for a potential rebound. Nevertheless, this rally is essentially pushed by extremely leveraged futures, with open curiosity for each longs and shorts hitting a report $24.08 billion.

Whereas Bitcoin’s ‘slight’ restoration supplies optimism, Ethereum’s breakthrough to $4K seems unlikely as a consequence of vital liquidity build-up, leaving the door open for a correction until key circumstances match.

Excessive leverage may create a robust resistance barrier

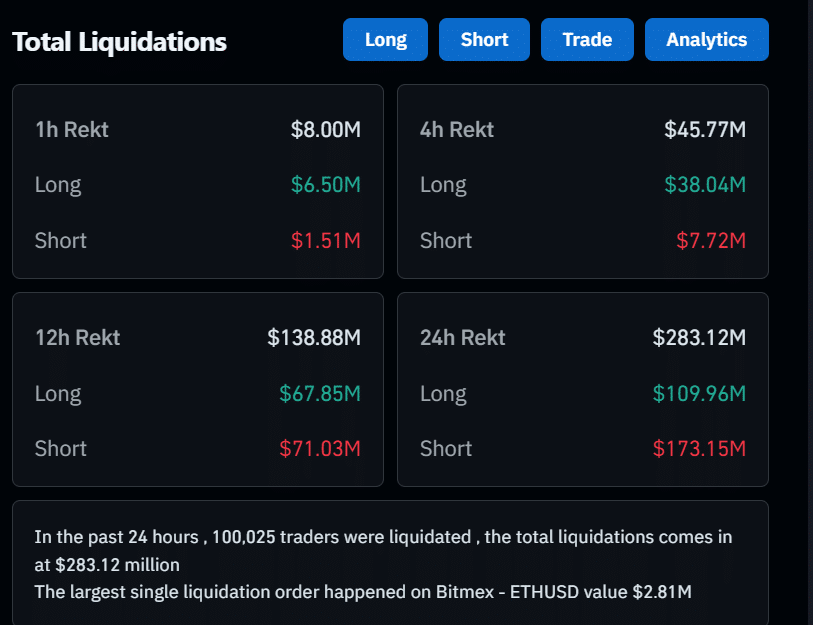

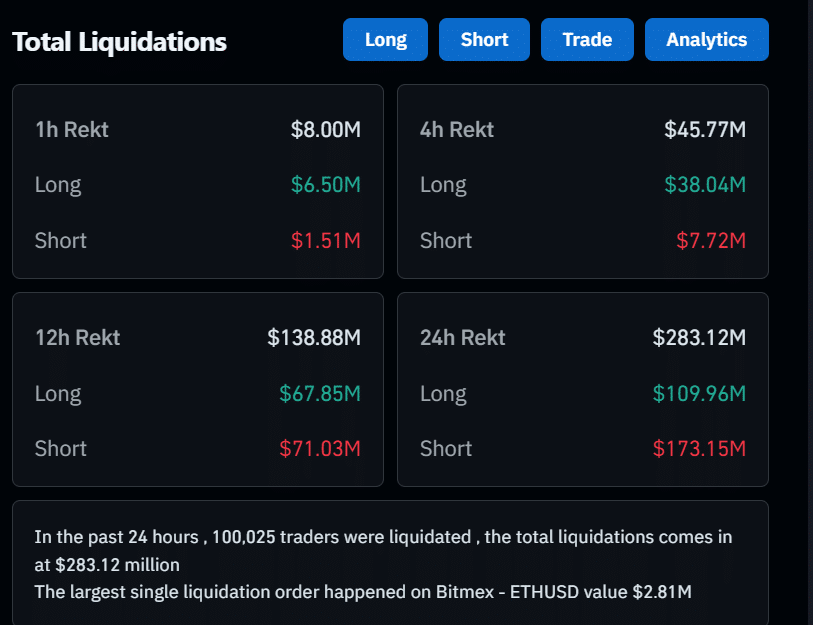

Within the final 24 hours, complete liquidations amounted to $283.12 million, with shorts hit the toughest, dropping nearly $173 million. This comes because the market recovers, with most main cash posting sturdy positive factors, together with ETH, which rose practically 9% to reclaim the $3.6K vary.

Notably, ETH noticed the most important liquidation order on Bitmax, totaling $2.81 million. Whales, accumulating round 50 million ETH tokens, seemingly triggered a significant quick squeeze, pushing the worth right into a key resistance zone.

Merely put, Ethereum confronted a “tug of conflict” this previous week, with bulls and bears battling for management. The bulls ultimately received, when the whales stepped in and compelled quick sellers to purchase again their positions, inflicting a notable worth enhance.

Supply: Coinglass

Now the actual take a look at begins. A brief-term goal of $4,000 may turn into a actuality if the whales proceed their technique within the coming days and stabilize the worth round $3.8,000. This might make $3.8K a psychological stage, attracting new market curiosity and paving the best way for a possible breakout to $4K.

Nevertheless, it’s worthwhile to contemplate each inner and exterior components. Bullish exercise throughout knowledge units is crucial to reaching the short-term goal.

