Ethereum

Here’s What These Key Metrics Signal

Credit : ambcrypto.com

- Ethereum’s worth drops to $3,867 amid elevated withdrawals, signaling potential market volatility.

- Energetic addresses and leverage ratios point out elevated retail curiosity and potential near-term market shifts for ETH.

Ethereum [ETH] has seen a exceptional one worth adjustment after reaching the $4,000 threshold late final week. On the time of writing, ETH was buying and selling at $3,867, down 2.2% previously day.

Whereas belongings stay almost 30% greater this month, the drop beneath $4,000 positions ETH 20.5% away from the all-time excessive of $4,878 recorded in 2021.

Regardless of this correction, market exercise round Ethereum presents some engaging prospects insights. In response to a CryptoQuant analyst often known as Mignolet, there was a noticeable enhance within the variety of Ethereum withdrawal transactions from exchanges.

Whereas some could interpret this as a bearish indicator, Mignolet means that this alerts the potential for “elevated market volatility.”

The analyst highlights a sample of elevated exercise in Ethereum transactions, which regularly correlates with a decline in Bitcoin dominance, doubtlessly signaling a broader market pullback as buyers take income.

Key metrics spotlight the U-turn for Ethereum

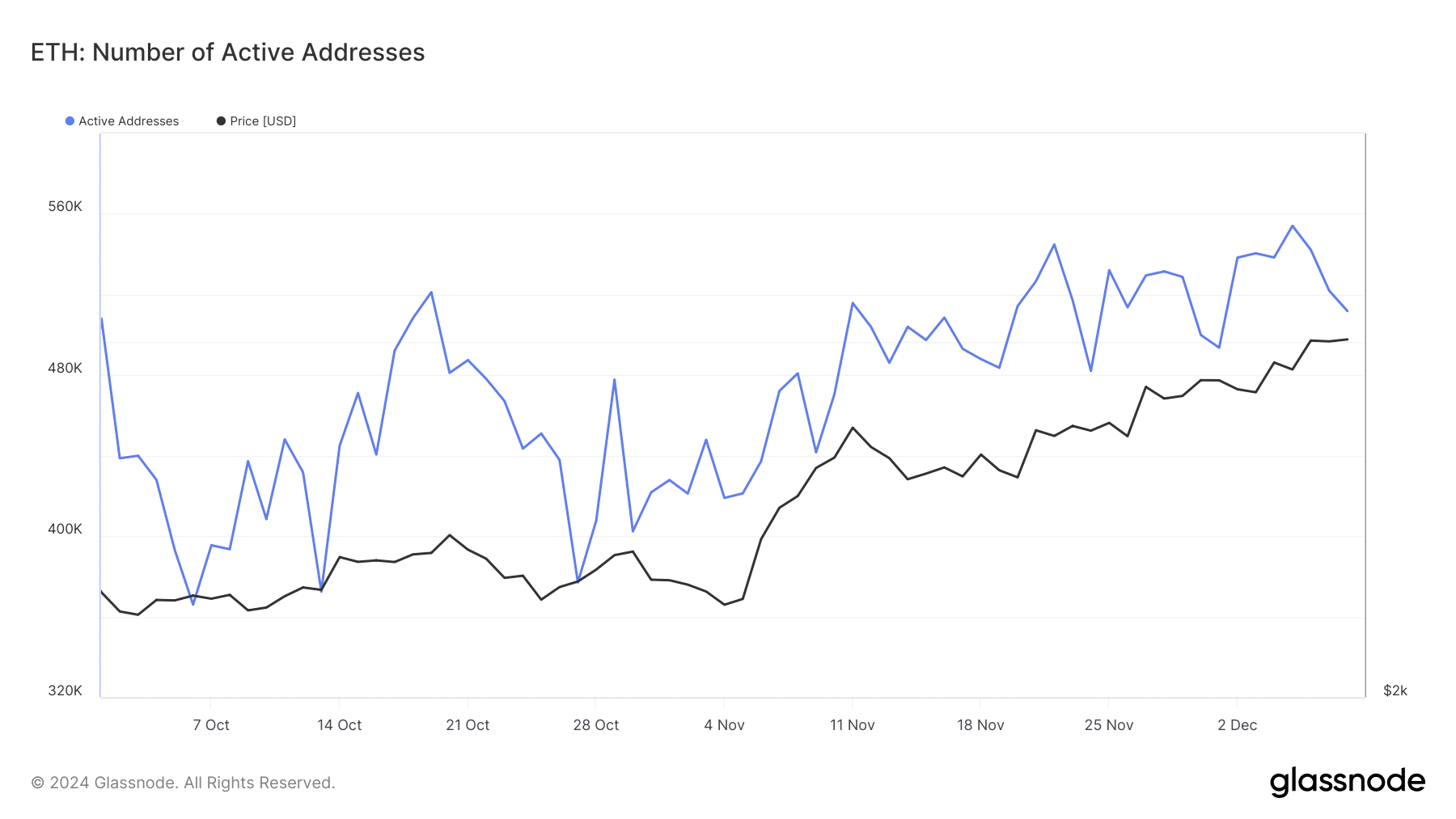

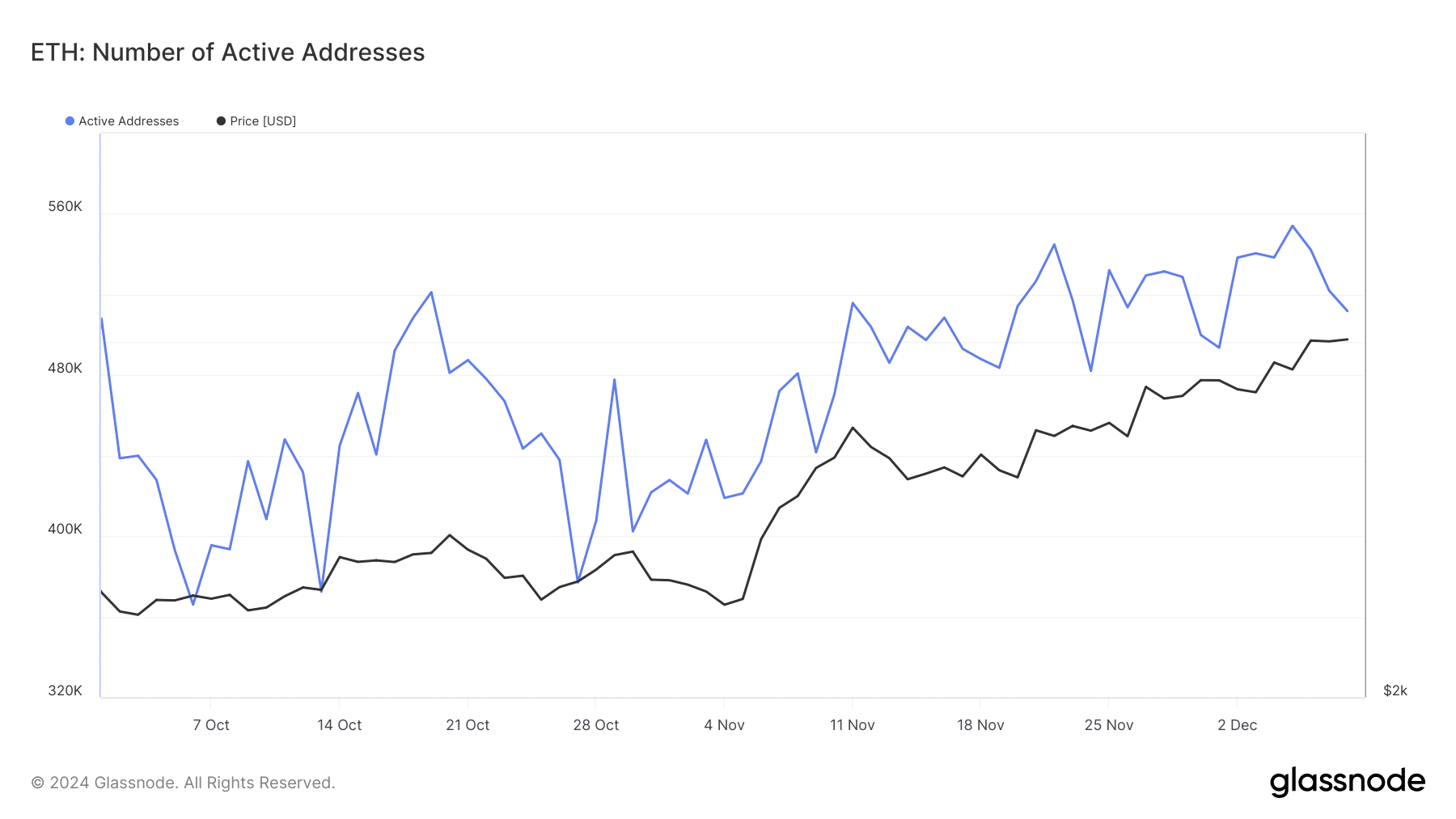

In the meantime, Ethereum lively addresses, a vital indicator of retail investor curiosity, have trended upward in current months.

