Ethereum

Ethereum ETFs soar to $428M in inflows: ETH a step closer to $4K now?

Credit : ambcrypto.com

- Grayscale nonetheless had the biggest market share in ETH spot ETFs.

- Shopping for strain elevated and one gauge urged ETH was undervalued.

Ethereum [ETH] ETFs have proven commendable efficiency in latest days. In truth, web flows have as soon as once more reached a brand new excessive, reflecting excessive investor acceptance and confidence. Regardless of this, ETH has struggled to cross the $4k mark.

Ethereum ETFs have set a brand new report

Lookonchain is latest tweet identified that 9 Ethereum ETFs accelerated their holdings of ETH over the previous month, reaching a complete of 362,474 ETH, which was price greater than $1.42 billion.

This marked a rise of 4,363% in comparison with the earlier month, by which solely 8,121 ETH, price over $31.8 million, was added.

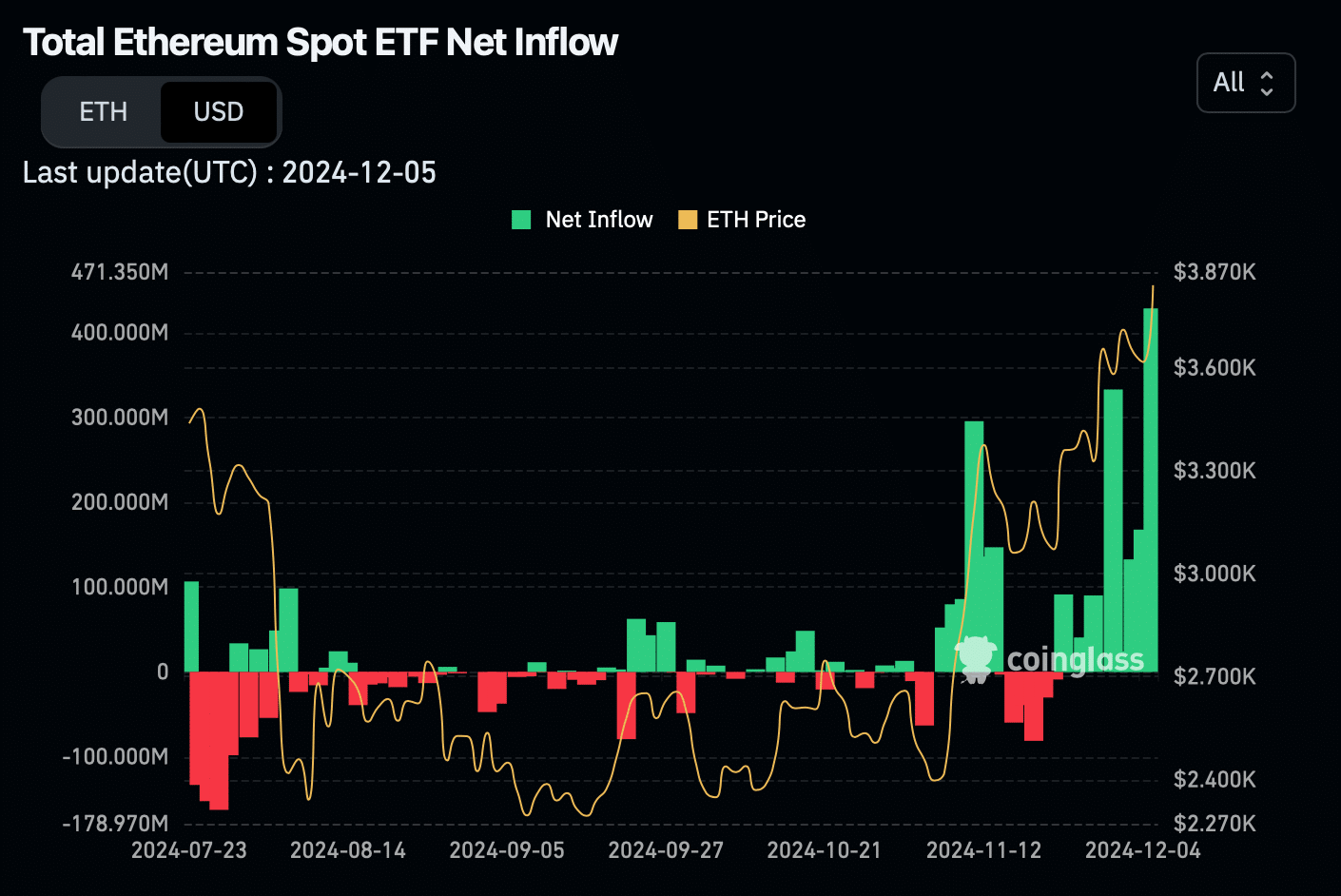

The higher information was that ETH ETF inflows peaked. In keeping with Coinglass information, ETH ETF web flows have elevated in latest weeks. On December 5, web flows reached a whopping $428.5 million, setting a brand new report.