With out this, Ethereum’s rise may hit a roadblock. With record-breaking exercise within the derivatives market, even a small distinction may give the bears a chance to use strain.

The end result? Short sellers may take management, resulting in a short-term correction again to the $3.5K vary.

Ethereum’s rise is probably going on the mercy of whale help

Of this graphicit’s clear that increasingly traders are taking over excessive leverage threat in derivatives buying and selling, with the leverage ratio reaching a report excessive. This means that the current rise is pushed extra by hypothesis than fundamentals.

This isn’t shocking, contemplating that Ethereum’s worth actions, because the second largest cryptocurrency by market capitalization, are inclined to mirror these of Bitcoin. Traders are carefully watching BTC’s actions to find out whether or not to go lengthy or quick ETH.

With Bitcoin recovering over 4% and returning to the $95K band, Ethereum bulls have responded positively. Whales see this as a significant catalyst for a short-term surge.

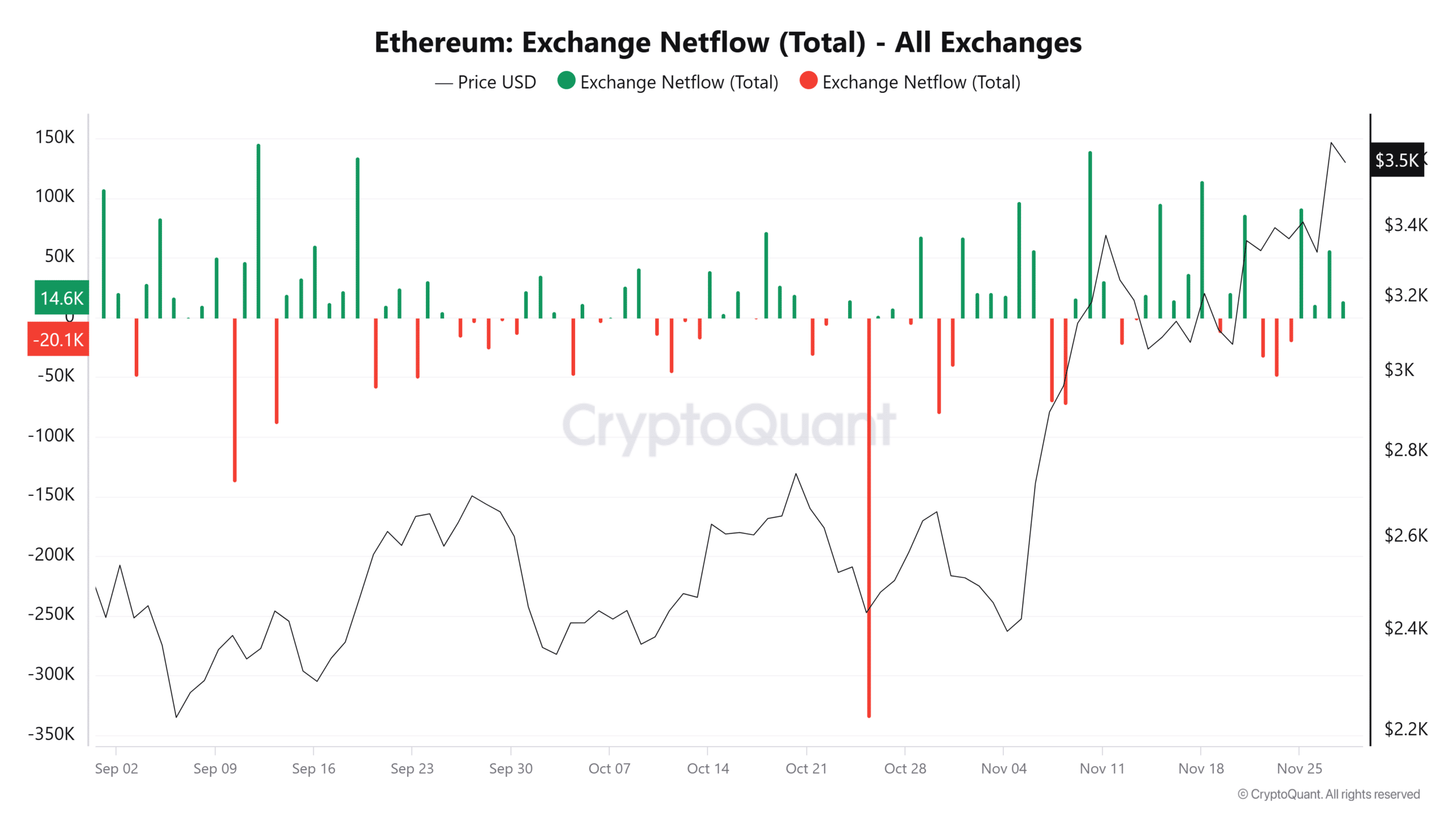

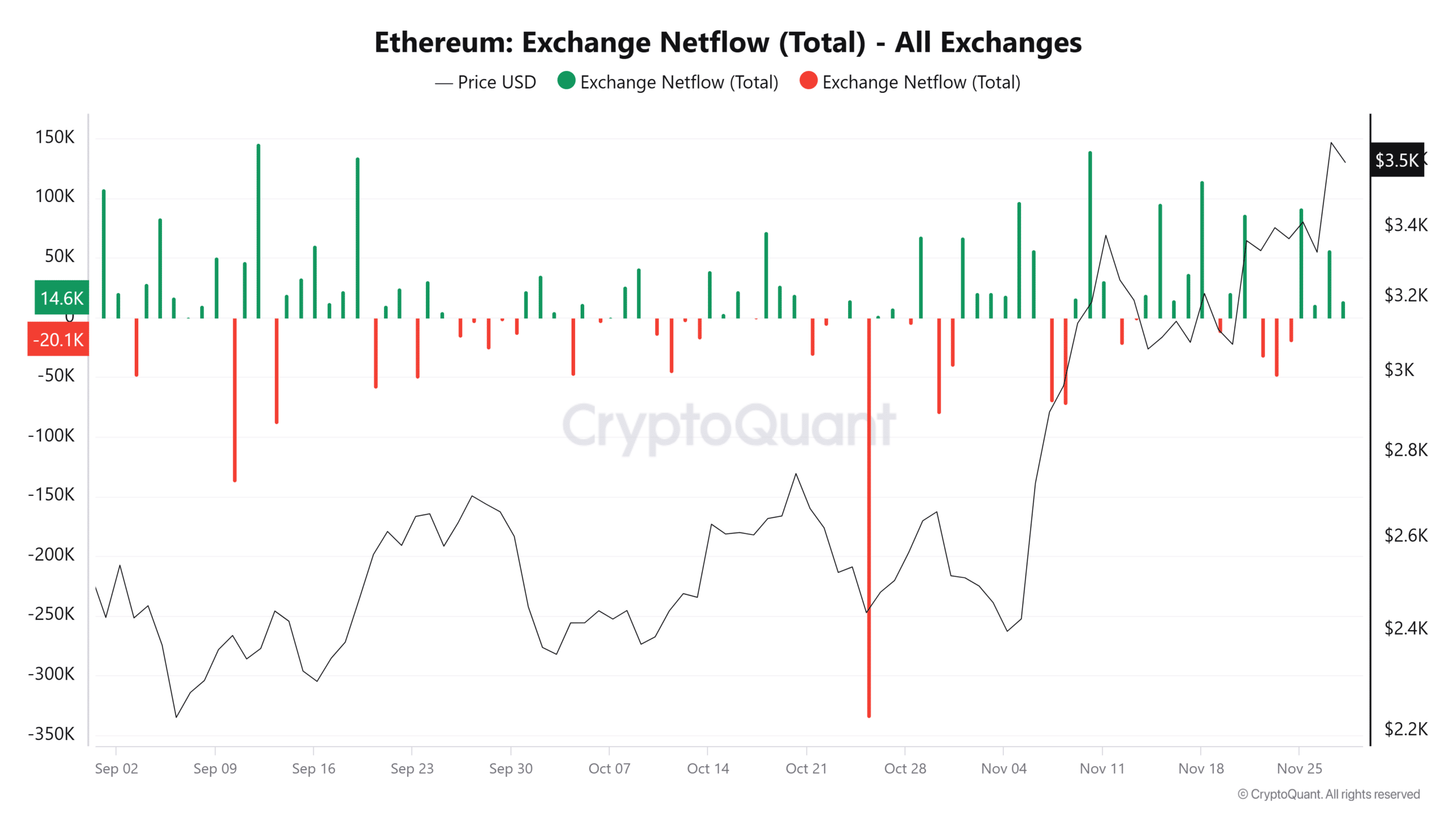

Furthermore, the online movement has turned constructive over the previous 4 days as increasingly weak palms go away the market.

Supply: CryptoQuant

However in contrast to earlier cycles, the place every inexperienced bar indicated a possible prime and an impending correction, this time the whales absorbed the strain, driving a worth enhance of virtually 10%.

That mentioned, the mounting strain across the present worth shouldn’t be underestimated as Ethereum’s rise is more and more depending on continued help for whales.

However what occurs when that help disappears? Any further the volatility index stands at 66, which is comparatively excessive in comparison with typical markets. This means that traders could also be anticipating vital worth actions over a brief time frame.

Consequently, whales have seemingly centered on the volatility that has gripped the market. The uncertainty surrounding Bitcoin’s short-term actions has shifted their consideration to extremely capitalized tokens.

Learn Ethereum [ETH] Value forecast 2024-2025

This makes Ethereum’s rise in the direction of $3,600 much less secure and extra speculative, with the $4K goal remaining elusive until whales proceed to build up even throughout bullish durations, driving the rise on a extra ‘basic’ foundation.

Till then, consolidation appears extra seemingly, with a potential correction on the charts if the whales maintain on to their positive factors, permitting shorts to take management.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024