Facts from Coinglass revealed that Ethereum’s lively addresses have risen from lower than 400,000 in early October to greater than 500,000 on the time of writing.

Supply: Glassnode

This enhance signifies rising participation from smaller, retail-oriented buyers. A rise within the variety of lively addresses sometimes displays elevated community exercise, which might contribute to Ethereum’s worth stability and long-term development.

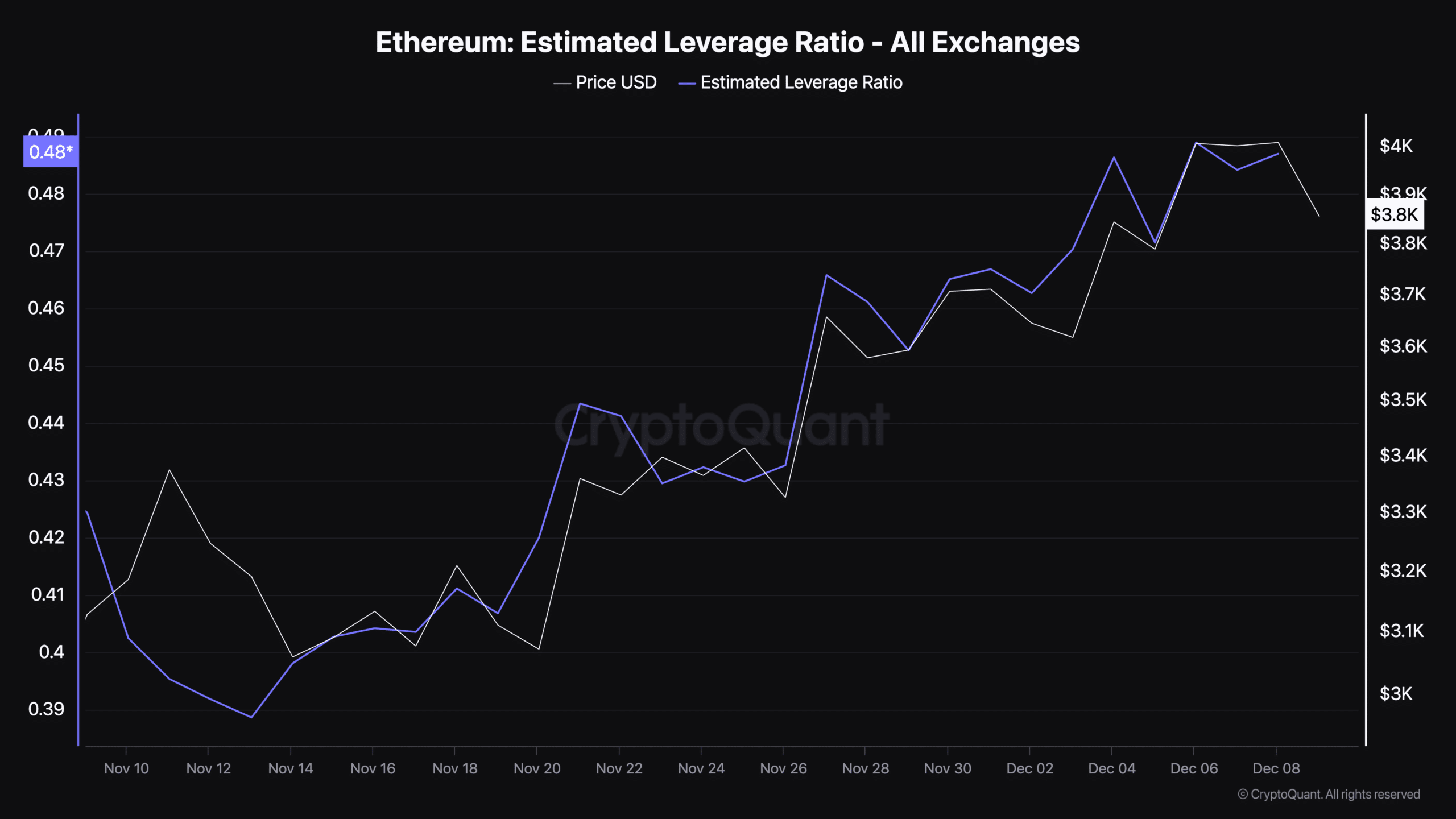

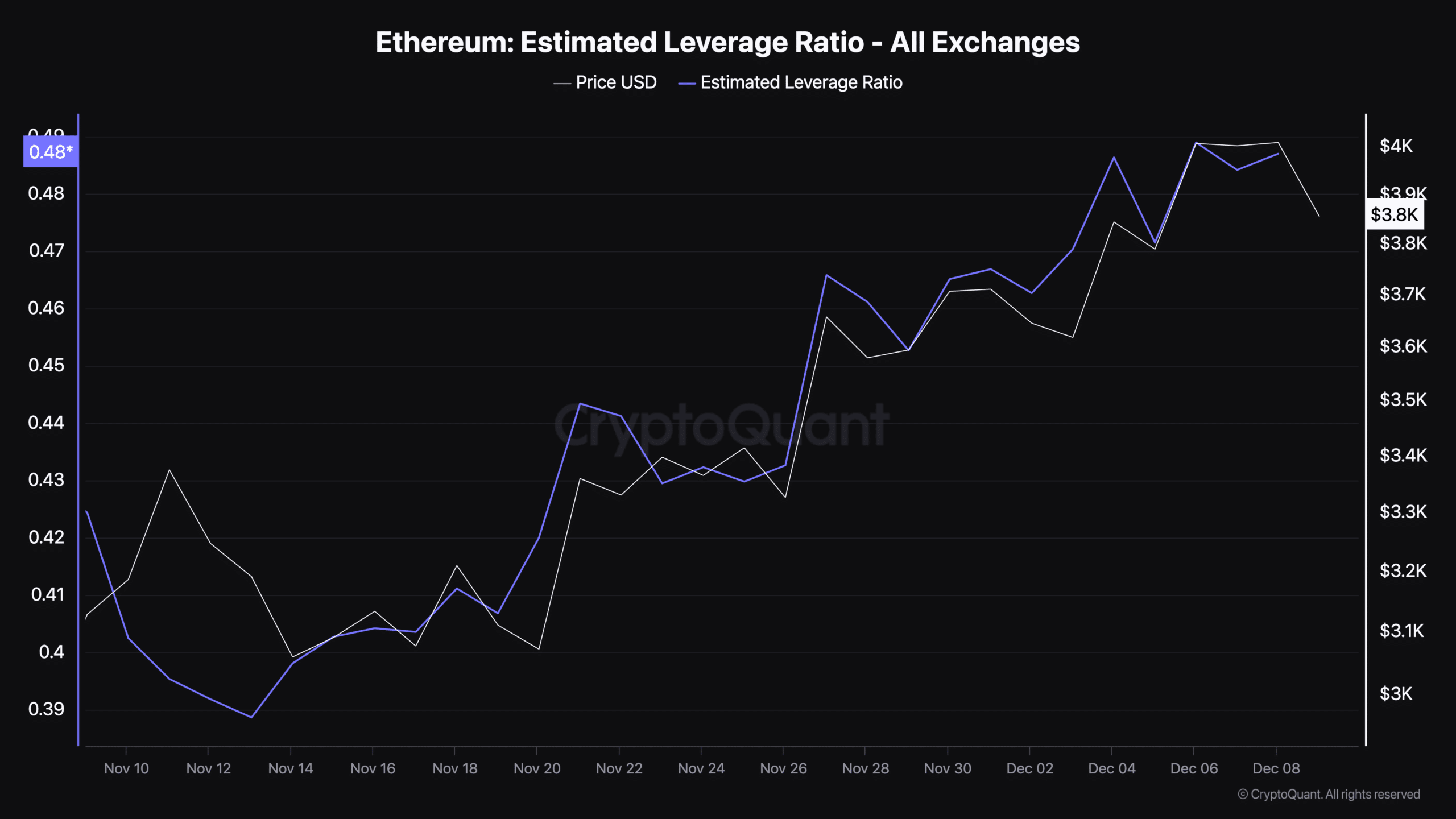

One other key metric, Ethereum’s estimated leverage ratio, at the moment stands at 0.487 CryptoQuant.

The estimated leverage ratio measures the diploma of leverage utilized by merchants within the derivatives market, calculated because the ratio of open curiosity to the whole coin stability held on exchanges.

Supply: CryptoQuant

Learn Ethereum’s [ETH] Value forecast 2024–2025

The next leverage ratio signifies taking extra danger, as extra merchants use borrowed cash to strengthen their positions. At present ranges, Ethereum’s leverage ratio signifies average leverage in the marketplace.

Whereas not excessively excessive, it highlights the potential for sharper worth actions as merchants place themselves for future market tendencies.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024