Altcoin

Can Solana (SOL) maintain its fourth spot amid $182.5 million outflows?

Credit : ambcrypto.com

- 73.5% of the highest Binance merchants have lengthy positions, whereas 26.5% have brief positions.

- If SOL does not achieve momentum, it may lose its fourth spot to Ripple’s native token, XRP.

Solana [SOL]The world’s fourth-largest cryptocurrency by market capitalization is consolidating inside a decent vary and has shaped a bearish worth motion sample.

In the meantime, altcoins similar to Ethereum [ETH] and Ripple [XRP] present robust bullish momentum. This raises issues amongst SOL holders concerning the capacity of the SOL to keep up its place.

In line with CoinMarketCap, Solana’s market cap has remained at $114.4 billion regardless of the sideways transfer over the previous two weeks. In distinction, XRP skilled an 80% upward momentum throughout the identical interval, growing its market capitalization to $106.5 billion.

Robust whale participation

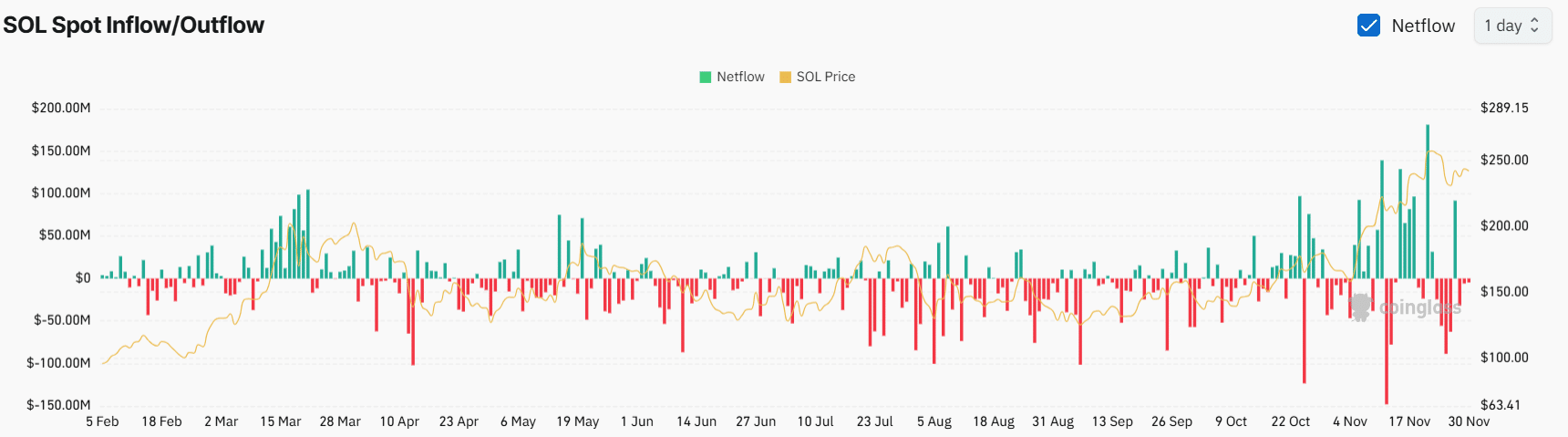

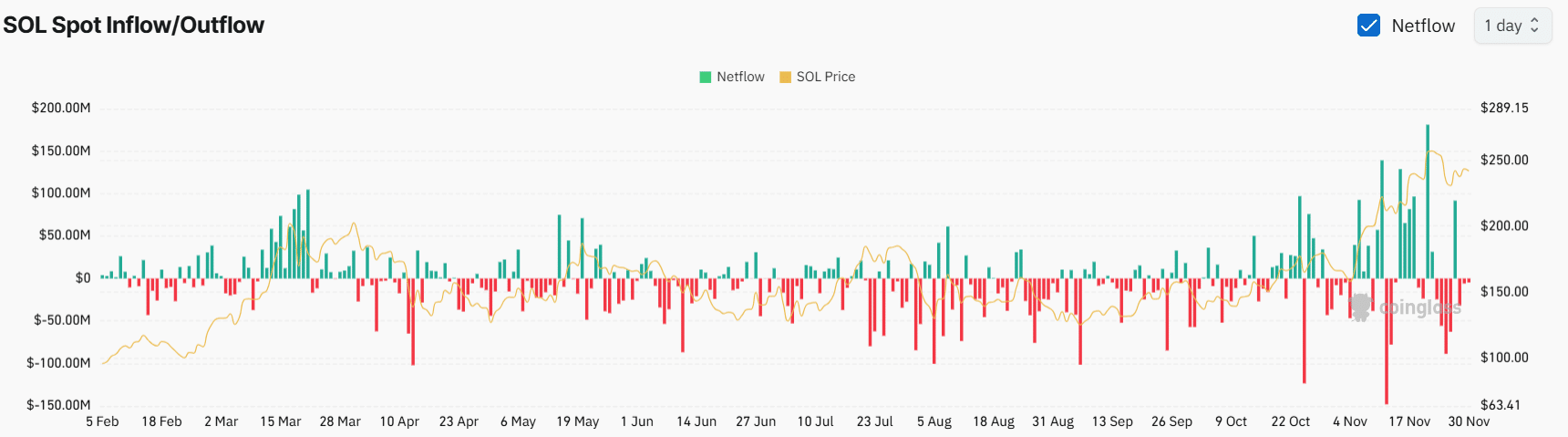

Information from on-chain analytics agency Coinglass signifies that regardless of SOL’s worth being in a consolidation zone, long-term holders have proven robust curiosity within the asset.

Coinglass’ SOL Spot Influx/Outflow statistics point out that SOL has seen a big outflow of $182.5 million from the exchanges since November 23, 2024.

These substantial outflows recommend that whales and long-term holders have withdrawn these tokens from the exchanges to their wallets, indicating accumulation.

Supply: Coinglass

The crypto neighborhood typically views forex outflows as a constructive signal, indicating a possible shopping for alternative and upside momentum.

Current exercise from merchants

Along with long-term holders, merchants have additionally proven robust curiosity and confidence within the token, as reported by Coinglass. On the time of writing, the Binance SOLUSDT Lengthy/Brief ratio stood at 2.77, indicating robust bullish sentiment amongst merchants.

Supply: Coinglass

At the moment, 73.5% of Binance’s prime merchants have lengthy positions, whereas 26.5% have brief positions.

The mixture of those on-chain metrics with technical evaluation means that bulls are presently dominating the asset and could also be making an attempt to maintain SOL within the fourth place.

Solana’s technical evaluation and key ranges

In line with AMBCrypto’s technical evaluation, Solana seems to be forming a bearish head-and-shoulders sample on the four-hour chart. At the moment this sample is incomplete as a result of the second shoulder remains to be growing.

If SOL completes this sample and breaks the neckline at USD 230, it may probably fall in direction of the USD 200 degree.

Supply: TradingView

Conversely, if SOL closes above the $245 degree for 4 consecutive candles, this bearish outlook may finish and we may see a brand new excessive.

On the upside, Solana’s Relative Power Index (RSI) indicated the potential for an upward rally within the coming days. With an RSI of 51, the value remained beneath the overbought space, indicating that there’s nonetheless room for development.

Learn Solana’s [SOL] Worth forecast 2024–2025

On the time of writing, SOL was buying and selling round $242 and has skilled a worth drop of over 1.25% previously 24 hours.

Throughout the identical interval, quantity elevated by 14.56%, indicating higher dealer and investor participation in comparison with earlier days.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now