Bitcoin

Is a Bitcoin price correction coming? Assessing key levels

Credit : ambcrypto.com

- Promoting stress on Bitcoin elevated.

- A worth correction might push BTC again all the way down to $95.8k.

After crossing a historic $100,000 mark, Bitcoin [BTC] witnessed a pullback and dropped close to the $98k vary. The king’s coin slowly approached the three-digit mark once more.

Nevertheless, BTC faces numerous obstacles sooner or later, which might trigger a worth correction.

Bitcoin is heading in the direction of $100,000 once more, however…

Bitcoin worth consolidated over the previous 24 hours as the worth moved marginally. On the time of writing, the King was buying and selling at $99.6k with a market cap of over $1.97 trillion.

Nevertheless, this sluggish strategy to $100,000 won’t be a profitable effort as a key metric was rising.

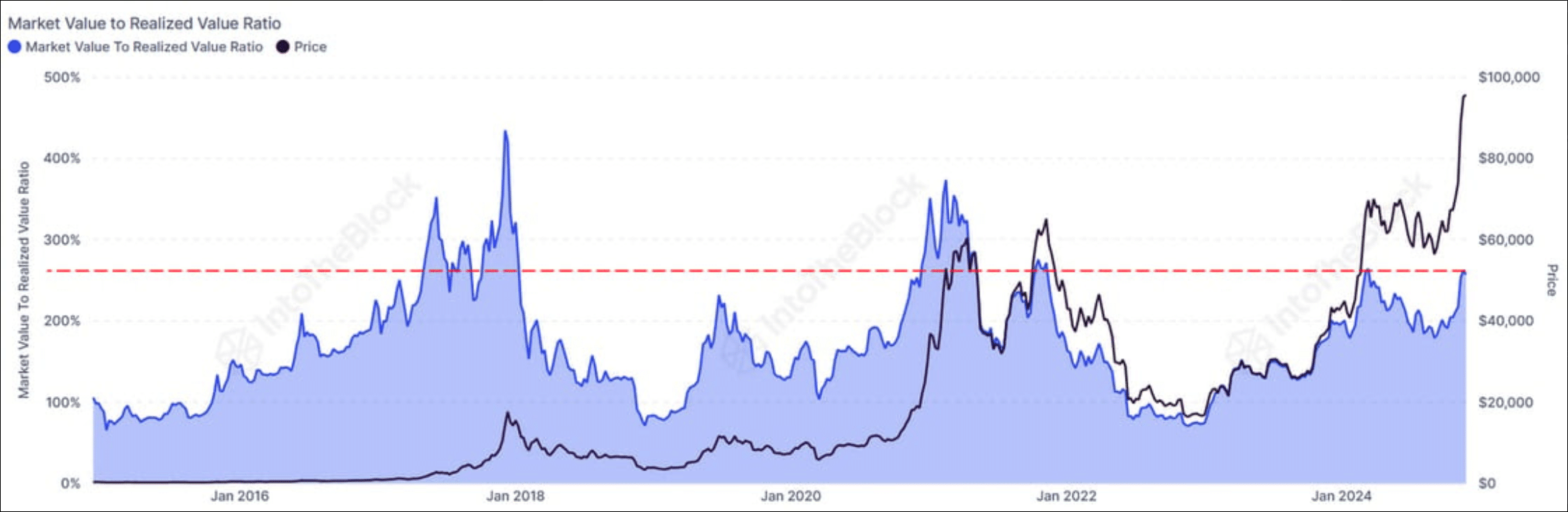

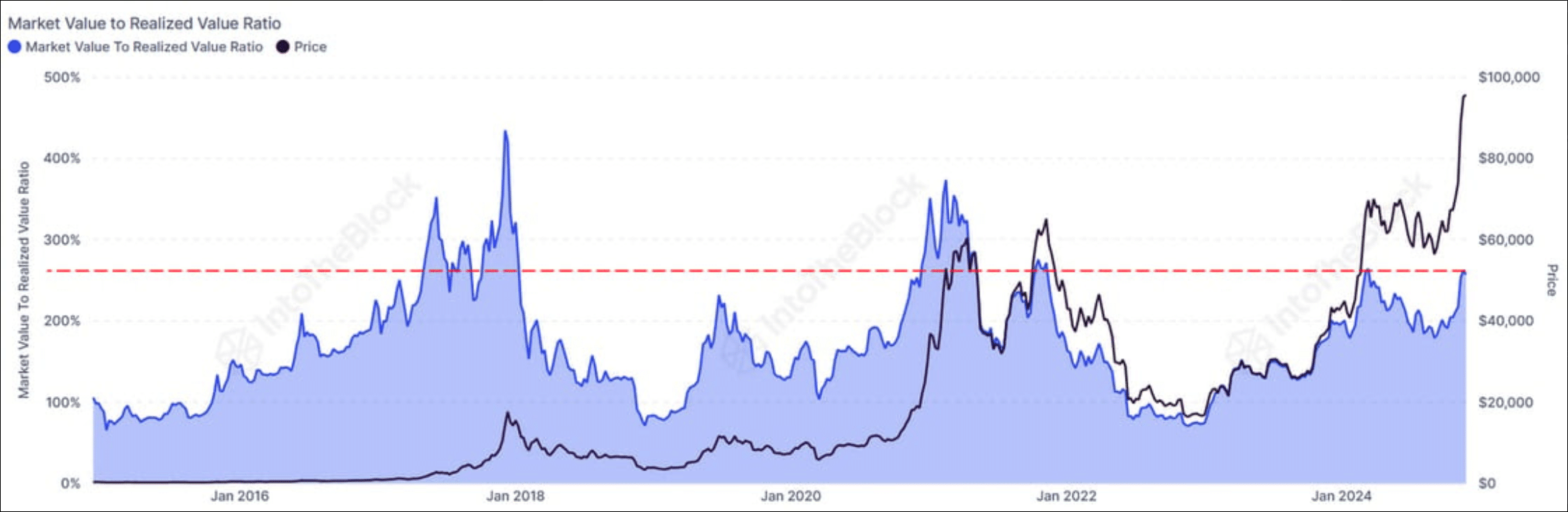

IntoTheBlock, a knowledge analytics platform, lately posted tweet spotlight BTC’s MVRV ratio. In keeping with the tweet, Bitcoin’s MVRV moved nearer to historic peak ranges.

When the MVRV rises, worth corrections are normally adopted.

Traditionally, BTC witnessed related pullbacks in 2018, 2021, 2022, and 2024. If historical past repeats itself, BTC buyers ought to put together for a speedy worth correction.

Supply:

Is a worth correction inevitable?

Not solely did the MVRV ratio give a purple sign, another on-chain metrics additionally painted the same image. For instance, BTC dominance has been declining recently.

The ratio fell from 53.7% to 51% final week – an indication of a brand new altcoin season.

