Bitcoin

Why It’s Not Too Late to Invest in Bitcoin

Credit : bitcoinmagazine.com

For years, Bitcoin skeptics have watched from the sidelines, ready a second to hitch in, convincing themselves that that they had already missed the boat. Nevertheless, actuality tells a unique story. Not solely is it not too late, however Bitcoin continues to show itself as a superior funding choice in comparison with conventional belongings – whether or not you will have $25 per week to spare or tens of millions to spend.

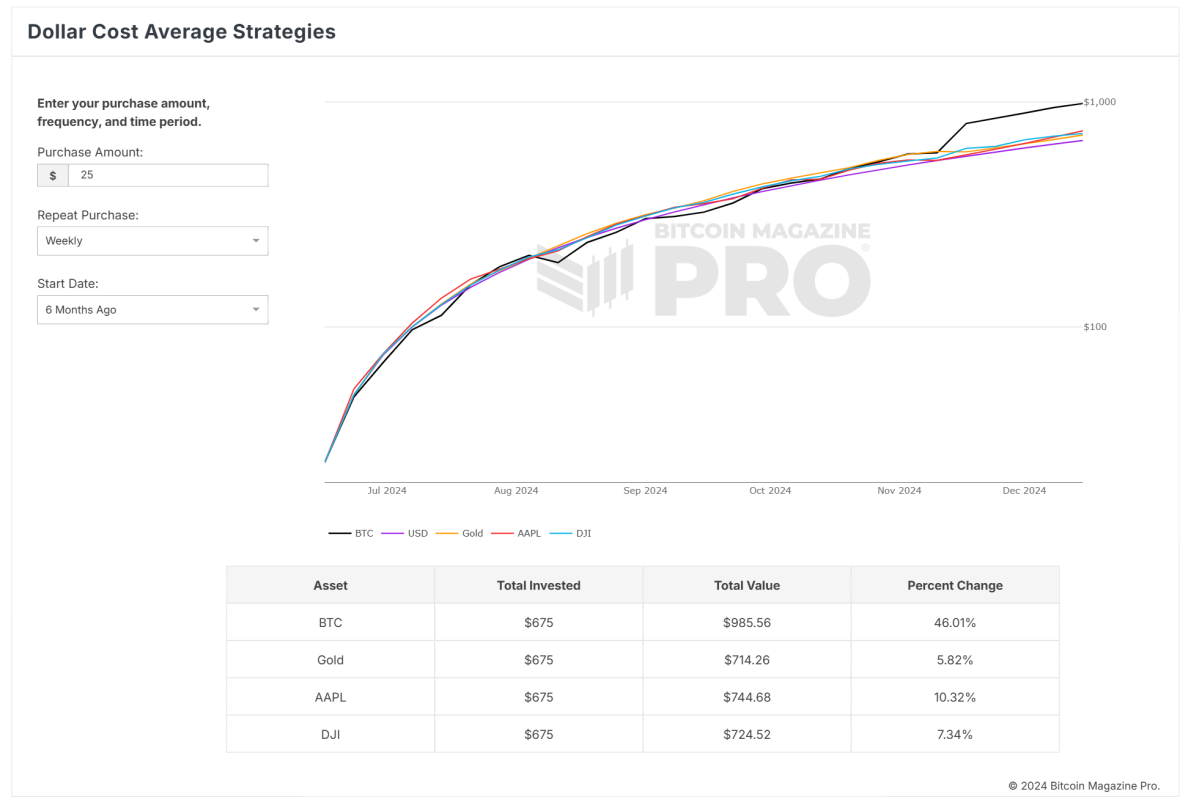

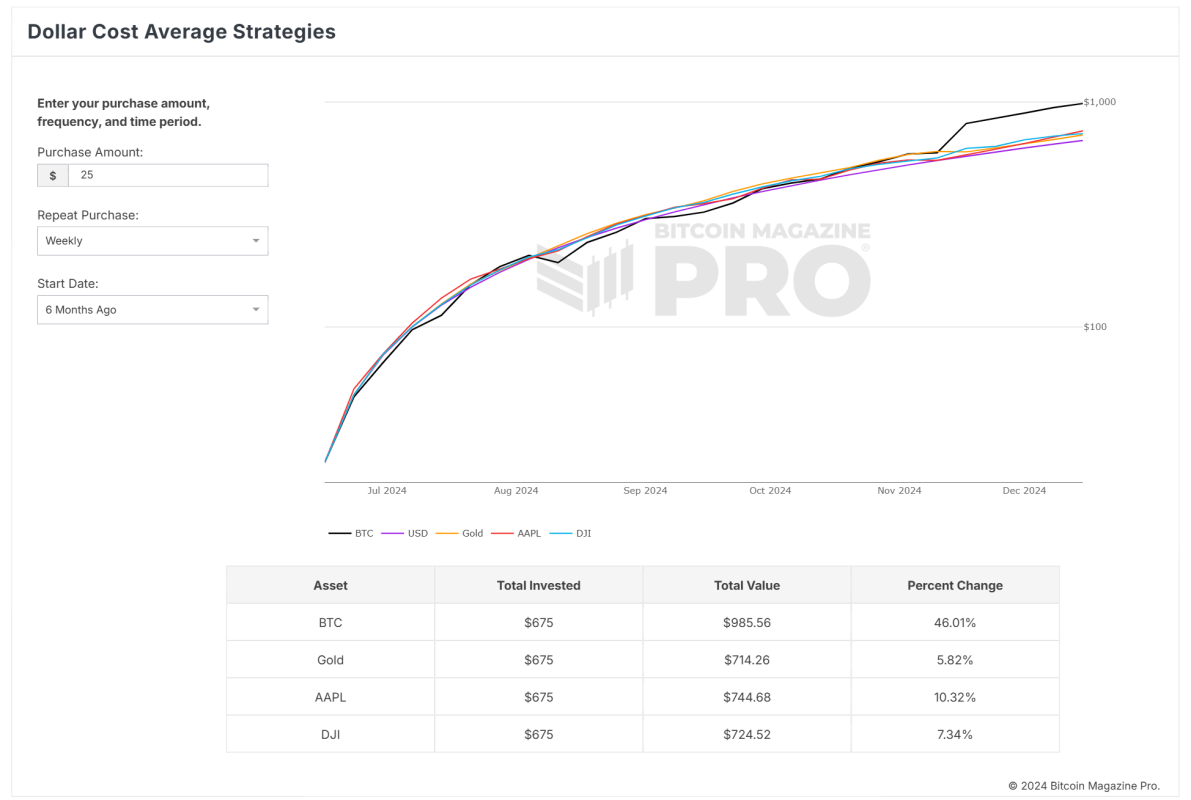

Bitcoin Magazine Pro has a free portfolio evaluation device, Dollar cost averaging (DCA) strategies.permitting buyers to gauge Bitcoin’s efficiency in opposition to different main belongings resembling gold, the Dow Jones (DJI) and Apple (AAPL) shares. This highly effective device offers laborious knowledge to reveal how constant and disciplined investing can result in outsized returns over time, even with modest quantities.

What’s the Bitcoin Greenback Value Common?

Greenback Value Avering invests a hard and fast amount of cash at common intervals, whatever the value of the asset. This technique eliminates emotional determination making and mitigates the consequences of market volatility. By constantly buying Bitcoin over a time period, buyers profit from market downturns whereas constructing their portfolios over time.

Outperform conventional belongings over completely different time frames

Let’s break down the numbers utilizing the DCA Methods devicebeginning with the final six months to focus on current achievements::

- 6 months:

A weekly funding of $25 in Bitcoin would have returned $675 $985.56A 46.01% return. In the meantime: Gold simply rose 5.82%. Apple (AAPL) received 10.32%. The Dow Jones (DJI) solely made a revenue 7.34%. - 1 12 months:

With a complete funding of $1,325 in Bitcoin, your portfolio could be price now $2,140.20on account of a 61.52% return. By comparability, gold rose by 14.50%. Apple received 22.80%. The Dow Jones solely grew 11.36%. - 2 years:

A weekly funding of $25 totaling $2,650 would now be valued at $7,145.42-A 169.64% return. In the meantime: Gold surged previous 26.56%. Apple continued to develop 36.22%. The Dow Jones delivered outcomes 21.13%. - 4 years:

The long-term situation is even stronger. A $5,250 funding could be price it now $14,877.77which represents an unimaginable one 183.39% return. Throughout the identical interval: Gold rose by 37.26%. Apple received 54.05%. The Dow Jones grew 27.32%.

In each timeframe, Bitcoin outperforms conventional belongings and affords compelling returns, even over short-term intervals of six months to a 12 months.

Why market timing would not matter

For buyers who’re hesitant to enter the market proper now, it is necessary to grasp that Bitcoin’s long-term efficiency speaks for itself. Historic knowledge exhibits that adopting a DCA technique minimizes the danger of market timing whereas rising returns over time. Even small, common investments change into considerably bigger as Bitcoin will increase in worth.