Supply: Coinglass

By way of market share, Grayscale ETF had the biggest market share at 47%, in response to Dune Analytics’ facts.

Grayscale was adopted by Grayscale Mini and BlackRock, which had 13% and 12% respectively. Whereas Grayscale’s holdings had been $5.8 billion, BlackRock’s holdings had been $2.9 billion.

ETH’s battle continues

Whereas Ethereum ETFs set a brand new all-time excessive, ETH was rejected a number of instances close to the $4k resistance. On the time of writing, the king of altcoins was buying and selling at $3,912.25 with a modest worth enhance of 1.3% over the previous 24 hours.

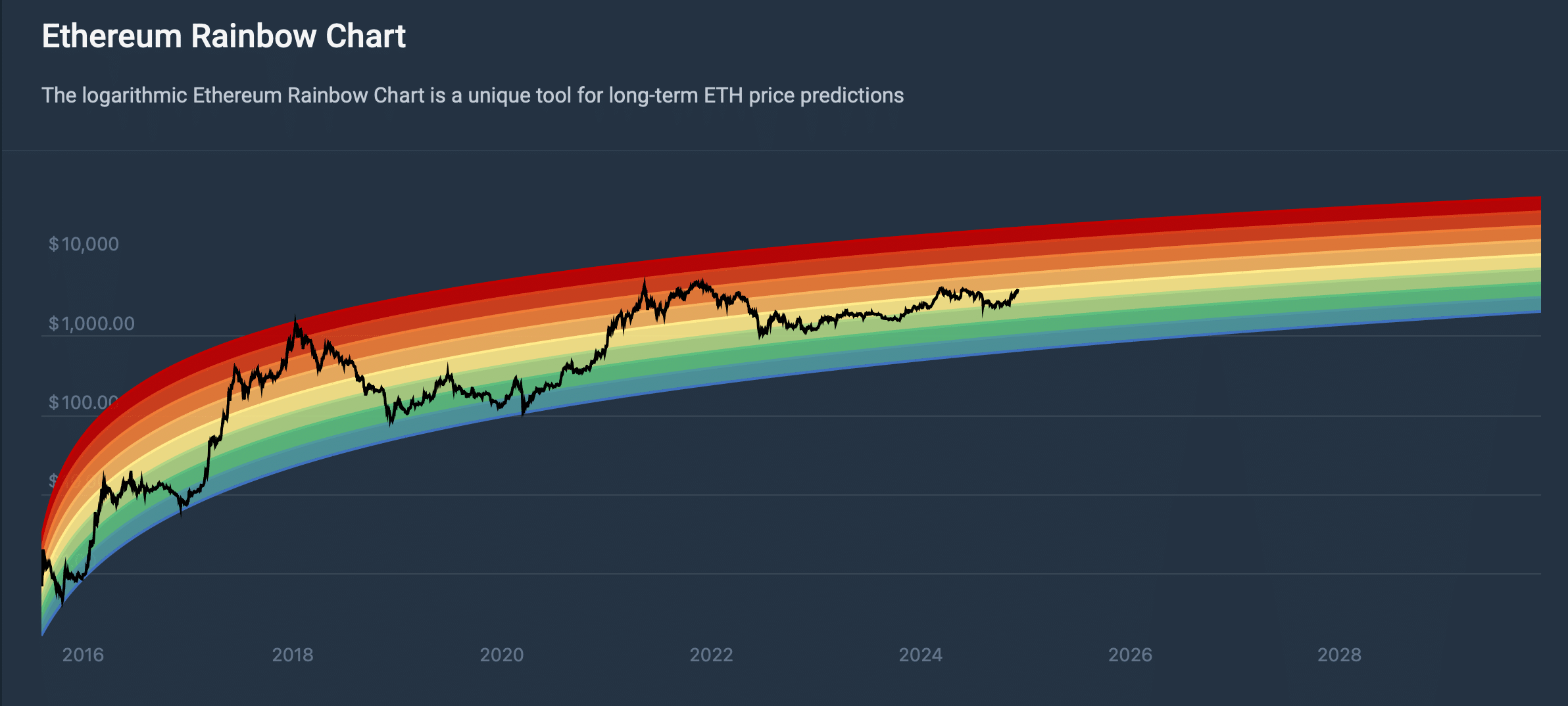

Whereas the token struggled to interrupt a barrier, the Ethereum Rainbow Chart urged traders remained affected person. In keeping with the chart, ETH worth was within the HOLD zone, that means there’s a good probability the token will go up within the coming days.