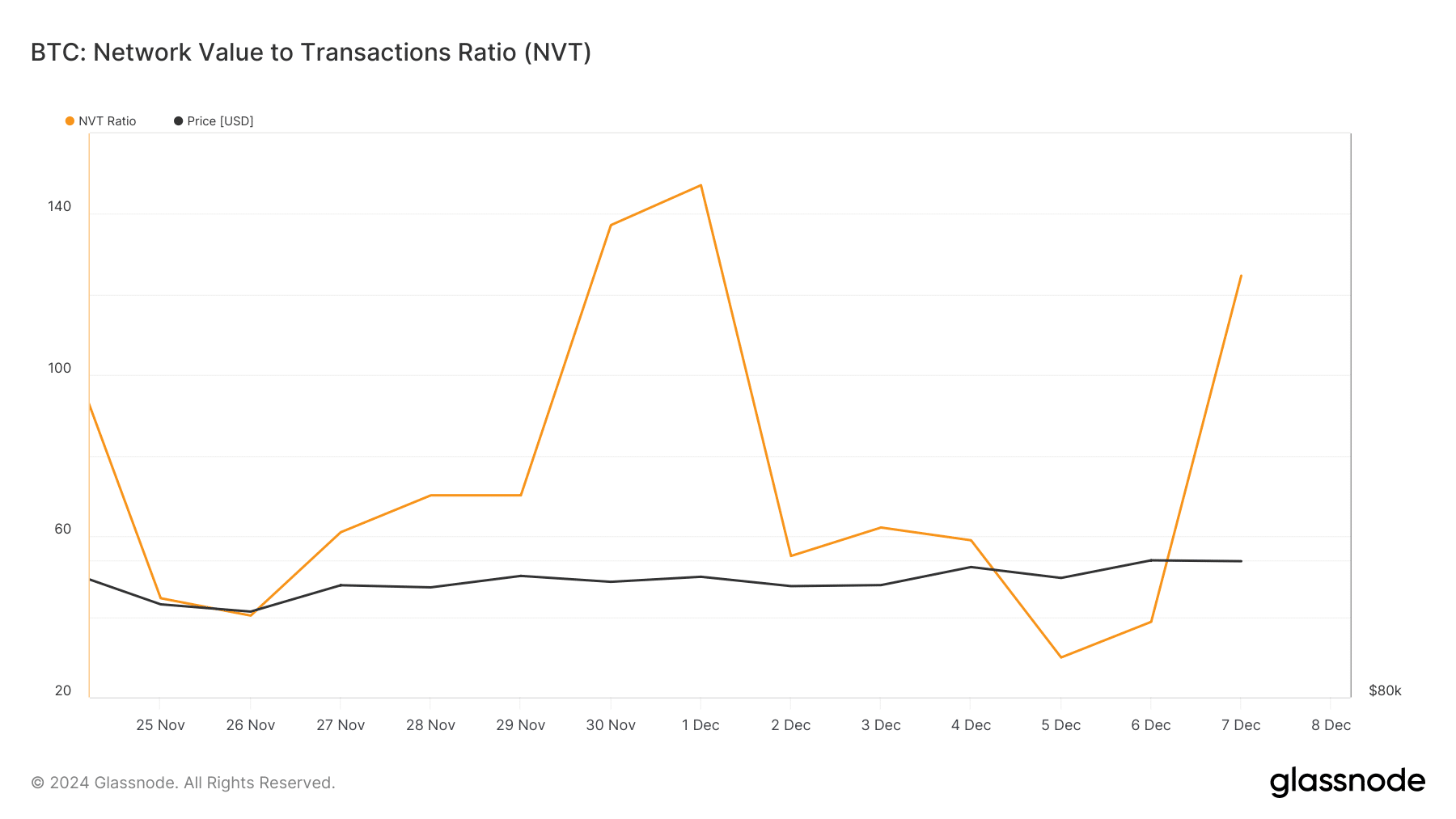

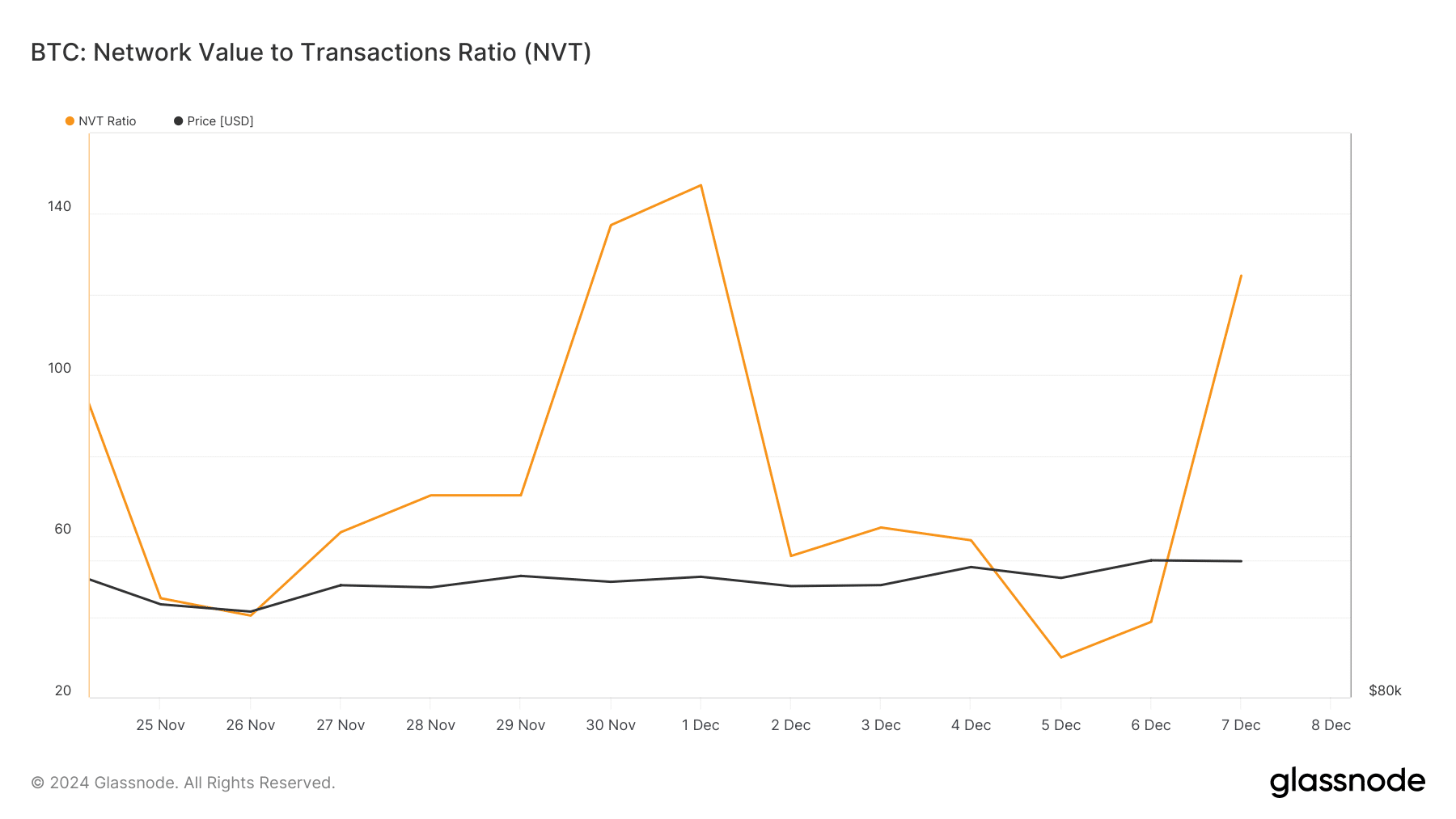

Glassnode’s information confirmed that Bitcoin’s NVT ratio registered a pointy enhance. At any time when the measure rises, it signifies that an asset is overvalued, signaling a worth correction sooner or later.

Supply: Glassnode

CryptoQuant’s facts additionally identified some bearish stats. Web deposits of BTC on the exchanges had been excessive in comparison with the common of the previous seven days. It is a clear signal of accelerating promoting stress on the king coin.

Moreover, the aSORP turned purple, that means extra buyers are promoting at a revenue. In the course of a bull market, this might point out a market high.

Other than that, AMBCrypto reported fairly, miners confirmed much less confidence in BTC once they offered their holdings.

To be exact, over the previous 48 hours, BTC miners have offered a whopping 85,503 BTC, bringing miners’ balances all the way down to round 1.95 million BTC – the bottom degree in months.

