Policy & Regulation

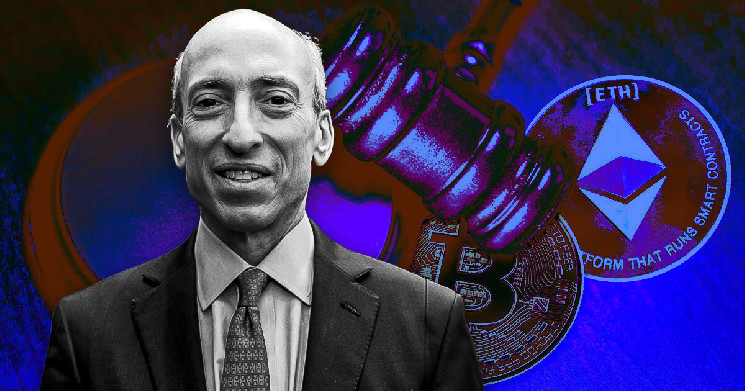

SEC rejecting Solana ETFs is Gensler’s ‘parting gift’ to crypto industry – Bloomberg analyst

Credit : cryptonews.net

The U.S. Securities and Alternate Fee (SEC) will reportedly reject two functions for a Solana (SOL) exchange-traded fund (ETF), in response to Bloomberg ETF senior analyst Eric Balchunas.

Balchunas stated the rejections have been chairman Gary Gensler’s “parting present” to the crypto business.

Fox Information reported that Eleanor Terrett revealed sources at two Solana ETF issuers who instructed her the SEC is not going to approve a brand new crypto-related ETF below Gensler. He plans step down on January 20, 2025.

Balchunas anticipated the issuers will reapply for the Solana ETFs as soon as Paul Atkins begins his time period as chairman of the SEC. President-elect Donald Trump confirmed Atkins for the position on November 27.

Commenting on the information, former VanEck digital asset technique director Gabor Gurbacs stated commented that Gensler “will take a stroll quickly,” and Balchunas replied:

“This was his parting present, I feel.”

Nevertheless, Balchunas’ fellow Bloomberg ETF analyst James Seyffart argued that Gensler had no alternative within the Solana ETF challenge as a result of it will be “disingenuous” to permit SOL-related exchange-traded merchandise when the regulator claims the crypto is an impact in a number of lawsuits. .

In consequence, the brand new SEC administration might be liable for resolving the crypto lawsuits by which SOL is taken into account a safety. Till then, Seyffart regards functions as ‘lifeless within the water’ till the watchdog decides on a brand new plan of action.

This shifts the approval timeline for Solana ETFs, which Seyffart initially anticipated to shut in August 2025. Nonetheless, he added that this was the earliest deadline, and he anticipated it to be postponed.

Two items

Seyffart additionally emphasised that the SEC’s latest letter on the Binance case is the true parting present, which he stated was an pointless transfer by the regulator.

Ripple’s Chief Authorized Officer, Stuart Alderoty, just lately sharedthat the regulator has filed an 81-page doc urging the courtroom to not dismiss the Binance lawsuit, which accuses the trade of providing 11 tokens as funding contracts.

In accordance with Alderoty:

“Somewhat than again down and pause the crypto lawsuit with new management for only a few weeks, Gensler’s SEC yesterday filed an 81-page temporary within the Binance case, reusing the identical failed arguments — together with the absurd (and unsupported) declare that crypto has no inherent worth. .”

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024