Moreover, Bitcoin is now not seen as a speculative asset, however as a dependable retailer of worth in a unstable financial panorama. With institutional adoption, technological developments, and rising shortage on account of mounted provide, Bitcoin’s long-term prospects stay overwhelmingly constructive.

Why you are still early

International adoption of Bitcoin continues to be in its infancy. Regardless of its spectacular efficiency, Bitcoin’s complete market capitalization is small in comparison with conventional asset courses resembling gold or shares. This implies there may be nonetheless important room for progress as extra people, establishments and even governments acknowledge its usefulness and worth.

Regardless of Bitcoin’s spectacular monitor file of outperforming gold by way of returns, its market capitalization on the time of writing is barely 10.82% of the market capitalization of gold. This highlights important progress potential; at present market costs, Bitcoin ought to rise 9.24 instances to realize parity with gold, which interprets into an anticipated value of $934,541 per BTC.

This value goal is according to current Bitcoin predictions, together with Eric Trump’s assured projection that the value of Bitcoin will attain $1 million.

With instruments like Bitcoin Magazine Pro’s DCA Strategiesanybody can discover how small, common investments can create exponential progress over time. Whether or not your place to begin is €25 per week or €2,500, the information proves one factor: it is by no means too late to begin investing in Bitcoin.

A device for each investor

The DCA Methods device out there at Bitcoin Magazine Pro This lets you customise your funding parameters, together with buy quantities, frequencies and begin dates. This flexibility permits buyers to create custom-made methods that match their monetary objectives and time horizon.

The device additionally offers comparative evaluation with different belongings, so you may clearly see how Bitcoin is outperforming over time. This isn’t only a theoretical train; it is a helpful perception for anybody critical about constructing long-term wealth.

Conclusion: now’s the time to behave

For individuals who are hesitant and assume they missed their likelihood, the information is obvious: Not solely is Bitcoin a viable funding, it is also the best-performing asset of the last decade. With a DCA technique, even essentially the most cautious investor can begin small and reap the rewards of long-term progress.

It is time to cease watching from the sidelines. Use Bitcoin Journal Execs Dollar cost average strategies device to form your funding strategy right now. If historical past repeats itself – and there may be each motive to imagine it’ll – Bitcoin’s future seems to be brighter than ever.

To discover stay knowledge and keep updated with the most recent evaluation, go to bitcoinmagazinepro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. At all times do your personal analysis earlier than making any funding choices.

This text is a To take. The opinions expressed are solely these of the creator and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now