Learn Bitcoins [BTC] Worth prediction 2024-25

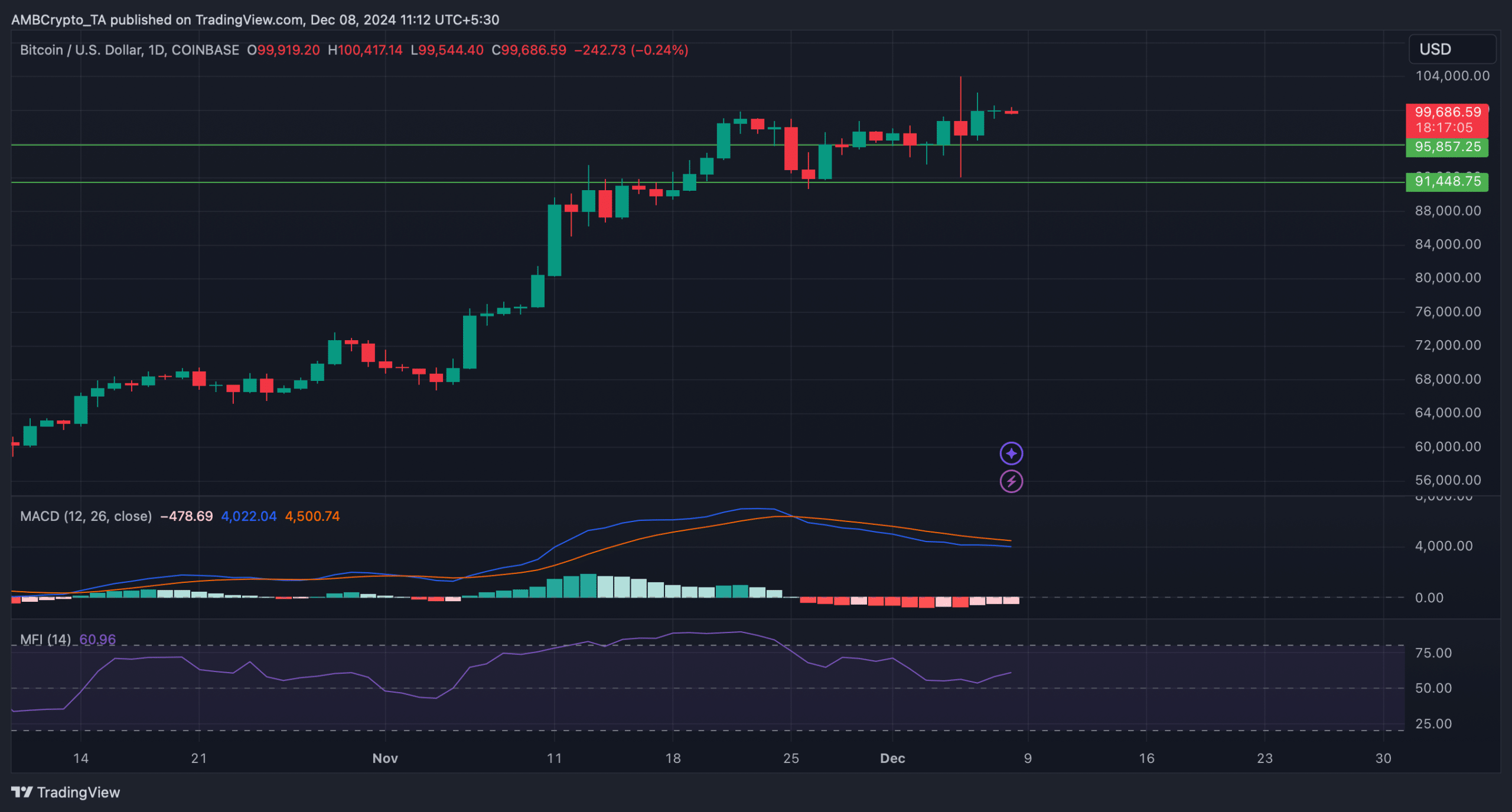

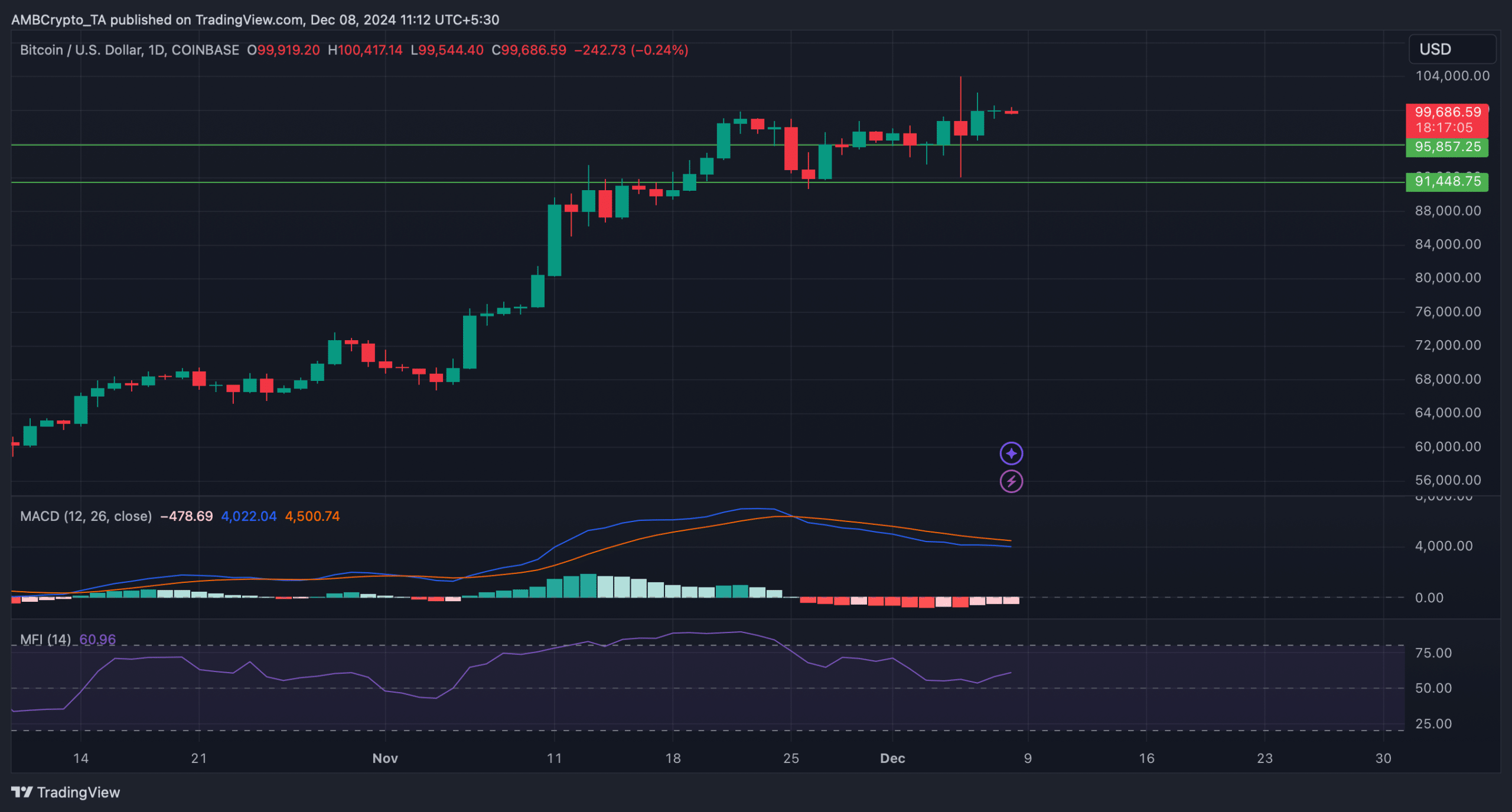

The technical indicator MACD confirmed a bearish benefit out there. Within the occasion of a worth correction, BTC might quickly drop to $95.8k. A slip beneath might push BTC in the direction of $91,000 once more.

Nevertheless, the Cash Circulation Index (MFI) recorded a rebound, indicating continued worth appreciation. This might push BTC again above $100,000 within the coming days.

Supply: TradingView

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024