Supply: Coincodex

A number of different information units even hinted at an identical chance. In keeping with Glassnode information, Ethereum’s NVT ratio recorded a pointy decline. When the benchmark falls, it means an asset is undervalued, indicating that the chance of a worth enhance is excessive.

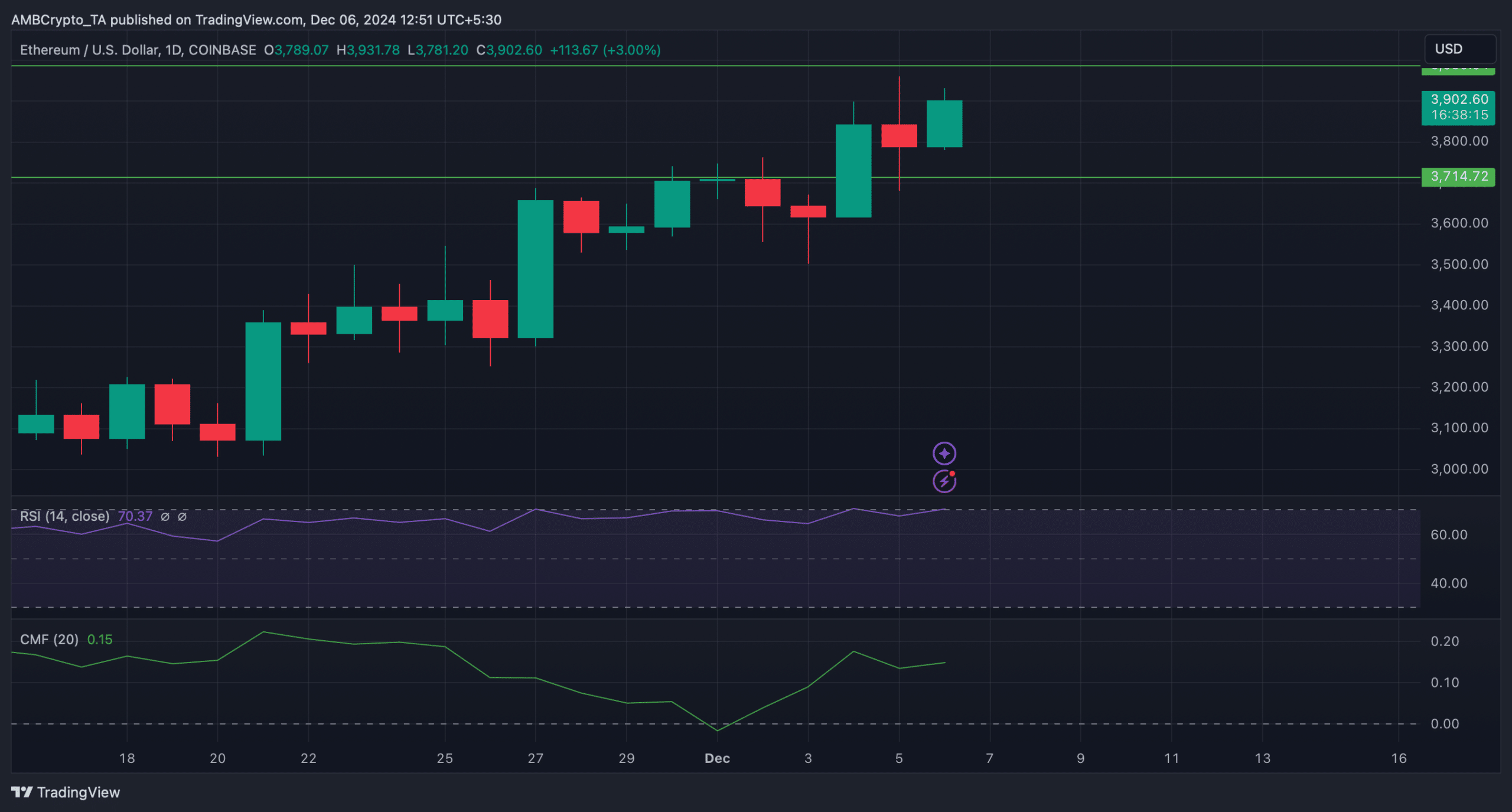

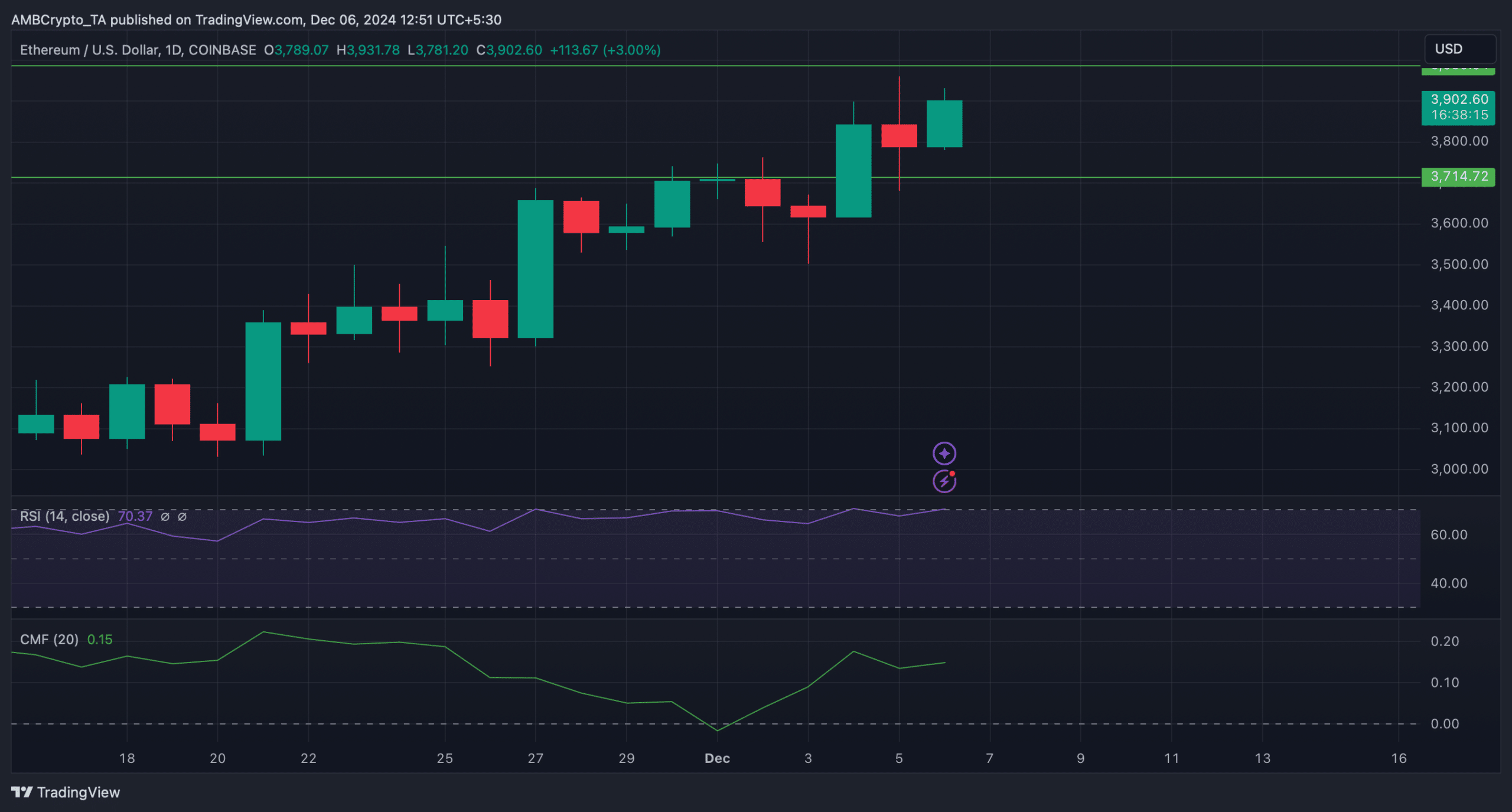

The technical indicator Relative Energy Index (RSI) moved north. This meant that buying exercise elevated. A rise in buying strain typically leads to worth will increase.

Learn Ethereums [ETH] Worth prediction 2024–2025

Notably, the Chaikin Cash Circulation (CMF) additionally adopted an identical upward development.

If ETH approaches the $4k resistance once more and is supported by robust shopping for strain, then it won’t be formidable to count on the token to transform the $4k resistance into its new help within the coming days.

Supply: TradingView

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024